SEC Investigates If BofA Broke Customer-Protection

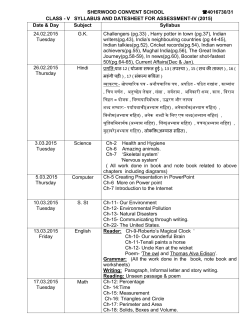

Market Snapshot* DJIA Nasdaq Tuesday, April 28, 2015 Most U.S. stocks rose despite weakness in the biotechnology sector. "In a market that's been up huge, it's taking a breather," said Ian Winer, head of equities trading at Wedbush Securities. Last week, the Nasdaq Composite advanced to a record close for the first time in 15 years, and on Friday, strong corporate results in the technology sector catapulted both the Nasdaq and the S&P 500 into record territory. Treasurys U.S. government bonds sold off on Tuesday, sending the yield on the benchmark 10-year note to a one-month high, as the market was hurt by a flurry of new bond sales from the public and private sectors. In late-afternoon trading, the yield on the benchmark 10-year Treasury note was 1.975%, the highest closing level since March 26, compared with 1.923% on Monday. Forex Wednesday's Federal Reserve statement kept dollar bulls at bay as the central bank was thought likely to acknowledge disappointing first-quarter growth and heightened uncertainty about the state of the economy. The euro touched a 3week high against the dollar. -4.81 2114.76 +5.84 10-Year 1.9745% -16/32 30-Year 2.6707% -1 7/32 Euro $1.09735 +0.0086 $57.06 +0.07 Nymex Crude *preliminary values subject to adjustments Tomorrow’s Headlines SEC Investigates If BofA Broke Customer-Protection Rules The Securities and Exchange Commission is investigating whether Bank of America Corp. broke rules designed to safeguard client accounts, potentially putting retail-brokerage funds at risk in order to generate more profits, according to people familiar with the inquiry. For at least three years, the bank used large, complex trades and loans to save tens of millions of dollars a year in funding costs and to free up billions of dollars in cash and securities for trading that Bank of America otherwise would have needed to keep off-limits, these people said. Now, the SEC is investigating whether the bank’s unusual strategy violated customer-protection rules and whether the bank misled regulators about what it was doing, these people said. Bank of America, the second-largest U.S. lender by assets, stopped the strategy in mid-2012, amid internal debate about its potential regulatory and other risks, they said. The trades took place in Bank of America’s Merrill Lynch unit, which it bought in 2009. continued on page 2 Tomorrow’s Calendar 7:00 a.m. 8:30 a.m. Commodities U.S. oil prices ended Tuesday with a modest gain, after a brief spike following the news that Iran seized a Western cargo ship in the Strait of Hormuz. Light, sweet crude for June delivery rose 7 cents, or 0.1%, to $57.06 a barrel on the New York Mercantile Exchange. Brent crude, the global benchmark, fell 19 cents, or 0.3%, to $64.64 a barrel on the ICE Futures Europe exchange. +72.17 5055.42 S&P 500 Source: SIX Telekurs, ICAP plc Stocks 18110.14 10:00 a.m. 10:00 a.m. 10:30 a.m. 2:00 p.m. 04/24 MBA Weekly Mortgage Applications Survey Market Composite Index (previous 458.4) Market Composite Index Cur Chg (previous +2.3%) Purchase Index (S.A.) (previous 205.4) Purchase Index (S.A.) Cur Chg (previous +5%) Refinance Index (previous 1920.1) Refinance Index Cur Chg (previous +0.6%) Q1 Advance estimate GDP GDP (expected +1%) Chain-Weighted Price Index (expected +0.4%) PCE Price index (previous -0.4%) Purchase Price Index (previous -0.1%) Real Final Sales (previous +2.3%) Core PCE Price index (Ex Food/Energy) (previous +1.1%) Personal Consumption (previous +4.4%) Mar Pending Home Sales Index Current (previous 106.9) MoM Pct Change (Current Period) (expected +1%) YoY Pct Change (Current Period) (previous +12%) Mar Metropolitan Area Employment & Unemployment 04/24 EIA Weekly Petroleum Status Report Crude Oil Stocks (previous 489.M) Crude Oil Stocks (Net Change) (previous +5.32M) Gasoline Stocks (previous 225.74M) Gasoline Stocks (Net Change) (previous -2.14M) Distillate Stocks (previous 129.34M) Distillate Stocks (Net Change) (previous +0.4M) Refinery Usage (previous 91.2%) Total Products Supplied (previous 19.14M) Total Products Supplied (Net Change) (previous +0.14M) U.S. interest rate decision Federal Funds Rate Federal Funds Rate Change (Pts) Discount Rate Discount Rate Change FOMC Vote For Action (previous 10) FOMC Vote Against Action (previous 0) High Range Value (Current Period) Low Range Value Federal Funds Rate Change High Range (previous 0.25) Federal Funds Rate Change Low Range (previous 0) Copyright © Dow Jones & Company, Inc. All Rights Reserved. www.dowjones.com page 1 Tuesday, April 28, 2015 4 p.m. ET Tomorrow’s Headlines Earnings beat expectations, though revenue fell short because of the stronger dollar and lower fuel surcharges. continued “These transactions, which began at Merrill Lynch before the acquisition by Bank of America, received extensive review and approval,” a spokeswoman for the Charlotte, N.C.