January 22, 2015 Gilchrist County Board of County Commissioners

January 22, 2015

Gilchrist County

Board of County

Commissioners

Vision Statement:

Our vision for Gilchrist County in 2030 is rural

communities working in harmony to provide opportunities for all its

citizens through balanced growth and enhanced education, while

preserving our proud heritage, natural resources and agriculture.

Agenda

Table of Contents

January 22, 2015

Call to Order

2:00 p.m.

Prayer/Flag

Agenda Changes

Consent Agenda ………………………………………………………………. Page 3

Public Participation

Constitutional Officers

County Administrator’s Report …………………………………………….. Page 21

Attorney’s Report …………………………………………………………….. Page 59

Clerk’s Report …………………………………………………………………. Page 70

Time Certain Schedule ………………………………………………………. Page 78

2:15 p.m.

Ordinance 2015-01; TODS …….………………………………… Page 79

2:30 p.m.

Budget Hearing …………………………………………………….. Page 84

2:45 p.m.

Resolution 2015-01; Petition for Road Closure

“Horace Thomas Grade” ………………………………………… Page 87

FYI (documents filed in Clerk’s Office)…………………………………………… Page 89

Commissioner Reports

Old Business

New Business

Public Participation

Adjourn

Consent Agenda

."'Gilchrist

January 22,2015

Regular

Meeting

October 6,2014

Dixie County SherifPs Office

Inmate Housing, December

2014

Mills Engineering Company

widenand Resurfacing Sw 1006 St

S14,652.00

..............

$2,910.00

Sidorenko

...$27,450.00

SREC,Inc.

Request for SHIP Funds for Angelia

CRI CPAs and Advisors

Progress

Billing on 2014 Audit

...........

........ $20,000.00

Suwannee Valley Leagues, Inc.

Budget Disbursement

...........

City of Trenton

2014-2015 Community Redevelopment Fund

.

Invoice

$25,650.00

574,782.00

Property Transfer - Permanent

From Otter Springs to Emergency Management

ID#03 I 13, John Deer, Gator 4x4

Justification: Surplus Property from Otter Springs; transfer

response and recovery operations

to EM to be

used

Property Transfer - Permanent

From Otter Springs to Hart Springs

ID#3 I I 5, E-Z Go, TXTPDS, Seial #2250497, 52,27 5.00

Justification: Surplus properry from Otter SpringVper agreement with ForVets

ln

emergency

MIITUTES OF A REGULAR MEETING OF THE GILCHRIST COI.JNTY

BOARD OF COUNTY COMMISSIONERS HELD OCTOBER 6,2014

The Gilchrist County Board of Counry Commissioners, in and for Gilchrist County, Florid4

convened in a Regular Meeting on Monday, October 6, 2014, at 2:00 p.m., in the Board of

County Commissioners Meeting Facility, located at 210 South Main Street, Trenton, Florida, with

the following members' present to-wit:

Districl I

Disttict II

District III

Districl IV

District V

Commissioner

Commissioner

Commissioner

Commissioner

Commissioner

Sharon A, Langford

D. Ray Harrison, Jr., Chairman

Todd Gray, Vice Chairman

fohn Rance Thomas

Kenrick Thomas

Otherc in Attendance

of Cou(; Jacki Johnson, Finance

Director; Patty McCagh, Board

Secretary/Deputy Clerk; Wesley Robert, Finance/Deputy Clerk; David Lang, County Attomey;

Bobby Crosby, County Administrator; Terri Hilliard, Administrative Assistant; Carrie Mizell,

Gilchrist County Joumal; David Peaton, Director of Emergency Management; Billy Caruron, Road

Department Superintendent; Chief Mitch Harrell, GC Fire/EMS; Lt. Jeff Manning, GCSO; Diane

Rondolet, Code Enforcement; Brother Ricky Whitley, Pine Grove Baptist Church; Ray & Jane

Todd Newton, Clerk

Rauscher; Marion Poitevint; Harold Barry, Florida Department of Agriculture; Katherine LaBarca;

Meredith Webber, Cheyenne Siegel, Kalin Siegel, Joshua Akin, Lorrie Akin and Chris DeCubellis,

Gilchrist County 4-H; Nell Yelvington; and Richard & Leslie Esseck.

Call to Order

Chairman D. Ray Harrison, Jr., called the meeting to order at 2:00 p.m. Brother Rickey Whitley,

Pine Grove Baptist Church, delivered the invocation and Commissioner Todd Gray led the pledge

ofallegiance.

Asenda

Mr. Todd Newton, Clerk, presented the following change(s):

l.

Addition: Trade-in regarding Caterpillar Grader

Motion made by Commissioner Kenric* Thomas, seconded by Commissioner Sharon A.

Langlford, lo approve the Agenda, as presenled, wilh noled changes. Motion carried

unanimously.

Consent Agenda

The Board approved the Consent Agend4 as presented:

Gilchrist County Board of County Commissioners Meeting Minutes

october 5, 2014

2

Budeet Entrv

BEl4-037, Fund 410, EMS

.................

.. $2,000.00

Reouest for Pavment Aooroval

Dixie County Sheriff s Offrce

Inmate Housing , May 2014

Inmate Housing, June

2014

$9,583.00

$12,062.00

Motion nade by Commissioner Todd Gray, seconded by Commissioner lohn Thomas, lo

approve the Consent Agenda, as presented Motion carried ananimously.

Constitutional Officer's

SherifFs Offrce

o

Lt. JeffManning, GCSO, addressed the Board and requested use of the funds from Crime

Prevention Revenues, in the amount of$ 16.500.00, for three (3) Kiosks and fifty (50) signs,

for Crime Prevention. Discussion took place and determination needs to be made whether

the kiosks are on state contract.

Motion made by Commissioner Kenrick Thomas, seconded by Commissioner John Thornas ,o

approved the purchase olthree (3) kiosks and lilty (50) signs, at Stale contruct price or by bid

process. Motion carried unanimously.

Countv Administralor's Report

Mr. Bobby Crosby, County Administrator, presented the following documents, and/or addressed

the following issues:

Road Department

.

Monthly Lime Rock Reoort: Mr. Crosby presented, for the Boards' information, the

Monthly Limerock Report, as submitted by Mr. Billy Cannon, Road Department

Superintendent.

o

Coleman Construction for SE 79s Lane: Mr. Crosby presented a pay request for Coleman

Construction, in the amount of $36.177 .97 , for the CDBG project, SE 79h Lane.

Discussion took place.

Motion mode by Commissioner Todd Groy, seconded by Commissioner Shoron A. Langlford, to

approve the pay rcquesl lo Coleman Conslruction, in the amount of $6,177.97, subjecl to

Satisfaction of Lien,Jor the CDBG project, SE 79h Lane. Motion carried unanimously.

Gilchrist County Board of County Commissioners Meeting Minutes

october 6, 2014

3

o

Reouest for Travel: Mr. Crosby presented a request for out of town travel, for Mr. Billy

Cannon, Road Department Superintendent, who was selected by Volvo, to travel to Volvo

Factory, in Pennsylvania, October 27-29,2014; all expenses paid by Volvo. Discussion

took place.

Motion made by Commissioner John Thomas, seconded by Commissioner Todd Gray, lo

appruve tavel rcquesr, as presented, for Billy Cannon to travel lo Pennsylvania, to Volvo

Factory. Motion carried unanimausly.

Chris DeCubellis and Gilchdst County 4H: The Gilchrist County 4H Organization requested that

the Board approve a proclamation recognizing 4H Week, in Gilchrist County.

Chairman Harrison read the short title for the record.

Motion made by Commissioner Kenriclt Thomas, seconded by Commksioner Sharon A.

Langford, to appruve lhe presenled proclamation recognizing the weeh of October 5-11, 2011

as Nalional 1H lleek, in Gilchrkt County, as requesled by lhe Gilchrisl Counly lH Club.

Motion carried unanimously,

Countv Administrator's Reoorl continues...

Clerk's Aeenda Chanqe: Trade-in regarding Caterpillar Grader: Mr. Newton, Clerk, presented his

agenda change at this time, while Mr. Cannon, Road Department Superintendent, was present.

Mr. Newton brought to the Boards' attention that during the budgeting process this year, funds

were budgeted for a new grader. Along with that, $50.000.00 was also considered in the budgeting

process, as a trade in, for the old grader. Mr. Newton wanted to bring it to the Boards' attention

that it has been discussed to keep the old grader as a "backup" and not trade it in. Discussion took

place.

It

was the consensus of the Board to keep the Caterpillar Grader for use as an

"emergency/backup" grader, in lieu of trading it in to Volvo.

EMS/Fire

o

Ambulance Chassis and Remount Bid results: Mr. Crosby presented the following bid

results for the Ambulance Chassis and Remount, of existing Patient Care Compartrnent.

