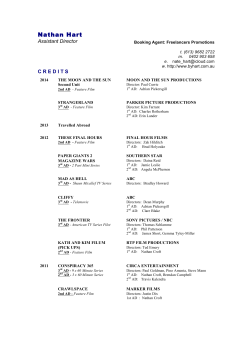

For personal use only Page 1