Automotive Clearthought â March 2015

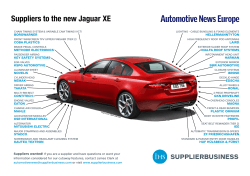

Automotive Insights from Clearwater International Spring 2015 clearthought Automotive Technologies How new technologies are transforming the automotive sector Introduction Today, more money is being ploughed into R&D in the automotive sector than ever before. R&D spending by the industry has grown at an annual rate of 8% since 2009, almost three times the rate of increase seen between 2001 and 20121. In the EU market, the automobile sector invests more than any other sector, making up 25% of all R&D spend2. However, it is little wonder that we are seeing such frenetic R&D activity - given that today’s car has the computing power of more than 20 personal computers, approximately 100 million lines of programming code, and processes up to 25 gigabytes of data an hour. Indeed, industry analysts predict that 40% of the value of a car will soon be made up of software components. Against this data revolution, it should come as little surprise that a sector historically dominated by established OEM manufacturers, such as Ford, Toyota, GM, Volkswagen, Honda and BMW, is now seeing the likes of Tesla and Google take the stage and bring competition to the arena. In short, we have entered a new stage in the development of the automobile where OEMs need to be fearful of innovative technology companies that are progressively shifting the balance of power. The car is rapidly becoming a smartphone on wheels and our relationship with the car is changing, as semi-autonomous features are taking away our need for input. The idea of a fully autonomous vehicle is getting closer and closer to reality. There are now more than 830 million cars on the road worldwide, forcing governments to think carefully about pollution and to implement measures to control emissions. Meanwhile, various alternative fuel options have also been introduced and are constantly being developed. 1.Boston Consulting Group, Accelerating Innovation: New Challenges for Automakers 2.European Commission. The 2014 EU Industrial R&D Investment Scoreboard M&A Overview As the car becomes more technologically advanced and complex, the power is moving away from the OEMs and towards the software, electronics and technology companies in the supply chain which will undoubtedly lead to consolidation within the market. Suppliers need to commit significant R&D expenditure into advancing technologies which creates high barriers of entry for smaller players, deterring them from entering the market. Small players with niche technologies are likely to be swallowed up by mega-suppliers that have the capacity and finance to push the technology to market. With regards to automotive technology, we are seeing cross-sector acquisition activity from both the automotive suppliers and the technology companies - both using acquisitions as a means to secure their position in the automotive supply chain. clearthought | Spring 2015 Automotive Insights from Clearwater International Recent M&A activity ZF Friedrichshafen (ZF), a global leader in driveline and chassis technology and top ten automotive supplier, has agreed to acquire TRW Automotive Inc, a US developer and producer of active and passive safety systems, for ¤11bn. ZF expects the combined company sales of driver-assist safety systems to grow by 15 - 25% per year. The combined R&D budget will be ¤1.8bn, in addition to TRW’s 13 test tracks and 22 technology centres worldwide and ZF’s eight R&D hubs. ZF is also planning to build a technical centre in Japan. With this transaction, ZF-TRW will be competing in the premier league with Bosch, Continental and Denso. Autoliv, the Swedish supplier of seat belts and airbags, is restructuring to focus more on its fast growing, highmargin active safety business, including radar, night vision and front-view cameras. Autoliv has spent ¤24m on active safety-related acquisitions since 2010 and sales of its products have quadrupled from ¤75m in 2010 to ¤303m in 2013. Panasonic Corp has acquired a 49% stake in Ficosa International, a Spanish car parts manufacturer focused on rearview systems, command and control systems, under-the-hood systems, advanced communications, commercial vehicles, and door & seat systems. In a move to bolster its automotive business and move away from consumer electronics, Panasonic has paid ¤242m for the stake and plans to jointly develop self-driving car technology. Panasonic, which supplies lithium ion batteries for cars, has also signed an agreement with Tesla Motors Inc for the construction