TEN-8

ETR

Base

Bid

BaseBid

$113,283.00

$118,900.00

A/C

A/C

Option

Option

$1,300.00

Included

Total

Total

$114,583.00

$118,900.00

Discussion Took place. It was StaIls recommendation to go with bid from TEN-S.

Gilchrist County Board of County Commissioners Meeting Minutes

october 6, 2014

4

Motion made by Commksioner Todd Gray, seconded by Commissioner Kenric* Thomas, to

appruve bid Jrom TEN-&, in the amount ol $!]!SEJ,!!, for the Ambulance Chassis and

Remount, of existing Patienl Care Compartmenl Molion carried unanimously.

Code Enforcement

o

Monthly Report: Mr. Crosby presented, for the Boards' information, the Monthly Code

Enforcement Report, as submitted by Ms. Diane Rondolet, Code Enforcement Officer.

Communitv Develooment

.

Road Crossine Fee Schedule: Mr. Crosby presented the following information regarding

the Proposed Fee Schedule, for a road crossing:

All county road crossings will require an application and road crossing permit. All county

road crossings will be 60" in depth, fron the top of buried malerial. Meqsurement will be

laken from lowesl point of right oway (includes ditch). All counly road crossing will be

jack and bore. County road crossings may be open cut ifpre-approved by Gilchrist Board

of County Commissioners. The application and permit cost will include collection of

(l) site visit by County Engineer.

Counly Staff my make additional srte vriits at the County's expense. Additional

requirements of County resources will be billed to applicant accordingly.

documenls, review ofdocuments by County Staffand One

FEES:

Application (per road crossing)

Road Crossing (per rood crossing)

Use of County Right of Way (parallel to road)

Additional Fees

81,000.00

$250.00

$5,000.00*

Cost to County

+$5,000.00 up to l,000feet. $50.00 per each l0Ofeet

afierfirst 1,000feet. Must

be

continual footage.

Discussion took place. It was consensus of the Board to direct the County Administrator to

come back with a revised Road Crossing Fee Schedule separating pipelines and agriculture;

it was also requested that surrounding counties be contacted regarding their fee schedule for

pipelines.

General Govemment

o

Guardian Ad Litem: Approval of Shared Cost Agreement for Guardian Ad Litem Services

with Lery County, for hscal year October 1, 2014 through September 30, 2015. The

applicable percentage allocations for Levy County shall be 70% and Gilchrist county 30%.

Mr. Crosby requested the Boards' approval for him to be authorized to sign agreement.

Motion made by Commissioner lohn Thomas, seconded by Commissioner Sharon A. Langlford,

,o approve lhe Shared Cosl Agreement for Guardian Ad Lilem Semices wilh Levy County, for

ftscal year Oclober l, 2014 lhrough September 30, 2015; and to allow the County Administrator

to sign. Molion carried unanimously.

Gilchrist County Board of County Commissioners Meeting Minutes

october 6, 2014

5

o:

Mr. Crosby addressed the issue of the lease with the Florida Depa(ment of Agriculture, in

Fanning Springs. He requested that Mr. Lang, County Aftomey draft a lener to continue a

lease on a month to month basis until the finalization ofthe Fanning Springs project (hotel)

is complete. Discussion took place.

Motion made by Commissioner Todd Gray, seconded by Commissioner John Thomas, to

appruve a monlh to monlh lease ntith the Florida Department of agriculture, pending the results

of the hotel access needed in Fanning Springs; Mr. Lang to draft letter. Molion carried

unanimously.

o

County Employee Benefits Policy: Mr. Crosby addressed the issue of determining the

definition of creditable service, in the County Employee Benefits Policy for health

insurance benefit. He stated that the issue at hand is the retirement ofan employee who

has fiorty-one years of services and the benefits she should be compensated for. Discussion

took place.

Motion made by Commissioner Kenrick Thomas, seconded by Commissioner John Thomts, to

apprcve one yeu ol heallh insurance beneJits upon Nell Yelvington's reliremenl lrom lhe

Coun| alter lorTy-one (41) years of Credible Service. Motion carried unanimously.

o

New Proposed Rate for Agricultural Complex: Mr. Crosby stated that he has received phones

calls from interested parties from Marion County, looking for covered areas for horse

exercising/practice. He recommended the following proposed rate schedule:

Day Time Rate $200.00

1. Arena will be rented as is during daylight hours only

2. Arena can only be used for practice and exercise - no events

3. $1,000,000.00 Liability insurance required

Discussion took place.

Molion made by Commissioner Todd Gray, seconded by Commissioner John Thonas, to

approve new daylight hour rale of $200 lor use of the Agriculture Complex, Monday thru

Thursday only (when available), on an as-is-basis, with proof of $1 million liahilily insurance;

with the understanding lhal events will be given prior@. Motion corried unanimously.

The Board requested that the RiverCross Cowboy Church be contacted regarding fulfilling

their agreement with the County for use of the Agriculture Complex and the need to keep

the grass mowed and restrooms cleaned.

FYI

o

School Zone Speed Limit: Mr. Crosby informed the Board that the City of Trenton is in

the process of increasing school zone speed limit to 20 mph on CR 307,4 to match SR 12.

Gilchrist County Board of County Commissioners MeetinB Minutes

october 6, 2014

6

Additional Item: Change time for first Meetine in November

o

Mr. Crosby requested that the Board consider changing the meeting time for the November

3'd meeting from 2:00 p.m. to 4:00 p.m. due to reason being that he and the County Attomey

have an Animal Control Hearing to attend earlier that day as well.

It

was consensus of the Board to change the meeting time from 2:00 p.m. to 4:00 p.m. on

November 3'd, per the request ofthe County Administrator atrd County Attorney.

Attornev's Reoort

Mr. David M. Lang, Jr., County Attomey, presented the following documents, and/or addressed

the following issues:

Gilchrist County 4-H: addressed and approved earlier during this meeting.

Clerk's Reoort

Mr. Todd Newton, Clerk of Court, presented the following documents, and/or

addressed the

following issues:

North Florida Economic Development Partnershio: Mr. NeMon presented the NFEDP invoice for

2014-2015 Partnership Dues, in the amount of$1.694.00, for the Boards' approval.

Motion mtde by Commhsioner Todd Gray, seconded by Commissioner Kenrick Thomas, to

appruve the NFEDP invoice for 2011-2015 Parlnership Dues, in the amounl of $!-.691.00.

Molion carried un an imo us ly.

Circuit Holidays: Mr. Newton presented the 8th Judicial Circuit Court 2015

Holiday Schedule, for the Boards' information, in relation to their consideration of the County's

2015 holiday schedule. The following holiday schedule was presented:

20'15 Eishth Judicial

Day

New Year's

Martin Luther King, Jr.

President's

Good

Memorial

Independence Day

Labor

Dav

Friday

Day

Day

(Observed)

Day

Hashan&

Yem Kippur

Veterans Day

Thanksgiving Day

Friday after Thanksgiving

Day before Christmas

Christmas Day

Cesh

Thursday, January 1,2015

Monday, January 19, 2015

Mondav. Februarv 16.2015

Friday, April 3, 2015

Monday, May 25,2015

Friday, July 3,2015

Monday, September 7, 2015

Menday; Se

Wednesday; September 23; 2015

Wednesday, November 11,2015

Thursday, November26,20l5

Friday, November 27,2015

Thursday, December 24, 2015

Friday, December 25,2015

Gilchrist County Board of County Commissioners Meeting Minutes

october 6, 2014

7

Discussion took place with consideration to remeve Rosh Hashanah

President's Day'.

& Yom

Kippur and add

Motion made by Commissioner Sharon A. Langford, seconded by lohn Thomas to dPprove lhe

2015 Holiday Schedule,Jor all County Depa ments, as noted. Molion carried unanimously.

Three fuvers Regional Library System Interlocal Agreement: Mr. Newton presented the Interlocal

Agreement between TRRL System and the four (4) counties which are part ofThree Rivers, which

are Dixie, Gilchrist, Lafayette and Taylor. He stated that Mr. Lang, County Attomey has reviewed

the contract and requests the Boards' approval.

Molion made by Commissioner John Thomas, seconded by Commissioner Todd Gray, lo

approve the Interlocal Agreement wirh Three Rivers Regional Library Systen Motion carried

unanimously.

Mid-month Meeting in December: Mr. Newton addressed the issue of the meeting schedule for

the month of December. He stated that it has been history that there is no mid-month meeting held

in December unless an emergency arises. He asked the Board for their direction on a meeting

schedule for the month of December. Discussion took place.

It was consensus ofthe Board to change the first meeting in December from December l't at

2:00 p.m. to December 8th at 2:00 p.m. and determined that there will be NO mid-month

meeting in December unless there is an emergency.

