DTCU Services Welcome to DTCU

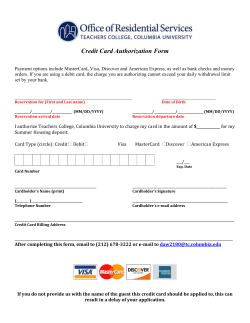

DTCU Services Serving members financial needs for over 80 years Welcome to DTCU Thank you for your interest in the Duluth Teachers Credit Downtown 11West2ndStreet Duluth,MN55802 218-722-9242 Union(DTCU).Welookforwardtobecomingyourexclusive Kenwood full-servicefinancialinstitution.DTCUwasfoundedin1933to 1358WestArrowheadRoad Duluth,MN55811 218-724-8218 serve the financial needs of the educational community of Duluth. Today DTCU has a community charter which allows anyone wholivesinSouthSt.Louis,CarltonorDouglasCountyorthe cityofTwoHarborstobeeligibleforcreditunionmembership. We offer both personal and business accounts along with a full array of lending products. Ournameremainsthesame,asdoesourcommitmentto personal, friendly member service. Look no further than DTCU for all of your financial needs and discover all that DTCU can Miller Hill 4433TrinityRoad Duluth,MN55811 218-279-DTCU(3828) Virtual Branch www.dtcu.net Audio Teller 218-722-9242 1-800-378-DTCU(3828) Downtown & Kenwood Office Hours Rick Lappi MONDAY-THURSDAY 9a.m.-5p.m. FRIDAY 9a.m.-5:30p.m. SATURDAY (Kenwood) 9a.m.-1p.m. President Miller Hill Office Hours offer you! MONDAY-FRIDAY 9a.m.-6p.m. SATURDAY 9a.m.-1p.m.(Drive-up) Serving everyone in the communities Honor Roll Savings / Checking Account EarnaspotonDTCU’sHonorRolland receive valuable benefits from DTCU. To qualify, have one of the following bundles of DTCU services: Share Savings DTCU’s Share Account is a no-fee savings account. When you open a DTCUShareAccount(withaminimum depositof $25),youautomaticallystart earning dividends on your account as a member/owner of DTCU. Once you’re a member, you’re welcome to use all of the services that DTCU offers. Gold Star Savings A plan specially designed for our youngestmembers, DTCU’s GoldStar Savings Account teaches children the value of a dollar and makes saving money fun! Children, from birth to 11 years old, receive a special Gold Star Passbookwhentheyopenthisaccount. Each time they make a deposit – small orlarge–theyreceiveaGoldStarfor their passbook. For every five Gold Starstheyearn,theychooseaprize.All thatisrequiredisa$5.00membership deposit to open and maintain this account. Plus kids receive a free piggy bank at account opening. Key Savings (Age 12 - 24 Years) DTCUhelpsKeyAccountholdersreach their savings goals. If you are between theagesof16and24youareeligibleto open a checking account that carries no monthly fees. Also, apply for a Debit MasterCard, a Share Secured DTCU VISACreditCardoropenanIRA. Merit Account (Money Market) Savings Earn higher interest on large-balance savings with DTCU’s Merit Account. This money market account offers tiered rates, meaning the higher your balance is, the higher the dividend rate you’ll earn. The minimum balance requirement for a Merit Account is $2,500. The minimum deposit to a MeritAccountis$100,andtheminimum withdrawal is $250. Dividends are posted monthly. IRA Share Savings DTCU’sIRAShareAccountrequiresno minimum deposit and no annual administrative fee. Your funds are insured separately from your other savingsaccountsforupto$250,000by the NCUA. Open a Ttraditional or RothIRAtoday. AnominimumbalanceChecking Account DebitMasterCard VISACard AnyLoanorLineof Credit ~or~ AnominimumbalanceChecking Account DebitMasterCard MoneyMarketAccountwithminimum $2,500balance Dream Account Savings DTCU’sDreamAccounthelpsyousave for your dream – whether it’s a longoverdue vacation, a new car or anything else – by keeping your money in an account separate from your Share Savings. You can have more than one dream account. Each one can be personalized with a name you choose and will show separately on your statement. When meeting either of these two criteria, “Honor Roll” status will show on your monthly statement and you will enjoy the following money saving benefits: •.50%off theinterestrateof collateral- Checking Account type loans for new and used cars and SignupforaDTCUCheckingAccount trucks or recreational vehicles (does and you’ll appreciate the savings. Our not include mortgage, signature or most popular checking plan has no variableratehomeequityloans.) minimum balance requirement and no •.50%morepaidoncertificates per-itemcharge.Therearenomonthly •Freechecks(onefreeboxperyear) maintenance fees. You also may apply •FreeVISAGiftCardpurchases for our other checking services, including a DTCU Debit MasterCard, Share Certificates Line of Credit, overdraft protection, DTCU offers many choices when direct deposit and more. investing in certificates. We offer terms as little as 6 months