Understanding Price Elasticity to Drive Portfolio Profit

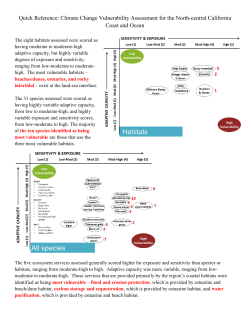

EXECUTIVE WHITEPAPER Understanding Price Elasticity to Drive Portfolio Profit In today’s challenging lending environment, setting prices to optimally balance customer demand and lender profitability is critical. Lending institutions that understand and utilize consumer sensitivity to price will be in a better position to increase consumer response and product usage to drive portfolio profitability. “To make profitable decisions a lender needs to understand how consumers value its offerings. Despite the substantial impact that price has on profit, it is surprising that many lenders do not have analytic solutions that directly classify customers based on price sensitivity.” ------Dr. Robert Phillips Nomis Solutions, Founder, Chief Science Officer & Vice President, Research & Development Professor of Professional Practice in the Decision, Risk and Operations Division, Columbia University EXECUTIVE WHITEPAPER Executive Summary Background In today’s challenging lending environment, setting prices to optimally balance customer demand and lender profitability is critical. Despite the substantial impact that price sensitivity has on profit, we find that many lenders do not have analytic solutions that directly classify customers based on price sensitivity --hampering their ability to target promotions and pricing programs in a way that both meets customer needs and maximizes expected profitability (See Figure 1). Lending institutions that understand and utilize consumer sensitivity to price will be in a better position to increase consumer response and product usage to drive portfolio profitability. While risk and response scores are commonly used tools, they do not isolate and predict individual sensitivity to price. Strategies that utilize only these scores result in lost profit opportunity. Predicting consumer level price sensitivity to credit offerings is complex. Analytic estimation of price sensitivity at an individual level requires highly sophisticated statistical techniques. Furthermore, accurate estimation of price sensitivity should be based on data derived from a variety of products, lenders and other sources. The Nomis Score™ provides a customer-level estimation of price sensitivity that can be efficiently integrated into acquisition, origination and customer management strategies. Based on credit file and other readily available data sources, the score capitalizes on Nomis Solutions’ unique pricing experience and research data to produce a price sensitivity score that is robust across product, channel and lender. The score captures predictive interactions distinct from those captured by risk or response scores and, when properly calibrated, can be used to estimate the change in demand resulting from a change in price. To make profitable decisions a lender needs to know how customers value its offerings, reputation and brand relative to the competition. Most lenders use a risk score to understand the variation in riskiness among potential borrowers. Other, more analytically sophisticated lenders, such as credit card issuers apply complex champion/challenger testing to understand the overall response of consumers for particular products. However, in our experience, most lenders have devoted less analytic attention to understanding customer price sensitivity. www.nomissolutions.com -2- EXECUTIVE WHITEPAPER Nomis Solutions developed the Nomis ScoreTM in order to help lenders better understand the price sensitivity of their existing customers and prospects. The Nomis Score is an individual price sensitivity score – that is, it is a number that measures the relative sensitivity of an individual to the price of credit. Individuals with higher Nomis Scores are more sensitive to the price of a credit product than individuals with lower scores. The Nomis Score can be used to segment customers based on price sensitivity or to more directly estimate the change in response to a change in price in order to develop more refined and profitable strategies for prospecting, acquisition and retention. Experience has shown that using the Nomis Score can increase the profitability of credit products by 10% - 20% or more. This paper describes the basic concept of price sensitivity and the properties that make this amenable to a broadbased scoring approach as well as an overview of how the Nomis Score is calculated. It then discusses how the Nomis Score can be used to segment customers to support pricing decisions across the customer life cycle, and how the Nomis Score can be leveraged to improve the profitability of credit offerings. What is Price Sensitivity? It is hardly news that consumers are sensitive to prices. For the vast majority of products and services, increasing the price will result in fewer units sold. Typically, the dependence of demand on price can be represented by a continuous downward-sloping price-response curve such as the one shown in Figure 2. A market price-response curve such as the one in Figure 2 is an aggregation of independent decisions made by many different customers. An individual customer will purchase from a seller if the price is sufficiently low or, if the price is too high, he will either purchase from another seller or not purchase at all. As the price is changed, the population of customers who will purchase also changes, with more customers purchasing if the price is low. While customer price sensitivity is ubiquitous across all consumer markets, we are interested in the specific case of consumer lending. Despite the complexity of some loan offerings, the fundamental principles of price sensitivity operate the same in lending markets as they do elsewhere. Namely, holding everything else the same, reducing the price of a loan will result in a higher response and vice versa. This is true whether the price