Getting Ahead versus Getting By with the Earned Income Tax Credit

Getting Ahead versus Getting By with the Earned Income Tax Credit Laura Tach Department of Policy Analysis and Management Cornell University Sarah Halpern-Meekin Department of Human Development and Family Studies University of Wisconsin-Madison Kathryn Edin Departments of Sociology and Population, Family, and Reproductive Health Johns Hopkins University ABSTRACT The public safety net has increasingly functioned as a system that rewards work. The passage of welfare reform, expansions of the Earned Income Tax Credit, and reforms to in-kind transfer programs have tied benefit receipt to employment. Many working poor and near-poor families have seen their incomes boosted under this new work-based system, offering opportunities for asset building and the potential for upward mobility. But many low-wage workers in contemporary American society face a double bind: unstable incomes and volatile expenses. In this paper, we ask how low-wage workers make resource allocation decisions under the new work-based safety net by examining their spending and saving decisions with their tax refund checks. Using qualitative data from a sample of 115 lower-income working families, we find that although many have aspirations for upward mobility, even when resources are more abundant, as they are at tax time, the insecurity of daily life means they must devote most of their refund dollars to cushioning against income and expense shocks. Therefore, we highlight the use of annual tax refund checks as a key resource in the creation of a personal safety net. Specifically, we argue that workers leverage their tax refund dollars into multiple forms of self-insurance. By saving, purchasing durable goods, stockpiling, and paying off debts to kin and creditors at tax refund time, families work to ensure they will have this array of resources to call on later when income and expense shocks occur. Getting Ahead versus Getting By with the Earned Income Tax Credit Over the past several decades, the public safety net has increasingly functioned as a system that rewards work. Welfare reform, expansions of the Earned Income Tax Credit (EITC), and reforms to in-kind transfer programs have tied benefit receipt to employment. Many families among the ranks of the working poor and near-poor have seen their incomes boosted under this new workbased system, offering opportunities for asset building and the potential for upward mobility. But this story of progress masks the fact that many low-wage workers in contemporary American society face a double bind: unstable incomes and volatile expenses. It is difficult for households with low and unpredictable earnings to make long-term investments that promote upward mobility, as even small, unexpected expenses can send them into a financial tailspin. The new work-based safety net is not very effective at stabilizing this volatility, and in some cases even exacerbates it. In this paper, we ask how low-wage workers make resource allocation decisions under the new work-based safety net. Using qualitative data from a sample of 115 lower-income working families, we find that although families value economic mobility and view their tax refund check as a means to getting ahead, most allocations from their tax refund checks are designed to foster economic security rather than economic mobility. Many have aspirations for upward mobility, but even when resources are more abundant, as they are at tax time, the insecurity of daily life means they must devote most of their dollars to cushioning against income and expense shocks. Therefore, we highlight the use of annual tax refund checks as a key resource in the creation of a personal safety net. Specifically, we argue that workers leverage their tax refund dollars into multiple forms of self-insurance. By saving, purchasing durable goods, stockpiling, and paying off debts to kin and creditors at tax refund time, families work to 1 ensure they will have this array of resources to call on later when income and expense shocks occur. Because no single source of support is adequate by itself, financial management can look like a patchwork quilt: earnings, child support, help from kin, in-kind benefits, credit cards, some savings, and refundable tax credits are the bits and pieces parents stitch together to make ends meet. Household Income Volatility and Economic Insecurity Income volatility—which measures economic insecurity by the year-to-year changes in individual earnings and household incomes—has grown since the 1970s (Dynan, Elmendorf, and Sichel 2012; Gottschalk and Moffitt 1994; Gottschalk and Moffitt 2009; Hacker 2006; Hacker and Jacobs 2008; Haider 2001; Shin and Solon 2011). Volatility created by income loss is a particularly relevant indicators of households’ experiences of economic insecurity. DiPrete (2002) called adverse events associated with downward mobility “trigger events,” and the experience of these events is unevenly distributed in American society. Low-skilled workers are disproportionately likely to experience income losses associated with unemployment, health shocks, and family disruption (Kalleberg 2011; McLanahan 2004). Economic insecurity is produced by a combination of income loss and insufficient social or private insurance to cover such losses (Western, Bloome, Sosnaud, and Tach 2012). Families who experience economic insecurity may find that they must divert investments in children to cover basic needs in cases of unexpected income losses (Brooks-Gunn and Duncan 1997; Sandstrom and Huerta 2013). They may also find it difficult to plan for the future, with negative implications for their psychological and financial wellbeing (Catalano 1991; Gorbachev 2011; Hill, et al. 2013; Sullivan, Warren, and Westbrook 2000). The Public Safety Net 2 The consequences of volatile incomes and expenses depend on the surrounding institutional context. Government transfer programs—including most social insurance and social assistance programs—can mitigate the income losses associated with adverse events. In some ways, however, trends in US assistance programs have arguably moved in the opposite direction. The welfare rolls have plummeted, falling more than 60 percent since the passage of welfare reform in 1996 (Schott 2012); this meant that only 1.8 million families received cash assistance from TANF in 2013 (Falk 2013). Critics have argued that cash assistance from TANF has become a less reliable safety net as diversions, sanctions, waiting periods, and employment requirements made it more difficult or less desirable for families to access the program in times of need. The dwindling availability of this form of public assistance was evident when TANF caseloads only ticked upward slightly during the 2008 recession (Pavetti, Finch, and Schott 2013). In the meantime, the number of people benefiting from refundable tax credits, in particular the Earned Income Tax Credit (EITC), has exploded; in the early 1990s, approximately 8 million households received the credit compared to 27 million in 2013 (Flores 2014; Scholz 1994). More families are receiving more government support through the EITC and Child Tax Credit than ever before. The EITC offers a substantial refund for working parents and reaches far up the income distribution. In 2014, benefits phased in up to earnings around $14,000 and started to phase out around $18,000 in income for single parents with two children (single parents are the majority of EITC claimants); for this group, benefits were totally phased out for those earning around $44,000. For a single parent of two with earnings in the maximum benefit range, the EITC refund was $5,460 in 2014—equivalent to about one third of her annual earned income. 