up to 48 months. Virtual Checking Rates are tiered based on how much Virtual Checking is a checking account money you use to open certificate. without the paper. Honor Roll members receive .50% Howitworks:CarrytheDTCUDebit above current rates. MasterCard. Carry a $50 minimum WealsoofferIRACertificateswiththe monthly balance. Enroll in direct deposit same rates and terms. Whether its (ifyourcompanyoffersit),signupfor short-term investing or investing for eStatements and enroll in Free Online retirement, DTCU has a certificate to VirtualBranchandFreeOnlineBillPay. fit you! Shouldyouneedtowriteapapercheck you are allowed four free paper check Christmas Club Savings clearings per month. A $1.00 check DTCU’sChristmasClubisanexcellent clearing charge will apply to any clearings way to save for gifts and holiday fun. over four in a month. With the DTCU There is no minimum balance debit card there is little need to write requirement. Your Christmas Club paper checks. funds are transferred to your regular savings account Oct. 31, for early Club Checking holiday shopping. This account is designed for nonprofit organizations that are DTCU members with a Share Savings Account. We recognize the important work you do in our community, so Club Account Checking offers all the benefits of RegularCheckingAccounts. “As a member of DTCU, you are also an owner.” s of Duluth, Hermantown and Proctor. Loans As a DTCU member, you can take advantage of competitive rates on all ourDTCUloans.Inaddition,wecharge simple interest, meaning you pay interest only on your unpaid balance, andyoupaynopenaltyforpre-payment. Quick and easy loan pre-approval is available so you will know how much you qualify for before making a purchase. The loans we offer include: MortgageLoans (10,15,20&30yearterms) LandLoans(100%financing) ARMLoans SecondMortgageLoans NewConstructionLoans HomeImprovementLoans HomeEquityLoans/LineofCredit New/UsedVehicleLoans* RecreationalVehicle(e.g.boat, ATV,RV)Loans ReadyReserve(noannualfee,use as overdraft protection on your checkingaccount) Additional Services and Benefits Virtual Branch Accessallofyouraccounts24hoursa day from your computer. DTCU’s VirtualBranchissafe,convenientandfree! Through our secure site, www.dtcu.net, you can review your account balances and history, transfer funds between accounts, make loan payments, make DTCUVISAcardpaymentsandmore! Signuponlineatwww.dtcu.net.Demo site is also available, go to Virtual Branch,thentoDemo. Mobiliti Accessyouraccountsfromyoursmart phonewithfreeMobilitiMobileBanking. TosignuplogontoVirtualBranchfrom our website then click on self service tab. Online Bill Pay Service www. t dtcu.ne Transfers You may transfer money between your accounts at any time. However, regulations make it necessary for DTCU toplacealimitof sixpre-authorizedor automatic transfers per month via telephone or the Internet, from a savings to a checking account. Direct Deposit eStatements SaveyourselfatriptotheCreditUnion with our safe and convenient Direct Deposit service. Any check you regularly receive, such as a paycheck or Social Security, can be automatically deposited into your DTCU savings or checking account. No more paper in your mailbox when yousignupforfreeDTCUeStatements! eStatementsareasecurefastwaytoreceive your credit union statement normally on the VISA Gift Cards first or second day of each month! Weofferanexcellentwaytogiveagift SignupforeStatementsonlineorwhen anyonecanenjoy!AVISAgiftcardcan you open your new DTCU account! beforanyamountrangingfrom$25to $1,000 and is good anywhere VISA is Audio Teller Service accepted. Access your account information by MakeDTCUyouronestopshopforgift phone. For your convenience, DTCU cards! offers a 24-hour audio teller service that allows you to check balances, VISA Travel Cards transfer funds between accounts, hear CarrytheVISATravelCardwhenyou which checks have cleared and more! travel and travel free from country Call (218) 722-9242 or 1-800-378restrictions! DTCU(3828). The travel card can be reloaded an unlimited amount of times. ® VISA Credit Card DTCU offers instant issue or we can Enjoy the purchasing power and order you a personalized travel card at convenience of the card that’s honored no additional cost. worldwide with the following DTCU advantages: no annual fee, a low APR, Maximum load at purchase is $5,000 and our ScoreCardSM Rewards proandmaximumreloadamountis$2,000. gram. For every dollar spent on qualified purchases, you’ll receive points that Safe Deposit Boxes Looking for a safe place to store can be redeemed for airline travel, important papers and valuables? Look hotels