Commissioners Reports

o

o

Commissioner D. Ray Harrison, Jr., asked about the plaque recognizing honorable

Gilchrist County Citizens, that is to be displayed at the Gilchrist County Agriculture

Complex; the names will be brought back at the next meeting

Commissioner Kenrick Thomas mentioned looking into power & water hookups at the Ag

Complex

Old Business: None noted.

New Business: None noted.

Public Participation: None

noted.

Adiourn

With there being no further business... a Molion was made by Commksioner John Thomas,

seconded by Commissioner Todd Gray, to adjourn. Molion carried unanimously. Chairman

Harrison adjoumed the meeting at 3:58 p.m.

Board oJ County Commbsioners

Gilchrist County, Florida

Approved:

Todd Newton, Clerk of Court

D.

Ray

Harrison, Jr., Choirman

Gilchrist County Board of County Commissioners Meeting Minutes

october 6, 2014

FIL ED

$.tttrttt

dll illt 0V oFNry \g

H. uercxrn.

IIElr,El

MI i L()tlo\ rfit Rlttsas,llx L\ In)fi

sll

r

BOX .r?0 . CROSS CITY.

1220 . FAX (15

(J5!, .9t-

RI

FL

INVOICE AGREEMENT BETWEEN

DIXIE COUNTY AND GILCHRIST COUNTY

SHERIFF'S DEPARTMENT

DECEMBER 2OI4

SHERIFF ROBERT D. SCHULTZ

I9

9239 SOUTH US

TRENTON. FLORIDA 32693

CILCHRISI CO. INMATE

INMATE

DAY

DAY

TOTAL

NUMBER

IN

OUT

DAYS

13.

15.

AMBRIZ MISEAL

l2- l9- l.r

BARR ATHENA

n-25-14

t2- 1614

BARR ATHENA

r2-

r615

ll -3G I4

r2{9- 14

t24,-14

BOYD. CARLIE

BOYD. CARLIE

BRENNER RICHARD

BUSTER VICTORIA

CANa|ON. JAMIE

CANNON. JAMIE

CANNON. JAMIE

CANNON. .,AMIE

DOUGLAS. BARBARA

DOUGLAS. BARBARA

DOUGLAS. BARBARA

DOUGLAS. BARBAM

DOUGLAS. BARBARA

DOYLE. JOSHUA

DOYLE. JOSHUA

DOYLE. JOSHUA

CODBOLT. DANIEL

CODBOLT. DANIEL

GOLDTHORPE. CHRISTOPHER

HAZELWOOD. TAMMY

HAZELWOOD. TAMMY

r2{3-t4

t242-t4

r2- t5- t4

l2-19-t 4

-25- 14

l2{t - t.l

t24t-14

l2-09- t 4

r24S- l.r

l2-t

t

2-

t

&t4

t-14

l24l-l.l

t249-t4

4

l2- t t- t4

t2-t2-t4

t2-t&l4

r2- r t- t4

r2-31- 14

t

2{+r

l2-3l-t4

-0614

t244-t4

t2- t8- t4

r2{3-

14

r2-lt-t4

t2-o3- t4

l2-lt-r4

t2- 18-t 4

I t -20-t 4

l2-t9-t4

l2{3-r4

l-20-r4

l2- 16-t 4

l2- 16.14

l2-tt- t4

I

t6,

06.

16.

30.

0t-

007

08-

09.

14t

05-

6t3J

0l .

02.

15.

0l .

0215 ,

02.

11

14J

HAZELWOOD. TAMMY

HICKS. MARCUS

t2-tt-r{

KARSMIZKI. MRTHY

KARSMIZKI. DORTHY

KARSMIZKI. DORTHY

I t-

MCDANIEL. CHRISTOPHER

MCDANIEL. CHRISTOPHER

MATHIS. LEONDRE

MONTCOMERY. JESSE

MONTGOMERY. JESSE

PORTER MICHAEL

SMITH. JOSEPH

WHITE. JENNIFER

WHITE, JENNIFER

r2- r9- t 4

{Gl4

tt- r4

r243-r.r

t242-t 4

I244- t4

l2-t5-t.t

l2- l5- l,l

t2-31-

r2-i

I-

l.l

15

r2-03- 14

I t-2G14

l2- tt- t4

I t -25- t4

44- r4

r2- t8- t4

t2- I t-14

17/

t2-

0l .

15.

3l .

11

14r'

l2{i-r4

I

r2{9-

ZELLER VALERIE

I I -25- 14

r

ZELLER VALERJE

l2{l/-"t4

ZELLER VALERIE

l2-o9- t+

l-25-t4

t2- tG l4

l1 .

02t

0l .

|.

14

t2-tt-t4

2{3- t4

r2{9-r,r

n- t8- l.t

02'

OE,

06/

02t

05,/

09.

TOTAL DAYS FOR MONTH: 396

A 537.00 PER DAY =$ 14.6s2.00

TOTAL HOUSING: Sl4652.lX)

TOTAL DUf:

Sl{652.m

J

PLEASE REMIT BILL TO:

DIXIE COI,JNTY SHERIFF'S DEPARTMENT

N.E.35l HWY

SUITE L

cRoss ctry. FLoRIDA 3252t

214

(,rJ ,

lo/

-//{

FAX

Mills Ensi eerins Com

?tto{p

(35rYU-2r72

E-Mril:

lvlailing: P. O. Box 77t

Physical: 5(X East Hathaway Avcauc

Bronson, FL3262l

Gilchrist County

Board of County Commissioncrs

POBox3T

Treaton, FL 32693

tnngt5

IN RE: WIDEN AND RESLTMACE SW 100fi{ ST FROM SW TOTH AvE

TO CR-341

FINANCIAL PROJECT IDI 43302&I.5t.OI

BILLING PERIOD: l2l0tD0l4 - t2fitnOt4

Prcfrsrion ofcoDsEuctioo pleas for Gilchrir Couaty SW l00rh Strct

27.00 hotw @ 395.00 pcr boru =

5.00 houn @ 327.fi) pcr hour

5.00 hours @ $2.00 pcr hour =

2,565.00

-

135.00

210.00

Total

t2,ero.oo

t /o7

Nalla

t15

SI,'I.d.IARY OE TIITE

FilG: PRTTP

Houla

D.t.

;ND

CHARGES FOR BILLTNG

Notc!

R.port:

Rl

Page

PROJECT NUUBER: 2013072.00

DESCRIPTION: Gllchrlsr Co corlr'Hld.n / Resurf sH l.oorh st-sH Toch ro GcR 3a1

AC

t2/ 08 / t5

GCR SId 10 0 th-r opogr.ph:,

8.00

AC

L2/O9/L5

7.00

GCR Sw looEh-pl.en plofi Ie

AC

L2/15/t5

a.Oo

GC Sll 100rh-p1an profiLo

AC

L2/71 /15

8.0O

GC Sn looth-gulnr 1r iar, r,/w

HOURS :

sL

sL

\ZILO/L

t2/L7 /L4

HOURS :

sR

SR

72/ tO/ Ll

L2/ L1 /Ll

HOURS :

tofAl. Al.touNt

DUE :

27.OO RATE:

CHARGES: 2,565.00

2.5O

GCR Sr loot.h-vcrlfy drl-eHa:.a i pold.r Line3

2.5O

GC sH looth-raahooE drii.Gs;vcrif:. nonu8anEs

5.0O RATEr 27 .OO

CIIARGES:

135. OO

2.30

GCR SH loorh-v€rify drlr.L,ri's,. por{6r lin€g

2.50

GC Sf lOOth-rGrhoor driyGsrvertfl' rlonurent!

5.00 RATE3 az.OO

CIIARGES:

210.00

2,91O.00

95.O0

.\\el

Suwannee River Economic Council, Inc.

J

\-.

r(

Post Ofice Box 70

Live Oak, Florida 32064

tJ

i

+,

?y

.s>

ir

ii

ADMTNTSTRATIVE OFFICE - PHONE (386)362-41I5

FAX (386) 362-4078

E-Mail: [email protected]

€.,f

rEB.\I

RIVE

Spl

\ VC

C11t-

GTLCHRTST COUNTY

STALE HOUSZNC INITTATI\IE PARTNERSHIP

PROGR;AIt

CTTECK REQWST

MEIIOB,AIiIDI,}{

TO:

GILCERTST COU}iITY

EIROM:

IIATT PEARSON, EXECIITI\'E DIRECTOR /

DATE:

JaIIUARY

PAYAALE

TREMII'H

2015

TO GIIEERTST

IN TEE AI.{O[ NlI oF $27,450.00, ro BE IIADE

TITIE SERVICES rNc. , 302 N. vn rN STRE8T

EL 32693

TEE SHIP HOUSING TRUST

ISSUE A

PLEtrSE

13,

/

CSECK

ERo["t

FUND.