of a large-scale battery manufacturing plant in the US, known as the Gigafactory. Vodafone completed the ¤156m acquisition of Cobra Automotive Technologies SpA, an Italian specialist in telematics software, to create a leading connected car services provider. The deal enables Vodafone to follow growth outside of its traditional mobile markets. Vodafone is trying to establish itself as a key player in this space: last year, the business announced agreements with Audi and Volkswagen to provide automotive connectivity. Given the significant cost proportion of technology in the modern car, expect to start seeing more automotive businesses investing in technology companies and vice versa as the competition between the two sectors heats up. Autonomous Driving The driverless technology industry is forecast to be worth c. ¤1,200bn globally by 2025 and is currently growing at 16% a year. Consultancy firm IHS Automotive1 predicts that global sales of autonomous vehicles will hit 21 million units a year by 2030. Fully autonomous driving has the power to completely change our lifestyles. Without the need for a driver, there is potential to increase our leisure time or, perhaps, enable us to commute further distances to work. It could open up a whole new world to those presently unable to drive, such as the elderly or the visually impaired, while it could also significantly improve both traffic and fuel efficiency. some time, for instance: Audi claims its next generation A8 - a fully autonomous, self-driving vehicle - will be ready by 2017; JLR is predicting ten years for its new XE Sedan; while Nissan claims it will have autonomous vehicles ready by 2020. However, despite these predictions, the Insurance Information Institute estimates that autonomous cars will not populate roads until 2028 - 2032. Technology is progressing at such a rate that some car manufacturers are predicting that fully autonomous vehicles will be available within the next five to ten years. However, the jury is still out on the precise timeframe. Although the technology is virtually here and now, there remain significant regulatory and legislative issues to overcome. That all said, a consensus is emerging that the journey to autonomy will be a progressive one in which small steps are made along the way and new features are added to vehicles every six to nine months or so. That said, the long-term direction of travel is clear. All the major OEMs have teams of engineers working on autonomous vehicle technologies and have done for We are already seeing pre-collision braking features and self-parking on many luxury cars, with current versions of the Mercedes S Class as well as models from Acura displaying robust radar-based cruise control and lane-keeping systems that take much of the effort out of motorway driving. 1. IHS Automotive, Emerging Technologies: Autonomous Cars - Not If, But When clearthought | Spring 2015 Automotive Insights from Clearwater International The Connected Car Case study: Google In 2014, Google revealed the first fully working prototype of its electric driverless car which has undergone testing at its private track in California. This year, the model is set to hit the public roads for testing and among the named suppliers are Continental, Bosch and LG. Google plans to build around 100 to 200 of these prototype vehicles, but they are not expected to be commercially available until 2020. The cars have radar, GPS and 3D laser mapping and are currently restricted to 40kph. To comply with Californian law, the car has manual controls so that a human can override the software. If the tests go well, Google will team up with an automotive manufacturer to bring the technology to market over the next few years. Toyota is also introducing a range of advanced active safety systems across its mass market line-up: pre-crash breaking packages, an improved auto-parking feature, a next generation auto-adjust headlamp, and a vehicle-to-infrastructure communication system. By 2035, it is predicted that 75% of vehicles sold worldwide will have some autonomous capabilities1. Trials are being set up in different parts of the world to test the feasibility of autonomous driving. For instance, in the UK trials have started in four locations and will run for between 18 months and three years. In two of the locations, engineers involved in the Autodrive Programme (including Ford, JLR, and ARUP) will develop infrastructure to best work with autonomous cars navigating real roads. Another location will test automated electric shuttle buses and robotic valet parking. In the US, the states of Nevada, California and Florida, and the city of Washington DC, have already authorised trials of autonomous vehicles. In Sweden, the city of Gothenburg has given Volvo permission to test 100 driverless cars, although trials are not likely to begin before 2017. 