3 The EITC boosts average incomes (Grogger and Karoly 2008; Moffitt 2008), and because of its structure—delivered in a large lump sum once a year at tax time—it has been touted as an opportunity for lower-income families to build assets and save, offering the chance for upward mobility. Quantitative research has shown that EITC receipt is tied to a lower likelihood of debt accumulation and less year-to-year consumption volatility (Athreya, Reilly, and Simpson 2014; Shaefer, Song, and Shanks 2013), as well as increased consumption of durable goods, particularly around tax time (Barrow and McGranahan 2000). At the same time, there is little evidence that lower-income families use the EITC for long-term asset building, with only a modest amount of the refund invested in homeownership, education, or long-term savings vehicles (Halpern-Meekin, et al. 2015; Mendenhall et al. 2012; Smeeding et al. 2000). These findings suggest that families may deploy their tax refund check to promote current consumption rather than economic mobility, but these studies do not focus specifically on how or why families do this. Private Economic Coping Strategies In addition to public sources of assistance to cushion against economic insecurity, families may also rely on private forms of self-insurance. Lower-income households are less able to cope with economic insecurity using private strategies, however, as the resources they draw on to insure against adverse events and unexpected income losses—savings, kin, and credit—tend to be more limited than those of economically advantaged households. Precautionary savings. Precautionary savings—deferring current consumption to save for future consumption in the event of an income loss—is one important household coping strategy. Economic models of precautionary savings suggest that an individual’s precautionary savings rate will be higher when predicted future income insecurity is greater. There is some empirical 4 evidence for this theory: a doubling of uncertainty—measured by the transitory variance of income—boosts savings rates by 29 percent (Kazarosian 1997). However, it is difficult for lower-income households to accumulate precautionary savings when monthly expenses outstrip their incomes, even when they report that such savings are desirable. Reflecting this, the bottom fifth of the income distribution has a negative net worth (Mishel, Bernstein, and Allegretto 2007). Kin support. Carol Stack’s seminal study (1974) demonstrated how disadvantaged families relied on extended kin networks to get by. Edin and Lein (1997) demonstrated that kin support was a key element in helping low-income single mothers bridge the gap between their income from welfare or work and their families’ financial needs. The availability of such assistance can be a boon both psychologically and financially for parents, relieving hardship and its stresses simultaneously, and is associated with better emotional and behavioral outcomes for their children (for a review, see Ryan, Kalil, and Leininger 2009). However, kin support is not distributed evenly, with disadvantaged parents being less able to summon help (Harknett 2006; Harknett and Hartnett 2011) and more likely to see its availability disappear over time (Radey and Brewster 2013). In addition, kin assistance can be undependable and using it extensively can be a source of personal anxiety and can strain relationships. As a result, many low-income adults report that they seek kin support only reluctantly, particularly when it involves cash rather than in-kind support or when doing so undermines their sense of self-sufficiency (Sherman 2009, 2013; Tach and Greene 2014). Credit. Lower-income families were increasingly able to access credit starting in the 1980s with the deregulation of the credit industry and the expansion of credit markets (Draut and Silva 2003; Lyons 2003; Weller 2006). Credit can be used to promote economic stability by 5 borrowing in hard times to smooth consumption. It can also be used to promote upward mobility through investments with long-run payoffs, like education or the equity in a home. Lowerincome families are less likely than others to use credit for such mobility purposes, however; they are more likely to have unsecured credit, such as credit cards, and to borrow on less favorable terms than more affluent households. By 2004, over a quarter of low-to-moderate income families (with incomes of $10-50,000) spent more than 40 percent of their take-home income to pay off debt (Weller 2006). Lower-income households are reluctant to ask kin for assistance with debt, and there are few sources of public assistance for debt relief, so they typically juggle their debts in private, using a scheme of rotating and partial payments to keep debt collectors at bay (Tach and Greene 2014). The Present Study We examine the resource allocation decisions families make under the new work-based safety net administered through tax refunds. Prior work shows that this transformation increased and smoothed consumption, but did little to promote asset building and upward mobility. Using data from in-depth qualitative interviews with 115 lower-income working parents, we examine why families allocate their tax refunds this way. We find that because low-income parents are reliant on the precarious low-wage labor market, they use their refunds to self-insure against future economic insecurity during the one time of year when they experience financial abundance—tax time. We examine in detail the strategies families use to accomplish this goal. Although they have long-term aspirations for upward mobility, their short-term financial allocation decisions focus primarily on promoting economic security. Data & Methods 6 We engaged in a two-stage data collection process in the Boston metropolitan area. The first step was to conduct surveys with EITC claimants around the time they filed their taxes. Nationally about 70% of EITC claimants file their taxes with for-profit companies, while 30% use a Volunteer Income Tax Assistance (VITA) site, have a friend or relative do their taxes, or file by themselves. The vast majority (over 80%) file either in February or March (LaLumia 2013). To capture a variety of EITC claimants, we surveyed parents at two H&R Block locations, two VITA sites, and a set of Head Start centers between January and April of 2007. At the H&R Block and VITA locations, respondents had just filed their taxes when they filled out our survey. At the Head Start centers, respondents had filed their taxes recently, typically within the past month. After surveying 332 parents to ascertain their refund amounts and allocation intentions, we drew a sub-sample for in-depth interviews. We stratified by race (white, black, and Hispanic) and marital status (married and single) to ensure a diverse sample. All had received the EITC and a refund of at least $1,000, and all claimed dependent children for taxfiling purposes. Of the 120 respondents selected, we were able to interview 115 (96%), with approximately one third of each racial-ethnic group married and two thirds unmarried. We conducted the in-depth qualitative interviews approximately six months after the surveys, allowing parents time to receive and allocate their refund checks. Table 1 shows the descriptive characteristics of respondents in our sample. At the time of this study, tax filers received a higher EITC for claiming up to two children as dependents, but additional benefits were not available to those with three or more children. This was changed in the American Recovery and Reinvestment Act, in which additional benefits were made available to those claiming three children. This policy change, therefore, is not reflected in the current study. [Table 1 about here.] 7 The interviews lasted 2.5 hours on average, and they typically took place in respondents’ homes. We sought detailed budgets of all sources of income and expenditures in order to capture what their finances looked like during the few months after they got their tax refund, and what their finances were like the rest of the year. We also explored what these financial experiences and decisions meant to respondents, and how tax refunds fit in with the larger context of their lives, like with their roles as parents and as members of broader kinship networks. This allows us to examine how low-income families consume during the one time of the year when they experience an infusion of cash: at tax time. Results We first describe the finances of the families in this study and the ways they allocate their tax refund checks. We then focus on five areas to which parents allot refund dollars—savings, durable goods, stockpiling, and paying down debts to kin and to creditors—and document their motivations for this spending. Household Finances: Instability and Insecurity Like EITC households nationally, most families in our sample are getting by just above the poverty line. As Table 2 shows, single parents, who compose two thirds of our