is reduced by lowering the APR or by lowering fees or by some combination of both. In what follows, we will refer to “APR” or “rate” as the “price” of a loan with the understanding that the same variation in response will hold for other elements of loan price as well, while ‘response’ will be used as a generic measure of the change in consumer demand. At heart, individual price sensitivity is a measure of the extent to which a customer weights price relative to other characteristics in choosing a credit product. Some individuals are extremely price sensitive and will spend considerable time and energy searching for a loan at the lowest possible APR. At the other extreme, there are individuals for whom price is not the critical factor in choosing the credit product. These borrowers are more interested in such factors as convenience, lender identity and reputation, rewards and brand. Note that these differences hold true even after we adjust for the riskiness of the consumer for whom the availability of credit will play a role in their price sensitivity. While a response score captures the overall response level of a segment of customers, it provides no information on which customers would change their response if the lender changed its price. This is the purpose of the Nomis Score. www.nomissolutions.com -3- EXECUTIVE WHITEPAPER The Nomis Score and Consumer Demand Consider a population of potential borrowers. If we offer all of the prospective borrowers the same product at the same rate then we would expect response to the offer to follow a price-response curve such as the one shown in Figure 3. One way to think about such a price-response curve is that it is the result of a distribution of maximum willingness-to-pay (W.T.P) for loans over the population (Phillips, 2005). As an example, assume that Acme Bank offers unsecured consumer loans of $10,000 at a single rate. It is reasonable to expect that each successful applicant has a “ceiling APR” – or maximum willingnessto-pay – such that they will accept the loan if the APR quoted by Acme Bank is lower than their ceiling APR and they will not take the loan if the quoted APR is higher. If every borrower had the same maximum willingness-topay – say 5%, then all of the customers would take the loan if Acme’s quoted rate were 5% or lower and none of them would take the loan if the quoted rate were greater than 5%. This would correspond to a case of “perfect competition”. However, in reality, there is always variability in the W.T.P among borrowers in a population and W.T.P can be modeled as a random variable with a normal distribution as shown in Figure 3. For example, potential borrowers for the $10,000 from Acme Bank might have a W.T.P. distribution with a mean of 5% and a standard deviation of 2.5. Thus, if Acme Bank sets its rate at 5%, half of its applicants – those with willingness-to-pay above 5% -- will take the loan. If it raises its rate to 7.5%, then only 16% of applicants will accept its loans. If it lowers its rates to 2.5%, then 84% of applicants will accept its loans.1 In general, if the bank offers a rate of y%, the fraction of applicants that will accept its offer will be 1-Θ [(.01y.05)/.25] where Θ[x] is the standard cumulative normal distribution function. Now, assume that the lender used the Nomis Score to segment the population. For simplicity, let us assume that the lender creates just two segments: “high-price sensitivity” customers and “low-price sensitivity” customers. Note that the price sensitivity of the population is related to the standard deviation of the W.T.P distribution – a population with a lower standard deviation is more price sensitive than one with a higher standard deviation in the sense that demand falls off more quickly as the price is increased. In other words, this population will have a smaller standard deviation, while the “low price-sensitive” population will have a higher standard deviation. This illustrates a critical difference between price sensitivity and response: price sensitivity is a measure of the rate at which demand changes as a function of price while response is a measure of absolute demand. In Figure 4, both distributions demonstrate the same level of demand at an APR of 5%; however demand changes much more quickly as a function for the price when the standard deviation is 1% than when it is 5%. 1 We note that the acceptance percentages can be calculated using the fact that the probability that a normally distributed random variable will be within one standard deviation of the mean is 68%. Because the normal distribution is symmetric about its mean, there is a 16% chance that the random variable (here, willingness to pay) will be more than one standard deviation higher than the mean. In this case, the mean is 5 and the standard deviation is 2.5, so the offered rate of 7.5% is one standard deviation above the mean. Similarly, there is an 84% chance that willingness-to-pay will be higher than 2.5%,the which is one standard deviation below the Specifically, “high-price sensitivity” segment willmean. www.nomissolutions.com -4- EXECUTIVE WHITEPAPER demonstrate price response in accordance with priceresponse curve A and the “low-price sensitivity” segment will demonstrate price response in accordance with curve B. Acme Bank could use this information in a number of different ways. For example, assume the bank plans to offer two different products– one with a higher rate but an enhanced points program and one with a lower rate and a standard points program. Then it should offer the higher rate card to the less-price sensitive segment and the lower rate to the higher price-sensitive segment. By doing this, it can increase both take up and profitability relative to, say, targeting products based solely on risk score or offering both products to all customers. Value of a Broad-Based Price Sensitivity Score The Nomis Score is a unique measure of the relative price sensitivity of an individual consumer to credit prices. The viability of the Nomis Score is predicated on four properties of price sensitivity: 1. Customers differ in terms of their price sensitivity for lending products. Some customers are highly sensitive to the price of a loan – others are less sensitive. 