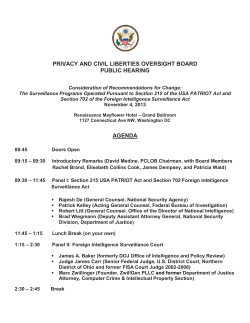

Now - Evidence Exchange

3/16/2015

How Secure Is Your Company’s EDiscovery Program? | The Metropolitan Corporate Counsel

How Secure Is Your Company’s EDiscovery Program?

Monday, March 16, 2015 10:46

AlixPartners LLP

David J. White

Matthew Cohen

It is difficult to look at a newspaper these days

without seeing at least one article disclosing a

major data breach, and it’s no wonder that

corporate executives and counsel are scrambling

to secure their environments and avoid

becoming the next headline. To this end,

companies are cataloging information assets,

auditing access controls, testing firewalls, and

reviewing privacy and security programs as a David J. White

whole. After the Target breach implicated the

Matthew Cohen

company’s HVAC services vendor, many companies started reviewing thirdparty contractual

arrangements and access control policies. The Home Depot breach also started with a hacked

vendor, further increasing scrutiny of vendor access rights. One area that hasn’t received

much attention, however, is the downstream transfer of corporate data in connection with

litigation and regulatory matters to ediscovery vendors, outside counsel, experts and

opposing parties.

As holders of the company’s most valuable and secret documents, legal departments are a

prime target for hackers. At the heart of any legal matter are the documents that have been

gathered for the purpose of asserting or defending the claims and for disclosure in discovery,

and in a typical litigation or regulatory investigation, many are central to the company’s

operations, including employee and customer personally identifiable information (PII),

company financials, intellectual property, confidential agreements, deal papers, transactional

records, and other highly sensitive and proprietary information. More importantly, the legal

department usually has the authority to override the company’s security controls, allowing it

to investigate and gather records from highly secure systems and extract that data for use in

legal matters. The downstream storage, use and sharing of this extracted information presents

one of the biggest security gaps in many companies, yet it often goes unchecked.

The discovery lifecycle involves many parties. Once collected from its original source,

information is often copied to mobile media and transported for processing and review by

outside ediscovery vendors and/or outside counsel. In preparation, copies may be held in

staging areas on a file server or on storage area networks (SANs) or network attached storage

(NAS) within the company. Because staging areas generally are not set up to store sensitive

data, they are not as secure as the original data sources. Once collected, data is often shipped

http://www.metrocorpcounsel.com/articles/31977/howsecureyourcompany%E2%80%99sediscoveryprogram

1/5

3/16/2015

How Secure Is Your Company’s EDiscovery Program? | The Metropolitan Corporate Counsel

using common carriers. While it’s easy to ensure portable media are encrypted before

transport, this isn’t always done due to time or resource constraints or simply a lack of

training or awareness. Further, some media, like legacy backup tapes, can’t be encrypted and

must instead be physically secured and properly transported.

Protecting Information Prior To Production

Correcting these security gaps before the data leaves the company’s custody is easily

accomplished by mapping the flows and implementing policies to close the holes through

encryption, anonymization and access controls. However, protecting the data once it is in the

hands of others is more difficult. And there are many hands, including ediscovery and data

restoration vendors, the company’s own expert witnesses and outside counsel, opposing

counsel and their witnesses and vendors, governmental agencies, and various courts and

tribunals, just to name a few. For example, in labor and employment class actions, defending

companies often collect the PII of tens of thousands of employees. This data remains

vulnerable to hackers at each handoff or delivery, both in transit and while at rest in the hands

of each party in the chain. How do you control the security practices of these actors and

ensure that data is properly disposed of at the close of the matter?

Dealing with vendors, experts and attorneys with whom you have a contractual relationship is

the easiest. These contracts should ensure that outside parties are legally obligated to

adequately protect the company’s data and are fully liable for loss or inadvertent disclosure,

and that the company has the right to audit and enforce these requirements. Reviewing their

security practices and certifications should include independent thirdparty testing and

certification. While disclosing test results will be a security concern, vendors should be

comfortable disclosing executive summaries that describe testing methods and an overall

“rating” when requested. The goal is to make sure the service provider’s security meets or

exceeds regulatory requirements within your industry, or at least meets appropriate standards

for the data being handled. Anything less poses too much liability for the company.

Ensuring that vendors have adequate security programs isn’t just good practice, its likely

required by law for many companies. For example, the U.S. Department of Health and Human

Services’ HIPAA Omnibus Final Rule clearly places the responsibility for data privacy and

confidentiality on the covered entity, meaning the data owner, even as the data moves

downstream to outside vendors. Similarly, in a recent examination priorities letter, FINRA

reminded firms that

[O]utsourcing covered activities in no way diminishes a brokerdealer’s responsibility for

1) full compliance with all applicable federal securities laws and regulations, and FINRA

and MSRB rules, and 2) supervising a service provider’s performance. Outsourcing will

be a priority area of review during 2015 examinations, and will include an analysis of the

due diligence and risk assessment firms perform on potential providers, as well as the

supervision they implement for the outsourced activities and functions.

Further, the SEC's new guidance requires that companies disclose not only material

cybersecurity events when they occur but also potential material risks. When outsourced

functions carry material risks, the guidance requires a description of the functions and how the

company manages the associated risks. When a company suffers a data loss in this context, a

material issue may need to be disclosed or, further, may give rise to a shareholder claim that

http://www.metrocorpcounsel.com/articles/31977/howsecureyourcompany%E2%80%99sediscoveryprogram

2/5

3/16/2015

How Secure Is Your Company’s EDiscovery Program? | The Metropolitan Corporate Counsel

the company should have disclosed the (now apparent) material risk before the incident

occurred. The best defense in such circumstances is the company’s due diligence in selecting

the vendor and vetting its security certification.

