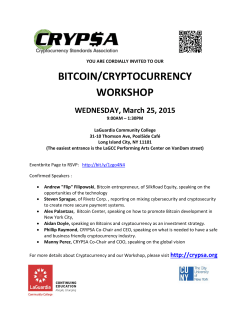

Presentation

Who we are

• UK based Investment team

• Experience in fund management and corporate finance

• Leading figures in the crypto currency space

• Pre-IPO offering at 5p for up to £400,000

• Planned IPO on AIM to raise minimum of £3m

• Target additional raise once funds have been deployed

Coinworks Limited - confidential

2

What we do

• Identify trends and companies with the innovation, leadership

and drive to build commercial and scalable companies

• Support these companies with the investment, mentoring,

facilities and the commercial framework to succeed

• Building the digital currency and block chain technology space

Coinworks Limited - confidential

3

Fintech and disruption

Established monopolies being disrupted: Fintech is to

established finance sector what e-commerce was to retailing

1.

2.

3.

4.

5.

6.

Payments and clearing (Stripe)

Remittances (Transferwise)

FX (The Currency Cloud)

Lending (Zopa)

Securities issuance/crowdfunding (Crowdcube)

Digital currency / block chain – our growth space

Coinworks Limited - confidential

4

UK government support

• Treasury announcement (March 18) supportive of digital

currency innovation

• Digital currency exchanges to be recognised and regulated

• FCA regulatory sandbox to encourage start ups

• BSI to lead standards initiative

• UK government funding for research into digital currency

opportunities

Coinworks Limited - confidential

5

The next stage of the internet

Block chain technology is the second phase of the Internet –

the distributed trust network for transferring value that the

Internet has always needed

Block chain

Coinworks Limited - confidential

6

Digital currency - metrics

Source: Coindesk, State of Bitcoin 2015 – figures as of 31 December 2014

Coinworks Limited - confidential

7

Digital currency - VC Funding

1Q2015 $200m

2015 Projected: $800m

Coinworks Limited - confidential

8

Funding the Internet 2.0

Coinworks Limited - confidential

9

2014 fundraising

Coinworks Limited - confidential

10

2015 completed fundraises

• Coinbase (bitcoin wallet and regulated US exchange)

– US$75m on a valuation of US$400m

– Backed by New York Stock Exchange (NYSE), Spanish bank BBVA

and Japanese telecom giant NTT DoCoMo

• 21 Inc (mass consumer implementation)

– US$116m (largest raise to date)

– Backed by Andreessen Horowitz, Qualcomm, eBay founder

Peter Thiel and Dropbox CEO Drew Houston

• Circle (universal bitcoin wallet and payment provider)

– US$50m backed by Goldman Sachs

Coinworks Limited - confidential

11

Bitcoin ETFs

• Bitcoin ETF launched in Stockholm NASDAQ

• Bitcoin Investment Trust (GBTC) in New York

• Bitcoin ETF on London Stock Exchange

awaiting approval

Coinworks Limited - confidential

12

Returns and upside potential

2012

2014

Raised

US$30.5m

Valuation

US$153m

200x return

Coinworks Limited - confidential

13

Additional blockchain use cases

• Internet of things

• Asset issuance and exchange

• Proof of existence / time-stamping

• Smart contracts

• Data storage

• Distributed crowdfunding / exchange /custody

Coinworks Limited - confidential

14

Investment Focus

4 Pillars:

- Block chain infrastructure

- Security and certification

- Exchanges

- Payments and remittances

Coinworks Limited - confidential

15

Investment criteria

• Criteria

– Must be commercial

– Developed business plan

– Cash generation potential

– Management: tech skills + business development

– Significant market opportunity

• Board position/significant influence day-to-day

• Minimum investment of £50k

• Generally no less than 10% of a company (except pre-IPO/IPO)

We will not be investing into bitcoin or any digital currencies or tokens

Coinworks Limited - confidential

16

Potential investments (1)

• Buying vouchers with digital

currencies – founded Feb 2014

• From zero to £600k in

revenue/£40k in profit in 12

months

• Gyft in US - comparison

– founded June 2012 – first

external fundraising round

US$1.25m

– Sold to First Data for ~US$50m

in July 2014

Coinworks Limited - confidential

17

Potential investments (2)

• Digital assets exchange – founded August 2014

• Aim to become industry clearinghouse for digital equities,

crypto-futures and smart contracts

• 0.2% - 2% spread per transaction

• From zero to volume of US$350,000 a month in 6 months

• Valuation $4.6m – target first year revenue of US$1.8m

Coinworks Limited - confidential

18

Summary

•

•

•

•

Strong UK centred team

Disciplined investment approach

Pipeline of potential opportunities identified

Dramatic opportunities from the disruptive potential of block

chain technology

• Listed vehicle providing regulated monitored framework

Coinworks Limited - confidential

19

Board of directors

•

•

•

•

•

•

•

•

Adam Cleary; Director

Adam Cleary is the Founder of Bullion Bitcoin Limited which operates bullionbitcoin.com - a bitcoin to gold bullion exchange

platform. He is also the Chief Executive of Coin Capital Limited, a regulated investment management firm investing in digital

currency businesses and a Director and Founder Member of the UK Digital Currency Association, the trade association that

promotes digital currencies in the UK. Adam is a leading figure in the UK digital currency sector. Prior to becoming involved

in financial technology and digital currency Adam worked as an investment manager and research analyst at a number of

investment banks in London and Hong Kong. Adam’s role will be to source and assess potential investments, and work with

investee companies to monitor the digital currency technology proposition and the business as a whole.