2. The price sensitivity of individual customers is statistically stable over time and over transactions – that is, a customer who demonstrates a high-level of price sensitivity in one transaction is highly likely to demonstrate a high level of price sensitivity in a future transaction. 3. Ordinal price sensitivity holds across lending products and channels. That is, if customer A was more price-sensitive than customer B in choosing a home-equity loan, then customer A is likely to be more price-sensitive than B in choosing a credit card. Similarly, if customer A was more price-sensitive than customer B in choosing a loan through an on-line channel, they will also be more price-sensitive in choosing a loan when shopping at a branch (even though the average price sensitivity of on-line customers may be higher than the average price sensitivity of in-branch customers). 4. The relative price sensitivity of two customers can be estimated from information available in a standard credit file supplemented with demographic information and historic pricing transaction data. Nomis experience and research has found that these four properties hold true across a wide variety of lending products, channels, and geographies. The first property is non-controversial – the fact that customers vary in their willingness-to-pay for loan products is reflected in the fact that lending markets support a wide range of price variation. The second property – the stability of individual price sensitivity – is also not surprising. Indeed it is consistent both with the experience of other retail industries as well as the experience of credit rating agencies. Stability reflects the fact that the Nomis Score is measuring an underlying element of customer behavior that does not change quickly over time. Note that this does not mean that price sensitivity never changes. For example, events that result in a change in a person’s financial situation and their need and desire for credit – e.g., a better job or the birth of a child – will result in changes in price sensitivity that will be captured in the score the next time that it is calculated and so it is important to obtain the freshest score www.nomissolutions.com -5- EXECUTIVE WHITEPAPER The third property – the independence of individual price sensitivity from product and channel – is related to the second. Namely, it is another way of stating that there is an element of price sensitivity that is idiosyncratic and independent of the details of any specific transaction. Mathematically, it means that the personal element of price sensitivity can be separated from the underlying characteristics of a particular channel or product. We have called this the “decomposition principle”. For example, customers applying on-line for a loan tend to be more price sensitive (all else being equal) than those who apply in a branch. Nonetheless, we find that the Nomis Score effectively ranks the relative price sensitivity among customers who are applying through different channels. In essence, the Nomis Score “decomposes” individual differences in price sensitivity from the underlying characteristics of the product or branch. The fact that price sensitivity can be estimated using credit file data is also not surprising – such data incorporates a rich record of financial transactions and current financial position. It is also very useful from two additional points of view. First, such data is readily available and already leveraged by lenders for most credit decisions and is accepted as being regulatory compliant for credit decisions. Secondly, the use of this data in price sensitivity scoring means lenders can segment customers on price sensitivity using the same underlying data that they would use for underwriting or for “riskbased pricing”. We note that the four properties of price sensitivity listed above also hold for “customer riskiness” – which is why credit-bureau based risk scores are such an effective and ubiquitous approach to segmenting customers. Like price sensitivity, “riskiness” is an individual characteristic that varies among borrowers, is largely stable over time for a particular borrower, has a component that is product and channel independent, and can be estimated using credit file data. In both instances, developing the scores based on representative samples of consumers with credit files (as opposed to those in the particular market niche of the lender) provides a breadth of perspective that adds value over and above lender-specific risk models. However, the development of a broad-based price sensitivity score also requires access to pricing data across a variety of industries and products. Developing the Nomis Score Leveraging our deep pricing experience, the Nomis Score was developed using predictive information from the potential borrower’s credit file along with other demographic data (if available). This was combined with performance data based on Nomis’ proprietary research data that includes information on price points and consumer reaction for a variety of products, lenders and channels. The specific mathematical formulae and variables used to calculate the Nomis Score are based on an extensive set of historical regressions to determine which variables, under what transformations, and in which combinations are most predictive of customer price sensitivity. In order to isolate the consumer aspect of price sensitivity, it is essential to include data from many different products, channels and lenders. The final model identifies those specific customer characteristics