sample, earn approximately $1,500 a month on average, putting them just above the poverty line for a family of three in 2007 ($17,170). Adding the tax refund to this annual income boosts them to about 135% of the poverty line. This is consistent with quantitative studies, which find that the EITC pushes 6.5 million people above the poverty line each year (Policy Basics 2014). [Table 2 about here.] What the averages in Table 2 hide, however, is the frequent financial instability families faced. Many parents in this sample had seasonal jobs—teachers’ aides, preschool staff, 8 construction workers, and even tax preparers—so they spent part of each year without a paycheck. Others had jobs in the retail or service sectors or with temp agencies, where hours fluctuate often. A home health aide’s patient enters the hospital, and she sees her hours fall by a third from one week to the next, or a waitress is sent home each time there are not many customers. Further, families often depended on child support and help from kin for a portion of their monthly income—about $200 among those who receive anything from kin; as with income from wages, these other sources of money were not necessarily dependable, fluctuating with the finances and emotions of exes and kin. Financial shocks hit often, and parents would struggle to cope with them. Jerry Morales is a white, 32-year-old, married father of three. He lives with his wife, Tessa, their kids, and his mother in a housing project in South Boston. He works two jobs—full time during the week in a community college mailroom and on the weekends, a 2:00 a.m. shift delivering doughnuts. Despite his hard work, his financial dreams remain elusive. “My dream basically is to get a house and be settled financially, everything. That’s all I ever wanted. No matter how much we try, there’s always something that just kicks us in the butt.” Jerry’s wife Tessa recalls the year the financial hits just kept on coming. First, she lost her waitressing job. Then, “My mom passed away. I just had [my youngest daughter]. Jerry got sick [and couldn’t work]. So, it was a stressed year.” This combination of family, health, and employment instability is the norm, rather than the exception, for families in our sample. Families’ monthly incomes often leave them not able to keep up with regular expenses, let alone with room to spare to pay down debts, like credit card bills or student loans. Each month can be a juggling act for parents, as they figure out what to pay and what to let slide, hoping for a forgiving landlord or a naïve employee at the electric 9 company who believes that the check really is in the mail. Given such circumstances, it is not surprising that tax time, with its large annual refunds from the EITC and other sources, is keenly anticipated by so many, likened to “winning the lottery,” getting “a bonus,” and “better than Christmas.” Table 2 shows that tax refund check was equivalent to approximately one sixth of annual income for those who filed as married, and one quarter of annual earned income for those filing as single. Tax Refund Allocations What do families do with their windfalls? Table 3 illustrates that the largest allocation category is paying off debts and bills—over one third of refund dollars are devoted to this. Debt payments were large relative to the total amounts owed as well: those who allocated any of their refund to paying off debt reduced their outstanding debt burdens by half. Another one quarter of refund dollars were devoted to current consumption, which includes regular monthly expenditures like groceries, household staple items, clothing, and child expenses like diapers, school supplies, and medications. While an elusive goal for most of the year, at tax time families can often afford all of their monthly obligations and household necessities. [Table 3 about here.] Families initially saved 17 percent of refund dollars, either in a savings account or through informal means like hiding it in the house or having a family member hold on to it. However, most of this savings was spent over the ensuing months—on average, only seven percent of refund dollars remained in savings six months after receipt of the check. Very few refund dollars were invested in traditional assets like home ownership or improvement, educational expenses, business startups, or long-term savings. Respondents were more likely to invest in durable goods, like cars, stand-alone freezers, washers and dryers, and household 10 furnishings such as couches or bedroom sets; about 16 percent of refund dollars were spent on such purchases. A small fraction of refund dollars (11 percent) were devoted to ‘treats,’ or nonessential expenditures like gifts for children, vacations, eating out, or cigarettes and alcohol. In sum, the tax refund allocations of respondents in our sample are similar to the findings from larger population-based surveys about planned expenditures (Smeeding, Phillips, and O’Connor 2000; Spader, Ratcliffe, and Stegman 2005; Rhine et al. 2006). Families who receive the EITC devote the bulk of their refunds to paying off debt and current consumption. They spend much less on investments that might boost upward mobility, and they ‘blow’ very little of the refund on nonessential items. Creating a Personal Safety Net When we examined respondents’ narrative accounts of why they allocated their refunds as they did, we found that what appear to be distinct types of allocations—like debt repayment, grocery shopping, savings account deposits, and car purchases—often constitute a unified attempt to self-insure. In other words, when we look beyond what the allocations are to why families make the allocations they do, we find that most allocations constitute attempts to foster economic security amid unstable work and family situations. Families attempt to create personal safety nets that make them feel more financially secure in the present as well as in the near future. They view setting some savings aside as a guard against future shocks; acquiring durable goods—like a car—makes them more independent and gives reliable access to work and school; grocery shopping entails stockpiling goods for use during lean times ahead; paying back kin makes the possibility of future assistance more likely; and paying down debts frees up credit for future spending. Late winter’s tax refund time was typically the only time of year when families 11 could make substantial strides in building up such protections, as they were often unable to cover even basic monthly expenses in the summer and fall. Savings Many parents leverage their tax refund checks to achieve greater financial security in a straight-forward way, via saving. Twenty-three-year-old LaWanda James, a black single emergency medical technician and the mother of an elementary schooler, has little savings but wants to put aside some of her tax refund. She doesn’t have specific uses in mind, but says she wants to save it “Just for a rainy, a real rainy day, a thunderstorm, blizzard, hurricane, I wanna save. . . . Just want to have a nice cushion of money.” Home health aide Veronica Flores, a 37year-old Hispanic single mother to two teenage boys, saves with a specific future expense in mind. She sets aside a portion of her tax refund for the summer months, when she knows using the air conditioner will cause her energy bill to spike. Angela Capponi, a 30-year-old white single mother of three with another baby on the way, saves for the little expenses that crop up. She works as an assistant manager at an electronics store. After stocking up on the items she will need for the new baby and having birthday parties for her boys, she says, “What I had left, I just put in my drawer, and took out money here and there when I needed things.” The tax refund’s association with the ability to save is part of what makes it so prized. Families view it as forced savings that accumulates during the year and is cashed out at tax time. Tiffany Grier, a white 22-year-old single mother of two toddlers who works as a video store clerk, describes why she likes the “enforced savings” function built into the tax refund system: “It’s funny, ’cause people say . . . , ‘All this is is them taking the money out . . . from your check.’ But if they didn’t, you know you wouldn’t get that thousand-, couple-thousand-dollar check. . . . [The tax refund is] as good as putting the money in the bank. You just can’t take it out 12 when you want.” This gives families like Tiffany’s an opportunity to put a substantial sum in the bank when they get their refunds, which is not typically possible during the rest of the year. If they had to save on their own, many families acknowledged that they would have drawn on the money for other expenses, so they wouldn’t accumulate very much. As the quotations above reveal, however, it was also common for families to describe saving for reasons that looked more like precautionary savings or deferred consumption than as a way of building assets or long-term investments in the future. Like Angela, most parents would “pinch off” their saved refund dollars over the ensuing months as needs and wants arose, enabling an ease of spending and a sense of financial security not experienced during other times of the year. As we noted above, most parents spent a large portion of their saved refund dollars within about six months. Durable goods Economists and policymakers typically think of precautionary savings as money that is saved for future consumption in the event of a loss of income, but we found that families viewed items they bought in this way as well. In particular, many viewed the purchase of durable goods as a means of smoothing their future consumption by increasing their independence, providing stable access to employment, and, rather than deferring consumption, anticipating future consumption needs by making purchases when money is available. Marisa Castillo, a 49-year-old Hispanic mother of five, with the two youngest still at home, is separated from her husband, who has terminal cancer and is unable to work; he has not been contributing anything from his disability check to Marisa or their daughter. She decided to use a large portion of her $5,000 refund check to put a down payment on a car and pay for a year’s worth of insurance, which cost her $2,500 in total. “We needed a good car. I did not have 13 my husband with me anymore. … So we decided to buy the car because we had this very old car. … [My 17-year-old son and I] both look in the Internet for different insurance…and [the one we chose] was the best.” While Marisa had dreams of using her refund as the down payment on a house, she ultimately concluded it was not practical at this point, and so she set her sights on the car. She felt it was a more accessible way of simultaneously giving the family a more stable life and the feeling of not being impoverished. The car helped to buffer the loss of income and reliable transportation that resulted from her husband’s illness and their separation; it also ensured that they would be less reliant on family and friends (or an unreliable old car) when they needed transportation to work and school. Linda Valdez is a 41-year-old Hispanic single mother of two elementary schoolers. During our visit to her apartment in a South Boston housing project, she proudly shows off the bedroom set she bought for her daughters: two white twin beds and dressers, decorated with small flowers painted on the drawers. She does not earn much at her part-time job cleaning offices, and since her daughters’ father left her for someone else, he has not helped a lot financially. It was only relatively recently that they started getting SNAP; before, they had sometimes run short on food between paychecks. This is why something like new bedroom furniture can feel like such a triumph to Linda; the family’s hold on financial stability is weak, and signs of its presence in their life are welcome. Before tax time, Linda says, “My daughters didn’t have a bed,” leaving the three of them crammed in hers—a nightly sign of their financial struggles. Between the mattresses, furniture, and delivery costs, she spent about $1,500 of her $6,000 refund check buying the bedroom set. She also purchased a washer and dryer and a dining room set, which cost another $1,700 all together. She is not allowed to have a washer and dryer in her public housing unit, but she says the costs and impracticalities of taking the laundry 14 and her daughters to the Laundromat, especially in the winter and without a car, meant she needed to do laundry at home. With her refund check, Linda was also able to make the more expensive clothing purchases her girls need: sneakers and school uniforms. She was thinking ahead to the upcoming school year, six months away, when her youngest daughter will graduate Head Start and join her eldest at public school. Come fall she knew she would not have the cash on hand to make such purchases. Her focus, she says, is making sure her daughters are taken care of, which is what the purchases for the house and the school clothes represent: “I am one of those who prefer to see their children well, more than myself. I prefer to see my daughters well dressed, with good shoes. Me? No. I'm not like those women who enjoy luxuries.” Later she notes, “As they say in my country, you cover yourself as far as the blanket will cover you.” The refund check gives Linda a larger “blanket” to spread over her girls. It buys them more stable finances—these purchases mean fewer demands on her finances in the future, avoiding laundry costs and uniform expenses—and offers a greater sense of security that comes from being able to provide the basic necessities for her children. This includes both necessities in the present (like a place to sleep), as well as future obligations (like the school uniforms) that she may not be able to afford when times become lean again. Stockpiling Because the working poor and near-poor often live with financial uncertainty, it was not uncommon for us to hear stories of families using tax time’s windfall to buy in bulk at discount stores and fill pantries and deep freezers. These stockpiles help to ensure that food will not run short when money gets tight. Mariella Ambrosini is a white 57-year-old whose daughters, ages 15, 20, and 23, all live at home; her emphysema keeps her from working and secures her a 15 monthly SSI check, while her husband works seasonally in construction. A large metal shelf overflowing with pasta, canned goods, chips, and cereal sits prominently in Mariella’s third-floor East Boston apartment. She tells us, “My big expense is food, my refrigerator gotta be full all the time. Otherwise I get very depressed.” As another mother noted, “I mean, I don’t consider us poor. We’re just like right there in the middle. Like I never run out of pampers. Cause when I have the money, I stock up on everything so that when I am broke, I don’t need anything.” Like these mothers, many parents see their pantries as a basic gauge of how they are faring financially; not being able to feed one’s children means financial, and personal, disaster. Brenda Hutchinson is a married, white school lunch aid in her late thirties who has two daughters. At tax time she and the kids head to BJ’s Warehouse, a wholesale chain that sells groceries and other items in bulk. This year, they bought box upon box of pizza bagels, cases of soup, and over $400 worth of meat, which she stores in her mother’s stand-alone freezer. Brenda says, “I just keep them like stocked up so you don’t have to worry about running out of food, you know?” Parents’ use of refund dollars on basic necessities like food suggests the possibility that, even with SNAP, their incomes are often inadequate to meet their needs on a monthly basis. Using the refund to stockpile allows them the chance to self-insure against this occurrence. Another married couple, Johanna and Mack Clark, who are white, in their late twenties, and parents of two, see the arrival of the tax refund check as the one time of year they can buy clothes for themselves. While their growing children may need new winter coats, boots, rain jackets, swimsuits, and back-to-school clothes the whole year through, they do not have money in the budget to make similar purchases for themselves. Johanna says, “What we normally do…with tax money, we try to take like at least $500 and get ourselves things, like sneakers and 16 clothes for the year.” And Mack adds, “Yeah, we stock up for the year.” Such purchases are not possible at other times of the year when their expenses already outpace their income. Another way parents “stockpile” is by paying ahead on bills when their refund check comes. As Ashlee Reed, a 29-year-old white