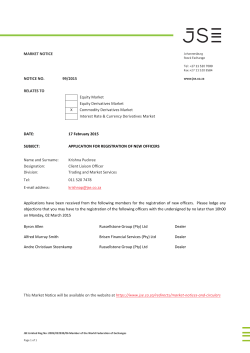

Read more