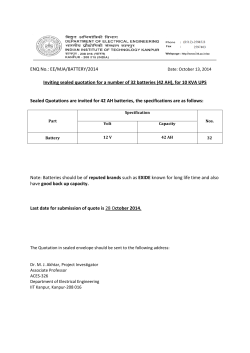

Prospectus