Q--Daily News-2015-Jun-20150615-jsmr.mdi

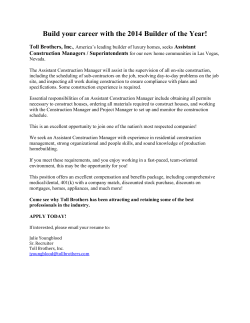

Monday, 15 June 2015 TOLL ROAD/COMPANY UPDATE Jasa Marga BUY Target Price, IDR 8,200 Upside 31.2% The government has unexpectedly decided to apply special discounts of between 25-35% on all toll road tariffs during this year’s Idul Fitri holidays. At the inauguration 6,250 of JSMR’s newest section, Gempol-Pandaan, President Joko Widodo instructed the 6,800 Ministry of SOE and the Ministry of Public Works to apply the discounts 10 days before (H-10) to 5 days after (H+5) Idul Fitri. This policy move is aimed at helping 42,500 people who are traveling to their hometowns during the annual Idul Fitri exodus 3,187 in addition to ensuring the more efficient distribution of goods. In our calculation, 3.3 the financial impact from the 15-days discount will be quite small, resulting in only 1.0-1.4% lower revenues for JSMR. Nonetheless, we don’t think this populist move will be welcomed by the market as it raises further concerns over government IDR, 8200 intervention, which may, we believe, create more uncertainty in the market. JSMR IJ/JSMR.JK Last Price, IDR No. of shares (mn) Market Cap, IDR bn (US$ mn) 3M T/O, US$mn Last Recommendation 28-Apr-2015 19-Mar-2015 27-Feb-2015 BUY BUY BUY IDR 8,200 IDR 8,200 JSMR relative to JCI Index JSMR (LHS) Relative to JCI Index (RHS) % 20 7,500 15 7,000 10 6,500 5 6,000 0 6 /1 2 /1 5 5 /1 5 /1 5 4 /1 7 /1 5 3 /2 0 /1 5 2 /2 0 /1 5 1 /2 3 /1 5 1 2 /2 6 /1 4 1 1 /2 8 /1 4 1 0 /3 1 /1 4 9 /5 /1 4 1 0 /3 /1 4 8 /8 /1 4 7 /1 1 /1 4 -5 6 /1 3 /1 4 5,500 Market Recommendation BUY 21 HOLD SELL 5 0 Danareksa vs Consensus Target price, IDR EPS 2015F, IDR PER 2015F, x Our 8,200 235 26.6 Cons 7,732 262 23.8 Joko Sogie (62-21) 2955 5827 [email protected] Danareksa research reports are also available at Reuters Multex and First Call Direct and Bloomberg. www.danareksa.com Unexpected toll tariff discounts % Diff 6.1 -10.3 11.8 The first time toll tariffs have been discounted Last Friday, during the inauguration of JSMR’s newest section, Gempol-Pandaan, President Joko Widodo took the opportunity to instruct the Ministry of SOE and the Ministry of Public Works to apply special discounts of between 25-35% on all toll road tariffs in Indonesia from 10 days before (H-10) to 5 days (H+5) after Idul Fitri. This is the first time toll tariffs have been discounted in Indonesia. The reasoning behind this government policy move is that it ostensibly helps people traveling to their hometowns during the annual Idul Fitri exodus which falls 5 days before to 5 days after Idul Fitri. Nonetheless, we believe the policy move is also intended to curb the high inflation which is normally seen during this period through the lowering of logistical costs. Minimal impact on JSMR’s performance We have tried to gauge the financial impact of the toll tariff discounts on JSMR’s financial performance by calculating the average daily traffic during the Idul Fitri holiday months in the past. Then we determined how large the traffic in those 15 days was in comparison to JSMR’s fullyear traffic. On average, the 15-days total traffic volume during the Idul Fitri holiday period only constituted nearly 4.0% of JSMR’s total full-year traffic. Assuming 25-35% tariff discounts, this will only translate into 1.0-1.4% lower revenues. All in all, the financial impact of this populist policy on JSMR’s earnings is minimal. Indeed, higher traffic during the Idul Fitri period should offset the impact of lower tariffs on earnings – hence we don’t believe that any downward revisions need to be made at this juncture. This populist move may rattle the market In our view, even though this policy move reduces logistical costs and helps people who are travelling to their hometowns during the Idul Fitri holiday, we also feel that it raises further concerns over government intervention at the micro level. To recall, the government has undertaken several interventions earlier in the year, such as lowering cement prices in February and industrial gas prices in April. In short, this policy move may create more uncertainty in the market. 