Corporate governance and social responsibility

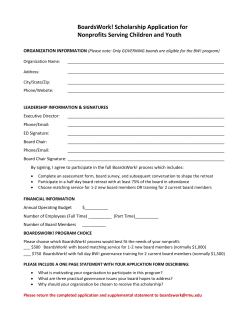

International Journal of Law and Management Corporate governance and social responsibility Marty Stuebs Li Sun Article information: Downloaded by Universitas Muhammadiyah Malang At 20:22 27 March 2015 (PT) To cite this document: Marty Stuebs Li Sun , (2015),"Corporate governance and social responsibility", International Journal of Law and Management, Vol. 57 Iss 1 pp. 38 - 52 Permanent link to this document: http://dx.doi.org/10.1108/IJLMA-04-2014-0034 Downloaded on: 27 March 2015, At: 20:22 (PT) References: this document contains references to 36 other documents. To copy this document: [email protected] The fulltext of this document has been downloaded 379 times since 2015* Users who downloaded this article also downloaded: Luu Trong Tuan, (2012),"Corporate social responsibility, ethics, and corporate governance", Social Responsibility Journal, Vol. 8 Iss 4 pp. 547-560 http://dx.doi.org/10.1108/17471111211272110 Lance Moir, (2001),"What do we mean by corporate social responsibility?", Corporate Governance: The international journal of business in society, Vol. 1 Iss 2 pp. 16-22 http://dx.doi.org/10.1108/ EUM0000000005486 Yingjun Lu, Indra Abeysekera, Corinne Cortese, (2015),"Corporate social responsibility reporting quality, board characteristics and corporate social reputation: Evidence from China", Pacific Accounting Review, Vol. 27 Iss 1 pp. 95-118 http://dx.doi.org/10.1108/PAR-10-2012-0053 Access to this document was granted through an Emerald subscription provided by 609392 [] For Authors If you would like to write for this, or any other Emerald publication, then please use our Emerald for Authors service information about how to choose which publication to write for and submission guidelines are available for all. Please visit www.emeraldinsight.com/authors for more information. About Emerald www.emeraldinsight.com Emerald is a global publisher linking research and practice to the benefit of society. The company manages a portfolio of more than 290 journals and over 2,350 books and book series volumes, as well as providing an extensive range of online products and additional customer resources and services. Emerald is both COUNTER 4 and TRANSFER compliant. The organization is a partner of the Committee on Publication Ethics (COPE) and also works with Portico and the LOCKSS initiative for digital archive preservation. *Related content and download information correct at time of download. The current issue and full text archive of this journal is available on Emerald Insight at: www.emeraldinsight.com/1754-243X.htm IJLMA 57,1 Corporate governance and social responsibility 38 Department of Accounting and Business Law, Hankamer School of Business, Baylor University, Waco, Texas, USA, and Marty Stuebs Li Sun Downloaded by Universitas Muhammadiyah Malang At 20:22 27 March 2015 (PT) Department of Accounting and MIS, Collins College of Business, University of Tulsa, Tulsa, Oklahoma, USA Abstract Purpose – This paper aims to draw on the stakeholder theory to examine the association between corporate governance and social responsibility. Design/methodology/approach – This paper hypothesized that corporate governance is positively associated with corporate social responsibility (CSR), and good corporate governance also leads to good social responsibility in the following year. Corporate governance was measured by using the corporate governance index provided by Brown and Caylor (2006, 2009). CSR data come from Kinder, Lydenberg and Domini (KLD), Inc. Findings – Regression analysis documents significant evidence to support a positive association between corporate governance and social responsibility. Evidence suggests that good governance leads to good CSR performance. Originality/value – The results should interest managers who engage in behavior leading to or maintaining strong corporate governance mechanisms, financial analysts who conduct research on corporate governance and firm performance and policymakers who design and implement guidelines on corporate governance mechanisms. Moreover, results of this study can increase individual investors’ confidence in investing in companies with stronger corporate governance. Keywords Corporate social responsibility, Corporate governance, Stakeholder theory Paper type Research paper International Journal of Law and Management Vol. 57 No. 1, 2015 pp. 38-52 © Emerald Group Publishing Limited 1754-243X DOI 10.1108/IJLMA-04-2014-0034 1. Introduction Stakeholder theory (Hill and Jones, 1992) focuses on the importance of a firm’s relationship with stakeholders. Relationships with various stakeholder groups like customers, employees and the community affect firm performance whether or not those stakeholder groups share in ownership rights. Effectively responding to and managing these stakeholder relationships is critical to success. Successful relationships are based on trust, and trust is created and maintained by meeting and exceeding responsibilities to stakeholders. Corporate governance mechanisms play an important role in this process. They build and maintain trust by ensuring that responsibilities are either met or exceeded. For example, Sarbanes–Oxley reforms are efforts to repair public trust by improving governance mechanisms assuring financial reporting responsibilities to various stakeholders. Does improved governance further improve trust by assuring that other stakeholder and social responsibilities besides financial reporting responsibilities are met? Does governance improve other dimensions of performance besides financial performance? Downloaded by Universitas