-based bank said. “The firm fully complied with the rules designed to safeguard client funds.” US Sends Ship, Planes as Iranians Seize Commercial Ship A U.S. Navy destroyer was rushed to the area of a confrontation Tuesday between Iranian warships and a Marshall Islands-flagged cargo ship in the Strait of Hormuz amid increased tensions in the region over the simmering conflict in Yemen, the Pentagon said. The USS Farragut sped to the scene after Iranian sailors fired warning shots across the bow of the M/V Maersk Tigris that was in Iranian waters, said Col. Steve Warren, a Pentagon spokesman. The warning shots were fired after the cargo ship refused Iranian orders to head further into Iranian waters, Col. Warren said. After the Iranian ship fired the warning shots, the cargo ship changed course and complied with the order, Col. Warren said. The ship was directed to proceed to Larak Island by Iranian vessels, he said. Iranian sailors from the Iranian vessel then boarded the ship. The ship is currently under the control of Iranian forces, officials said. In response to the confrontation, the U.S. Navy sent the Farragut and U.S. planes to keep watch on the confrontation. The U.S. is observing the Maersk Tigris with a Navy maritime patrol and reconnaissance plane, Col. Warren said. Consumer Confidence Falls in April Chief Executive David Abney said the company is now “on track” to achieve its long-term financial targets. For the full year, UPS reaffirmed its guidance for per-share earnings between $5.05 and $5.30. Separately, the company said today that Chief Financial Officer Kurt Kuehn, 60, will be retiring on July 1. He will be succeeded by Richard Peretz, 53, who is currently the corporate controller and treasurer. Last quarter, the shipping giant surprised Wall Street by announcing that preparations to handle the holiday rush cost it $200 million more than expected. On UPS’s last quarterly earnings call, executives said they would increase holiday rates by tacking on peak surcharges for customers shipping to residential addresses. Ukraine Leaders Fear Russian Attack, Says EU’s Juncker Ukraine’s leaders believe Russia is preparing a broad attack on their country, European Commission President Jean-Claude Juncker said on Tuesday, as he returned from a summit in Kiev that coincided with fresh violence in Ukraine’s east. In an interview with a small group of reporters in his flight back from Kiev, Mr. Juncker said he had advised Ukrainian President Petro Poroshenko to ease tensions by avoiding comments on Ukraine’s possible bid to join the North Atlantic Treaty Organization. His advice, he acknowledged, received short shrift. In the last couple of days, the Organization for Security and Cooperation in Europe has warned of an uptick in violence in eastern Ukraine where a Feb. 12 cease-fire, signed in the Belarus city of Minsk, was supposed to bring fighting between Kiev and pro-Russian separatists to an end. Consumers are feeling less upbeat about the economy this month amid a slowdown in job creation and worries about the near-term outlook. Cablevision to Offer Hulu to Its Customers The Conference Board, a private research group, said Tuesday its index of consumer confidence decreased to 95.2 in April from a revised 101.4 in March, which had been first reported as 101.3. Economists surveyed by The Wall Street Journal had forecast a level of 102.5 for this month. Cablevision Systems Corp. reached a deal with streaming video service Hulu to offer the service’s catalog of ondemand shows and movies to its customers, becoming the first cable or satellite TV provider to strike such a partnership. The present situation index, a gauge of consumers’ assessment of current economic conditions, fell to 106.8 from a revised 109.5, first set at 109.1. And consumer expectations for economic activity over the next six months dropped to 87.5 from an unrevised 96.0. UPS Posts Higher Earnings; CFO To Retire United Parcel Service Inc. said Tuesday that first-quarter earnings rose 14%, boosted by new pricing initiatives and strong growth in its domestic segment. “There is a new generation of consumers who access video through the Internet, and