TEESE FUNDS ARE TO BE USED AS:

ATTACEED

P

I,E;ASE

IS

DOC'UMEIiTTATION AUTEORIZING

TlATL THE CIIECK TO:

Tffi

EXPENDITURE.

SREC, INC.

7439

sr A, 307A

74/75 oEOE 075 L23

c:

SREC

Sr-l I P

BRADFORO -

Finance iepar tne::

Ci.renr alie

COLUMBII - DIXIE

-

GIrHR|ST

-

SERVING

HAMILTON L-{FAYETTE

- LEVY - MADISON

' PL'rNAM

- SLiWAN^EE - TAYLOR -

tr}lloN

" This institution is an equal opportunit-v provider and employn "

-__--J

cRrtu{?i#

CPAs and Advisors

4010 NW 25 Place PO Box 13494

Gainesville, FL 32604

(3s2) 372-6300

Federal lD 72-1396621

Gilchist County

PO Box 37

112 S. Main Street

Trenton, FL 32693-3249

lnvoice

No.

Date

ClientNo.

906893 (include on check)

01h 2,r2U 5

90-00834.000

Professional services rendered as follows:

Progress Billing on 2014 Audit.

Cunent Amount Due

s__2Q,QQQ-00

We accept most majo. credit cards. Please complete the following information

or contact our office to submit your payment

phone.

over the

lnvoice Date: O1t12t2}15

lnvoice Number: 906893

Client No: 90-00834

TotalAmount Due:

20,0OO.OO Grlchrist County

5

Name as it appears on card:

Billing Address:

Card #

Payment Amounl:

Exp Date:

Security #

Sqnature:

Can, Riggs & lngram, LLC reserves the right to assess finance charges oo past due balances up to the maximum amount allowed under

State law

Suwannee Valley Leagues, Inc

PO &ox I102

Tenron. FL 32693

January 9, 201 5

Board of Commissiorrcrs

Cilchrisr County. FL

TrEntoG FL32693

RE:

Suwannee Valley

tragrrs

Budgct Disbursenrcnt

Dear Commissiorrrs:

Plcasc allow this lcttcr to scrve as our

rrqlEsl ft,onr thc Board of Dircctors of Suwanocc Vallcy

Inc. for thc disbuncrncat of the 325.650 tbat was budgaed for our leagrr. Ttis frmdiDg is

critical to our leagrr operation ard we thanl you grcatly for your continued srpporr. As a Board, wc

feel srongly that our program continues to prcvide thc childrco ofour County a viablc recrcational

outlet to &velop oustanding young adults.

Leagrs

Cordially,

Downing Treasurer

Suwannee Valley Leagues. Irrc.

DBA Gilchrist Leagues

M ichael

City of Trenton

Phone 3524634000

114 N, iHain St.

Trenton, Florida 32693

2074-2075

Fax 3524534CC7

COMMUNITY REDEVELOPMENT FUND INVOICE

Bill to:

Gilchist County Cle* of Courts

rl

=

Attn : F in ance D ep artment

P.O. Box 37

Trenton, Fbnda 32693

t\)

I

i'Tl

q?

Value Differential

Communify Redevelopment Area - Real

Property Taxable Value FY

Community Redevelopment Area - Taxable

Value in 2002

O

(i

$ 20,u6,527.00

$

Difference

11,585,545.00

9,260,982

Cilv Revenue Calculation

Difference

Revenue Per Mill To CRF

Mills L,evied (Gilchrist County)

TotaI

$

Less 5% Administrative Fee

$

Total Amount Due to City From County

$

9,260,982

$9,267

8.500

78,718

3,936

74,782

6l f^ zotf

Date

Gilchrist County BOCC

Finance Department

Gilchrirt

County

Properly TYansJer Form

Ihis

fom

is

lo be used for lhe honsfer of ossels on loon belween deportmenh

,o,., January 7 2015

Type of Tronsfer:

tr Temporory

E Permonent

Xl$n-.n,, otter Springs

Io:

D''eporrment:

Emergency

Locotion: Otter Springs Camp

Mg mt Locotion:

EOC

# Monufocturer Model Number Seriol Number

031 13 John Deer Gator 4x4

Couniv lD

Cosl

Jusriricotion: Surplus property from Otter Springs.

Transfer to EM to be used in emergency response and recovery operations

MUST BE COMPLETED AA/D S'G'VED BY BOTH PARIIES

[i;"

Oavid Peaton

Dote:

1-7-2015

Dote: Ot ^ .,,y'- Jo/ S-

Approved:

Complete this form ond submit signed originol to the Finonce Deportment, ond retoin o copy

of the submitted form for your records.

Gilchrist County BOCC

Finance Department

ProperlU TlansJer Form

Ihis fom ls to be used for lhe hons{er of osseh on loon befiflr9en cbpodments

oqrer

1

.6.2015

Type of lrons{er:

3#*"",'

To:

Deportment:

County lD

3115

Jusrificotion:

tr Temporory

I

Permonent

otter springs

Locotion:

Otter Springs

Hart Springs

Locotion:

Hart Springs

#

Monutoclurer Model Number

E-Z Go

TXTPDS

Seriol

Number

2250497

Cosl

2275.00

Surplus property from Otter Springs/Per

agreement with Forvets

MUST BE COMPLEIED N,ID S'G'VED BY BOIH PARTIES

TO:

lrlorne:

Signoture:

Dqte:

Dote: Ot-

t/-/{

Approved:

complete ihis form ond submit signed originol 10 ltte Finonce Deportmenl, ond retoln o copy

of tle submltted tom for your recorch.

Gilchrist County

County Administrator Report

Bobby Crosby

January 22, 2015

1.

2.

3.

4.

5.

6.

Road Department

a. Monthly Lime Rock Report

b. Discussion of Termite Treatment Agreement

c. Permission to advertise and hire equipment operator

Animal Control

a. Monthly Report

Library

a. Monthly Report

TDC

a. Approval of promotional advertising

b. Permission for Donna to travel to VISIT FLORIDA Regional

Area of Opportunity Consumer Show program

General Government

a. Approval of modification to CDBG sub-grant agreement

b. Paul Stressing – Update on BoCC meeting room

FYI

a. Letter re: Noise ordinance

MONTHLY

TOWNSEND PIT

LIME ROCK REPORT

DISTRICT 1

DISTRICT 2

DISTRICT 3

DISTRICT 4

DISTRICT 5

December 2014

Paid For

5

4

42

MONTHLY TOTAL

X

TOTAL

$10.00

SHOP STOCK PILE

SOLID WASTE - 47

_______________________________________

ROAD DEPT. SUPERVISOR

_____________________

DATE

MONTHLY

TOWNSEND PIT

LIME ROCK REPORT

December 2014

DISTRICT 1

DISTRICT 2

DISTRICT 3

DISTRICT 4

DISTRICT 5

335

12

MONTHLY TOTAL

X

TOTAL

SHOP STOCK PILE

SOLID WASTE - 47

_______________________________________

ROAD DEPT. SUPERVISOR

(NW 50 St)

427

$10.00

4270.00

28

52

_____________________

DATE

A.{

Pest Gontrol

*-!-t'

hdr, [email protected], @..5-m

Subterranean Termite Agreement

r9l5

12ノ 23′

Residential

Commercial -

Cancellation

-

Notice

Name/Address

Project

Gilchrist County Commission

PO Box 37

Trenton, FL 32693

USA

Road Dept.

1770 US 129

Bell, FL 32619

USA

2014

506

Retreatment Only Agreement

Technician, Permit #

:

Notice of Treatment

Payment

Mth:

Service Agree...

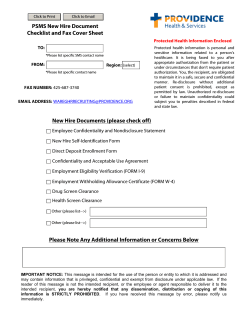

A-1 Pest Control, lnc., shall control and provide a retreatment service for one year from the treatment date against

the infestation or re-infestation of termites at the above treated said property.

lf an infestation/re-infestation of subterranean termites occurs while this agreement is in affect, A-1 Pest Control,

lnc., will treat the area where the live infestation has occured. This will be done at no additional cost to the owner

of this agreement.

A-1 Pest Control, lnc., will extend protection and re-inspection annually to the homeowner for 4 years, at the below

price stated as annually sub-terranean termite inspection and contract renewal. All annual sub-terranean termite

inspections are payble at the time of service.

This agreement contains disclaimer limitations and conditions. Any additional provisions attached

herto, including the terms and conditions are attached to said agreement.

