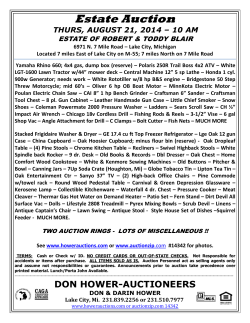

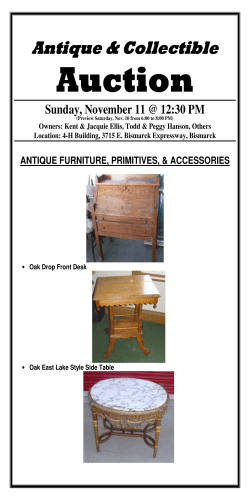

Document 167859