mother of three who works as a preschool teacher, explains, “I usually pick like, you know, am I gonna pay off another [bill], like car insurance...because I do the monthly payments for the car insurance so I figure okay, let me just try to pay off all the insurance [with my refund], so that’s one less bill for the rest of the year….” Prepaying bills is one way families can free up earnings at a later date for spending on expected expenses and to guard against unplanned shocks. Paying back kin Approximately 20% of respondents received help from kin or romantic partners during a typical month, averaging just under $200 a month. There are two central kinds of monetary assistance from kin that families describe receiving. The first includes small cash payments and in-kind support, such as a gallon of milk, $20 for gas, or a new outfit for the baby. Respondents do not view this sort of help as a loan, and it does not come with an expectation of repayment. The second form of assistance is larger sums of money for major expenses, and these are seen as loans that require repayment. Given how tight finances are during the typical month, it is common for workers to wait until tax time’s lump sum arrives to make good on these debts. Among the families in our study, the tax refund is used to pay back kin, ranging from a few hundred dollars up to $2,500. On the lower end of this range we find Sheri Frye, a white 29year-old who lives with her two sons, her boyfriend, and his mother; she does clerical work while her boyfriend works at Logan airport. When tax time arrived, Sheri was able to pay her sister the $500 she borrowed for Christmas gifts for her boys. At the other end of the spectrum, 17 Ricardo Torres uses tax time to give $1,600 to his kin. This 33-year-old, Hispanic father of three with a fourth on the way works full-time as a cashier and part-time cleaning offices while his girlfriend (who he refers to as his “wife”) takes care of the children and manages their household. The Torres’ situation illustrates the complexity of kinship support, as Ricardo uses their tax time windfall both to send money to their families in El Salvador—approximately $600 this year—and to pay back loans from different family members—about $1,000 to his girlfriend’s mother. He explains that a loan from family is preferable to a loan from an institution like a bank since “I don’t pay interest because it’s family.” Nonetheless, it comes with the expectation that the loan will be repaid at tax time. He describes his conversation with his girlfriend’s mother, “She told me, ‘Don’t worry about it and pay me at the end of the year.’” Because she is someone the family turns to routinely for money in hard times, living up to their end of the bargain, and making the repayment at the expected time, is essential. Tax time offers the opportunity to do so, and, in fact, the terms of the loan were made around the arrival of tax time’s expected windfall. Parents describe looking forward to the opportunity to pay back their loans from kin at tax time. Being able to settle those debts brings a sense of relief since outstanding obligations can be a source of stress or even tension in family relationships. The weight of owing money to family—even if it is accruing no interest—can be heavy; Maureen Ellis, a white 31-year-old waitress and single mother of two girls, says that she hates borrowing from kin so much that “[I]f I borrow from somebody, I’ll pay that off before I’ll even pay my own rent.” Likewise, 33-yearold Tamara Bishop, a black assistant preschool teacher and single mother of four, says that, come December, she is eagerly looking ahead to the arrival of tax time and the opportunity it will offer to make good on her debts. She starts thinking about “‘Who do I owe?’ I try to like take care of 18 people that I owe that are, you know, basically my mom because she gets her taxes every year and she saves every year, so we have her to go to. She’s like our bank in between.” Without her own tax refund, Tamara says, she would be “crying probably” and her mom “would stress too much [about] the money I owe her.” Tamara’s story illustrates two key points about families’ approach to kin support and their refund. First, as for Ricardo, tax time is the time of year to catch up on loans from kin. Second, kin support serves as an essential part of the family’s personal safety net, such as Tamara’s mother acting as her “bank” when her finances run short. For Tamara, this has been a regular occurrence during the year, with her borrowing to buy groceries for the family and pay for her kids’ after-school programs, leaving her repaying a hefty $2,500 to her mother when her refund check arrives. Tamara keeps a careful log of how much she borrows from her mother throughout the year. Repaying this loan is important both to Tamara’s relationship with her mother as well as her future ability to borrow from her “bank.” On top of paying her mother back, Tamara also spent $100 of the refund money on a nice gift for her mom on Mother’s Day. In contrast to what she paid her mother, Tamara only put $500 of her refund toward settling her credit card debt. Now that her refund dollars are all spent, Tamara is back to borrowing from her mom each month to cover the expenses for her family of five. She says, “I’m gonna owe her [again] when I get my refund.” Similarly, after Sheri repaid her sister’s $500 loan for Christmas gifts with her tax refund, she subsequently borrowed money from her sister several months later for delinquent utility bills. Repayment using the annual refund at tax time is what makes this kinbased financial coping strategy available the rest of the year. Paying down debts 19 For a regular month—not during tax refund time—the typical household in our sample pays $173 monthly toward their outstanding debt and back bills, constituting six percent of their monthly expenditures; this sum does not include rent or regular monthly payments on items like furniture, appliances, or cars. This did not even come close to covering debt obligations for many. For this reason, tax season is often viewed as the time of year for paying off debts. And while paying off debts offers psychological relief, it also has a practical implication: it gives more space for the accumulation of debts in the future. There is only so long you can go without paying your electric bill before services are shut off or your rent before you are evicted. Getting caught up means you can fall behind on such bills in the future when money is tight without risking catastrophe. Paying down debts, therefore, is in part a way of securing economic stability. We hear this from Sharon Ingram, a 47-year-old black clerical worker with a 21-year-old daughter and a 15-year-old son, who paid off her credit card debt in full with her refund. Sharon explained that she prioritized paying off bills to “…just get a little ahead of the game. Just get a little ahead of myself. Just breathe a little better.” In February, Ashlee Reed got a refund check from H&R Block totaling $4,704—more than three times the amount that she brings home in an average month from her job as a preschool teacher. Much of her allocation decisions revolve around the financial consequences of being out of work during the summer, when school is not in session. After she had used the refund to get up to date on her student loan (she often falls behind on her payments each summer), the remaining $3,204 from the refund allowed Ashlee to pay down some of the principal on her credit cards, which she had also accrued the prior summer, and to catch up on the overdue cable and phone bills. Now, just as summer arrives and she faces another layoff, the savings from her tax refund have nearly run dry. 20 Ashlee needs to be out of work for a week before she can apply for unemployment insurance payments, and once she does it often takes three weeks for her first check to arrive, leaving her to cover a month without income. This year Ashlee has once again made no progress toward her goal of having enough left over from her refund to cover this month-long shortfall: “I try to save [a lot of my refund]. My goal usually, even though I don’t ever make it, is to have enough money saved up for the summer for when I go onto unemployment . . .. That’s four weeks without pay if I don’t have anything saved up from when I was working. So I