Agenda 15-16 April - East Africa Property Investment Summit

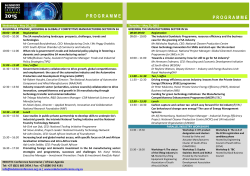

Agenda 15-16 April Platinum sponsor Gold sponsor Silver sponsor Bronze sponsor Industry Sponsors 1 15 April 2015 07:30 to 08:30 Breakfast and Registration 09:00 to 09:15 Welcome and Opening address by our Platinum Sponsors James Muratha Regional Director STANLIB East Africa 09:15 to 10:00 Regional Economic and Political Overview-East Africa David Ndii Managing Director Africa Economics This year heralds interesting times for East Africa as each of its member states tackle unique experiences to prosper. Kenya, the largest economy in the region is still faced with insecurity challenges while Tanzania is banking on re-basing its economy for a better 2015. Rwanda will be seeking to re-ignite its economic spark, whilst Uganda looks at its fledgling oil industry. This session will provide delegates an opportunity to discuss key drivers of growth and allow us to compare data for the various East African countries. Key Points to be elaborated on: • • • • • • • • 10:00-10:45 Political and Economic Governance of East Africa Macro Economic outlook Foreign Investment into the East African Region Ease of doing business and growth challenges Drivers of the East African Growth Story How does the growing property industry improve the economic prospects? East Africa vs. Competing Emerging Markets. Policies and changing economic landscape on the continent How to structure a successful property development in East Africa? Property Developments can be tricky to structure, especially when dealing with new markets. This session will give you step by step guide on how to effectively manage a) the purchasing of your land b) the design phase and construction of your project c) fund-raising and d) any legal challenges that may arise. Obtain an in-depth understanding from our lawyers, Bankers, Property and Asset managers In this session we cover: • • • • • • 10:45-11:00 Land ownership rights The importance of finding a good local partner in East Africa Cross border financing vs. Local financing – Dollars vs KSH vs TZS Criteria/ Checklist required for bank finance Design and cost challenges in East Africa. What banks look for when lending to developers? Africa Speed Networking Session This session will allow individuals to get to know the players in the room and hear about their strategy in Africa. The networking format will assist delegates with building contacts and growing business relationships across the continent 11:00 to 11:15 Tea Break and Media Interviews 11:15 to 11:45 The future of Airport cities in East Africa - a look at the growth of JKIA In this session we elaborate on the future of Airport cities and the importance airports play in building a country and attracting foreign FDI. • Understanding the plans for JKIA as a regional transport hub • A clear vision of the future - what airports of tomorrow represent and what is the plan for regional airport development • Insights on the medium term project plans to ensure EAC Airports can keep pace with the current growth in aviation demand • Real estate development and investment around airport nodes- hotels, logistics and commercial requirements? • Do regulations hamper the approach to airport modernisation programmes Lessons learned & solutions for successful airport city development 2 Godwin Wangong’u Senior Partner Mboya Wangong’u & Waiyaki Advocates Nnema Byrd Principal STANLIB Ralph Gunn Head of Debt Products East Africa region Stanbic Kevin Teeroovengadum CEO AttAfrica Carol Musyoka Master of Ceremonies Mr Raphael Nzomo CEO Afrika Aviation Services. 11:45-12:30 Future of REIT’s in the East Africa Community Kenya has become the third country in Africa to establish a REIT as an investment vehicle for private or public investment funds. Many investment companies now look to capitalize on this international trend in East Africa. Kenneth Kaniu CIO STANLIB Kenya In this session we discuss: • • • • Types of REIT’s – Income vs. Development Formation and Structure of the REITS in East Africa – Including a look at the tax benefits The ability for REITS to invest in regional property? Prospects for growth in market capitalization of REIT industry? 