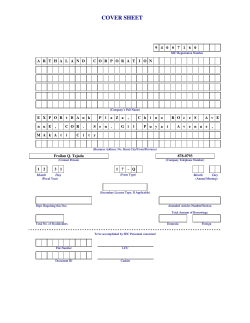

Document 255982