usually have that goal, which is to at least have enough to get me through that [month without any cash coming in].” For Ashlee, having that cushion in savings would decrease her reliance on credit cards and alleviate stress. It is precisely because the formal social support system— unemployment insurance—does not cover Ashlee’s needs during that four-week period that Ashlee wants to use her tax refund as a personal safety net, to offer a way of smoothing consumption in light of her plummeting income. However, because she had used her refund to pay down some of her bills and to pay ahead on others, she is at least in a better financial position to face the summer’s financial crunch than she would be in the refund’s absence. Exceptions: Asset Builders While the bulk of refund allocations were focused on building personal safety nets as a precaution against future needs, we examined our sample to identify who did apportion some of their tax refund for asset-building purposes: contributing refund dollars towards educational expenses or home investment, or keeping more than $1,000 from the refund in savings at least six months after tax time. In total, 27 families (23%) fell in this category, with eight (7%) having allocated money to education, seven (6%) to homes, and 14 (12%) with money in savings. This select group of asset builders shared some characteristics: they were more likely to be employed 21 full time, have bank accounts, be older, and be immigrants. They also typically went to extraordinary lengths to cut back on their expenses in service of their savings goals. Linda Valdez, who purchased the bedroom set for her daughters, is among the relatively rare group who was able to keep part of her refund in long-term savings. Like many other asset builders in our sample, she has a bank account, is an immigrant and, at 42, is older than the 35year-old average age in our sample. Linda received just over $6,000 between her federal and state refunds, and she spent about $3,000 of that buying furniture and other items for the house and clothing for her daughters. With her part-time job as a cleaner and her annual use of her refund to slowly furnish her apartment, this year was the first time Linda was able to save part of tax time’s windfall. The other $3,000, she explains, she deposited into her brother-in-law’s bank account since she, as a public housing resident, would see her rent increase were she to have a substantial sum in her savings account. Linda’s ability to save such a large sum is notable. She has a well-planned out budget— she has calculated, based on the dates of her paychecks and the due dates on her bills, exactly which day each month she must pay each bill, and uses the government assistance programs available to her, including public housing, MassHealth, and SNAP. She opened a bank account to avoid paying fees to cash checks, and is careful to keep her bank account high enough so she does not get charged by the bank for having it, but low enough so the housing authority does not raise her rent. She only has one credit card, one with a $200 limit from Macy’s, and is sure to make a payment on it every month. Furthermore, she is particularly thrifty, avoiding many of the material purchases other families make, like video rentals or a cell phone, and sometimes goes a year or two without buying clothes for herself. While her income is quite low and she lacks the financial support from kin that many others enjoy, her frame of reference is quite different than 22 most. She remembers growing up on her family’s farm in Honduras, where they lacked enough money to buy shoes or bread; her father would hunt armadillos and iguanas to feed his children. Even though she has lived in the US for 11 years, she is still amazed by how much assistance she can receive—the SNAP benefits pay for all the family’s groceries for the month and her rent— $172 a month—includes her electric and water utilities. This means that even her fairly meager budget seems relatively plentiful given her past and the circumstances in which she knows her parents are currently living. With $455 in the bank account she keeps in her own name, and another $3,000 in the account her brother-in-law keeps for her, Linda would seem to be investing in the future, far more than just creating a safety net. However, the reasoning behind this cash-strapped mother’s savings reveals otherwise. With her elderly parents, subsistence farmers in Honduras, totally dependent on Linda and her siblings for support, she says, “You never know when you’ll have an emergency in your [home] country. So this way you’re not running around borrowing money. This way you have your savings in case you have an emergency in your country; you take out the money and send it. That’s what it’s for.” While Linda doesn’t view this money a safety net for herself, it does represent one for her parents. Juliana Soto is also an asset builder, and she and her family lived very frugally, but their reasons for doing so were fuelled by dreams of mobility. When we interviewed Juliana, she and her husband, Diego, had just realized one of these dreams: they had bought a single-family house in a bustling working class suburb of Boston. Juliana is 32 and Diego is 33; together they have two kids. Juliana and Diego got their own public housing unit when she got pregnant at 18, and Juliana went on welfare for a period of time when the children were young. Although both ended up landing stable jobs, they continued to live in public housing until they purchased their home. 23 Juliana does not have fond memories of her life in public housing, recounting rats, roaches, and “disgusting neighbors.” One day, she recalls saying to Diego “I’ve been here long enough. I can’t do it anymore. I have to get out.” Many families in our sample talked of wanting desperately to get out of public housing but few manage to do so. How were Juliana and Diego able to achieve this goal? First, both had long-term, stable jobs with benefits, and their committed 12-year marriage allowed them to pool their resources. Juliana has worked for eight years as a receptionist at a financial services company, and cashed out her company 401k to help with their down payment. Diego worked first as an EMT and then as a physical therapy assistant at a local hospital; he got medical insurance and tuition assistance through the job, which he used to earn an associate’s degree. Second, the Soto family lived quite frugally for the ten years it took them to save $10,000 for their down payment, which they were able to save while living in public housing by keeping Diego off of their public housing lease. As Juliana recalls, “I scrimped on everything. I got my bills paid, got the food, and then we budgeted everything... If I had ten dollars left over, there it went [into the house savings account].” They never touched that money “because it’s for our house....” They used their tax refunds each year to pay off credit cards and boost their credit ratings in anticipation of buying the house; this past year they used part of their $6,000 tax refund to pay off the credit cards once and for all—Juliana cut up the cards and cancelled them. They devoted the rest of the refund to expenses related to the home purchase: closing costs, home inspection, and a moving truck. They also had some help in realizing their mobility dreams: they got home ownership counseling and affordable mortgage terms through MassHousing, a local non-profit specializing in affordable homeownership. 