whatever their preference, Cablevision will facilitate a great content experience,” said Kristin Dolan, chief operating officer of Cablevision, in a statement. Hulu’s $7.99-a-month Plus subscription service, which is battling streaming giant Netflix and Amazon.com Inc.’s Prime Instant Video for customers, could benefit from the marketing boost by Cablevision. “Even with the rapid growth in streaming, there is a huge audience that consumes television through their cable provider, and we want to be there for them too,” said Tim Connolly, senior vice president of distribution at Hulu. Copyright © Dow Jones & Company, Inc. All Rights Reserved. www.dowjones.com continued on page 3 page 2 Tuesday, April 28, 2015 4 p.m. ET Tomorrow’s Headlines observers, the results indicate that oil companies may be able to cope with low prices better than many investors expected. continued The companies didn’t say whether Hulu would be made available as an app on Cablevision set-top boxes. Cablevision said it will provide pricing and other details in the “near future.” Hulu has been seeking such tie-ups with pay TV providers since the latter half of 2013, after its media company owners decided not to sell the company. Hulu is owned by Walt Disney Co., 21st Century Fox and Comcast Corp. (Fox and The Wall Street Journal were part of the same company until mid-2013.) Ford Profit Down on International Markets Ford Motor Co. reported net income down 7% in the first quarter as better-than-expected North American profits were dented by losses in Europe and South America, which continue to be a drag on the bottom line. The Dearborn, Mich. auto maker earned $924 million, or 23 cents a share, in net profit for the first quarter, down from the $989 million, or 24 cents a share, booked in the same year-ago period. The company’s pretax operating profit of $1.4 billion, or 23 cents a share, missed Wall Street expectations by 3 cents. The performance represents a muted start for new Chief Executive Mark Fields in 2015. The company said the timing of important vehicle launches and capacity additions should generate more earnings momentum over the second half of the year, allowing the auto maker to meet its targeted operating-profit range of $8.5 billion to $9.5 billion. Sales totaled $33.9 billion for the quarter, down 6% from a year earlier. Revenue fell in each of the company’s five regions as the strong dollar, product changeovers and dismal conditions in South America hit the top line. BP, Total Report Sharply Lower Profits BP PLC of the U.K. and Total SA of France each reported sharply lower quarterly profits on Tuesday while providing glimpses into how the world’s largest oil companies are weathering the depths of an oil-price crash. BP’s version of net income plunged by 40% from a year earlier and its cash flow nose-dived more than 75%, while Total’s net profit fell by 20%. Both companies saw their revenues from oil sales plummet as crude traded for about $54 a barrel in the first quarter of 2015, half its price a year earlier. “The dire earnings collapse is not going to be as bad as generally anticipated,” said Brian Youngberg, an analyst at Edward Jones. Citi Holders OK Pay Packages, Proxy-Access Proposal Citigroup Inc. shareholders on Tuesday approved the pay packages of the bank’s top executives, a vote of confidence for a bank that is trying to move forward after a tough 2014. However, the approval rating slipped slightly from a year ago. About 84% of investors voted in favor of CEO Michael Corbat’s $13 million pay package at the annual shareholder meeting, according to preliminary calculations from the bank. About 85% voted in favor last year. Pfizer Trims Outlook on Stronger Dollar Pfizer Inc. trimmed its full-year outlook on Tuesday amid a stronger U.S. dollar and weaker euro, though the pharmaceutical giant posted better-than-expected results in the first quarter on the strength of its new products. For the year, the company now expects per-share earnings between $1.95 and $2.05, down from its previous guidance of $2 to $2.10. It lowered its revenue forecast to $44 billion to $46 billion from its previous forecast of $44.5 billion to $46.5 billion. Pfizer has had to combat a wave of patent expirations weighing on sales, while a stronger dollar also has hurt results. The company has forged development partnerships and sought to make deals in a busy time for pharmaceutical mergers and acquisitions. In February, Pfizer agreed to buy Hospira Inc., a maker of injectable drugs and infusion technologies, for about $16 