Description

Termite Treatment

Annualsubterranean termite inspection

Qty

1

Rate

950.00

165.00

Total

950.00

165.00

begins in 2015

Signature of Purchaser / Home

owner Date

Authorized A-l Pest Control

Print Name of Purchaser / Homeowner

Prieston J. Jones

A-1 Pest Control, lnc.

License Holder Name

Trenton, FL 32693

Phone 352-463-2469

Fax 352-463-7336

Date

Intake Detail Report

Print Date

Thursday, January 15, 2015

Intake StartDate

12/1/2014 12:00 AM

Intake EndDate

12/31/2014 11:59 PM

Jurisdiction

All

Injury Cause

All

Intake Type

All

PreAltered

All

Intake SubType

All

Site Name

All

Species

All

Age Group

All

DOA

All

Animal Tag Type

All

Intake Status

Completed

Animal#

Animal Name

Species

Breed

Age

Gender Color

PreAltered

IntakeDate

Intake Type

PetID

ARN

Tag type

Size

Location / Sublocation

Altered

Danger

S/N

By

Subtype

DOA

Danger Reason

Clinic

Total Intakes: 4

Total Unique Animals: 4

Owner/Guardian Surrender

Total Intakes: 35

Total Unique Animals: 35

Return

Total Intakes: 1

Total Unique Animals: 1

Stray

Total Intakes: 46

Total Unique Animals: 46

Total Count:

Page 1 of 1

86

Outcome Summary Report

Print Date

Thursday, January 15, 2015

Animal#

Name

Species

ARN#

Secondary Breed

Outcome StartDate

12/1/2014 12:00 AM

Outcome EndDate

12/31/2014 11:59 PM

Outcome Type

All

Outcome SubType

All

Species

All

Jurisdiction

All

Age Group

All

TransferOut Reason

All

Site

All

Outcome Status

Primary Breed

Age

Sex

Danger

Danger Reason

Alter

Outcome Type

Outcome SubType

Outcome By

Jurisdiction

TransferOut Reason

Outcome Date/Time

Completed

Recorded By

Adoption

Total Outcomes: 3

Total Unique Animals: 3

Clinic Out

Total Outcomes: 2

Total Unique Animals: 2

Euthanasia

Total Outcomes: 23

Total Unique Animals: 23

Return to Owner/Guardian

Total Outcomes: 5

Total Unique Animals: 5

Transfer Out

Total Outcomes: 33

Total Unique Animals: 33

Total Count:

66

Page 1 of 1

Case Detail

Print Date

Thursday, January 15, 2015

Case Category

All

Case Result

All

Include Activities

False

Case Type

All

Case Result By

All

Include Conditions

False

Case SubType

All

Case Memo Type

All

Include Memos

False

Case Status

All

Include Case Address

False

Include Violations

False

Case Officer

All

Include Animal Info

False

Based On

Case Date/Time

Officer Site

All

Include Person Info

False

Date From

12/1/2014 12:00 AM

Case Jurisdiction

All

Include Animals

False

Date To

City

All

Include Persons

False

Patrol Area

All

Case#

Case Category

Case

Reference #

Case Type

Case Date/Time

Case

SubType

Reported

Date/Time

Case Status

Case Officer

Case Jurisdiction

Case Result

Patrol Area

Case Result By

Cruelty / Neglect

2712147

Incident

12/31/2014 11:59 PM

Case Result

Date/Time

Case Review

Date/Time

1

Cruelty /

Neglect

12/8/2014 3:14 PM

Open

Ericka Husdon

Gilchrist County

Other

Enforcement

2704672

Incident

7

Enforcement 12/1/2014 1:05 PM

Open

Ericka Husdon

Gilchrist County

Enforcement 12/3/2014 10:39 AM Open

Ericka Husdon

Gilchrist County

Ericka Husdon

Gilchrist County

Ericka Husdon

City of Trenton

Ericka Husdon

Gilchrist County

Ericka Husdon

Gilchrist County

Nuisance

2707024

Incident

Dangerous

Dog

2717064

Incident

Enforcement 12/12/2014 3:33 PM Open

At Large

2720627

Incident

Enforcement 12/16/2014 3:45 PM Open

At Large

2727888

Incident

Enforcement 12/24/2014 1:10 PM Open

At Large

2732989

Incident

Enforcement 12/30/2014 7:49 PM Open

Page 1 of 2

2732992

Incident

Enforcement 12/30/2014 7:53 PM Open

Ericka Husdon

Gilchrist County

Nuisance Animal

2732994

Investigation

1

Nuisance

Animal

12/30/2014 7:57 PM Open

Ericka Husdon

Gilchrist County

Seizure

2717100

1

Incident

Seizure

12/12/2014 3:52 PM Open

Ericka Husdon

Gilchrist County

Owner in

Hospital

Stray

2704659

7

Incident

Stray

12/1/2014 12:53 PM Open

Ericka Husdon

Gilchrist County

12/2/2014 11:58 AM Open

Ericka Husdon

Gilchrist County

12/3/2014 2:41 PM

Open

Ericka Husdon

Gilchrist County

12/3/2014 2:46 PM

Open

Ericka Husdon

City of Trenton

12/12/2014 3:45 PM Open

Ericka Husdon

Gilchrist County

At Large

(Equine)

2705771

Incident

Stray

Trap

Placement /

Retrieval

2707488

Incident

Stray

In Custody

2707495

Incident

Stray

At Large

(Dog/Cat)

2717094

Incident

Stray

At Large

(Dog/Cat)

2717196

Incident

Stray

12/12/2014 4:53 PM Open

Ericka Husdon

City of Trenton

2732996

Incident

Stray

12/30/2014 8:24 PM Open

Ericka Husdon

Gilchrist County

In Custody

Total Count: 17

Page 2 of 2

Gilchrist County Public Library

Activity Report for November/ December

Activity

November

December

Adult Circulation

2023

2893

Magazines

76

90

Juvenile Circulation

1,390

1,881

Audio Books

67

102

Videos/DVD's

749

1,279

New Patrons

22

48

Public Computer Use

s07

651

WiFi Log !n

319

309

# of Groups/Meeting

Room

8

12

Total Meeting Room

Attendance

134

186

3270

2652

#in Library Programs

13

17

Average Patron per day

182

126

#

of Patron Visits

Gilchrist County

Tourist Development Council

www.VisitGilchristCounty.com

(1)

(2)

(3)

(4)

Place ad in the 2015-2016 Florida Freshwater

Fishing Guide Book ¼ page ad discounted rate

of $2,050

Place ad in the Undiscovered Florida Magazine

1/12 page ad rate of $1,495

Place ad in the Florida Travel & Lifestyle

Magazine 3-issues rate for full size ad is

$1,780

Place ad in Hidden Coastlines Magazine ¼

page for 4-issues rate is $716

Greetings Show Attendee and Alternate This letter is to confirm your commitment to the VISIT FLORIDA Region Area of Opportunity Consumer Show Program. The Tourism Task Force thanks you for your dedication. Hopefully, this will answer most of the questions you should have in regards to travel, dates, accommodations, per‐diem etc. You will be, as mentioned at the task force meeting in November, responsible upfront for your own transportation, lodging and meals and then be reimbursed by the Original Florida Tourism Task Force. I (Roland) will arrive early to each show, set‐up and in case of a long show (4 days or more), work one day alone. The first day of your arrival to the city in which the show is being held is not a work day for you, as travel is enough for an unpaid volunteer. We will meet the day of your arrival. You can contact me upon arrival by cell 325 231 2077. At the last Task Force meeting we picked shows we could attend. Should your availability change, it is your responsibility to contact the alternate for that show. Should both the primary and alternate be unavailable, I will work with Steve and our intern to find a solution. However, I have worked a few of these shows in the past by myself – so that would not be a critical situation as long as I know about it. Chicago RV and Camping next to the Double tree Rosemont 847 292 9100 (excellent rate – falls in budget) Donna Creamer is primary and Nancy Wideman is the alternate. Stevens Convention Center 2 miles from O’Hare Donna is to arrive on Thursday 2/18 by Air and depart Sunday 1/23 by AIR – unless you select to leave on the red‐eye on the 22th Hotel choice is you own and your budget is $200 including tax – I’m staying at The Doubletree847 292 9100 code RVV From: Doherty, Roger [mailto:[email protected]]