24 In this study, we argue that volatility of income and expenses necessitate that workers use their tax refund’s windfall to purchase “self insurance” via short-term saving, purchasing durable goods, stockpiling, and paying down debts. Implied is that in the absence of such economic instability, families would make fundamentally different allocation decisions. While we are limited in our ability to examine this counterfactual directly, the group of asset builders in our sample does offer some support for this argument. For instance, they are likely to have more secure employment situations, offering the financial stability necessary to divert refund dollars from building a personal safety net to investments with the potential for upward mobility, like educational expenses, home purchase or repair, or long-term, substantial savings. Conclusion This paper brings together and extends research literatures on household income volatility, the transformation of government cash transfer programs, and private economic coping strategies. We build on prior research on the EITC by describing not only how families spend their refund dollars, but also uncovering why they spend as they do. Using qualitative data from a sample of 115 lower-income working families who received the EITC, we found that workers leveraged their tax refund dollars into multiple forms of self-insurance to cushion against future income and expense shocks. Allocations made to seemingly-distinct categories of expenditures—like debt, current consumption, durable goods, and savings—were often done with the goal of ensuring economic security for the present and near future. In addition to precautionary savings, families made other precautionary investments in anticipation of lean times ahead by paying off debts and kin obligations, purchasing durable goods that promote economic independence and security, stockpiling food and other household goods, and paying ahead on bills and other expenses. These findings suggest the need for a broader definition of 25 precautionary assets that extends beyond savings in the bank. This should be a key consideration for policymakers and practitioners, as there is growing interest in leveraging tax time as a “magic moment” to encourage workers to make deposits in savings accounts or purchase other savings vehicles, like bonds (Harris 2013; Tufano, Schneider, and Beverly 2005). The current study suggests that families may already be engaging in a variety of savings-like behaviors that are misunderstood as consumption. Our results also shed light on the ‘puzzle’ of why EITC recipients do not invest more of their refund dollars in traditional assets like home ownership, education, or stocks. Given the instability and insecurity of their work and family lives, they do not have the luxury of setting aside resources for a time very far in the future because they view their current needs as pressing and unpredictable. This does not mean that they have no aspirations for traditional forms of economic mobility, like better jobs, better homes and neighborhoods, or ample savings; in fact, mobility dreams are strong and persistent, despite repeated setbacks (Sykes et al. 2014). But these dreams must be put on hold in order to invest in a protective way. Even though their current precautionary investments may not move them very far up the income ladder, families do feel better off knowing that they have a more secure footing on that ladder. Families leverage the annual lump sum of their tax refund into multiple forms of selfinsurance that create a personal safety net they can draw on over the rest of the year, or at least as far into the future as they can stretch it. By paying ahead, setting money aside for later spending, paying down debts to credit card companies and kin, and investing in durable goods, parents are hoping they can catch themselves when tough times inevitably come, as unexpected expenses pop up or incomes fall. Underlining this point, some parents even refer to their tax refund check as “savings.” The use of the refund to foster economic security likely has important material, as 26 well as psychological, benefits for low-income workers and their families and perhaps explains why quantitative results have found less food insecurity and consumption volatility as the result of EITC receipt (Athreya, Reilly, and Simpson 2014; Shaefer, Song, and Shanks 2013). Some might question why parents choose to spend the refund money in the short term on durable goods and stockpiles that won’t be needed for several months rather than saving this money and then making purchases, such as school uniforms and food, as these needs arise. Families’ preferences for future-oriented consumption is in line with their appreciation for the “forced savings” function of the tax refund; many told us that were they to have the money on hand, it would be claimed by expenses and treats in the interim, leaving them short when these anticipated expenses demanded payment. Work in economic psychology demonstrates that times of financial abundance may offer greater clarity in decision-making, as parents are freed from the typical stresses and distractions of making ends meet (Mullainathan and Shafir, 2013). Tax refund time may offer just such a window, and the research on resource scarcity indicates that parents may be wise to make their allocation decisions in this period. By pre-purchasing items and pre-paying bills, parents ensure that they have spent their available dollars in their most preferred way. Our study is not without limitations. In particular, the set of families captured in our sample is not representative of all EITC recipients. While many EITC beneficiaries do not get the credit more than one year in a row and some also only receive a small sum, with their earnings too low or high to earn them a substantial refund (Dowd and Horowitz 2011), most of those in our sample receive a substantial check at tax time and expect to do so year after year. Although they expect to get the refund, they have a limited understanding of what factors would make their refund rise or fall and therefore express a good deal of uncertainty about how much 27 they may get in any given year. Therefore, for most, the refund was both expected and unexpected—they were expecting a refund, but unsure of how much this “bonus” might be (Author citations). As a result, respondents in our sample may be more likely than some EITC recipients to use their refunds as self-insurance and less likely than some to view the refund as a one-time windfall. Our results have important implications for policy and program design. Families do not feel that their resources—between wages and government assistance—are sufficient to make ends meet on a regular monthly basis. As a consequence, they draw on private coping strategies and kin support, which become depleted over the course of a year and are replenished at tax time. The disbursement of the tax refund as a large lump sum offers families unusual opportunities to make investments and expenditures that they could not make in a typical month, but much of this is spent in anticipation of future economic insecurity. From their perspective, current government safety net programs do not fully buffer against the regular sources of economic insecurity that they commonly face, such as lost wages and fluctuating expenses. Until their incomes are more stable, or until there is more robust public and private insurance to effectively cushion against that income instability, it is unlikely (and perhaps unwise) for EITCeligible households to direct much of their refunds toward long-term economic mobility purposes. 28 Bibliography Athreya, Kartik, Devin Reilly, and Nicole Simpson. 2014. “Young Unskilled Women and the Earned Income Tax Credit: Insurance Without Disincentives?” Federal Reserve Bank of Richmond Working Paper Series WP 14-11R. Barrow, Lisa, and Leslie Moscow McGranahan. 2000. “The Effects of the Earned Income Credit on the Seasonality of Household Expenditures.” National Tax Journal, 53(4):1211–1244. Brooks-Gunn, Jeanne and Greg J. Duncan. 1997. “The Effects of Poverty on Children.” The Future of Children 7:55–71. Catalano, Ralph. 1991. “The Health Effects of Economic Insecurity.” American Journal of Public Health 81:1148–1152. DiPrete, Thomas. 2002. “Life Course Risks, Mobility Regimes, and Mobility Consequences: A Comparison of Sweden, Germany, and the U.S.” American Journal of Sociology 108:267–309. Dowd, Tim, and John B. Horowitz. 2011. “Income Mobility and the Earned Income Tax Credit: Short-Term Safety Net or Long-Term Income Support. Public Finance Review 39:619-652. Draut, Tamara and Javier Silva. 2003. Borrowing to Make Ends Meet: The Growth of Credit Card Debt in the ‘90s. New York: Demos. Dynan, Karen E., Douglas W. Elmendorf, and Daniel E. Sichel. 2012. “The Evolution of Household Income Volatility.” The B.E. Journal of Economic Analysis and Policy 12:Article 3. Edin, Kathryn, and Laura Lein. 1997. Making Ends Meet: How Single Mothers Survive Welfare and Low-Wage Work. New York, NY: Russell Sage Foundation. Falk, Gene. 2013. “The Temporary Assistance for Needy Families Block Grant: Responses to Frequently Asked Questions.” Congressional Research Service RL32760. Flores, Qiana Torres. 