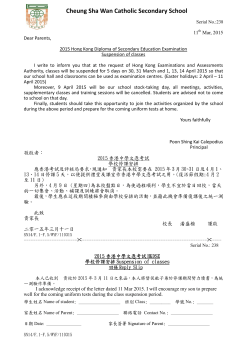

Interim Report 2014/2015