1. Navigant Research, Autonomous Vehicle, 2014 Connectivity has become a huge part of our everyday lives, with consumers demanding online access on the move. By collecting and analysing vast amounts of data from a huge array of sources, the connected car is yet another means of making our lives more efficient. Through Vehicle-to-Vehicle Communication (V2V), cars will be able to talk to other cars and alert each other to potential collisions. Through Vehicleto-Infrastructure Communication (V2I) systems, cars will talk to sensors on signs, stoplights and bus stops in order to receive traffic updates and make decisions on re-routing. Cars will also be able to communicate with your house, office and smart devices to ensure that you know the plan for your day. Access to the internet will facilitate streaming of music and films, as well as improve navigation. Technology will also enable stolen vehicle tracking and location-based recovery services. The disappearance of the in-dash CD player has already begun, making way for MP3 jacks, USB/iPod connectors and streaming Bluetooth audio. For most new vehicles, drivers can still opt for a CD player but will often find it in the centre armrest or glove compartment in order to make space for large screen displays on the dash. The connected car brings with it many advantages from improved safety, to assisting with traffic congestion and increased security. For example, remote access to vehicles via smartphones and tablets will notify owners should a vehicle move unexpectedly. Through vehicle diagnostics, early warning systems alert the driver to any potential problems with the vehicle prior to a breakdown. The European Union is calling for systems that automatically call for assistance in the event of a crash to be fitted to all new vehicles by 2015. eCall systems that alert the emergency services in the event of an accident are to be the most common services supported by connected cars and are likely to be seen in 41.7m vehicles in 2018, up from 7m in 20122. 2. GSMA, Connected Car Forecast, Feb 2013 GSMA predicts that, by the end of this year, 20% of global vehicle sales will include embedded connectivity solutions and 50% will be connected either by embedded, tethered or smartphone integration. GSMA also predicts that every car will be connected in multiple manners by 2025. As connectivity becomes more and more prevalent, the opportunity also becomes greater for telecoms companies to make their move in this market. In the US, AT&T is already offering customers the option to add their car to their mobile data sharing plan. Carmakers now need to work with mobile partners in order to offer integrated products and solutions to customers - and we have already seen this happen, as Chrysler has partnered with Sprint Nextel and GM with AT&T. However, the question remains as to who will pay for the services. Will it be the customer paying direct to the mobile phone company? Or will it form part of a rolled-in payment to the car company? All of this circulating data, which will be stored in the Cloud, could then be used by third parties. For instance, driver behaviour data could be passed on to insurance companies. Case study: JLR Recognising the importance of consumer demand for connectivity within the vehicle, JLR is collaborating with Intel and has opened a new Technology R&D centre in Portland, Oregon, with a specific focus on future vehicle entertainment systems. For many OEMs, having a base close to the technology hubs of Silicon Valley and Seattle is now considered essential as carmakers and technology companies are increasingly collaborating to build the car of the future. The Portland facility is JLR’s first dedicated software R&D operation. clearthought | Spring 2015 Automotive Insights from Clearwater International Alternative Energy Growing environmental concerns are leading to tighter regulations on vehicle emissions. Along with increasing environmental awareness from consumers, the volatility of gas prices and the depletion of oil reserves, finding alternative forms of energy for fuelling vehicles is becoming more urgent. The most feasible alternative energy options present in today’s market are: Conventional Hybrids, Plug-in Hybrids, Battery Electric