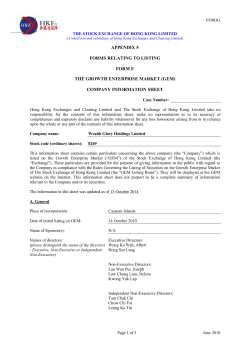

GLOBAL OFFERING