Sent: Tuesday, December 30, 2014 4:42 PM

To: Fred Fox

Cc: Anderson, Tammy

Subject: Gilchrist County

Fred: Attached are 4 files that need to be reviewed by Gilchrist County and then returned to the Department to complete its request for Modification 5 to 11DB‐C5‐03‐31‐01‐PS16. All old subgrant agreements have to be brought up to current standards when modifications are requested. Most of the changes should not have an impact on the County as they are revisions related to audit and E‐Verify requirements which the County should already be following. The following four files are attached: 1. a revised Modification to Subgrant Agreement form. Please have the chairman sign and return at least two copies. 2. new pages 1 ‐ 13A. The new language on these pages is underlined. 3. a revised page 33 with new Special Condition 3 related to submitting Requests for Funds, and 4. the new Attachments M and N, which contain audit language. I have typed in the language that the legal office wants under Other at the bottom of page 2 of the Modification to Subgrant Agreement form. The County will not have to complete Attachment N until next November. Special Condition 3 on the revised page 33 requires documentation to be submitted with requests for construction costs. The County should be getting this already. We will need a new letter signed by the chairman stating that the County has reviewed the new subgrant pages provided by the Department and agrees to include them as part of Modification 5 to the subgrant agreement. We have the revised Program Budget and Activity Work Plan pages, along with the Request for Amendment form that was submitted on December 17. We will attach them to the revised Modification to Subgrant Agreement forms upon receipt and continue to process the request. Please call me if you have any questions. Roger J. Doherty, CLEP Planning Manager Small Cities CDBG Program Mailing Address: Florida Department of Economic Opportunity 107 E. Madison St. ‐ MSC 400 Tallahassee, FL 32399‐6508 Office Address: Collins Building 107 E. Gaines St. Room 243C Tallahassee, FL O: 850‐717‐8417 [email protected] Department of Economic Opportunity – Small Cities Community Development Block Grant Program

Form SC-44

Modification to Subgrant Agreement

12/9/2014

Modification Number 5 to Subgrant Agreement Between

the Department of Economic Opportunity and

Gilchrist County

This Modification is made and entered into by and between the State of Florida, Department of

Economic Opportunity, (“the Department”), and Gilchrist County, (“the Recipient”), to modify DEO

Contract Number 11DB-C5-03-31-01-PS16, awarded on June 30, 2011 (“the Agreement”).

WHEREAS, the Department and the Recipient entered into the Agreement, pursuant to which the

Department provided a subgrant of $750,000 to the Recipient under the Small Cities Community

Development Block Grant (“CDBG”) Program as set forth in the Agreement;

WHEREAS, the Department and the Recipient desire to modify the Agreement;

NOW, THEREFORE, in consideration of the mutual promises of the parties contained herein, the

parties agree as follows:

Reinstate the Agreement

1. The Agreement is hereby reinstated as though it had not expired.

Extend the Agreement

2. Paragraph 3, Period of Agreement is hereby revised to reflect an ending date of (Type in the date,

if applicable).

Revise the Activity Work Plan

3. Attachment I, Activity Work Plan, of the Subgrant Agreement is hereby deleted and is replaced by

the revised Attachment I, which is attached hereto and incorporated herein by reference.

Revise the Program Budget

4. Attachment A, Program Budget, of the Subgrant Agreement is hereby deleted and is replaced by

the revised Attachment A, which is attached hereto and incorporated herein by reference.

Department of Economic Opportunity – Small Cities Community Development Block Grant Program

Form SC-44

Modification to Subgrant Agreement

12/9/2014

Modification Number: 5

DEO Contract Number: 11DB-C5-03-31-01-PS16

Recipient: Gilchrist County

Page 2

Change the Participating Parties

5. Attachment A, Program Budget, is hereby modified to delete all references to “(Type in the name,

if applicable.),” as the Participating Party, and replace them with “(Type in the name, if

applicable.)” as the Participating Party with the understanding that the Recipient and the new

Participating Party will enter into a Participating Party Agreement containing provisions and

caveats that meet or exceed the conditions agreed to in the Participating Party Agreement between

the Recipient and the original Participating Party.

Include an Unmet Need as Addressed in the Original Application

6. Attachment A, Program Budget, of the Subgrant Agreement is hereby deleted and is replaced by

the revised Attachment A, which is attached hereto and incorporated herein by reference.

7. Attachment I, Activity Work Plan, of the Subgrant Agreement is hereby deleted and is replaced by

the revised Attachment I, which is attached hereto and incorporated herein by reference.

8. A revised Project Narrative, Form G-2 from Part II of the approved CDBG Application Form,

which shows the unmet need from the original application that is being included in the Subgrant

Agreement listed as addressed need, is attached hereto and incorporated herein by reference.

Change the Number of Accomplishments and/or Beneficiaries

9. Attachment A, Program Budget, of the Subgrant Agreement is hereby deleted and is replaced by

the revised Attachment A, the Program Budget, which is attached hereto and incorporated herein

by reference.

Reflect the Change in Agency from DCA to DEO

10. This modification to the Subgrant Agreement hereby replaces “Department of Community

Affairs” with “Department of Economic Opportunity” where appropriate in context.

Other:

11. Replace the current pages 1-13 of the agreement with the attached pages 1-13A. The underlined

portions of the replacement pages reflect, in part, changes in law, as well as revisions to the

Department's standard terms and conditions. Page 33 is being replaced by the attached page 33,

which includes a new special condition related to submitting documentation with Requests for

Funds. Attachments M and N are being added to the contract.

Department of Economic Opportunity – Small Cities Community Development Block Grant Program

Form SC-44

Modification to Subgrant Agreement

12/9/2014

Modification Number: 5

DEO Contract Number: 11DB-C5-03-31-01-PS16

Recipient: Gilchrist County

Page 3

A Request for Amendment, Form SC-35, shall be included with this Modification if there is a

change to the Attachment A, Program Budget, of the Subgrant Agreement; if unmet need is being included as

addressed need; or if there is a change in the number of accomplishments or beneficiaries.

All provisions of the Subgrant Agreement and any attachments thereto in conflict with this

Modification shall be and are hereby changed to conform to this Modification, effective as of the date of the

execution of this Modification by both parties.

All provisions not in conflict with this Modification remain in full force and effect, and are to be

performed at the level specified in the Agreement.

IN WITNESS WHEREOF, the parties hereto have executed this document as of the dates set

herein.

State of Florida

Department of Economic Opportunity

Recipient: Gilchrist County

By: __________________________________

By: _____________________________________

Name: William B. Killingsworth

Name: Todd Gray

Title:

Title:

Director

Division of Community Development

Date: _________________________________

Chairman, Board of County Commissioners

Date: ___________________________________

STATE OF FLORIDA

DEPARTMENT OF ECONOMIC OPPORTUNITY

Contract Number: 11DB-C5-03-31-01-PS16

CFDA Number: 14.228

Rule Chapter: 73C-23, Florida Administrative Code

Effective: June 6, 2010

FFY 2010 FEDERALLY-FUNDED SUBGRANT AGREEMENT

Neighborhood Revitalization

THIS AGREEMENT is entered into by the State of Florida, Department of Community Affairs

(amended to the Department of Economic Opportunity in Modification 1 on June 6, 2013, with

headquarters in Tallahassee, Florida (hereinafter referred to as “DEO” or the "Department"), and Gilchrist

County (hereinafter referred to as the "Recipient").

THIS AGREEMENT IS ENTERED INTO BASED ON THE FOLLOWING

REPRESENTATIONS:

A. The Recipient represents that it is fully qualified and eligible to receive these grant funds to provide

the services identified herein; and

B. The Department has received these grant funds from the State of Florida, and has the authority to

subgrant these funds to the Recipient upon the terms and conditions below; and

C. The Department has statutory authority to disburse the funds under this Agreement.

THEREFORE, the Department and the Recipient agree to the following:

(1) Scope of Work

The Recipient shall perform the work in accordance with the Program Budget, Attachment A of this

Agreement; the Activity Work Plan, Attachment I of this Agreement; and the Florida Small Cities

Community Development Block Grant (CDBG) Application for Funding submitted by the Recipient on

November 27, 2010, including future amendments to this Subgrant Agreement that are agreed upon by both

parties.

(2) Incorporation of Laws, Rules, Regulations and Policies

The Recipient and the Department shall be governed by applicable State and Federal laws, rules and

regulations, including those identified in Attachment B and K.

Rev. 6/20/2014

1

(3) Period of Agreement

This Agreement shall begin upon execution by both parties, and shall end on June 29, 2015, unless

terminated earlier in accordance with the provisions of Paragraph (12) of this Agreement. Contract

extensions will not be granted unless Recipient is able to provide substantial justification and the Division

Director approves such extension.

(4) Modification of Contract

Either party may request modification of the provisions of this Agreement. Changes which are agreed

upon shall be valid only when in writing, signed by each of the parties, and attached to the original of this

Agreement.

