Centre of Hope-GLIA Gift Catalogue Order form

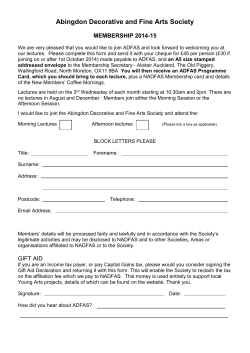

Centre of Hope-GLIA Gift Catalogue Order form Title…………..…Forename(s)…………………………………….….……………………………….……………… Surname……………………………………………………………………………………………………………….……. Address………………………………………………………………………………………………………………………. …………………………………………………………………………………………………………………………………… ………………………………….………………………………………….…..Post Code……………….……........... Gift Description eg Family Food Bags (COH-2) Price Qty Total Cost Qty Gift Card(s) £20 2 £40 1 Payment method (please tick relevant box): A- By cheque made payable to “Centre of Hope-GLIA” B- By Direct Debit or Bank transfer (see catalogue for bank details) C- Online through “Justgiving” (see catalogue for details) Name and Address (if different) for Gift Card to be sent to: Title …………..…Forename(s) ….……………………………….………………….…………………………….. Surname …………………………………………………………………………………………...……………………. Address ……………………………………………………………………………….…………...……………………. ……………………………………………………………………………………………………….………………………. ………………………………………….……...…........................... Post Code……………….…….......... Please send this form (with payment if paying by cheque) to: Centre of Hope-GLIA, 7 Mosford Close, Horley, Surrey RH6 8JS If you are a tax payer you can increase the impact of your gift by 25%. Please see below: Name of Charity: Centre of Hope –GLIA (Reg. England & Wales 11000325; Scotland SCO43667) I want the charity to treat all donations I have made since 6 April last, and all donations I make from the date of this declaration until I notify you otherwise as Gift Aid donations. Signature................................................................................ Date ……/……/…….. Note: You can cancel this declaration at any time by notifying the charity. You must pay an amount of income tax and/or capital gains tax at least equal to the tax that the charity reclaims on your donations in the tax year (currently 25p for each £1 you give). If in the future your circumstances change and you no longer pay tax on your income and capital gains equal to the tax that the charity reclaims, you can cancel your declaration. If you pay tax at the higher rate you can claim further tax relief in your Self Assessment tax return. If you are unsure whether your donations qualify for Gift Aid tax relief, ask the charity. Or ask your local tax office for leaflet IR113 Gift Aid. Please notify the charity if you change your name or address.

© Copyright 2026