2014. “Tax credits for working families: Earned Income Tax Credit.” National Conference on State Legislators. Accessed September 20, 2014. Gorbachev, Olga. 2011. “Did Household Consumption Become More Volatile.” American Economic Review 101:2248–2270. Gottschalk, Peter and Robert Moffitt. 1994. “The Growth of Earnings Instability in the US Labor Market.” Brookings Papers on Economic Activity 25:217–272. Gottschalk, Peter and Robert Moffitt. 2009. “The Rising Instability of U.S. Earnings.” Journal of Economic Perspectives 23:3–24. Grogger, Jeffrey and Lynn A. Karoly. 2008. Welfare Reform: Effects of a Decade of Change. Cambridge, MA: Harvard University Press. 29 Hacker, Jacob S. 2006. The Great Risk Shift. New York: Oxford University Press. Hacker, Jacob S. and Elisabeth Jacobs. 2008. “The Rising Instability of American Family Incomes, 1969–2004: Evidence from the Panel Study of Income Dynamics.” Economic Policy Institute Briefing Paper. Haider, Steven J. 2001. “Earnings Instability and Earnings Inequality of Males in the United States.” Journal of Labor Economics 19:799–836. Halpern-Meekin, Sarah, Kathryn Edin, Laura Tach, and Jennifer Sykes. 2015. It’s Not Like I’m Poor: How Working Families Make Ends Meet in a Post-Welfare World. Berkeley, CA: University of California Press. Harknett, Kristen. 2006. “The Relationship Between Private Safety Nets and Economic Outcomes Among Single Mothers.” Journal of Marriage and Family 68:172-191. Harknett, Kristen S., and Caroline Sten Hartnett. 2011. “Who Lacks Support and Why? An Examination of Mothers’ Personal Safety Nets.” Journal of Marriage and Family 73:861-875. Harris, Karen K. 2013. “The Tax-Time Savings Movement.” The Shriver Brief. Hill, Heather D., Pamela Morris, Lisa A. Gennetian, Sharon Wolf, and Carly Tubbs. 2013. “The Consequences of Income Instability for Children’s Well-Being.” Child Development Perspectives 7. Kalleberg, Arne. 2011. Good Jobs, Bad Jobs: The Rise of Polarized and Precarious Employment Systems in the United States, 1970s to 2000s. New York: Russell Sage Foundation. Kazarosian, Mark. 1997. "Precautionary Savings - A Panel Study." The Review of Economics and Statistics 79(2):241-247. LaLumia, Sara. 2013. “The EITC, Tax Refunds, and Unemployment Spells.” American Economic Journal: Economic Policy 5:188-221. Lyons, Angela. 2003. “How Credit Access Has Changed Over Time for U.S. Households.” The Journal of Consumer Affairs 37(2):231-255. Mishel, Lawrence, Jared Bernstein, and Sylvia Allegretto. 2007. The State of Working America 2006/2007. Ithaca: Cornell University Press. Moffitt, Robert A. 2008. “Welfare Reform: The US Experience.” Working Paper, Institute for Labor Market Policy Evaluation. Mullainathan, Sendhil, and Eldar Shafir. 2013. Scarcity: Why having too little means so much. New York: Times Books. 30 Pavetti, LaDonna, Ife Finch, and Liz Schott. 2013. “TANF Emerging from the Downturn a Weaker Safety Net.” Washington: Center for Budget and Policy Priorities. At: http://www.cbpp. org/files/3-1-13tanf.pdf. “Policy Basics: The Earned Income Tax Credit.” 2014. Center on Budget and Policy Priorities. http://www.cbpp.org/cms/?fa=view&id=2505 Accessed September 22, 2014. Radey, Melissa, and Karin Brewster. 2013. “Predictors of Stability and Change in Private Safety Nets of Unmarried Mothers.” Journal of Social Service Research 39:397-415. Rhine, Sherrie L.W., Sabrina Su, Yazmin Osaki, and Steven Y. Lee. 2005. “Householder Response to the Earned Income Tax Credit: Path of Sustenance or Road to Asset Building.” New York, NY: Federal Reserve Bank of New York. Ryan, Rebecca M., Ariel Kalil, and Lindsey Leininger. 2009. “Low-Income Mothers’ Private Safety Nets and Children’s Socioemotional Wellbeing.” Journal of Marriage and Family 71:278-297. Sandstrom, Heather and Sandra Huerta. 2013. “The Negative Effects of Instability on Child Development: A Research Synthesis.” Urban Institute working paper, Washington DC. Scholz, John Karl. 1994. “The Earned Income Tax Credit: Participation, Compliance, and Antipoverty Effectiveness.” National Tax Journal 47:63-87. Schott, Liz. 2012. “Policy basics: An introduction to TANF.” Center on Budget and Policy Priorities. http://www.cbpp.org/files/7-22-10tanf2.pdf Shaefer, H. Luke, Xiaoqing Song, and Trina R.Williams Shanks. 2013. “Do Single Mothers in the United States Use the Earned Income Tax Credit to Reduce Unsecured Debt?” Review of the Economics of the Household 11:659-680. Shin, Donggyun, and Gary Solon. 2011. “Trends in Men’s Earnings Volatility: What Does the Panel Study of Income Dynamics Show?” Journal of Public Economics 95:973-982. Smeeding, Timothy M., Katherine Ross Phillips, and Michael O'Connor, M. 2000. “The EITC: Expectation, Knowledge, Use, and Economic and Social Mobility.” National Tax Journal 53:1187-1209. Spader, Jon, Janneke Ratcliffe, and Michael A. Stegman. 2005. Transforming tax refunds into assets: A panel survey of VITA clients in Greenville, Henderson, and Raleigh, North Carolina. Center for Community Capital, University of North Carolina at Chapel Hill. Stack, Carol. 1974. All Our Kin: Strategies for Survival in a Black Community. New York: Harper and Row. Sullivan, Teresa A., Elizabeth Warren, and Jay Lawrence Westbrook. 2000. The Fragile Middle Class: Americans in Debt. New Haven, CT: Yale University Press. 31 Sykes, Jennifer, Katrin Križ, Kathryn Edin, and Sarah Halpern-Meekin. 2014. “Dignity and Dreams: What the Earned Income Tax Credit (EITC) Means to Low-Income Families.” American Sociological Review. Tach, Laura, and Sarah Halpern-Meekin. 2014. “The Earned Income Tax Credit: Tax Refund Expectations and Behavioral Responses.” Journal of Policy Analysis & Management 33:413439. Tach, Laura and Sara Sternberg Greene. 2014. “Robbing Peter to Pay Paul: Economic and Cultural Explanations for How Lower-Income Families Manage Debt.” Social Problems 61(1):121. Tufano, Peter, Daniel Schneider, and Sondra Beverly. 2005. “Leveraging Tax Refunds to Encourage Saving,” Retirement Security Project Policy Brief 2005-8. Pew Charitable Trusts, Washington, DC. Weller, Christian. 2006. Drowning in Debt: America’s Middle Class Falls Deeper in Debt as Income Growth Slows and Costs Climb. Washington DC: Center for American Progress. Western, Bruce, Deirdre Bloome, Ben Sosnaud, and Laura Tach. 2012. “Economic Insecurity and Social Stratification.” Annual Review of Sociology 38: 341-359. 32 Table 1. Descriptive Statistics of Sample of EITC Recipients (N=115) Number of Qualifying Children Sample Zero 0% One 26.3% Two or More 72.8% Tax Filing Status Head of household/Single 71.3% Married filing jointly 28.7% Total 2006 Tax Refund $4,686 2006 EITC Refund $2,633 Location in EIC Schedule Phase-In 12.2% Plateau 19.1% Phase-Out 68.8% Average Age 34.5 (9.7) Gender Female 90.4% Male 9.7% Educational Attainment Less than high school 14.1% High school/GED 14.1% Some College/Vocational Education 57.9% BA or higher 11.4% Marital Status Unmarried 60.9% Married 39.1% Race/Ethnicity Black or African American 36.0% Non-Hispanic White 34.2% Hispanic/Latino 29.7% 33 Table 2. Respondents’ Average Monthly and Annual Incomes, by Marital Status Monthly earned income Tax refunda Annual earned income Refund as percentage of annual earned income Single (N = 75) $1,562 $18,744 $4,545 24.2% Married (N = 40) $2,496 $29,952 $4,952 16.5% Total (N = 115) $1,887 $22,644 $4,686 20.7% Note: Marital status refers to respondents’ tax filing status with the IRS. Single respondents used the “head of household” status, and married respondents used the “married, filing jointly” status. Incomes are in 2007 dollars. a Tax refund includes the refundable EITC, the refundable child tax credit, and refunds of paycheck withholding. It includes both federal and state tax refunds. 34 Table 3. Allocations of Tax Refund (N = 115 Respondents) % Who Spent In Category Initial Savings Asset Building Education Home Ownership/Improvement Other Current Consumption Shopping Groceries Child Expenses Other Treats Durable Goods Furniture/Appliances Car Purchase/Repair Bills and Debt Obligations Kin Repayment Current Bill Payments Bill Pre-Payments Debts and Back Bills 35 % of Total Refund Dollars Spent 40.0 16.8 6.9 6.1 0.9 1.9 3.1 0.2 49.6 26.9 100.0 14.8 37.4 6.3 3.5 6.1 0.9 10.7 28.7 26.1 7.8 8.0 28.7 14.8 9.6 66.9 4.7 7.1 2.7 20.9

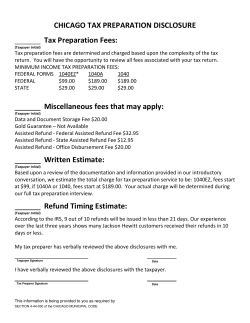

© Copyright 2026