Muhammadiyah Malang At 20:22 27 March 2015 (PT) In this study, we examine the relationship between corporate governance and social responsibility. We posit that: • corporate governance is positively associated with social responsibility; and • good corporate governance leads to good future social responsibility. We measure corporate governance by using the corporate governance index provided by Brown and Caylor (2006, 2009). Corporate social responsibility (CSR) data come from Kinder, Lydenberg, and Domini (KLD), Inc. Our study documents significant evidence to support a positive association between corporate governance and social responsibility. In addition, the results suggest good corporate governance leads to good social responsibility in the following year. Our paper delivers new evidence on the link between corporate governance and social responsibility. It integrates and contributes to the corporate governance literature and emerging accounting literature on CSR. The results should interest managers who engage in behavior leading to or maintaining strong corporate governance mechanisms, financial analysts who conduct research on corporate governance and firm performance and policymakers who design and implement guidelines on corporate governance mechanisms. Moreover, results in this study can increase individual investors’ confidence in investing in companies with stronger corporate governance. The remainder of the paper is organized as follows. Section 2 reviews prior research and develops the hypotheses. Section 3 describes our research design, including measurement of primary variables and empirical specification. Section 4 describes sample selection and descriptive statistics, while Section 5 reports the results from our regression analyses. Section 6 reports supplemental tests, and Section 7 summarizes the study. 2. Literature review and hypothesis development 2.1 Review on CSR CSR is defined as “the voluntary integration of social and environmental concerns into business operations and into their interaction with stakeholders” (European Commission, 2002). Vilanova et al. (2009) propose that the definition of CSR consists of five dimensions, including vision, community relations, workplace, accountability and marketplace. Vision, for example, includes CSR conceptual development, codes and value within the organization. Community relations include partnerships with different stakeholders such as customers, suppliers, etc. Workplace includes human rights and labor practices within the organization. Accountability includes the transparency in communication and financial reporting. Marketplace includes the relationship between CSR and core business processes such as sales, purchasing, etc. Many prior studies (Cochran and Wood, 1984; McGuire et al., 1988; Waddock and Graves, 1997; Griffin and Mahon, 1997; Roman et al., 1999; Tsoutsoura, 2004; Beurden and Gosslin, 2008) suggest a positive relation between CSR and financial performance. The consensus appears to be that a positive relation exists between CSR and financial performance. Some CSR studies examine the relation between CSR and other firm characteristics. Dhaliwal et al. (2011) find firms with superior CSR performance also receive favorable analyst coverage and achieve lower absolute forecast errors and dispersion. Dhaliwal et al. (2012) examine the relation between CSR disclosure and analyst forecast accuracy using firm-level data from 31 countries, and find that the Corporate governance and social responsibility 39 Downloaded by Universitas Muhammadiyah Malang At 20:22 27 March 2015 (PT) IJLMA 57,1 issuance of CSR reports is associated with lower analyst forecast error. Kim et al. (2012) document a positive relation between CSR and earnings quality, suggesting that socially responsible firms have higher earnings quality. In summary, the above CSR studies suggest that engaging in CSR activities may bring future benefits to firms. 40 2.2 Review on governance Corporate governance is important to a firm’s performance and success. Much of the research in this area documents how corporate governance mechanisms affect dimensions of financial reporting and performance. Abdel-Khalik (2002) proposed post-Enron governance reforms to, among other things, improve auditor selection, retention and compensation. Recent work also documents financial reporting benefits from corporate governance. For example, there is less information asymmetry around quarterly earnings announcements (Kanagaretnam et al., 2007), and the quality of information available to financial analysts increases with higher levels of corporate governance (Byard et al., 2006). Given these reporting benefits, the determinants of good reporting governance have been investigated and documented. Board of Directors and audit committee characteristics like independence (Jaggi et al., 2009; Bronson et al., 2009) and expertise (DeZoort et al., 2003, Gul and Leung, 2004; Kelton et al., 2008) ensure good governance and high-quality financial reporting. Do corporate governance mechanisms have similar positive effects on other dimensions of firm performance besides financial reporting? Stakeholder theory (Hill and Jones, 1992) focuses on the importance of stakeholder relationships and recognizes stakeholders’ impact on firm sustainability and success. A stakeholder can be thought of as a “group or individual who can affect or is affected by the achievement of the organization’s objectives” (Freeman, 1984, p. 46). Because stakeholder relationships affect organization objectives, they are important. Effective stakeholder relationships are based on trust. Trust in these relationships is built and