Salary vs Dividend Worksheet

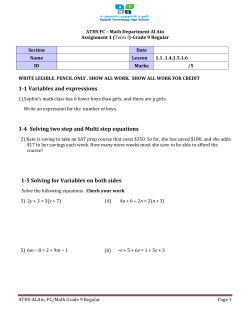

Salary vs Dividend Worksheet This worksheet projects the tax outcomes of salary vs dividend scenarios for Canadian corporations earning active business income or M&P income. Your client’s situation: • Corporate inputs o Tax province ON o Tax year ending Dec 31, 2014 o Taxable income 600,000 Subject to SBD • • 500,000 Allocation inputs o Amount to allocate to individual 100,000 o Taxpayer subject to CPP Yes o Taxpayer subject to EI No o Provincial health tax rate 1.95% Personal inputs o Tax year ending Dec 31, 2014 o Tax province ON o Existing salary from corporation 130,000 o Existing interest income 10,000 o Annual ROI 3.00% Determine which method of allocating income from the corporation will provide your client with the most aftertax funds, the projected amount, and the tax deferral available by retaining funds in the corporation. TTI develops Excel worksheets to help Canadian professionals solve tax challenges. Please see our website, or contact us for more information. We’re happy to arrange a presentation or provide cloud access. www.taxtemplates.ca | [email protected] | 1-800-501-8159 Mr. A Salary vs. Dividend Worksheet Prepared Template support Oct 1, 2014 Andrew Reviewed Approved Prepared on October 1, 2014 Corporate inputs Tax province Notes Allocation and related amounts ON Amount to allocate to individual Tax year ending Dec 31, 2014 Marginal dividend expenses - Tax year starting Jan 1, 2014 Marginal salary expenses - Taxable income 100,000 600,000 Taxpayer subject to CPP Subject to Federal SBD rate 500,000 Taxpayer subject to EI Subject to Federal General rate 100,000 EI payable by corporation No Subject to ON SBD rate 500,000 Provincial health tax rate (%) 1.95% Subject to ON General rate 100,000 Existing salary from corporation Summary Allocated as salary Salary only Yes No 130,000 Dividend only Salary + dividend mix 100,000 - 50,000 (Marginal salary expenses) - - - (CPP paid by corporation) - - - (EI paid by corporation) - - (Provincial health tax) (1,913) (Other salary taxes) Salary paid, net of marginal amounts - - (956) - - - 98,087 - 49,044 Allocated as dividend - 100,000 50,000 (Marginal dividend expenses) - - - (Federal SBD rate - 11.0%) - - (Federal General rate - 15.0%) - (ON SBD rate - 4.5%) - (ON General rate - 11.5%) - - (15,000) (7,500) - - (11,500) (5,750) (Other corporate taxes) - - - Dividends paid, net of marginal amounts - 73,500 36,750 (CPP paid personally) - - - (EI paid personally) - - - (Federal personal taxes) (28,445) (14,209) (21,327) (ON personal taxes) (18,883) (9,492) (14,187) (Social benefits repayment) - - Other adjustment - - (Total personal taxes + CPP + EI) Net amount received - (47,328) (23,701) (35,515) 50,759 49,799 50,279 Breakeven period on deferred tax amounts Tax savings (cost) vs. salary (960) Tax deferral available Breakeven investment period Tax Templates Inc. 3.00% 22,741 1 year(s) 4 month(s) Notes Notes (480) 11,665 1 year(s) 4 month(s) 2014-10-27 13:13 Mr. A Salary vs. Dividend Worksheet Prepared Template support Prepared on October 1, 2014 Description Tax year ending Calculation 1 - Existing amounts Calculation 2 - Existing amounts Mr. A Mr. A Mr. A Salary only Dividends only Salary and dividends Calculation 3 - Existing amounts ON ON ON Dec 31, 2014 Dec 31, 2014 Dec 31, 2014 Existing amounts Employment Oct 1, 2014 Approved Name Tax province Andrew Reviewed Existing amounts Existing amounts 130,000 130,000 130,000 Old Age Security - - - Eligible pension - - - Other than eligible dividends - - - - - - - - - - - - 10,000 10,000 10,000 - - - - - - Other income - - - Net business income (loss) - - - Total income (loss) 140,000 140,000 140,000 (RRSP deduction) - - - (CPP on business) - - - (Social benefits repayment) - - - (Other deductions) - - - 140,000 140,000 140,000 Gross-up Eligible dividends Gross-up Interest and other investment Net capital gains (Non-taxable portion) Net income (loss) (Other deductions) Taxable income (loss) Calculate CPP - - - 140,000 140,000 140,000 Yes CPP credit - employment CPP credit - business Calculate EI Yes Yes 2,426 2,426 - - No No 2,426 No EI credit - employment - - - EI credit - business - - - Eligible donations made - 75% limit - - - Eligible donations made - no limit - - - Other federal credits - credit rate - - - Other provincial credits - credit rate - - - Tax Templates Inc. 2014-10-27 13:13 Mr. A Salary vs. Dividend Worksheet Prepared Template support Prepared on October 1, 2014 Description Tax province Oct 1, 2014 Approved Name Tax year ending Andrew Reviewed Calculation 1 - Marginal amounts Calculation 2 - Marginal amounts Mr. A Mr. A Mr. A Salary only Dividends only Salary and dividends Calculation 3 - Marginal amounts ON ON ON Dec 31, 2014 Dec 31, 2014 Dec 31, 2014 Marginal amounts Employment Other than eligible dividends Gross-up Eligible dividends Gross-up Marginal amounts Marginal amounts 98,087 - 49,044 - 1,500 750 - 270 135 - 72,000 36,000 - 27,360 13,680 Total income (loss) 98,087 101,130 99,609 (RRSP deduction) - - - (CPP on business) - - - (Social benefits repayment) - - - (Other deductions) - - - 98,087 101,130 99,609 Net income (loss) (Other deductions) Taxable income (loss) Calculate CPP - - - 98,087 101,130 99,609 Yes Yes Yes CPP credit - employment - - CPP credit - business - - Calculate EI No No No EI credit - employment - - - EI credit - business - - - Eligible donations made - 75% limit - - - Eligible donations made - no limit - - - Other federal credits - credit rate - - - Other provincial credits - credit rate - - - Tax Templates Inc. 2014-10-27 13:13 Mr. A Salary vs. Dividend Worksheet Prepared Template support Andrew Oct 1, 2014 Reviewed Prepared on October 1, 2014 Approved Marginal tax calculations for Mr. A Direct to shareholder Federal Amount Rate Marginal tax calculations for Mr. A Direct to shareholder Federal Tax Amount Rate Marginal tax calculations for Mr. A Direct to shareholder Federal Tax Amount Rate Tax Bracket 1 - - - - - - - - - Bracket 2 - - - - - - - - - Bracket 3 - Bracket 4 98,087 29.00% - 101,130 29.00% - 99,609 29.00% - (Personal amount) - - 28,445 - - - 29,328 - 28,887 - - - (CPP credit - employment) - - - - - - - - - (CPP credit - business) - - - - - - - - - (EI credit - employment) - - - - - - - - - (EI credit - business) - - - - - - - - - (Canada employment amount) - - - - - - - - - (Other federal credits - credit rate) - - - - - - - - - (Dividend credit - other) - - (Dividend credit - eligible) - - (Donations and gifts) - - - - (1,770) 11.02% (195) (885) 11.02% (97) - (99,360) 15.02% (14,924) (49,680) 15.02% (7,462) (Unused credits from existing income) - - - Alternative minimum tax - - - Other adjustment Marginal federal taxes 28,445 14,209 Provincial Amount Rate 21,327 Provincial Tax Amount Rate Provincial Tax Amount Rate Tax Bracket 1 - - - - - - - - - Bracket 2 - - - - - - - - - Bracket 3 10,000 11.16% 1,116 10,000 11.16% 1,116 10,000 11.16% 1,116 Bracket 4 70,000 12.16% 8,512 70,000 12.16% 8,512 70,000 12.16% 8,512 Bracket 5 18,087 13.16% 2,380 21,130 13.16% 2,781 19,609 13.16% 2,580 Bracket 6 - - - - - - - - - 0 - - (Personal amount) 0 - - - 0 - (CPP credit - employment) - - - - - - - - - (CPP credit - business) - - - - - - - - - (EI credit - employment) - - - - - - - - - (EI credit - business) - - - - - - - - - (Other provincial credits - credit rate) - - - - - - - - (Donations and gifts) - - - (Dividend credit - other) - - - (1,770) 4.50% (80) (885) 4.50% (40) (Dividend credit - eligible) - - - (99,360) 10.00% (9,936) (49,680) 10.00% (4,968) (Unused credits from existing income) - - Alternative minimum tax - - - 6,725 6,949 6,837 Surtaxes Tax reduction Health tax - - - - 150 150 150 18,883 9,492 14,187 Other adjustment Marginal provincial taxes Tax Templates Inc. 2014-10-27 13:13 Salary vs. Dividend Worksheet - Net Cash Available Mr. A - Prepared on October 1, 2014 120,000 100,000 80,000 60,000 40,000 20,000 Salary only Dividends only Salary only Salary Dividend Less: CPP + EI + Health * Less: Corporate taxes and expenses ** Less: Personal taxes *** Net cash Tax savings (cost) vs. salary Personal tax deferred if dividends not paid Breakeven investment period @ 3.00% Tax Templates Inc. Dividends only Salary and dividends Salary and dividends 100,000 - 50,000 - 100,000 50,000 1,913 - 956 - 26,500 13,250 47,328 23,701 35,515 50,759 49,799 50,279 (960) 22,741 1 year(s) 4 month(s) * Calculate CPP: Yes, Calculate EI: No, EHT rate: 1.95% ** Tax province: ON, Tax year: Jan 1, 2014 to Dec 31, 2014, Taxable income: 600,000 (500,000 at Federal SBD rate + 500,000 at ON SBD rate) *** Tax province: ON, Tax year ending: Dec 31, 2014, Existing taxable income: 140,000 (480) 11,665 1 year(s) 4 month(s) 2014-10-27 13:13

© Copyright 2026