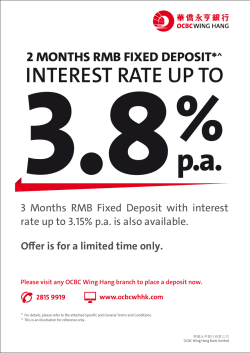

Annual Results for the Year Ended 31 December 2014