Christian West; Director

Christian has worked in the capital markets as both a fund manager and broker since 1998. He is and has been a director of a

number of financial mining and natural resources companies, both private and public. He is a Director of RDP Limited, a

venture capital group specializing in natural resource investments. Christian’s role will be to assess potential investments and

work with investee companies to develop their brand and promote business development and commercialisation.

David Hutchins; Non-Executive Chairman

David (“Sam”) Hutchins has over 30 years of investment experience in Australia and the UK and is currently a partner in RDP

Fund Management LLP, the investment manager for London listed Global Resources Investment Trust plc. He has been a

director of numerous public and private companies, including “start-up” companies, such as www.minesite.com, a resource

industry specific news related website and conference business. David is Member of the Chartered Institute for Securities &

Investments and a Member of the FTSE Gold Mines Index Committee.

Dominic Frisby: Non-Executive Director

Dominic is the author of two books - Life After The State ("fascinating, alarming, contentious" James Harding) and Bitcoin;

the Future of Money? ("Read it and glimpse into he future", Sir Richard Branson).He writes a weekly column for MoneyWeek

magazine, as well as various other publications, and is MoneyWeek's commentator on gold, cryptocurrencies and

commodities. As an investor, he has a long history investing in small caps, particularly junior resource companies and tech.

He is the presenter and producer of Frisby's Bulls & Bears - an internet radio show in which he discusses financial and

economic matters with leading lights of the sector.

Coinworks Limited - confidential

20

Advisors

•

Brokers

Smaller Company Capital Limited

•

Lawyers

DMH Stallard

•

NOMAD

TBC

•

Reporting Accountant

TBC

•

Company secretary

Geoffrey Cole & Co

Coinworks Limited - confidential

21

Disclaimer

The information contained herein is confidential information regarding Coinworks Limited (the “Company”). Only persons who qualify as

sophisticated or professional investors within the meaning of Articles 48, 50, and 50A of the UK Financial Services and Markets Act 2000

(“FSMA”) may review the information contained herein. By accepting this information the recipient agrees that it, and its officers, directors

and employees will use the information only to evaluate its potential interest in the Company and for no other purpose and will not divulge

such information to any other party. Any reproduction of this information, in whole or in part, is prohibited. The information contained

herein has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any

securities or any interest in the Company or any other investment. If any offer to purchase any interest in the Company is made in due

course it shall be made only pursuant to a definitive Offering Document prepared by or on behalf of the Company which would contain

material information not contained herein and which shall supersede this information in its entirety. Any decision to invest in the Company

should be made only in compliance with and subject to the limitations imposed by applicable laws applying to the ability to offer these

securities to prospective investors in their relevant jurisdictions and after reviewing the definitive Offering Document, conducting

investigations as deemed necessary by the investor and consulting the investor’s own investment, legal, accounting and tax advisors in

order to make an independent determination of the suitability and consequences of an investment in the securities.

The Company cannot accept investments from any US person and this presentation is not for use by any US person. No registration

statement has been filed with the United States Securities and Exchange Commission or any U.S. State Securities Authority with respect to

the shares of the Company. None of the Shares in the Company have been or will be registered under the United States Securities Act of

1933, as amended (the “1933 Act”). None of the Shares in the Company may be offered, sold, transferred, assigned or delivered, directly or

indirectly, in the United States of America, its territories and possessions, any State of the United States of America or the District of

Columbia (the “United States”), or to any U.S. Person as defined herein. In addition, the Company has not been and will not be registered

under the United States Investment Company Act of 1940, as amended (the “1940 Act”). None of the Shares in the Company may be

offered, sold, transferred, assigned or delivered, directly or indirectly, to any person in circumstances which might result in the Company

incurring any liability to taxation or suffering any other pecuniary disadvantages which they might not otherwise incur or suffer, or would

result in them being required to register under the 1940 Act.

All forward looking statements, performance and risk targets contained herein are subject to change without notice. There can be no

assurance that the Company will achieve any targets or that there will be any return on capital. Historical returns are not predictive of

future results. The Company is involved in the cryptocurrency sector and uses bitcoin - investments in this sector carry much greater risks

than traditional investments and may be considered high risk and volatile. There is a risk of total loss of the amount invested – please refer

to the definitive Offering Document for a full list of risks.

Coinworks Limited - confidential

22

© Copyright 2026