12:30 to 13:30 Lunch 13:30 to 14:30 Project Showcase - 5 developers, 5 exciting projects! In this session we allow 5 developers within East Africa to present their projects, giving the audience the opportunity to see first hand how the East African landscape will change in the coming years. This will be followed by a Q&A where presenters will answer any delegate questions in order to obtain insight into: • • • • • What factors contribute to the success or failure of projects in East Africa? The changing face of tenants profiles within the region Lessons learned when buying land Growing competition between developers – is there enough room for everyone? Where are the development opportunities in the EAC? Ronal Samani Director of Corporate Development AMS Group James Mworia Group CEO Centum Investment Company Daniel Kamau Head of Real Estate Fusion Capital Ken Luusa Executive Director Acorn Group Ltd Dr Dan Twebaze Managing Director Twed Property Development Company Limited 14:30-15:15 Keeping projects on time and within Budget In this session, we outline a construction site from beginning to end, and elaborate on the success and failures of a project in an African context. • • • • • • Construction costs across the continent Times to deliver projects How to work around poor Infrastructure and logistical difficulties. Availability and importing of construction materials Challenges of logistics on site in East Africa Different construction techniques and associated costs Competition and pricing Timothy Manyuira Founding Director Tandem & Stark Anthony Orelowitz Director Paragon Architects Azmeena Bhanji Manager of Real Estate Development PDM John Rogers Construction Director MML 15:15 to 15:30 Tea Break and Media Interviews 15:30-15:45 The Africa Report The long-term growth outlook for Africa appears bright. With a large and growing, young and increasingly wealthy population, Africa has a demographic advantage that few other parts of the world will be able to match over the coming decades. In this session we obtain an informed comparison on EAC markets EAST AFRICA PROPERTY INVESTMENT SUMMIT 2015 Peter Welborn Chairman Knight Frank Africa 3 15 April 2015 15:45-16:15 Comparing EAC markets The various regions across the continent present a story of rapid economic growth and an expanding consumer class- East Africa is no different! Each region also has its own unique set of challenges. This session will allow us to consider East Africa as a key investment hotspot for future real estate investment The above is followed by a panel discussion where we will compare the regions based on the following: Opportunities in the Development Sector • • • • • • • 16:15-16:45 The future nodes around airports and ports in East Africa Growth Forecast across the EAC Infrastructure growth The Housing gap across the East African market Land ownership rights and ease of doing business Expected IRR’s for typical projects within the region Construction cost and the ease of development in each region. Confidence through Professional Standards Professionalism is not the job you do, it’s how you do the job. As a consequence of globalisation, market efficiency requires consistency, transparency and comparability. International standards are the backbone. In This session we understand • • • • • Peter Welborn Chairman Knight Frank Africa Ben Woodhams MRICS Managing Director Knight Frank Kenya Gikonyo Gitonga Managing Director Axis Real Estate Ltd Jonathan Yach CEO Broll Kenya Mark Walley Managing Director, EMEA RICS IFRS* and valuation – the link (*International Financial Reporting Standards) The International Standards Coalition Better standards = Increased Transparency Market confidence leads to sustainable investment Professional ethics Global Standards and local practitioners 16:45 to 17:00 Closing remarks and questions 17:30-19:00 Cocktails and Dinner at Kempinski 16 April 2015 07:00 -07:30 Breakfast and Registration 07:30 –08:30 Master Class-What Drive’s Value in Real Estate? An introduction on how to perform property valuations and calculate yields. This seminar will use offices in Nairobi for calculations and Kenyan Retail to help illustrate the theory behind Real Estate Markets and Property Market Cycles. • • • • 08:30 -09:15 Interaction between Space, Asset and Developer Markets The Property Cycle and the case for Kenyan Retail How to calculate value, determine yields and adjust for risk Trends in the Nairobi Office Market Africa Insight Session The past decade has seen slow and steady economic growth across the continent of Africa. But co Author “The Fastest Billion” Arnold Meyer talks about Africa’s boom. He talks through a few of the indicators -- from rising education levels, African urbanisation to expanded global investment (and not just from China) -- that lead them to predict rapid growth for a billion people, sooner than you may think. 