2013 2014 2015F 2016F 2017F Toll Revenues, IDR bn EBITDA, IDR bn EBITDA Growth, % Net Profit, IDR bn Core Profit, IDR bn Core EPS, IDR Core EPS Growth, % Net Gearing, % PER, x Core PER, x PBV, x EV/EBITDA, x Yield, % 5,803 3,058 (4.7) 1,028 1,056 155 (28.6) 81.5 41.4 40.2 4.0 16.7 1.5 6,646 3,583 17.1 1,403 1,540 226 45.7 87.5 30.3 27.6 3.7 14.7 1.3 See important disclosure on the back of this report 7,329 3,953 10.3 1,600 1,710 251 11.1 94.6 26.6 24.9 3.4 13.8 1.0 8,316 4,678 18.3 1,877 2,007 295 17.4 101.2 22.6 21.2 3.1 12.1 1.1 9,181 4,937 5.5 1,982 2,117 311 5.5 104.3 21.4 20.1 2.8 11.8 1.3 15 June 2015 Jasa Marga Exhibit 1. 25-35% discount on tariffs Section Current Tariff Rp Jakarta-Cikampek Soedyatmo BORR Inner City Jagorawi Jakarta-Tangerang Cipularang Padaleunyi Surabaya-Gempol Belmera Semarang Palikanci JORR Semarang-Solo Nusa Dua-Benoa Surabaya-Mojokerto 25% Discounted Tariff Rp Chg, Rp 4,000 6,000 5,500 8,000 3,000 5,000 34,000 8,000 3,000 6,500 2,000 5,000 8,500 7,000 10,000 1,500 3,000 4,500 4,000 6,000 2,500 4,000 25,500 6,000 2,500 5,000 1,500 4,000 6,500 5,500 7,500 1,000 35% Discounted Tariff Rp Chg, Rp 1,000 1,500 1,500 2,000 500 1,000 8,500 2,000 500 1,500 500 1,000 2,000 1,500 2,500 500 2,500 4,000 3,500 5,000 2,000 3,500 22,000 5,000 2,000 4,000 1,500 3,500 5,500 4,500 6,500 1,000 1,500 2,000 2,000 3,000 1,000 1,500 12,000 3,000 1,000 2,500 500 1,500 3,000 2,500 3,500 500 Source: Company Exhibit 2. Average daily traffic during Idul Fitri months Year 2007 2008 2009 2010 2011 2012 2013 2014 2015 Idul Fitri Day 1 13/Oct/07 2/Oct/08 21/Sep/09 10/Sep/10 31/Aug/11 19/Aug/12 8/Aug/13 28/Jul/14 17/Jul/15 H-10 3/Oct/07 22/Sep/08 11/Sep/09 31/Aug/10 21/Aug/11 9/Aug/12 29/Jul/13 18/Jul/14 7/Jul/15 H+5 18/Oct/07 7/Oct/08 26/Sep/09 15/Sep/10 5/Sep/11 24/Aug/12 13/Aug/13 2/Aug/14 22/Jul/15 Effecting months October September/October September August/September August/September August July/August July/August July Daily avg. volume 2,239,133 2,350,292 2,425,748 2,550,413 2,924,415 3,137,617 3,342,382 3,423,064 15 days Volume 33,586,992 35,254,385 36,386,224 38,256,191 43,866,228 47,064,252 50,135,734 51,345,956 Source: Company Exhibit 3. Idul Fitri holiday traffic only 4.0% of JSMR’s full-year traffic Total traffic H-10 to H+5 Idul Fitri FY traffic % of FY (RHS) 1,400 4.04 4.02 1,200 Millions 4.00 1,000 3.98 800 3.96 3.94 600 3.92 400 3.90 3.88 200 34 35 36 38 44 47 50 51 - 3.86 3.84 2007 2008 2009 2010 2011 2012 2013 2014 Source: Company 2 15 June 2015 Jasa Marga Exhibit 4. Profit & Loss (IDR bn) 2013 2014 2015F 2016F 2017F Toll Revenues Others Operating Revenues 5,803 508 6,311 6,646 583 7,229 7,329 665 7,994 8,316 744 9,060 9,181 832 10,013 Toll collection Service Maintenance JO G&A Operating Expenses 873 482 1,569 308 1,088 4,319 1,083 557 1,365 313 1,161 4,477 1,204 618 1,504 329 1,286 4,941 1,318 673 1,674 344 1,399 5,408 1,545 758 1,946 359 1,630 6,239 Operating Profit EBITDA Net Interests Other Income (Expenses) Pre-tax Income Income Tax & Minorities Net Profit Core Profit 1,992 3,058 (715) (12) 1,311 (283) 1,028 1,056 2,752 3,583 (950) (5) 1,822 (419) 1,403 1,540 3,053 3,953 (852) 2,201 (601) 1,600 1,710 3,652 4,678 (1,059) 2,593 (716) 1,877 2,007 3,774 4,937 (1,061) 2,714 (732) 1,982 2,117 2013 2014 2015F 2016F 2017F 3,514 274 3,788 3,291 351 3,641 2,778 371 3,150 2,876 400 3,276 2,656 426 3,081 Fixed Assets -net Other Non-current Assets Total Non-current Assets 23,195 1,076 24,270 26,820 1,396 28,217 29,891 1,705 31,596 33,653 1,914 35,567 37,180 2,073 39,253 Total Assets 28,059 31,858 34,746 38,842 42,335 1,651 100 3,120 4,871 654 192 3,468 4,313 212 3,560 3,772 240 3,683 3,923 265 3,813 4,078 Long-term Debt Other Non-current Liabilities Total