that are the strongest determinants of price sensitivity and is used to estimate a score based on these characteristics. The Nomis Scoring Model calculates a Nomis Score between 200 (low sensitivity) and 800 (high sensitivity) that measures the relative price sensitivity of the borrower. In the sense of rank ordering consumers, the Nomis Score is analogous to a risk score. In both cases, the consumers’ relative rank ordering of performance (risk or price sensitivity) will hold true regardless of product, lender or channel, while the exact performance will vary depending upon these exogenous factors. However, unlike a risk score, which estimates the expected probability of default, each Nomis Score band represents an entire price-response curve that reflects the change in demand corresponding to a change in price as opposed to a single estimate of default. We note that developing a price sensitivity score such as the Nomis Score is significantly more complicated than developing a “response score”. Price sensitivity is proportional to the derivative of response with respect to price. For that reason, it requires substantially more data www.nomissolutions.com -6- EXECUTIVE WHITEPAPER to derive a price sensitivity score than it does a response score. And, while a response score is, by its nature, specific to a set of product/channel/lender attributes, a broad-based price sensitivity score must be based on experience from a wide range of different products, channels, and lenders. Development of a price sensitivity score is further complicated by another difference between response and price sensitivity. With a response score, the predicted response for two different customers will always have the same relative ordering of response. However, with the Nomis Score, highly price sensitive customers will be less responsive than less price sensitive customers to unattractive offers but more responsive to more attractive offers. between the two is positive with r2 = .35. This means that the variation in risk score only explains about 35% of the variation in Nomis Score within this population. The remainder of the variation in price sensitivity is independent of risk score. As can be seen in the figure, a high fraction of customers have a high risk score and a low Nomis Score and vice versa. This means that the Nomis Score will add additional value when used in conjunction with a risk score to create customer segments based both on price sensitivity and on risk. The Nomis Scoring Model changes over time, for two reasons. First of all, Nomis continually performs research to improve the accuracy of the Nomis Scoring Model. As improvements are discovered, they are incorporated into the model. Secondly, changes in the macroeconomic environment over time lead to changes in price sensitivity. Obtaining the freshest score available will result in scores that more accurately predict price sensitivity on a forward-looking basis. The Nomis Score can be used directly to segment customers based on their price sensitivity by adding the score as an additional dimension to an existing pricing strategy. However, when product, channel and lender attributes are available, Nomis can calibrate the score to provide more specific estimates of the price-response curve for the various Nomis Score bands. Nomis Score and Risk Today, many lenders use risk as a surrogate for price sensitivity. To some extent this is true, due to the fact that riskier customers have fewer options and are therefore, in general, less price sensitive. However, Nomis research has shown that price sensitivity is only weakly correlated with riskiness. Figure 5 shows a graph of Nomis Score as a function of risk score for a random population of credit card applicants. The correlation Using the Nomis Score The Nomis Score provides a statistically accurate and stable measure of relative individual price sensitivity. It can be used to guide segmentation decisions so that customers will receive the offers that are most suited to them. This will result in higher profitability – both through increased take-up or usage, as well as from more profitable offers. First consider an acquisition campaign. The Nomis Score can be used to guide pricing decisions, offering the best price point to prospects with higher Nomis Scores and higher rates to consumers with lower Nomis Scores. The Nomis Score can also be used for origination decisions in a de-centralized lending environment, for example in the Auto industry. Here, the Nomis Score can be used to www.nomissolutions.com -7- EXECUTIVE WHITEPAPER determine the magnitude of pricing discretion that should be allowed by dealers or branch personnel. Finally, the Nomis Score can be useful in segmenting customers’ price sensitivity for a variety of customer management decisions such as offering a competitive price to customers more likely to attrite in a mortgage portfolio, or determining how much to increase or decrease the price of a revolving loan to in order to increase utilization while maximizing profitability and reducing likelihood of attrition. As noted above, the price sensitivity of a customer in a particular situation depends not only on his idiosyncratic price sensitivity as measured by the Nomis Score but also on other factors such as the type and size of loan under consideration, the customer channel, the risk, previous relationship with the offering lender, etc. Using the Nomis Score in conjunction with your other existing attributes (risk and response scores for example) provides opportunity for optimal customer assessment and offer creation. The Nomis Score, by itself, captures only the differences in underlying individual price sensitivity – it does not capture differences in price sensitivity due to product, channel, or relationship influences and therefore cannot be translated directly into a “price-elasticity” or “response probability” for