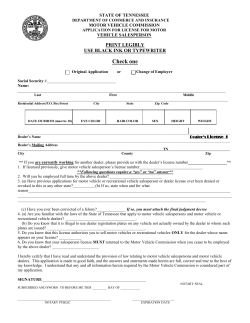

Vehicle Dealer & Manufacturer Resource Manual LICENSING