billion. Hospira Inc. on Tuesday reported sharply betterthan-expected profit in its first quarter as its injectable drugs continued to drive growth. MasterCard CEO’s 2014 Pay Increases MasterCard Inc. Chief Executive Ajay Banga received $13.4 million in compensation in 2014, an increase of 8.4% from a year earlier. Mr. Banga’s base salary inched up to $1.06 million from $1 million in 2013. The biggest increase came in his non-equity incentive plan compensation, which grew to $3.58 million from $2.54 million in 2013. In a sign of how bad things have been for big oil companies, those numbers were seen as being better than expected. Three months ago, Total reported a $5.7 billion loss for the fourth quarter of 2014, while BP’s losses totaled almost $1 billion. Mr. Banga, a former Citigroup Inc. executive, has led the Purchase, N.Y.-based payments network since 2010. This time around, BP and Total—the world’s fourth- and fifthlargest independent oil companies by market value—were helped by increased production, deep cost cuts and healthy profits from their refining businesses. To some industry Although consumers are saving money at the gasoline pump due to lower oil prices, Mr. Banga has said that so far there is no indication that they are funneling those savings into other discretionary spending. Mr. Banga said earlier this year that MasterCard is seeing good credit trends in the U.S. as banks and consumers move with caution during the recovery. Copyright © Dow Jones & Company, Inc. All Rights Reserved. www.dowjones.com page 3 Tuesday, April 28, 2015 4 p.m. ET Copyright Dow Jones & Co., Inc. Talking Points Tomorrow's News Today is made available as a complimentary service to Dow Jones News Service paying subscribers. No further redistribution is permitted without written permission from Dow Jones. Tomorrow’s News Today is intended to provide factual information, but its accuracy cannot be guaranteed. Dow Jones is not a registered investment adviser, and under no circumstances shall any of the information provided be construed as a buy or sell recommendation or investment advice of any kind. Auto Giants Get Savvy In China Want to send a co-branded daily version to your valued clients? Dow Jones offers subscribing firms the opportunity to co-brand Tomorrow's News Today for redistribution to their clients. If your firm is interested in co-branding, please contact us at [email protected] or 1.800.223.2274. As the demand boom for cars in China cools, global auto makers are looking to impart to their dealers skills common in more mature markets: salesmanship and after-sales service. Nissan Motor Co., whose passenger car sales rose a disappointing 2.7% in 2014, late last year parachuted in a U.S.-based expert to conduct a detailed survey of its Chinese dealer network. The Japanese auto maker also introduced a dealership advisory system, common in the U.S. and some European countries, to increase communication. Foreign auto makers are grappling with erosion in China’s car-buying binge: Chinese passenger-car sales growth is expected to slow to 8% this year to 21.3 million vehicles, compared with a 9.9% gain last year, according to an official estimate. Consultancy IHS Automotive forecast growth for this year and next at 8%. When China’s market was growing rapidly, selling cars was easy, auto executives and dealers say. Global auto makers tended to have the upper hand over dealers, who needed more cars to sell. But dealers now complain their profits are being hit by excess inventory, and some say the car makers’ sales targets are unrealistic. According to the China Automobile Dealers Association, dealers across China had inventories of 53 days of sales on average in March, exceeding what it calls the healthy level of no more than 45 days. The most glaring case of dealer malaise recently was for luxury-car maker BMW AG. Some of its dealers aired their grievances in the media, saying the German company’s sales targets were too aggressive. BMW has said it is in regular dialogue with its dealers and regularly readjusts its targets to reflect such discussions. Luxury-car brand Jaguar Land Rover, whose China sales growth of 28% for 2014 was down from 30% the prior year, brought a group of Chinese dealers to the U.K. last year to show them how dealerships operate there. General Motors Co. said it is also working with its dealers to help develop business beyond new car sales. GM’s first-quarter passenger car sales rose 2.2%, down from 13% growth a year earlier. Honda Motor Co.’s car sales in China rose 4.1% in 2014, exceeding 