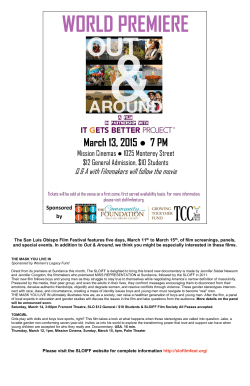

View More Details - Entertainment One