Vehicles and Fuel Cell Electric Vehicles. Alternative Energy Type Description Examples of Models Conventional Hybrid Combines a petrol engine with an electric motor but cannot be plugged in or recharged. Batteries are charged from capturing energy when braking. Toyota Prius Honda Accord Plug-in Hybrid Electric Vehicles (PHEVs) Similar to conventional hybrids in that they have both an electric motor and internal combustion engine but they can be charged by plugging into an outlet. Ford Fusion Energi Chevrolet Volt Toyota Prius Mitsubishi Outlander Battery Electric Vehicles (BEVs) Run exclusively on electricity via on-board batteries that are charged by plugging into an outlet or charging station. Nissan Leaf Fiat 500e Tesla Model S Ford Focus Mitsubishi i-MiEV Renault Twizy Fuel Cell Electric Vehicles (FCEVs) Use an electric-only motor (like BEVs) but store hydrogen gas in a tank as energy. The fuel cell combines hydrogen with oxygen from the air to produce electricity which then powers an electric motor. Toyota Mirai Hyundai ix35 The global light duty EV market is expected to grow from 2.7 million vehicle sales annually in 2014 to 6.4 million in 20231. 1. Navigant Research, Electric Vehicle Market Forecasts, 2014-2023 Hydrogen Hydrogen technology uses an electric motor but the power comes from hydrogen that is processed in a chemical reaction that takes place inside a fuel cell. The advantages of a fuel cell car include quick refuelling (five minutes or less) and a 480 kilometre range, in addition to no carbon dioxide emissions. However, it will take many years to build the necessary infrastructure and the production of hydrogen is not a straightforward process. Attempts to replicate the process using renewable sources have proven expensive. In California, ¤176m has been earmarked to build 20 filling stations by the end of this year while the UK has announced a scheme to expand the hydrogen refuelling network. Toyota’s first hydrogen fuel cell car, the ‘Mirai’, is to go on sale in the UK in 2015 and will compete with Hyundai’s new ix35 model. In the US, Toyota will be leasing the Mirai for about ¤440 per month. In Japan, the Mirai has secured 1,500 orders so far and there are plans to triple production in 2016. Other OEMs such as Hyundai, BMW and Audi are also developing solutions with hydrogen-driven technology. clearthought | Spring 2015 Automotive Insights from Clearwater International Electric Vehicles Much of the debate around alternative energy for vehicles has been focused upon electric vehicles, especially given the success of models such as Tesla’s Model S. Electric vehicles and hybrid electric vehicles produce less emissions and environmental pollutants, but are still in need of significant amounts of electricity to power them. A typical Electric Vehicle (EV) will have a range of 110-160 kilometres, though some models can travel up to 426 kilometres on a single charge. Plug-in Hybrid Electric Vehicles (PHEVs) are powered by a combination of grid electricity and liquid fuel. A PHEV runs on battery power until the battery charge is exhausted, then switches over to its internal combustion engine. Sales of the BMW i3 and Tesla Model S pure electric cars are increasing, with US producer Tesla holding back demand because it cannot produce enough for at least a year. However, the major problem with mainstream pure EVs remains price. There are signs that lower-priced EVs may not be that far away in China, with electronics contract manufacturer Foxconn partnering with BAIC Motor to produce a sub ¤13,000 pure electric car. The US is leading the way in sales of plug-in EVs, with the market dominated by four models which account for 81% of plug-in vehicle sales: the Nissan LEAF (EV), the Chevrolet Volt (PHEV), the Toyota Prius Plug-in (PHEV), and the Tesla Model S (EV). As of May 2014, approximately 50,000 LEAFs, 60,000 Volts, 30,000 Prius Plugins, and 26,000 Tesla Model S units had been sold. Plug-in vehicle sales currently account for less than 1% of all new vehicles, however, this is the fastest-growing segment of the automobile market. In the meantime, the infrastructure required to drive the market is growing. In the US, there are currently around 9,000 public charging stations - compared with 150,000 gasoline stations. Plug-in vehicles can be recharged at home in as little as 1.5 hours, depending on the size of the battery pack. Indeed, the single biggest expense in any plug-in vehicle is the battery pack. The Nissan Leaf’s lithium ion battery initially accounted for one-third of the cost of the