maintained by continually meeting and exceeding responsibilities. Effective corporate governance plays an important role in facilitating effective stakeholder relationships. Corporate governance builds and maintains stakeholder trust by assuring that firm responsibilities are met and exceeded. Empirical research on corporate governance suggests a positive link between corporate governance and different dimensions of firm performance. Good governance protects shareholder interests and reduces principal–agent problems (Riyanto and Toolsema, 2007). Specifically, Brown and Caylor (2009) argue that good corporate governance creates a system of greater control over managerial actions, which, in turn, should reduce principal–agent problems and improve trust. As a result, Brown and Caylor (2009) find that governance improves operating performance measured by return on assets (ROA) and return on equity (ROE). They rely on data from Institutional Shareholder Service (ISS) to create a firm-specific corporate governance measure known as Gov-Score. Unlike other governance indexes, Gov-Score is based on both internal and external factors. Corporate governance may be related to other dimensions of performance like dimensions of corporate social performance in addition to operating performance. While the relationship between corporate governance and operating performance has received attention, governance’s relationship with CSR has largely gone unexplored. Recent work has begun to explore the relationship between corporate governance and specific dimensions of CSR like environmental performance. Stuebs and Sun (2010) find that governance is positively associated with a firm’s environmental strengths. Earnhart (2002) finds that concentrated ownership improves environmental performance. The idea is that concentrated ownership creates strong governance which facilitates better cost management, including environmental cost management. We extend this work by investigating the following question: What is the relationship between corporate governance and CSR? This question leads to the two following hypotheses in this paper: H1. Corporate governance is positively associated with social responsibility performance. Downloaded by Universitas Muhammadiyah Malang At 20:22 27 March 2015 (PT) H2. Good corporate governance leads to good social responsibility performance. 3. Research design and variable description Brown and Caylor’s (2006, 2009) Gov-Score measure and KLD’s CSR data are used to investigate the relationship between corporate governance and CSR. Figure 1 We also include five control variables to control for firm size, age of long-term assets, leverage, return on assets and the market-to-book ratio. The next two sections provide details on how we measure the primary variables of interest in this study, i.e. CSR and corporate governance. 3.1 Measurement of the primary dependent variable – CSR KLD, a Boston-based consulting firm, has been actively providing rating data on CSR since 1991. KLD data are an influential measure of CSR. While many investment managers rely on KLD data when making social screening, the KLD data are also frequently used in academic literature. It is “the largest multidimensional corporate social performance database available to the public and is used extensively in research on corporate social performance” (Deckop et al., 2006, p. 334). KLD accumulates CSR information for more firms than other CSR data sources. It has become “the de facto corporate social performance research standard at the moment” (Waddock, 2003, p. 369). KLD provides rating data for approximately 80 variables in 7 qualitative areas for each selected firm. The seven areas include community, corporate governance, diversity, employee relations, environment, human rights and product. For each qualitative variable, positive ratings indicate strengths, and negative ratings indicate concerns. For example, the environment area contains six strength items (beneficial products, pollution prevention, recycling, clean energy, property plant and equipment and other strengths) and six concern items (hazardous waste, regulatory problems, ozone depleting chemicals, substantial emissions, agriculture chemicals and other concerns). In addition to these seven qualitative areas, KLD also evaluates six controversial issues that include, alcohol, gambling, firearms, military, nuclear power and tobacco activities. Involvement in any of these six controversial issues results in a negative rating. A complete listing strengths and concerns for KLD variables is provided in the Table AI. Consistent with prior research (Chen et al., 2008; Cho et al., 2006; Deckop et al., 2006; Nelling and Webb, 2009; Ruf et al., 2001; Johnson and Greening, 1999; Griffin and Mahon, 1997; Shropshire and Hillman, 2007; Waddock and Graves, 1997; Graves and Waddock, 1994), we subtract total concerns from total strengths and assign equal Corporate governance and social responsibility 41 IJLMA 57,1 Theoretical Model Corporate Governance 42 Corporate Social Responsibility (+) Operational Model Downloaded by Universitas Muhammadiyah Malang At 20:22 27 March 2015 (PT) H1 (+) (Table 4 Panel A) Brown and Caylor’s (2006, 2009) Gov-Score Measure KLD Index Score H2 (+) (Table 4 Panel B) Control Variables: Size (Sales) Age of Assets Leverage Figure 1. Provides an overview of the research design we use to test our hypotheses Return on Assets (ROA) Market-to-Book Ratio importance/weight to each area in calculating the KLD index score. This approach is also suggested by KLD[1]. The KLD index score is computed as follows: KLD ⫽ (Total strengths of Community – Total concerns of Community) ⫹ (Total strengths of Corporate Governance – Total concerns of Corporate Governance) ⫹ (Total strengths of Diversity – Total concerns of Diversity) ⫹ (Total strengths of Employee Relations – Total concerns of Employee Relations) ⫹ (Total strengths of Environment – Total concerns of Environment) ⫹ (Total strengths of Human Rights – Total concerns of Human Rights) ⫹ (Total strengths of Product – Total concerns of Product) ⫺ Any concerns of Alcohol – Any concerns of Gambling – Any concerns of Firearm – Any concerns of Military – Any concerns of Nuclear Power – Any concerns of Tobacco. 