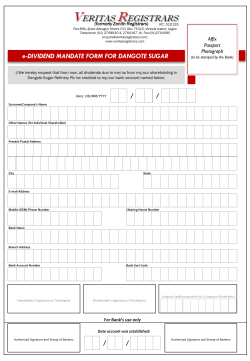

2014 Dangote CEMENT AR 27032015 whole