vehicle, though these prices are now falling dramatically with the average 24 kWh battery pack for a plug-in vehicle costing ¤10,000 today. When the new Tesla Gigafactory comes online in 2017, Tesla expects to achieve a minimum of 30% reduction in production costs. A report by IDTechEx1 predicts that sales of all hybrid and pure electric vehicles could exceed ¤470bn, but not until 2025. Most EVs are higher-cost premium cars and are likely to remain so for some time. 1.IDTechEx, Electric Vehicle Forecasts, Trends and Opportunities 2015-2035, 2014 Case study: Tesla Tesla was formed in 2003 by five Silicon Valley entrepreneurs and in 2009 secured ¤410m in low-interest loans from the US government. The following year, the company filed for a ¤88m IPO as it started to design and manufacture EV parts for other companies. Today, Daimler uses Tesla’s battery packs, Mercedez-Benz uses a Tesla Powertrain, and Toyota uses a Tesla motor. Tesla trades at much higher multiples than its luxury car peers and has a current market cap of more than ¤22bn. It recently announced that it will soon offer a suite of four safety systems that together offer a semiautonomous driving experience. This includes a forward-looking radar; a camera with image recognition that can read stop signs and identify objects before impact; a 360 degree long-range sonar; and a system to integrate those features with navigation, GPS and real-time data traffic. Conclusion These are exciting times in the global automotive industry, as technological breakthroughs take the concepts of automation and connected cars from dreams to reality and transform the driving experience. However, as OEMs clamber for a space aboard this fast-moving train, it is worth remembering that cars take much longer to develop than products such as smartphones (typically operating on a three- to five-year cycle) so one needs to feed in these timescales in terms of immediate expectations. In addition, there are plenty of risks for regulatory authorities to consider such as hacking, digital safety, privacy concerns and computer malfunctions. In the medium to long term, it is clear that the trends we have highlighted in this report not only have the potential to transform the driving experience, but could also bring about significant environmental and social benefits. Connected cars will in all likelihood become shared cars, as consumers move away from sole car ownership and tap into emerging sharing economy trends. Given that 70% of the world’s population is expected to be living in cities by 2050, the enormous potential benefits of more automated transport systems are clear. clearthought | Spring 2015 Automotive Insights from Clearwater International Deal highlights Some of our Automotive deals Meet the team Jon Hustler Partner, UK KLOKKERHOLM KAROSSERIDELE ANTOLIN GROUP AUTOMOTIVE +44 845 052 0364 [email protected] Leading distributor of auto body parts to the independent aftermarket Largest Spanish manufacturer of vehicle interior components Francisco Gómez Clearwater International advised the shareholders on the sale to Danish PE fund Capidea Clearwater International advised on the acquisition of shares in Gong Zhu Lin Automotive Components Partner, Spain +34 699 446 314 francisco.gomez@ cwicf.com Constantine Biller Partner, UK INFUN GROUP MANN+HUMMEL GROUP Leading producer of metal parts and components for the automotive sector Development partner and original equipment supplier Clearwater International advised on the corporate restructuring of the company Clearwater International advised the company on the acquisition of Bengby Haoye Filter +44 845 052 0353 constantine.biller @cwicf.com Søren Nørbjerg Partner, Denmark +45 40 21 45 19 soren.norbjerg@ cwicf.com Olivia Prew Deal Origination, UK +44 845 052 0375 [email protected] Group DRT mi TECHNOLOGY Recognised manufacturer of moulds for the automobile industry Provider of testing and development equipment for the automotive industry Clearwater International advised the shareholders of Group DRT on the sale of a minority stake in the company to OxyCapital Clearwater International advised on the sale of mi Technology to CSA Lars Rau Jacobsen Director, Denmark +45 25 39 45 71 lars.rau.jacobsen@ cwicf.com Carlos Morgado Director, Portugal +351 918 213 379 carlos.morgado@ cwicf.com Mark Gillingham Associate, UK +44 845 052 0368 mark.gillingham @cwicf.com www.clearwaterinternational.com AARHUS • BARCELONA • BEIJING • BIRMINGHAM • COPENHAGEN • LISBON LONDON • MADRID • MANCHESTER • NOTTINGHAM • PORTO • SHANGHAI

© Copyright 2026