3.2 Measurement of the primary independent variable – corporate governance scores ISS developed a measure of corporate governance strength using 61 variables grouped into the following eight areas: (1) board structure and composition; (2) audit issues; Downloaded by Universitas Muhammadiyah Malang At 20:22 27 March 2015 (PT) (3) (4) (5) (6) (7) (8) Corporate governance and social responsibility charter and bylaw provisions; laws of the state of incorporation; executive and director compensation; qualitative factors; director and officer stock ownership; and director education. 43 ISS gathers data from public sources, and companies can also provide ISS with updated or corrected data. Brown and Caylor (2006, 2009) used the ISS data to create a summary score, known as Gov-Score, to measure the strength of corporate governance. They selected 51 variables, and coded each of the 51 variables as either 0 or 1, depending on whether or not ISS considers the firm’s governance to be minimally acceptable. Brown and Caylor (2006, 2009) then aggregated those 51 binary variables to create a firm-specific summary score. Thus, a Gov-Score ranges from 0 to 51. Gov-Scores are generously provided by Brown and Caylor (2006, 2009). Interested users can freely download the data from their Web site[2]. 3.3 Empirical specification We use the governance score (GOV) and KLD’s social responsibility index score (KLD) in the following regression models to test the association between corporate governance and social responsibility (i.e. H1) in equation (1) and to test whether corporate governance leads to social responsibility (i.e. H2) in equation (2)[3]: KLDit ⫽ ␣0 ⫹ ␣1*GOVit ⫹ ␣2*SALESit ⫹ ␣3*AGEit ⫹ ␣4*LEVit ⫹ ␣5*ROAit ⫹ ␣6*MTBit ⫹ it (1) KLDit ⫽ ␣0 ⫹ ␣1*GOVit ⫹ ␣2*SALESit ⫹ ␣3*AGEit ⫹ ␣4*LEVit ⫹ ␣5*ROAit ⫹ ␣6*MTBit ⫹ it (2) Where: KLDit ⫽ social responsibility index score for firm i in year t; GOVit ⫽ corporate governance score of firm i in year t; GOVit-1 ⫽ corporate governance score of firm i in year t-1; SALESit ⫽ net sales (Compustat Item #12) of firm i in year t; AGEit ⫽ net property, plant and equipment (Compustat Item #8)/Gross property, plant and equipment (Compustat Item #7) of firm i in year t; LEVit ⫽ leverage ratio [total liabilities (Compustat Item #9 ⫹ #34)/total assets (Compustat Item #6)] of firm i in year t; ROAit ⫽ return on assets [income before extraordinary items – available for common equity (Compustat Item #237)/total assets (Compustat Item #6)] of firm i in year t; and MTBit ⫽ market-to-book ratio {[common shares outstanding (Compustat Item #25) ⫻ stock price – fiscal year-end (Compustat Item #199)]/total common equity (Compustat Item #60)} of firm i in year t. IJLMA 57,1 Downloaded by Universitas Muhammadiyah Malang At 20:22 27 March 2015 (PT) 44 The social responsibility index score (KLD) is the independent variable of interest. Five control variables are included to control for firm size, the age of long-term assets, leverage, return on assets and the market-to-book ratio. 4. Sample selection and descriptive statistics We obtain the list of firms with corporate Gov-Scores from the Web site described by Brown and Caylor (2006, 2009). Gov-Scores are available for 3,258 firms as of February 1, 2005. Consistent with Brown and Caylor (2006, 2009), we use the prior year (2004) as the testing period. Next, we obtain the list of firms with KLD index scores from the KLD database for 2004 and 2005. KLD contains approximately 3,000 firm observations each year because the KLD database contains firms on the Russell 3,000 Index. After matching Gov-Score and KLD observations with Compustat financial data, our final sample consists of 1,222 firms for 2004 and 1,107 firms for 2005. Panel A of Table I presents the industry distribution of sample firms for 2004, while Panel B of Table I reports the industry distribution of sample firms for 2005. Table II summarizes the sample firms’ descriptive statistics for each of the two years. Information including mean and median of selected variables is provided. For instance, the mean values of GOV are 30.64 and 30.67, while the mean values of the KLD score are ⫺0.43 and ⫺0.29 in Panels A and B, respectively. Table III reports the Pearson correlation matrix for selected variables in each of the two years. For each pair of variables, the Pearson correlation coefficient and related p-value are provided. In general, the results indicate that both GOVt and GOVt-1 are positively correlated with KLD, total sales, LEV, ROA and ROE. Of particular interest to this study, GOV is significantly (p ⬍ 0.01) positively correlated with KLD in each of the Sample selection process Panel A: Observation Reconciliation Observations with governance data Less: observations missing KLD Data Less: observations missing Compustat Data Net sample observations Industry Panel B: Observation Industry Distribution Agriculture, forestry and fisheries (SIC 01-09) Mineral Industries (SIC 10-14) Construction Industries (SIC 15-17) Manufacturing Industries (SIC 20-39) Transportation, communication and utilities (SIC 40-49) Wholesale (SIC 50-51) Retail (SIC 52-59) Financial industries (SIC 60-69) Service (SIC 70-89) Table I. Industry distribution Public administration (SIC 90-99) of sample firms Total No. of firms 2005 No. of firms 2004 3,258 (995) (1,156) 1,107 3,258 (861) (1,175) 1,222 No. of firms total No. of firms 2005 No. of firms 2004 9 123 47 1,199 132 66 239 48 461 5 2,329 4 64 23 569 64 32 114 22 213 2 1,107 5 59 24 630 68 34 125 26 248 3 1,222 Downloaded by Universitas Muhammadiyah Malang At 20:22 27 March 2015 (PT) Variable Mean SD 25th percentile Median 75% percentile Panel A: 2004 (n ⫽ 1222) 30.64 GOVt ⫺0.43 KLDt 4,477.88 SALESt 525.65 OCFt 2,987.70 COGSt 801.94 XSGAt 5,369.04 TAt 1,574.87 TDt 0.19 LEVt 0.49 AGEt 3.85 MTBt 3.42 ROAt 0.07 ROEt 4.85 1.96 16,873.89 2,290.16 12,415.82 2,845.51 29,612.18 14,698.53 0.17 0.16 7.06 13.33 207.36 27.00 ⫺1.00 273.03 19.32 132.28 63.97 336.12 4.29 0.01 0.38 1.74 1.54 3.47 31.00 ⫺1.00 803.68 71.82 432.70 162.20 849.30 151.04 0.17 0.49 2.49 4.91 10.07 34.00 0.00 2,445.49 248.62 1,571.31 483.89 2,635.89 600.38 0.30 0.59 3.83 8.78 16.99 Panel B: 2005 (n ⫽ 1107) 30.67 GOVt⫺1 ⫺0.29 KLDt 5,264.06 SALESt 590.81 OCFt 3,555.56 COGSt 896.70 XSGAt 5,946.63 TAt 1,698.72 TDt 0.19 LEVt 0.49 AGEt 3.98 MTBt 4.81 ROAt 4.42 ROEt 4.90 2.20 19,928.15 2,611.83 15,042.82 3,082.72 29,544.30 15,042.45 0.17 0.16 7.89 10.26 102.81 27.00 ⫺1.00 338.15 29.27 153.88 75.76 410.92 7.47 0.02 0.39 1.76 2.17 4.68 31.00 ⫺1.00 985.77 101.79 543.29 188.28 1,027.29 177.01 0.17 0.48 2.55 5.69 11.69 34.00 1.00 3,008.34 316.80 1,957.20 556.00 3,004.07 661.00 0.30 0.59 3.87 9.81 19.21 Corporate governance and social responsibility 45 Notes: Variable definitions: GOVt ⫽ Corporate governance score in year t; GOVt-1 ⫽ Corporate governance score in year t-1; KLDt ⫽ Social responsibility index score in year t; SALESt ⫽ Net sales (Compustat Item #12) in year t; OCFt ⫽ Net cash flows from operating activities (Compustat Item #308) in year t; COGSt ⫽ Cost of goods sold (Compustat Item #41) in year t; XSGAt ⫽ Selling, general and administrative expenses (Compustat Item #189) in year t; TAt ⫽ Total assets (Compustat Item #6) in year t; TDt ⫽ Total liabilities (Compustat Item #9 ⫹ #34) in year t; LEVt ⫽ Leverage ratio [total liabilities (Compustat Item #9 ⫹ #34)/total assets (Compustat Item #6)] in year t; AGEt ⫽ Net property, plant and equipment (Compustat Item #8)/Gross property, plant and equipment (Compustat Item #7) in year t; MTBt ⫽ Market to book ratio {[common shares outstanding (Compustat Item #25) ⫻ stock price – fiscal year-end (Compustat Item #199)]/total common equity (Compustat Item #60)} in year t; ROAt ⫽ Return on assets [income before extraordinary items – available for common equity (Compustat Item #237)/total assets (Compustat Item #6)] in year t; ROEt ⫽ Return on equity ratio [income before Table II. extraordinary items – available for common equity (Compustat Item #237)/common shareholders’ Descriptive statistics for the sample firms interest in the company (Compustat Item #60)] in year t. two years of our sample (i.e. 2004, 2005). The significant correlation between GOV-t and KLDt in 2004 (Panel A of Table III) suggests that corporate governance is positively associated with CSR, and the significant correlation between GOVt-1 and KLDt in 2005 (Panel B of Table III) suggests that corporate governance (as of 2004) has a positive IJLMA 57,1 Downloaded by Universitas Muhammadiyah Malang At 20:22 27 March 2015 (PT) 46 Table III. Pearson correlation among selected variables Variable GOV⫺t KLDt SALESt AGEt LEVt ROAt ROEt Panel A: 2004 (n ⫽ 1222) KLDt 0.0992 (p-value, two-tailed) 0.0005 SALESt 0.2492 (p-value, two-tailed) ⬍ 0.0001 AGEt 0.0983 (p-value, two-tailed) 0.0006 LEVt 0.1590 (p-value, two-tailed) ⬍ 0.0001 ROAt 0.1630 (p-value, two-tailed) ⬍ 0.0001 ROEt 0.0810 (p-value, two-tailed) 0.0046 MTBt ⫺0.0138 (p-value, two-tailed) 0.6305 0.2820 ⬍ 0.0001 0.0558 0.0512 0.1084 0.0001 0.0180 0.5295 0.0161 0.5734 ⫺0.0071 0.8038 0.0920 0.0013 0.0706 0.0135 0.0598 0.0366 0.0182 0.5257 ⫺0.0140 0.6257 0.3122 ⬍ 0.0001 0.0622 0.0299 ⫺0.0620 0.0303 ⫺0.0075 0.7924 ⫺0.0860 0.0026 ⫺0.0779 0.0065 0.2244 ⬍ 0.0001 0.2751 ⬍ 0.0001 ⫺0.0083 0.7723 ⫺0.0530 0.0638 Panel B: 2005 (n ⫽ 1107) KLDt 0.1097 (p-value, two-tailed) 0.0003 SALESt 0.2420 (p-value, two-tailed) ⬍ 0.0001 AGEt 0.0460 (p-value, two-tailed) 0.1256 LEVt 0.0848 (p-value, two-tailed) 0.0047 ROAt 0.1588 (p-value, two-tailed) ⬍ 0.0001 ROEt 0.0704 (p-value, two-tailed) 0.0192 MTBt ⫺0.0395 (p-value, two-tailed) 0.1893 0.2847 ⬍ 0.0001 ⫺0.0383 0.2037 0.0621 0.0390 0.0281 0.3505 0.0240 0.4246 ⫺0.0090 0.7642 0.0860 0.0042 0.0433 0.1501 0.0711 0.0181 0.0326 0.2784 ⫺0.0203 0.5003 0.3003 ⬍ 0.0001 0.0522 0.0826 0.0454 0.1313 ⫺0.0213 0.4785 ⫺0.2076 ⬍ 0.0001 ⫺0.2005 ⬍ 0.0001 0.2627 ⬍ 0.0001 0.4280 ⬍ 0.0001 ⫺0.1546 ⬍ 0.0001 ⫺0.6777 ⬍ 0.0001 Notes: Variable Definitions: GOVt ⫽ Corporate governance score in year t; GOVt-1 ⫽ Corporate governance score in year t-1; KLDt ⫽ Social responsibility index score in year t; SALESt ⫽ Net sales (Compustat Item #12) of firm i in year t; AGEt ⫽ Net property, plant and equipment (Compustat Item #8)/Gross property, plant and equipment (Compustat Item #7) in year t; LEVt ⫽ Leverage ratio [total liabilities (Compustat Item #9 ⫹ #34)/total assets (Compustat Item #6)] in year t; ROAt ⫽ Return on assets [income before extraordinary items – available for common equity (Compustat Item #237)/ total assets (Compustat Item #6)] in year t; ROEt ⫽ Return on equity ratio [ income before extraordinary items – available for common equity (Compustat Item #237)/common shareholders’ interest in the company (Compustat Item #60)] in year t; MTBt ⫽ Market to book ratio {[common shares outstanding (Compustat Item #25) ⫻ stock price – fiscal year-end (Compustat Item #199)]/total common equity (Compustat Item #60)} in year t. impact on future social responsibility performance (as of 2005). Overall, results in Table III provide initial evidence supporting our two hypotheses. 