How to be a good

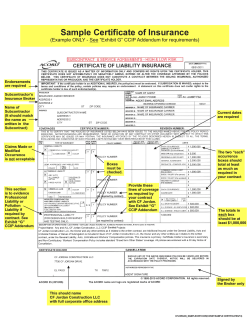

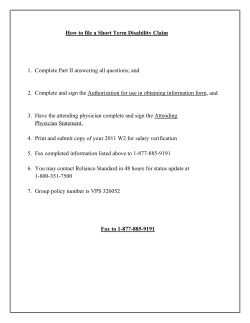

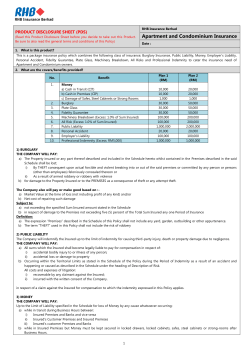

How to be a good consumer of Insurance Presented By: DC Insurance Collin Kostiha K Jeff Kostiha Advocates before Agents g Why y are we here today? y N New Legislature L i l t passed d by b the House of f Representatives: Bill #CS/HB 7165 Changes announced at Children’ss Week Children Why the New Changes? To standardize insurance limits state p wide on all child care providers, therefore protecting the children and y of each Coalition. the liability What are the new changes? H us Bill CS/HB 7165 House • Requires Continuous General Liability Limits • • • • – Formal & Informal Providers “Additional Insured” N i of Notice f Cancellation C ll i Transportation Workers Compensation Mandated Limits L Limits of f General G l Liability L bl : – $100,000 per Occurrence – $300,000 per Aggregate Transportation p Coverage g ((if p provided)) Workers Compensation (if required) What if I have no children? • D Do I still ill need d to carry a General G l Liability Li bili Policy? YES • “The General Liability insurance required must remain in full force and effect for the entire period of the provider’s contract with the coalition coalition” Why y do I need continuous coverage? Letting your policy expire and causing a Lapse in Coverage Coverage” could jeopardize “Lapse your contract with the ELC. How will w ll the coal coalition t on know if I cancel my policy? The insurance company sends immediate cancellation notices directly to those listed as an additional insured. insured ” “additional Today’s Topics • • • • • • What is the average policy cost? What type of policy should I look for? What should my policy cover? What is an additional insured? Do I need workers comp? Do I need a commercial auto policy? What is the average g ANNUAL cost? For General Liability: Commerciall Child h ld Care Centers: Starting From: $970 (Average:$1350) In Home Child Cares: Starting From: $283 (Average:$309) **Cost of Endorsing the Coalition as an ADDITIONAL INSURED** What Type of Policy Should I Look For? 11. R Rider d P Policy l vs. Surplus l Lines L 2. How long g is the application? pp 3. Does the Agent give you a quote on the spot? 4. How long until the policy goes into effect? What Type yp of Policy y Should I Look For? General Liability vs. Professional Liability Wh Type What T of f Policy P l Should h ld I Look For? Claims Made vs. vs Occurrence What Should My Policy Cover? Does the Policy Cover: Professional Liability (Negligent Supervision)? a.) Am I, My employees and volunteers all i insured? d? b.) Are residents of my household who are not employed in my business insured? What Should My Policy Cover? Does the Policy Cover: Child Abuse? • a.) Does the definition of “Abuse” include sexual, physical h i l and d mental t l abuse? b ? • b.) Am I, my employees and volunteers all insured? • c.)) Are residents d of f my h household h ld who h are not employed in my business insured? • d.) If an insured under the policy is accused of child hild abuse b and df found d guilty, ilt what h t iis th the mostt you will pay for damages? What Should My Policy Cover? Does the company provide an attorney to represent the Provider at a Regulators Administrative hearing resulting from an allegation related to Child Abuse? a.) If not, will the company pay for an attorney to represent me? b.) What, if any, is the limit the company will pay for legal representation? Limits within policy limits vs. outside policy limits What Should My Policy Cover? Are ALL Claims Expenses, Expenses including Attorney fees and investigative costs paid for all claims (including costs, abuse)? What Should My Policy Cover? • If f coverage is under d a master policy, l does the policy and aggregate limit apply l to each h certificate f h holder? ld ***Additional Insured*** What Should My Policy Cover? Is Non-OWNED N WNED Auto Coverage C available as an optional coverage? Example Asking a parent to transport Example: children on a field trip What Should My y Policy y Cover? If children hild are transported, t t d d does th the company offer optional coverage? *Coverage of physical vehicle vs. the medical bills of those injured in an accident id t What Should My y Policy y Cover? D Does my policy l cover animall bites? b What Should My y Policy y Cover? Does my policy D l cover Dispensing D Medication? What Should My y Policy y Cover? D Does my policy l cover Food F d Preparation? P What Should My y Policy y Cover? D Does my policy l cover Field F ld Trips? What Should My y Policy y Cover? Does my policy D l cover the h liability l bl of f infants (at no minimum age)? What Should My y Policy y Cover? D Does my policy l cover Libel, L b l Slander? l d What Should My y Policy y Cover? If f my child h ld care is open after f normall hours, will I still be covered? What Should My y Policy y Cover? D Does my policy l cover Swimming Pools? P l What about Field Trips to Swimming Pools? What Should My y Policy y Cover? Does the policy include ACCIDENT MEDICAL COVERAGE? a.) Is the accident coverage “Primary” and does it pay in addition to other coverage? paid for accident medical expenses p for b.)) How much could be p each injured child? c.) What is the total that could be paid if 3 children were injured in the same accident? d ) Will the policy pay accident medical bills if a child is injured d.) on field trips? e.) Will the policy pay accident medical bills if a child is injured while riding in an Insured’s car? What Should My y Policy y Cover? How much is my deductible for for: Liability Policy? A id nt Policy? Accident P li ? **There ** h are policies l with h NO N DEDUCTIBLES** WARNING: If f you use affidavits ff d and d a Cl Claim or a Law Suit is filed against you, you will h have to hire h your own attorney and d pay all expenses and any judgments! What is an “Additional Insured” A person or organization not automatically included as an insured under d an insurance policy l of f another h but for whom the named insured d i desires or iis required i d to provide id a certain degree of protection under i iinsurance policy. its li Why is it important? • The h coalition l can be b h held ld liable l bl & sued if a child is placed in an unsafe environment. • Protect the organization g that helps p you. What should a Certificate of Insurance look Like? (See Example Handout) Do I Need Transportation ransportat on Coverage? Coverage for C f the h transportation of f children is required if participating in the h School h l Readiness R d Program. P Endorsement vs. Commercial Auto Policy Do I Need Workers Compensation? • St State t mandated d t df for companies i with ith 3 or more workers – (owner ( can b be excluded) l d d) • Premium Pr mium c calculated lcul t d b by p payroll r ll – Rate: $1.46 per $100 of payroll – Class Code:8869 C de:8869 Extremely hard to find for smaller ll Centers! C ! Handout: Best Practices for FFC Providers For More Information: Contact C C Collin ll Kostiha K h DC Insurance Services Phone: 800-359-4300 Website: www.dcins.com www dcins com

© Copyright 2026