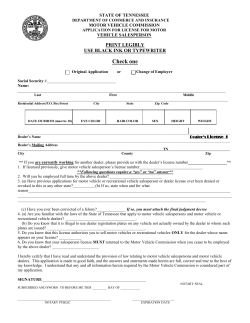

MOTOR VEHICLE DEALER AND MANUFACTURER