4 Natalie Bayfield Lecturer-Department of Land Economy University of Cambridge Arnold Meyer Director Nera Capital 16 April 2015 9:15-10:00 Beyond the capital cities- exploring growth nodes in outlying provinces. East Africa’s previously dormant, satellite towns are gaining elevated attention as agriculture, oil, gas and improved transport connectivity provide a springboard for growth. These towns, examples such as Nanyuki, Dodoma, Eldoret, Kisumu, Jinja and Arusha all have unique opportunities for real estate developers and investors. In this session we discuss: • The type of developments needed in these satellite towns • What are the drivers of growth in these secondary towns? Education, Tourism, Mining, oil, Agriculture, major transport routes? • The ease of developing in these towns and challenges with regards to land ownership • What does this market need and how do we bridge that gap? • The connectivity from a businessman’s point of view – how easy are these places to access? • What will be the major ports after the completion of the LAPSAT rail project? And how will this affect development? • Rentals and Returns compared to the major capital cities? • How do the investors/ developers deal with construction risk – local contractor or international player and how does this affect the cost of the development. 10:00-10:30 Tea Break and Media Interviews 10:30-10:55 The future of retail in East Africa The time is thus ripe for big brand retailers to set up shop in Africa. Many are using East Africa as a springboard into Africa. The rapidly emerging middle class and increasingly wealthy consumers are embracing western brands, products and lifestyles. At the same time, retailers need to understand the importance of supply chains, labour costs and consumer dynamics • • • • • 10:55-11:15 Nakumatt Holdings is today the leading retailer in East Africa. They operate nearly 50 branches across Kenya, Tanzania, Uganda and Rwanda. For more than two decades now, they have shaped and built their business on their founding principle of providing a variety of affordable, quality brands as well as excellent and superior service to their customers. In this session we learn from one of the brains behind the brand: 11:15-12:00 Fred Msemwa CEO Watumishi Housing Company Jonathan Jackson Chairman Lordship Africa Thiagarajan Ramamurthy Regional Director - Strategy and Operations Nakumatt Holdings Ltd Malcolm Horne Group CEO Broll Property Group We receive analysis from the CEO of Africa’s leading retail property manager Understanding the rise of the African middle class and the impact it has on the retail market. International retailers are flowing into the region although barriers to entry and ease of doing business might be a deterrent to foreign investment. How do you see the retail environment changing in East Africa? How does East Africa compare to the rest of Africa Retailer expansion in East Africa • • • • • • Heri Bomani CEO and Group Managing Director Pangani Group Thiagarajan Ramamurthy Regional Director - Strategy and Operations Nakumatt Holdings Ltd Closer look at retailer strategies – each country presents retailers with specific challenges and not even the most hardened Africa players are immune from country failures. Do logistical issues pose a risk to the retailer’s African expansion? What are retailers looking for when searching for housing for their brands? How does turnover rentals affect retail trade and expansion What do retailers look for when entering the market? How do you feel about the competition entering the EAC market? Bridging the residential Gap in East Africa Rapid urbanisation in response to population growth and sustained economic expansion is boosting demand for residential rental stock in Africa. The lack of affordable home loan solutions is resulting in an enormous rental market and in turn giving rise to high yielding mixed use developments across the region, In this discussion we elaborate on: • What is the demand for residential in the East African market? • Does the high cost of construction make it unaffordable to own a house in East Africa? • Would Low cost residential developments be lucrative investments for the rising middle class? • Does the lack of affordable home loan solutions open the door to a lucrative rental market? • Are Governments offering any incentives for developing residential developments? • What kind of residential offering is in demand? Low cost housing, mixed use developments, social housing? 12:00 to 13:00 EAPI Closing lunch at the Kempinski 13:00-17:00 Site Tour-Two Rivers EAST AFRICA PROPERTY INVESTMENT SUMMIT 2015 Aneesa Arshad Founder and CEO Lamudi East & Southern Africa Dan Karua Managing Director Lamudi-Kenya Mustafa Suleimanji Country Manager Lamudi-Tanzania Shakib Nsubuga Managing Director Lamudi-Uganda 5

© Copyright 2026