(5) Records

(a) As applicable, Recipient's performance under this Agreement shall be subject to the federal

OMB Circular No. A-102, Common Rule: Uniform Administrative Requirements for Grants and

Cooperative Agreements to State and Local Governments (53 Federal Register 8034) or 2 CFR 215,

Uniform Administrative Requirements for Grants and Agreements with Institutions of Higher

Education, Hospitals, and Other Nonprofit Organizations, and either 2 CFR 225, Cost Principles

for State, Local and Indian Tribal Governments, 2 CFR 220, Cost Principles for Educational

Institutions, or 2 CFR 230, Cost Principles for Non-Profit Organizations.

(b) Representatives of DEO, the Chief Financial Officer of the State of Florida, the Auditor

General of the State of Florida, the Florida Office of Program Policy Analysis and Government

Accountability or representatives of the federal government and their duly authorized representatives

shall have access to any of Recipient’s books, documents, papers, and records, including electronic

storage media, as they may relate to this Agreement, for the purposes of conducting audits or

examinations or making excerpts or transcriptions.

(c) Recipient shall maintain books, records, and documents in accordance with generally accepted

accounting procedures and practices which sufficiently and properly reflect all expenditures of funds

provided by DEO under this Agreement.

(d) Recipient will provide a financial and compliance audit to DEO, if applicable, and ensure that

all related party transactions are disclosed to the auditor.

(e) The Recipient shall retain sufficient records to show its compliance with the terms of this

Agreement, and the compliance of all contractors and consultants paid from funds under this

Agreement, for a period of six years from the date this Agreement is final closed. The Recipient shall

ensure that audit working papers are available upon request for a period of six years from the date this

Agreement is final closed, unless extended in writing by the Department. The six-year period may be

extended for the following exceptions:

Rev. 6/20/2014

2

1. If any litigation, claim or audit is started before the six-year period expires, and extends

beyond the six-year period, the records shall be retained until all litigation, claims or audit findings

involving the records have been resolved.

2. Records for the disposition of non-expendable personal property valued at $5,000 or more

at the time it is acquired shall be retained for six years after final disposition.

3. Records relating to real property acquired shall be retained for six years after the closing on

the transfer of title.

(f) The Recipient shall maintain all records and supporting documentation for the Recipient and

for all contractors and consultants to be paid from funds provided under this Agreement, including

documentation of all program costs, in a form sufficient to determine compliance with the requirements

and objectives of the Program Budget - Attachment A - and all other applicable laws and regulations.

(g) The Recipient, its employees or agents, including all contractors and consultants to be paid

from funds provided under this Agreement, shall allow access to its records at reasonable times to

representatives of DEO, the Chief Financial Officer of the State of Florida, the Auditor General of the

State of Florida, the Florida Office of Program Policy Analysis and Government Accountability or

representatives of the federal government and their duly authorized representatives. "Reasonable" shall

ordinarily mean during normal business hours of 8:00 a.m. to 5:00 p.m., local time, on Monday through

Friday.

(h) To the extent that it does not conflict with federal regulations, the Recipient shall transfer, at no

cost to DEO, all public records upon completion or termination of this Agreement, and destroy any

duplicate public records that are exempt or confidential and exempt from public records disclosure

requirements. All electronic records shall be provided to DEO in a DEO-compatible format.

(i) The Recipient shall include the aforementioned audit and record keeping requirements in all

approved contracts and assignments.

(6) Audit Requirements

(a) Review the Audit Requirements listed in Attachment M of this contract. For local government

fiscal years beginning after December 26, 2014, a recipient will not have to have a single or programspecific audit conducted in accordance with the provisions of OMB Circular A-133, as revised, unless it

expends $750,000 or more in Federal awards during its fiscal year.

(b) The requirements listed in Attachment M, Part II: State Funded, are not applicable to this

subgrant agreement which is a Federal pass-through award.

(c) Within sixty (60) days of the close of the fiscal year, on an annual basis, the recipient shall

electronically submit a completed Audit Compliance Certification (a version of this certification is

attached hereto as Attachment N) to [email protected]. Recipient’s timely submittal of one

completed Audit Compliance Certification for each applicable fiscal year will fulfill this requirement

within all agreements (e.g., contracts, grants, memorandums of understanding, memorandums of

agreement, economic incentive award agreements, etc.) between DEO and the Recipient.

Rev. 6/20/2014

3

This form is in addition to the audit certification memo that must be sent to the Department if an

audit is not required because the local government spent less than $500,000 ($750,000 for fiscal years

starting after December 26, 2014) in Federal funds during a fiscal year.

(d) In addition to the submission requirements listed in Attachment M, each recipient should send

an electronic copy of its audit report or certification memo (available on the CDBG website) by June 30

following the end of each fiscal year in which it had an open CDBG subgrant to its grant manager at the

following address to ensure that it does not incur audit penalty points:

Email: [email protected]

(7) Reports

(a) The Recipient shall provide the Department with quarterly reports and a close-out report. These

reports shall include the current status and progress by the Recipient and all subrecipients and

subcontractors in completing the work described in the Scope of Work and the expenditure of funds

under this Agreement, in addition to any other information requested by the Department.

(b) Quarterly reports are due to the Department no later than 15 days after the end of each quarter

of the program year and shall be sent each quarter until submission of the administrative close-out report.

The ending dates for each quarter of the program year are March 31, June 30, September 30 and

December 31.

(c) The close-out report is due 45 days after termination of this Agreement or 45 days after

completion of the activities contained in this Agreement, whichever first occurs.

(d) If all required reports and copies are not sent to the Department or are not completed in a

manner acceptable to the Department, the Department may withhold further payments until they are

completed or may take other action as stated in Paragraph (11) Remedies. “Acceptable to the

Department” means that the work product was completed in accordance with the Program Budget,

Attachment A of this Agreement; the Activity Work Plan, Attachment I of this Agreement; and the

Application for Funding submitted by the Recipient.

(e) The Recipient shall provide additional program updates or information that may be required by

the Department.

(f) The Recipient shall provide additional reports and information identified in Attachment C.

(8) Monitoring

The Recipient shall monitor its performance under this Agreement, as well as that of its contractors

and/or consultants who are paid from funds provided under this Agreement, to ensure that time schedules

are being met, the Schedule of Deliverables and Scope of Work are being accomplished within the specified

time periods, and other performance goals are being achieved. A review shall be done for each function or

activity in Attachment A to this Agreement, and reported in the quarterly report.

Rev. 6/20/2014

4

In addition to reviews of audits conducted in accordance with paragraph (6) above, monitoring

procedures may include, but not be limited to, on-site visits by Department staff, limited scope audits, and/or

other procedures. The Recipient agrees to comply and cooperate with any monitoring procedures/processes

deemed appropriate by the Department. In the event that the Department determines that a limited scope

audit of the Recipient is appropriate, the Recipient agrees to comply with any additional instructions provided

by the Department to the Recipient regarding such audit. The Recipient further agrees to comply and

cooperate with any inspections, reviews, investigations or audits deemed necessary by the Florida Chief

Financial Officer or Auditor General. In addition, the Department will monitor the performance and

financial management by the Recipient throughout the contract term to ensure timely completion of all tasks.

(9) Liability

(a) Unless the Recipient is a State agency or subdivision, as defined in Section 768.28, Florida

Statutes (FS), the Recipient is solely responsible to parties it deals with in carrying out the terms of this

Agreement, and shall hold the Department harmless against all claims of whatever nature by third

parties arising from the work performance under this Agreement. For purposes of this Agreement,

Recipient agrees that it is not an employee or agent of the Department, but is an independent

contractor.

(b) Any recipient which is a state agency or subdivision, as defined in Section 768.28, FS, agrees to

be fully responsible for its negligent or tortious acts or omissions which result in claims or suits against

the Department, and agrees to be liable for any damages proximately caused by the acts or omissions to

the extent set forth in Section 768.28, FS. Nothing herein is intended to serve as a waiver of sovereign

immunity by any recipient to which sovereign immunity applies. Nothing herein shall be construed as

consent by a state agency or subdivision of the State of Florida to be sued by third parties in any matter

arising out of any contract.

(10) Default

If any of the following events occur ("Events of Default"), all obligations on the part of the Department

to make further payment of funds shall, if the Department elects, terminate and the Department has the

option to exercise any of its remedies set forth in Paragraph (11). However, the Department may make

payments or partial payments after any Events of Default without waiving the right to exercise such remedies,

and without becoming liable to make any further payment:

(a) If any warranty or representation made by the Recipient in this Agreement or any previous

agreement with the Department is or becomes false or misleading in any respect, or if the Recipient fails

to keep or perform any of the obligations, terms or covenants in this Agreement or any previous

agreement with the Department and has not cured them in timely fashion, or is unable or unwilling to

meet its obligations under this Agreement;

Rev. 6/20/2014

5

(b) If material adverse changes occur in the financial condition of the Recipient at any time during

the term of this Agreement, and the Recipient fails to cure this adverse change within thirty days from

the date written notice is sent by the Department.