and merchandise. Plus, DTCU no further than a safe deposit box at VISA card holders receive free of DTCU. They’re available at our charge the added security of Verified by Downtown and Kenwood offices. Safe VISA, which protects you from unaudeposit boxes are secure, convenient thorized online purchases, as well as and affordable, and come in a variety of Travel AdvantageSM benefits, offering sizes to accommodate everything from protections and assistance when you’re important personal or business away from home. documents to family heirlooms. DTCU ATMs DTCU has three ATMs which you can access at any time to get cash. Use your DTCU Debit MasterCard to get cash and you will not pay any transaction fee. AnATMislocatedateachoffice. This simple system handles all of your paymentsonline,automatically.Setitup Debit MasterCard DTCU’sDebitMasterCardisreallytwo and never worry again about stamps, cardsinone!UsethiscardatanyATM Scholarships envelopes or late fees. Go to www. to get cash from your account, or use it DTCU awards scholarships each year dtcu.netanddlickonVirtualBranchto to make purchases anywhere to area high school seniors moving on signupforBillPay. to college. MasterCardisacceptedworldwide.All transactions will come directly out of Applicationsandeligibilityrequirements your DTCU checking account. can be downloaded from our website. DTCU Business Services Business Savings / Checking Accounts Business Savings Startyournewbusinessaccountwitha Business Savings Account. $25.00 is all that is needed to start your new account, andtherearenomonthlyfees.Oncethis account is opened you are eligible for all business products DTCU offers. Business Checking Run your business financing with ease with a Low Cost DTCU Business CheckingAccount.Nominimumbalance required and free online access to stay connected with your business account. Business Checks & Accessories DTCU offers quality business checks, accessories and deposit solutions with superior service to help you simplify the check selection process. Credit and Debit Business Revolving Line of Credit A Business Line of Credit will protect your business’ cash flow and automatically advance into your checking account should your balance ever fall below zero, eliminating costly overdraft fees and returned checks. VISA® Credit Card Putthepurchasingpowerinyourhands withtheDTCUVISACard.Nomonthly service charge and a 25-day grace period, along with our low annual percentage rate. As an added bonus, you are automatically enrolled in the VISA Scorecard program. For each dollaryouspendyouearnaScorecard point. Redeem points for airline travel or valuable gifts. Debit MasterCard Loans Business Loans We know businesses come in all shapes and sizes and so do business loans. From equipment or a vehicle to run your business to remolding projects, DTCU will look at each loan individually and work with you to find the loan that best fits your business needs. Additional Services • OnlineBillpay • NightDepository • ATMon-site(allthreeDTCUoffices) • Freemoneybagtotransportdeposit money • NotaryPublic • Currencyandcoindeposits • Currencyandcoinorders • SafeDepositBoxes DTCU’sDebitMasterCardisreallytwo cardsinone!UsethiscardatanyATM to get cash from your account, or use it to make purchases anywhere MasterCardisacceptedworldwide.All transactions will come directly out of your DTCU checking account. ww Business Processing Services DTCU’s Business Account Program is ideal for Sole Proprietorships, Limited Liability Companies (LLC), Corporations, Partnerships, and Not For Profit Organizations. Additional Free Services NightDepository Direct Deposit NotaryPublic DTCU has teamed up with a local vendor to supply you with the right tools to process your business’ card transactions. You can also set up desktop deposit, smart phone merchant processing and personalized gift cards. They can even help you with payroll processing for your business. Acustomsolutionwillbedesignedtofit your specific business needs. You will receive local one-on-one service and 24/7assistance. (A service offered through Heartland Payment Systems) Optional Services You may obtain the following DTCU services for a minimal fee: PhotocopyofDraft StopPaymentOrder Wire Transfer Draft Reconcilement InternationalMoneyOrder StatementCopy Certified Check VISA® Gift Card Easily manage all of your business bills in one place with DTCU’s bill pay service. NCUA Insurance Your accounts are federally insured up to $250,000 by the National Credit Union Administration (NCUA). It is possible for you to obtain additional insurance coverage on multiple accounts.

© Copyright 2026