2.6% growth a year earlier, but its first-quarter sales this year were up only 0.6%. The company is considering introducing a dealer advisory in China system similar to Nissan’s, said Seiji Kuraishi, head of Honda’s Chinese operations. “It has to be a win-win relationship for both sides,” said Yasuhide Mizuno, an operating officer for Honda and president of Guangqi Honda, one of the Japanese auto maker’s joint ventures with a Chinese partner. Dealers also need more of a marketing and after-sales service strategy than they had before, normal practice in markets such as Japan and the U.S. but not necessarily the case in China until recently, Mr. Mizuno said last week at the Shanghai auto show. Jaguar Land Rover’s sales took a beating during the first quarter following criticism on China’s government-controlled television broadcaster over faulty gearboxes. The unit of Tata Motors Ltd. didn’t disclose its sales for the period, but U.S.-based researcher JL Warren Capital said in the first three months of this year retail sales for the brand fell 20% to 20,526 vehicles. Bob Grace, China head of Jaguar Land Rover, said some Chinese dealers have seen the writing on the wall and are seeking profit sources beyond new-car sales, such as after-sales services. “At the moment they have got most of their eggs in one basket, which is new-car profitability.” Nissan was a latecomer to China, but its vehicle sales there grew more than sixfold over the decade ended 2014, making it the best-selling Japanese car maker in the country. In 2011 the company, which manufactures cars with joint-venture partner Dongfeng Motor Group Co., had planned to raise its China market share to 10% from 6% over six years. But Nissan later suffered from a Sino-Japanese political feud in 2012 that led to vandalism of Japanese cars in China. continued on page 5 Copyright © Dow Jones & Company, Inc. All Rights Reserved. www.dowjones.com page 4 Tuesday, April 28, 2015 4 p.m. ET Talking Points doors are open to any candidate who is serious about transforming our economy with high and rising wages,” Mr. Trumka said. continued Its 2014 market share fell to 5.2%, based on company sales figures provided by Nissan and overall market sales from the Chinese auto lobby. Its performance deterioration in China prompted Chief Executive Carlos Ghosn in December to declare the company was in “crisis mode” there. One of Nissan’s main ways of tackling the problem is the adoption in China last year of the dealership advisory body, which exists in the U.S. and some European countries. AFL CIO Blasts Trade Deal The country’s most powerful labor leader warned Democratic candidates Tuesday that they can’t take unions’ support for granted and must push to raise wages while opposing a contentious trade pact backed by President Barack Obama. AFL-CIO President Richard Trumka, in remarks at the union federation’s Washington headquarters, voiced skepticism about Democrats’ commitment to working-class Americans, took aim at President Obama and made veiled threats at Hillary Clinton, without naming her. “It’s early, and although many candidates are already in the race, the field remains open. And the labor movement’s “We’re tired of scared politicians who won’t stand up for what’s right,” he said, noting a union poll after the 2014 election that found about a third of working-class voters “couldn’t see any significant difference between the two parties.” Eight in 10 Democrats and Republicans surveyed in the same poll, he said, saw both parties as doing “far too much for Wall Street and not nearly enough to help average folks.” He credited President Obama with spending “much of his presidency” digging the U.S. out of a deep crisis, but said persistently flat wages would be worsened by the TransPacific Partnership trade deal Mr. Obama is pushing in Congress. Mr. Trumka said that over nearly two generations, national leaders of both political parties have “either taken steps that worsened inequality or fiddled around the edges’ trying to raise wages in an economy built to lower them. Dozens of major labor unions earlier this year agreed to freeze campaign contributions to Democratic and Republican members of Congress to pressure them to oppose the fast-track trade legislation sought by Mr. Obama. The move was part of the unions’ campaign against the Pacific trade deal, which the Obama administration is negotiating with Japan, Australia, Vietnam and eight other countries. Copyright © Dow Jones & Company, Inc. All Rights Reserved. www.dowjones.com page 5

© Copyright 2026