(c) If any reports required by this Agreement have not been submitted to the Department or have

been submitted with incorrect, incomplete or insufficient information;

(d) If the Recipient has failed to perform and complete in timely fashion any of its obligations

under this Agreement.

(11) Remedies

If an Event of Default occurs, then the Department shall, upon 30 calendar days written notice to the

Recipient and upon the Recipient's failure to cure within those 30 days, exercise any one or more of the

following remedies, either concurrently or consecutively:

(a) Terminate this Agreement, provided that the Recipient is given at least 30 days prior written

notice of such termination. The notice shall be effective when placed in the United States, first class

mail, postage prepaid, by registered or certified mail-return receipt requested, to the address set forth in

Paragraph (13) herein;

(b) Begin an appropriate legal or equitable action to enforce performance of this Agreement;

(c) Withhold or suspend payment of all or any part of a request for payment;

(d) Require that the Recipient refund to the Department any monies used for ineligible purposes

under the laws, rules and regulations governing the use of these funds.

(e) Exercise any corrective or remedial actions, to include but not be limited to:

1. Request additional information from the Recipient to determine the reasons for or the

extent of non-compliance or lack of performance,

2. Issue a written warning to advise that more serious measures may be taken if the situation is

not corrected,

3. Advise the Recipient to suspend, discontinue, or refrain from incurring costs for any

activities in question, or

4. Require the Recipient to reimburse the Department for the amount of costs incurred for

any items determined to be ineligible;

(f) Exercise any other rights or remedies which may be otherwise available under law.

(g) Pursuing any of the above remedies will not keep the Department from pursuing any other

remedies in this Agreement or provided at law or in equity. If the Department waives any right or

remedy in this Agreement or fails to insist on strict performance by the Recipient, it will not affect,

extend or waive any other right or remedy of the Department, or affect the later exercise of the same

right or remedy by the Department for any other default by the Recipient.

Rev. 6/20/2014

6

(12) Termination

(a) The Department may terminate this Agreement for cause with 30 days written notice. Cause

can include misuse of funds, fraud, lack of compliance with applicable rules, laws and regulations, failure

to perform in a timely manner, and refusal by the Recipient to permit public access to any document,

paper, letter, or other material subject to disclosure under Chapter 119, FS, as amended.

(b) The Department may terminate this Agreement for convenience or when it determines, in its

sole discretion, that continuing the Agreement would not produce beneficial results in line with the

further expenditure of funds, by providing the Recipient with 30 calendar days prior written notice.

(c) The Parties may agree to terminate this Agreement for their mutual convenience through a

written amendment of this Agreement. The amendment shall state the effective date of the termination

and the procedures for proper closeout of the Agreement.

(d) In the event that this Agreement is terminated, the Recipient will not incur new obligations for

the terminated portion of the Agreement after the Recipient has received the notification of termination.

The Recipient will cancel as many outstanding obligations as possible. Costs incurred after receipt of

the termination notice will be disallowed. The Recipient shall not be relieved of liability to the

Department because of any breach of Agreement by the Recipient. The Department may, to the extent

authorized by law, withhold payments to the Recipient for the purpose of set-off until the exact amount

of damages due the Department from the Recipient is determined.

(13) Notice and Contact

(a) All notices provided under or pursuant to this Agreement shall be in writing, either by hand

delivery, or first class, certified mail, return receipt requested, to the representative identified below at

the address set forth below or said notification attached to the original of this Agreement.

(b) The name and address of the grant manager for this Agreement is:

Tammy Anderson, Government Operations Consultant II

Florida Small Cities CDBG Program

Department of Economic Opportunity

107 East Madison Street – MSC 400

Tallahassee, Florida 32399-6508

Telephone: (850) 717-8425 – Fax: (850) 922-5609

Email: [email protected]

(c) The name and address of the Local Government Project Contact for this Agreement is:

Bobby Crosby

County Administrator

209 S.E. First Street

Trenton, Florida, 32693

Telephone: (352) 463-3198 - Fax: (352) 462-3411

Email: [email protected]

Rev. 6/20/2014

7

(d) In the event that different representatives or addresses are designated by either party after

execution of this Agreement, notice of the name, title and address of the new representative will be

provided as stated in (13)(a) above.

(14) Contracts

If the Recipient contracts any of the work required under this Agreement, a copy of the signed contract

must be forwarded to the Department for approval. The Recipient agrees to include in the contract (i) that

the contractor is bound by the terms of this Agreement, (ii) that the contractor is bound by all applicable state

and federal laws and regulations, (iii) that the contractor shall hold the Department and Recipient harmless

against all claims of whatever nature arising out of the contractor's performance of work under this

Agreement, to the extent allowed and required by law, and (iv) provisions addressing bid, payment, and

performance bonds and liquidated damages. The Recipient shall document in the quarterly report the

contractor’s progress in performing its work under this Agreement.

For each contract, the Recipient shall report to the Department as to whether that contractor, or any

subcontractors hired by the contractor, is a minority vendor, as defined in Section 288.703, FS.

(15) Terms and Conditions

This Agreement contains all the terms and conditions agreed upon by the parties.

(16) Attachments

(a) All attachments to this Agreement are incorporated as if set out fully.

(b) In the event of any inconsistencies or conflict between the language of this Agreement and the

attachments, the language of the attachments shall control, but only to the extent of the conflict or

inconsistency.

(c) This Agreement has the following attachments (check all that are applicable):

Exhibit 1 – Funding Sources

Attachment A – Program Budget

Attachment B – Program Statutes and Regulations

Attachment C – Recordkeeping (N/A)

Attachment D – Reports

Attachment E – Justification of Advance (N/A)

Attachment F – Warranties and Representations

Attachment G – Certification Regarding Debarment

Attachment H – Statement of Assurances (N/A)

Attachment I – Activity Work Plan

Attachment J – Program and Special Conditions

Attachment K – Civil Rights Compliance Assurance

Attachment L – Signature Authorization Form

Attachment M – Audit Requirements

Attachment N – Audit Compliance Certification

Rev. 6/20/2014

8

(17) Funding/Consideration

(a) The funding for this Agreement shall not exceed $750,000.00, subject to the availability of

funds.

(b) The Recipient agrees to expend funds in accordance with the Program Budget, Attachment A,

of this Agreement, and the Application for Funding.

(c) All funds shall be requested in the manner prescribed by the Department. The authorized

signatory for the Recipient set forth on the Signature Authorization Form (now called the eCDBG

Access Authorization Form,) Attachment L, to this Agreement, must approve the submission of each

Request for Funds (RFFs) on behalf of the Recipient.

(d) Pursuant to 24 CFR 570.489(b), pre-agreement costs reflected in the Recipient’s Application

for Funding as originally submitted that relate to preparation of the Application for Funding are

considered eligible costs and may be reimbursed to the Recipient, if they are otherwise in compliance

with all other requirements of the Agreement.

(e) Funds expended for otherwise eligible activities prior to the effective date of the Agreement,

except for those provided for in this Agreement or prior to the effective date of the enabling

amendment wherein the Department agrees to their eligibility, fundability, or addition to the Agreement,

or a separate letter authorizing such costs, are ineligible for funding with CDBG funds.

If the necessary funds are not available to fund this Agreement as a result of action by the United

States Congress, the federal Office of Management and Budgeting, the State Chief Financial Officer, or

under subparagraph (19)(h) of this Agreement, all obligations on the part of the Department to make

any further payment of funds shall terminate, and the Recipient shall submit its closeout report within

thirty days of receiving notice from the Department.

(18) Repayments

(a) The Recipient and its contractors may only expend funding under this Agreement for allowable

costs resulting from obligations incurred during the Agreement period; however, pursuant to 24 CFR

570.489(b) reimbursement can be requested for eligible application preparation costs that were listed in

the Recipient’s Application for Funding.

(b) In accordance with Section 215.971, FS, the Recipient shall refund to DEO any balance of

unobligated funds which has been advanced or paid to Recipient.

(c) The Recipient shall refund to DEO all funds paid in excess of the amount to which Recipient

or its contractors are entitled under the terms and conditions of this Agreement.

(d) All refunds or repayments to be made to the Department under this Agreement are to be made

payable to the order of the “Department of Economic Opportunity” and mailed directly to the

Department at the following address:

Department of Economic Opportunity

Community Development Block Grant Programs

Cashier

107 East Madison Street – MSC 400

Tallahassee, Florida 32399-6508

Rev. 6/20/2014

9

In accordance with Section 215.34(2), FS, if a check or other draft is returned to the Department for

collection, Recipient shall pay to the Department a service fee of $15.00 or five percent (5%) of the face

amount of the returned check or draft, whichever is greater.

(19) Mandated Conditions