Non-current Liabilities 10,465 2,165 12,629 12,629 3,491 16,120 14,649 3,780 18,430 16,922 4,118 21,040 18,522 4,518 23,041 Total Liabilities 17,501 20,433 22,201 24,963 27,119 Shareholder’s Equity Total Liabilities and Equity 10,558 28,059 11,425 31,858 12,544 34,746 13,880 38,842 15,216 42,335 Source: Company, Danareksa Sekuritas Exhibit 5. Balance Sheet (IDR bn) Cash & Equivalent Other Current Assets Total Current Assets Short-term Debt Trade Payables Other Current Liabilities Total Current Liabilities Source: Company, Danareksa Sekuritas 3 15 June 2015 Jasa Marga Exhibit 6. Cash flow (IDR bn) Pre-tax Minorities Depreciation Tax Working Capital Operating Cash Flow Capex Investment Others Investing Cash Flow Debt Equity Dividend Others Financing Cash Flow Changes in Cash 2013 2014 2015F 2016F 2017F 1,311 99 1,067 (538) (400) 1,539 1,822 188 831 (435) (455) 1,951 2,201 59 900 (583) (235) 2,341 2,593 62 1,026 (689) (110) 2,882 2,714 82 1,163 (720) (70) 3,168 (4,929) (5) 440 (4,494) (4,456) 7 435 (4,014) (3,971) (9) 203 (3,776) (4,787) (9) 240 (4,557) (4,690) (9) 283 (4,416) 1,902 383 (641) 523 2,167 1,167 (2) (535) 1,209 1,840 1,366 (59) (421) 37 923 2,272 (62) (480) 42 1,772 1,601 (82) (563) 72 1,027 (788) (223) (512) 98 (220) 2013 2014 2015F 2016F 2017F 31.6 48.5 16.3 16.7 10.1 3.9 38.1 49.6 19.4 21.3 12.8 4.7 38.2 49.4 20.0 21.4 13.4 4.8 40.3 51.6 20.7 22.2 14.2 5.1 37.7 49.3 19.8 21.1 13.6 4.9 114.8 81.5 2.2 116.3 87.5 2.3 116.8 94.6 2.6 121.9 101.2 2.9 121.7 104.3 3.0 6 10 10 10 10 4.0 (23.4) (4.7) (35.9) (28.6) 14.5 38.2 17.1 36.6 45.7 10.3 10.9 10.3 14.0 11.1 13.5 19.6 18.3 17.3 17.4 10.4 3.4 5.5 5.6 5.5 Source: Company, Danareksa Sekuritas Exhibit 7. Key ratios Profitability, % Operating Margin EBITDA Margin Net Margin Core Margin ROAE ROAA Capitalization Debt to Equity, % Net Debt to Equity, % Interest Coverage, x Turnover, days Trade Receivables Inventories Trade Payables Growth, % Toll Revenues Operating Profit EBITDA Net Profit Core Profit Source: Company, Danareksa Sekuritas 4 15 June 2015 Jasa Marga DISCLAIMER The information contained in this report has been taken from sources which we deem reliable. However, none of P.T. Danareksa Sekuritas and/or its affiliated companies and/or their respective employees and/or agents makes any representation or warranty (express or implied) or accepts any responsibility or liability as to, or in relation to, the accuracy or completeness of the information and opinions contained in this report or as to any information contained in this report or any other such information or opinions remaining unchanged after the issue thereof. We expressly disclaim any responsibility or liability (express or implied) of P.T. Danareksa Sekuritas, its affiliated companies and their respective employees and agents whatsoever and howsoever arising (including, without limitation for any claims, proceedings, action , suits, losses, expenses, damages or costs) which may be brought against or suffered by any person as a results of acting in reliance upon the whole or any part of the contents of this report and neither P.T. Danareksa Sekuritas, its affiliated companies or their respective employees or agents accepts liability for any errors, omissions or mis-statements, negligent or otherwise, in the report and any liability in respect of the report or any inaccuracy therein or omission therefrom which might otherwise arise is hereby expresses disclaimed. The information contained in this report is not be taken as any recommendation made by P.T. Danareksa Sekuritas or any other person to enter into any agreement with regard to any investment mentioned in this document. This report is prepared for general circulation. It does not have regards to the specific person who may receive this report. In considering any investments you should make your own independent assessment and seek your own professional financial and legal advice. 5

© Copyright 2026