a particular transaction. It can, however, be used as an input to the Nomis Price Optimizer or other optimization tools to provide a more accurate estimate of price elasticity for a segment, and hence better recommendations regarding prices to offer. In practice, if supplemental information about the loan product, channel, and prior customer relationship is provided to Nomis by the user, the score ranges can be translated directly into a “price-elasticity” curve or a “response probability” curve for each Nomis Score segment. These curves can be used to drive particular targeting or pricing decisions and/or provide insight into how loan prices should vary among channels or among different loan products. Price Sensitivity Scoring and Consumer Protection The growing focus on consumer protection in financial services requires that banks and finance companies offer products that are suitable, transparent, and competitively priced. Increasing transparency and standardizing terms and conditions of loan products will make lending markets more price-competitive which will benefit consumers. However, as the Nomis Score has shown, not all consumers are equally price sensitive and differences in price sensitivity are driven by real preferences for brand, access, service, product features, relationship and other aspects of the overall value proposition. The Nomis Score allows banks to determine which customers value differentiated products and benefits, and are willing to pay for these differentiated benefits. Consumers who are very price sensitive care less about product features and will prefer a competitively priced low-frills offer over a premium-priced offer with additional benefits. Conversely, consumers with low price sensitivity may prefer premium products and be willing to pay for the additional benefits and features offered. Using the Nomis Score allows banks to target higherpriced premium products to the customers who value the additional features and are willing to pay for them while targeting lower-priced standard products to customers who are driven primarily to price. This enables lenders to better target the “right product” to the “right customer” at the “right price thereby satisfying consumer financial protection and “Treating Customers Fairly” guidelines. www.nomissolutions.com -8- EXECUTIVE WHITEPAPER Nomis Score Case Study A top-tier North American credit card issuer was interested in growing receivables from existing customers through a balance transfer campaign. However, they realized they needed a new approach to targeting in order to increase both response rates as well as average size of balance transferred. The card issuer’s existing approach consisted of segmenting customers based on risk, historical behavior and their likelihood to respond to an offer based on a custom response score. This segmentation was used to test potential ‘teaser’ and ‘go-to’ rates based on competitive offerings in the marketplace at the time. Customers in each segment were randomly assigned one of three price points, all of which were competitive relative to the marketplace. This strategy was the control or ‘business as usual’ approach. While this approach provided a segmentation scheme, it provided no information on how customers within each segment were likely to react to a change in rate. In an attempt to improve performance, Nomis worked with the issuer to develop a ‘Nomis Score strategy’ which incorporated the Nomis Score as an additional segmentation variable to determine the rate to offer. Since the primary objective of the issuer was to increase receivables, the high Nomis Score segment (those most price sensitive) were offered the most attractive rate, the low Nomis Score segment was offered the least attractive rate and the medium segment was offered the medium rate (See Figure 7). The ‘average’ rate was the same in both strategies. Once the two strategies were developed, customers were randomly assigned to either the ‘business as usual’ or the Nomis strategy. By identifying the highly-price sensitive customers, the Nomis Score strategy enabled the bank to more effectively align the interest rate offer with their customers’ value for price and therefore achieve their objectives of maximizing receivables. Offering the best rate to the most price sensitive group of customers allowed the issuer to significantly increase both response rates and average balance transferred, resulting in a 20% increase in receivables and a ~10% increase in profit. The Nomis Score strategy returned an additional $35MM in receivables for every 1MM customers mailed. Conclusion Understanding the value a consumer places on price relative to other product attributes can have a significant impact on a lenders’ profitability. The Nomis Score provides a unique tool to enable lenders to segment prospects or customers by their price sensitivity independently of product, channel, or previous customer relationship in order to make more profitable targeting, acquisition, and retention decisions. This broad-based score is calculated on readily available data, and can be quickly and easily integrated into existing strategies to improve pricing decisions. www.nomissolutions.com -9- EXECUTIVE WHITEPAPER References About Nomis Solutions Phillips, R. L. (2005) Pricing and Revenue Optimization. Stanford University Press, Stanford, CA Nomis Solutions enables best-in-class Pricing and Profitability Management for financial services companies. Through a combination of advanced analytics, innovative technology, and tailored business processes, the Pricing and Profitability ManagementTM Suite delivers quick time-to-benefit and improves financial and operational performance throughout the customer acquisition and portfolio management processes. Visit www.nomissolutions.com or contact us at [email protected] or 650-588-9800. www.nomissolutions.com - 10 -

© Copyright 2026