5. Results We use regression analyses to further test our hypotheses. The regression model in equation (1) is used to test our first hypothesis and results are reported in Panel A of Downloaded by Universitas Muhammadiyah Malang At 20:22 27 March 2015 (PT) Table IV. Panel B reports results from the regression analysis using equation (2) to test our second hypothesis. As shown in Panel A of Table IV, the current year’s governance coefficient (␣1) is positive (0.0427) and significant (p ⫽ 0.0004) which supports our first hypothesis of a positive association between corporate governance and social responsibility. Panel B reports that the lagged governance coefficient (␣1) is also positive (0.0538) and strongly significant (p ⫽ 0.0001) which supports our second hypothesis that good governance leads to good social responsibility. Our regression results provide significant evidence (p ⬍ 0.01) to support these two hypotheses. Overall, good corporate governance is positively associated with good social responsibility performance and leads to good social responsibility performance. The regression analyses include five control variables. In particular, we include ROA as a control variable, as Brown and Caylor (2009) report a significantly positive association between GOV and ROA. Panel A of Table IV reports a significantly positive relation between CSR (KLD) and ROA and MTB, and a significantly negative association between KLD and LEV. Panel B of Table IV reports a significantly negative relation between CSR (KLD) and AGE and LEV and a SE t value p ⬎ ItI Panel A: 2004; n ⫽ 1222; Adjusted R2 ⫽ 0.0226 Intercept ⫺1.4344 GOV 0.0427 SALES 1.54E-06 AGE ⫺0.4334 LEV ⫺1.0504 ROA 0.0086 MTB 0.0176 0.3973 0.0121 3.40E-06 0.3692 0.3503 0.0043 0.0081 ⫺3.61 3.52 0.45 ⫺1.17 ⫺3.00 2.03 2.17 0.0003* 0.0004* 0.6500 0.2406 0.0028* 0.0427** 0.0299** Panel B: 2005; n ⫽ 1107; Adjusted R2 ⫽ 0.0379 Intercept ⫺1.2340 GOV 0.0538 SALES ⫺4.34E-07 AGE ⫺1.1545 LEV ⫺1.4372 ROA 0.0108 MTB 0.0229 0.4664 0.0139 3.37E-06 0.4365 0.4177 0.0067 0.0086 ⫺2.66 3.87 ⫺0.13 ⫺2.64 ⫺3.44 1.62 2.66 0.0080* 0.0001* 0.8975 0.0083* 0.0006* 0.1057 0.0079* Variable Parameter estimate Notes: Significance level: * p ⱕ 0.01, ** p ⱕ 0.05, *** p ⱕ 0.1; Model: KLDit ⫽ ␣0 ⫹ ␣1 ⫻ GOVit ⫹ ␣2 ⫻ SALESit ⫹ ␣3 ⫻ AGEit⫹ ␣4 ⫻ LEVit ⫹ ␣5 ⫻ ROAit ⫹ ␣6 ⫻ MTBit ⫹ ⑀it; Model: KLDit ⫽ ␣0 ⫹ ␣1 ⫻ GOVit-1 ⫹ ␣2 ⫻ SALESit ⫹ ␣3 ⫻ AGEit⫹ ␣4 ⫻ LEVit ⫹ ␣5 ⫻ ROAit ⫹ ␣6 ⫻ MTBit ⫹ ⑀it; Variable Definitions:; KLDit ⫽ Social responsibility index score for firm i in year t; GOVit ⫽ Corporate governance score of firm i in year t; GOVit⫺1 ⫽ Corporate governance score of firm i in year t⫺1; SALESit ⫽ Net sales (Compustat Item #12) of firm i in year t; AGEit ⫽ Net property, plant and equipment (Compustat Item #8)/Gross property, plant and equipment (Compustat Item #7) of firm i in year t; LEVit ⫽ Leverage ratio [total liabilities (Compustat Item #9 ⫹ #34)/total assets (Compustat Item #6)] of firm i in year t; ROAit ⫽ Return on assets [income before extraordinary items – available for common equity (Compustat Item #237)/total assets (Compustat Item #6)] of firm i in year t; MTBit ⫽ Market to book ratio {[common shares outstanding (Compustat Item #25) ⫻ stock price – fiscal year-end (Compustat Item #199)]/total common equity (Compustat Item #60)} of firm i in year t. Corporate governance and social responsibility 47 Table IV. Regression analysis IJLMA 57,1 Downloaded by Universitas Muhammadiyah Malang At 20:22 27 March 2015 (PT) 48 significantly positive association between KLD and MTB. In addition, we also checked the variance inflation factors (VIFs) and multicollinearity is not an issue in our models. 6. Supplemental tests To test the robustness of our results to alternative corporate governance measures, we reran our empirical tests using KLD’s net governance score instead of Brown and Caylor’s (2006, 2009) governance score. As shown in Panel A of Table V, the current year’s governance coefficient (␣1) is positive (0.2467) and significant (p ⫽ 0.0018) which supports our first hypothesis of a positive association between corporate governance and social responsibility. Panel B reports that the lagged governance coefficient (␣1) is positive (0.0141), as expected, but insignificant (p ⫽ 0.8803). The control variables have similar signs to Table IV. In general, ROA and MTB are positive and AGE and LEV are negative. In summary, the additional regression results in Table V provide strong support for our first hypothesis and insignificant support for our second hypothesis. SE t value p ⬎ ItI Panel A: 2004; n ⫽ 1222; Adjusted R ⫽ 0.0206 Intercept ⫺0.2067 KLDGOV 0.2467 SALES 2.55E-06 AGE ⫺0.4493 LEV ⫺0.8708 ROA 0.0103 MTB 0.0153 0.1810 0.0787 3.36E-06 0.3697 0.3464 0.0042 0.0081 ⫺1.14 3.13 0.76 ⫺1.22 ⫺2.51 2.45 1.89 0.2536 0.0018* 0.4485 0.2245 0.0121** 0.0145** 0.059*** Panel B: 2005; n ⫽ 1107; Adjusted R2 ⫽ 0.0248 Intercept 0.3580 KLDGOV 0.0141 SALES 2.48E-06 AGE ⫺1.1888 LEV ⫺1.2516 ROA 0.0150 MTB 0.0215 0.2186 0.0938 3.33E-06 0.4394 0.4190 0.0066 0.0087 1.64 0.15 0.74 ⫺2.71 ⫺2.99 2.26 2.47 0.1018 0.8803 0.4574 0.0069* 0.0029* 0.0238** 0.0135** Variable Parameter estimate 2 Table V. Additional regression test Notes: Significance level: * p ⱕ 0.01, ** p ⱕ 0.05, *** p ⱕ 0.1; Model: KLDit ⫽ ␣0 ⫹ ␣1*KLDGOVit ⫹ ␣2*SALESit ⫹ ␣3*AGEit⫹ ␣4*LEVit ⫹ ␣5*ROAit ⫹ ␣6*MTBit ⫹ ⑀it; Model: KLDit ⫽ ␣0 ⫹ ␣1*KLDGOVit⫺1 ⫹ ␣2*SALESit ⫹ ␣3*AGEit⫹ ␣4*LEVit ⫹ ␣5*ROAit ⫹ ␣6*MTBit ⫹ ⑀it; Variable Definitions: KLDit ⫽ Social responsibility index score for firm i in year t; KLDGOVit ⫽ Corporate governance index score in KLD database of firm i in year t; KLDGOVit-1 ⫽ Corporate governance index score in KLD database of firm i in year t-1; SALESit ⫽ Net sales (Compustat Item #12) of firm i in year t; AGEit ⫽ Net property, plant and equipment (Compustat Item #8)/Gross property, plant and equipment (Compustat Item #7) of firm i in year t; LEVit ⫽ Leverage ratio [total liabilities (Compustat Item #9 ⫹ #34)/total assets (Compustat Item #6)] of firm i in year t; ROAit ⫽ Return on assets [income before extraordinary items – available for common equity (Compustat Item #237)/total assets (Compustat Item #6)] of firm i in year t; MTBit ⫽ Market to book ratio {[common shares outstanding (Compustat Item #25) ⫻ stock price – fiscal year-end (Compustat Item #199)]/total common equity (Compustat Item #60)} of firm i in year t. Downloaded by Universitas Muhammadiyah Malang At 20:22 27 March 2015 (PT) 7. Conclusion In this study, we posit that corporate governance is positively associated with CSR. In addition, good corporate governance has a positive impact on future social responsibility. We examine the association between corporate governance (in 2004) and CSR (in 2004 and 2005). Regression analyses document a positive and significant (p ⬍ 0.01) association between corporate governance and CSR for both hypotheses. Results from Pearson correlation tables also confirm this significant and positive association. For the most part, the results are robust to alternative corporate governance measures. The results suggest that business entities with strong corporate governance mechanisms have good social responsibility performance, and good governance also leads to good social responsibility performance. These documented CSR performance benefits further support corporate governance improvement efforts in US corporations. Future work can continue to examine the relationship between corporate governance mechanisms and CSR performance. What corporate governance attributes affect CSR performance? What specific dimensions of CSR performance are affected most by corporate governance? This additional work will help us better understand the relationship between corporate governance and CSR performance, another growing and important dimension of overall corporate performance. Notes 1. www.kld.com/indexes/ssindex/faq.html 2. http://robinson.gsu.edu/accountancy/gov_score.html 3. H1: KLDi, 2004 ⫽ f(GOVi, 2004; control variablesi, 2004) H2: KLDi, 2005 ⫽ f(GOVi, 2004; control variablesi, 2005). References Abdel-Khalik, A. (2002), “Reforming corporate governance post Enron: shareholder’s board of trustees and the auditor”, Journal of Accounting and Public Policy, Vol. 21 No. 2, pp. 97-103. Beurden, P. and Gossling, T. (2008), “The worth of values – a literature review on the relation between corporate social and financial performance”, Journal of Business Ethics, Vol. 82 No. 2, pp. 407-424. Bronson, S.N., Carcello, J.V., Hollingsworth, C.W. and Neal, T.L. (2009), “Are fully independent audit committees really necessary?”, Journal of Accounting and Public Policy, Vol. 28 No. 4, pp. 265-280. Brown, L. and Caylor, M.L. (2006), “Corporate governance and firm valuation”, Journal of Accounting and Public Policy, Vol. 25 No. 4, pp. 409-434. Brown, L. and Caylor, M.L. (2009), “Corporate governance and firm operating performance”, Review of Quantitative Finance and Accounting, Vol. 32 No. 2, pp. 129-144. Byard, D., Li, Y. and Weintrop, J. (2006), “Corporate governance and the quality of financial analysts’ information”, Journal of Accounting and Public Policy, Vol. 25 No. 5, pp. 609-625. Chen, C., Pattern, D. and Roberts, R. (2008), “Corporate charitable contributions: a corporate social performance or legitimacy strategy?”, Journal of Business Ethics, Vol. 82 No. 1, pp. 131-144. Cho, C., Pattern, D. and Roberts, R. (2006), “Corporate political strategy: an examination of the relation between political expenditures, environmental performance, and environmental disclosure”, Journal of Business Ethics, Vol. 67 No. 2, pp. 139-154. Corporate governance and social responsibility 49 IJLMA 57,1 Downloaded by Universitas Muhammadiyah Malang At 20:22 27 March 2015 (PT) 50 Cochran, R. and Wood, R. (1984), “Corporate social responsibility and financial performance”, Academy of Management Journal, Vol. 27 No. 1, pp. 42-56. Deckop, J.R., Merriman, K.K. and Gupta, S. (2006), “The effect of CEO pay structure on corporate social performance”, Journal of Management, Vol. 32 No. 3, pp. 329-342. DeZoort, F.T., Hermanson, D.R. and Houston, R.W. (2003), “Audit committee support for auditors: the effects of materiality justification and accounting precision”, Journal of Accounting and Public Policy, Vol. 22 No. 2, pp. 175-199. Dhaliwal, D., Li, O., Tsang, A. and Yang, Y. (2011), “Voluntary nonfinancial disclosure and the cost of equity capital: the initiation of corporate social responsibility reporting”, The Accounting Review, Vol. 86 No. 1, pp. 59-100. Dhaliwal, D., Radhakrishnan, S., Tsang, A. and Yang, Y. (2012), “Nonfinancial disclosure and analyst forecast accuracy: international evidence on corporate social responsibility disclosure”, The Accounting Review, Vol. 87 No. 3, pp. 723-759. Earnhart, D. (2002), “Effects of ownership and financial status on corporate environmental performance”, Working paper, University of Kansas, Kansas. European Commission (EC) (2002), “Green book: promoting a European framework for corporate social responsibility”, available at: http://europa.eu.int/comm/employment_social/soc-dial/ csr/greenpaper.htm Freeman, R.E. (1984), Strategic Management: A Stakeholder Approach, Pitman, Boston, MA. Graves, S. and Waddock, S.A. (1994), “Institutional owners and corporate social performance”, Academy of Management Journal, Vol. 18 No. 1, pp. 303-317. Griffin, J.J. and Mahon, J.F. (1997), “The corporate social performance and corporate financial performance debate: twenty-five years of incomparable research”, Business and Society, Vol. 36 No. 1, pp. 5-31. Gul, F.A. and Leung, S. (2004), “Board leadership, outside directors’ expertise and voluntary corporate disclosures”, Journal of Accounting and Public Policy, Vol. 23 No. 5, pp. 351-379. Hill, C.W. and Jones, T. (1992), “Stakholder-agency theory”, Journal of Management Studies, Vol. 29 No. 2, pp. 131-154. Jaggi, B., Leung, S. and Gul, F. (2009), “Family control, board independence and earnings management: evidence based on Hong Kong firms”, Journal of Accounting and Public Policy, Vol. 28 No. 4, pp. 281-300. Johnson, R.A. and Greening, D.W. (1999), “The effects of corporate governance and institutional ownership types on corporate social performance”, Academy of Management Journal, Vol. 42 No. 5, pp. 564-576. Kanagaretnam, K., Lobo, G.J. and Whalen, D.J. (2007), “Does good corporate governance reduce information asymmetry around quarterly earnings announcements?”, Journal of Accounting and Public Policy, Vol. 26 No. 4, pp. 497-522. Kelton, A.S. and Yang, Y. (2008), “The impact of corporate governance on internet financial reporting”, Journal of Accounting and Public Policy, Vol. 27 No. 1, pp. 62-87. Kim, Y., Park, M.S. and Wier, B. (2012), “Is earnings quality associated with corporate social responsibility”, The Accounting Review, Vol. 87 No. 3, pp. 761-796. McGuire, J., Sundgren, A. and Schneeweis, T. (1988), “Corporate social responsibility and firm financial performance”, Academy of Management Journal, Vol. 31 No. 4, pp. 854-872. Nelling, E. and Webb, E. (2009), “Corporate social responsibility and financial performance: the virtuous circle revisited”, Review of Quantitative Finance and Accounting, Vol. 32 No. 2, pp. 197-209. Downloaded by Universitas Muhammadiyah Malang At 20:22 27 March 2015 (PT) Riyanto, Y. and Toolseman, L. (2007), “Corporate social responsibility in a corporate governance framework”, Working paper, National University of Singapore. Roman, R., Hayibor, S. and Agle, B. (1999), “The relationship between social performance and financial performance”, Business and Society, Vol. 38 No. 1, pp. 109-125. Ruf, B.M., Muralidhar, K., Brown, R.M., Janney, J.J. and Paul, K. (2001), “An empirical investigation of the relationship between change in corporate social performance and financial performance: a stakeholder theory perspective”, Journal of Business Ethics, Vol. 32 No. 2, pp. 148-156. Shropshire, C. and Hillman, A. (2007), “A longitudinal study of significant change in stakeholder management”, Business and Society, Vol. 46 No. 1, pp. 63-87. Stuebs, M. and Sun, L. (2010), “Corporate governance and environmental performance”, Journal of Accounting, Ethics and Public Policy, Vol. 11 No. 3, pp. 381-395. Tsoutsoura, M. (2004), “Corporate social responsibility and financial performance: the ‘virtuous circle’ revisited”, Working Paper, University of California, Berkeley. Vilanova, M., Lozano, J. and Arenas, D. (2009), “Exploring the nature of the relationship between CSR and competitiveness” Journal of Business Ethics, Vol. 87 No. 1, pp. 57-69. Waddock, S. (2003), “Myths and realities of social investing”, Organization and Environment, Vol. 16 No. 3, pp. 369-380. Waddock, S. and Graves, S. (1997), “The corporate social performance – financial performance link”, Strategic Management Journal, Vol. 18 No. 4, pp. 303-319. Corresponding author Li Sun can be contacted at: [email protected] Corporate governance and social responsibility 51 IJLMA 57,1 Appendix Category Strengths Concerns Community generous giving innovative giving housing support education support peoples relations non-US giving voluntary programs other strengths limited compensation ownership strength transparency strength accountability strength public policy strength other strengths CEO promotion board of directors work-life benefits women and minority employment of the disabled gay and lesbian policies other strengths union relations no-layoff policy cash profit sharing employee involvement retirement benefits health and safety other strengths beneficial products pollution prevention recycling clean energy property, plant and equipment other strengths investment controversies negative economic impact indigenous people relations tax disputes other concerns Downloaded by Universitas Muhammadiyah Malang At 20:22 27 March 2015 (PT) 52 Corporate governance Diversity Employee relations Environment Human rights Table AI. Products List of the strengths and concerns in KLD database positive record in S. Africa indigenous people relations labor rights strength other strengths quality R&D, innovation benefits to economically disadvantages other strengths high compensation ownership concern transparency concern accountability concern public policy concern other concerns controversies non-representation other concerns union relations health and safety concern workforce reductions retirement benefits concern other concerns hazardous waste regulatory problems ozone depleting chemicals substantial emissions agriculture chemicals climate change other concerns S. Africa Northern Ireland Burma concern Mexico labor right concern indigenous people relations concern other concerns product safety concern marketing-contracting concern antitrust other concerns

© Copyright 2025