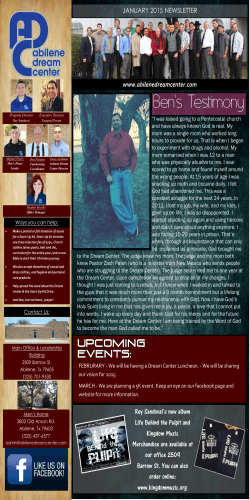

2015 Q1 Report