Given these fiduciary and legal obligations, corporate counsel cannot be expected, nor do they

have the means, to independently verify every outside partner’s security programs. Reliance

upon independent thirdparty certification is the only viable solution, and service providers will

have to keep up with prevailing certifications in today’s evolving markets, or risk losing their

client base. The biggest challenge for service providers has been

choosing which certification(s) meet their client’s

regulatory needs and unique legal requirements,

each of which also takes considerable time and

money to measure against. For example, it could

potentially cost several million dollars and take one

to two years to complete the design and

implementation of a security policy and necessary

procedures to meet banking industry standards, such

as SSAE 16 SOC 2, the Service Organization Controls

("SOC") framework established in 2011 by the

American Institute of Certified Public Accountants.

Furthermore, these requirements are similar to but

not the same as HIPAA requirements, which require

either an independent HIPAA audit against the OCR

HIPAA Audit Protocol or measurement against the

FedRAMP or NIST 80053 standards. Therefore a

SOC 2compliant service provider cannot

automatically tell healthcare clients that it also meets

healthcare industry standards; it must go through a

separate process, again at great cost. Looking to

overcome these issues for all companies with sensitive data, the White House released the

Cyber Security Framework (CSF) developed by the National Institute for Standards and

Technology (NIST) in 2013. Initially set up as a voluntary framework only for businesses that

operate as part of the country’s critical infrastructure, the CSF has become the defacto

measurement standard for many cyberinsurance carriers and courts considering liability,

making it mandatory for industries in and out of the critical infrastructure.

Importantly, the NIST CSF is not a certification, nor does it mandate specific controls or

requirements, but rather is designed to initiate discussion about how to manage risk. It is also

purely a U.S. construct and not recognized internationally. Therefore, vendor practices that

are consistent with the NIST framework may be insufficient. In response, leading vendors are

investing in certification against the International Standards Organizations (ISO) family of

cybersecurity standards revised in 2013, commonly called ISO 27000. Recognized globally,

these standards outline hundreds of potential controls and control mechanisms. For example,

ISO 27001 defines how to implement, monitor, maintain and continually improve the

organization’s information security management system. It reaches well beyond NIST and

focuses on protecting all types of information, not just information stored or processed in IT

http://www.metrocorpcounsel.com/articles/31977/howsecureyourcompany%E2%80%99sediscoveryprogram

3/5

3/16/2015

How Secure Is Your Company’s EDiscovery Program? | The Metropolitan Corporate Counsel

systems. Also, unlike the NIST Cybersecurity Framework, ISO 27000 clearly defines which

records are needed for certification, and what minimum standard is to be implemented.

Finally, ISO 27018 establishes commonly accepted control objectives, controls and guidelines

for implementing measures to protect PII. These controls enable vendors to make two

important commitments: first, to establish defined policies for the return, transfer and secure

disposal of PII and, second, to proactively disclose the identities of subprocessors and inform

the customer if data is ever requested by law enforcement agencies. For these reasons, ISO

27000 is quickly becoming the mandatory standard for measuring service providers, though

due to its relative newness and the time required to certify all operations, many are still in the

process of independent certification.

Protecting Information After It Has Been Produced

It is much more difficult to protect information produced to adverse parties, tribunals and

downstream entities, such as their vendors and experts, with whom you do not have

contractual relationships. Traditionally this is dealt with through the meetandconfer process

or other negotiations aimed at securing binding agreements to protect transferred data. Court

orders may be sought when agreement is not forthcoming. Counsel should ensure that any

obligations imposed by a stipulated or courtmandated protective order extend to each party’s

datasharing partners. In fact, doing so may be required in crossborder discovery involving

information regulated by countries with strict data privacy laws. The catch here is that while

you, as the producing party, may be able to obligate receiving parties to protect your data as

if it were their own, there are presently no mechanisms to audit or otherwise ensure those

obligations are being met. While parties may have postdisclosure recourse, they have

virtually no power to manage the risks of inadvertent loss. We know of no matter where a

litigant has successfully resisted the production of discovery on the basis of a vendor’s

inadequate substantiation of data protection capabilities or its refusal to allow an audit of its

security practices. Until certification becomes more common and expected, this conundrum

will persist.

Additionally, protective orders should include provisions for the final disposition of information

from all downstream participants at the close of the matter, and counsel on both sides should

follow through. They should also cover any derivative works and provide for written

certification that the data was either securely destroyed or that it has been returned to the

producing party, including copies made for disaster recovery purposes. Similar efforts should

be made to clean up data held by your own service providers, which may still be sitting on

corporate staging areas or otherwise held outside of routine retention schedules by custodians

or system stewards.

Conclusion

In leaving these issues unresolved, the legal department can present a gaping hole in

corporate data security programs; however, closing the gap is relatively easy. Counsel simply

needs to consider the entire lifecycle of discoveryrelated information and establish proper

security measures at every stage. They should take time upfront to decide what level of

protection is deemed adequate for their industry and for the type of information they are

handling, and to properly vet service providers. The cost of doing so is extremely small

compared to the reputational and financial costs of a data breach.

http://www.metrocorpcounsel.com/articles/31977/howsecureyourcompany%E2%80%99sediscoveryprogram

4/5

3/16/2015

How Secure Is Your Company’s EDiscovery Program? | The Metropolitan Corporate Counsel

David White is a director at AlixPartners LLP, where he advises clients on information

governance, information security and electronic discovery. Matthew Cohen is a managing

director at AlixPartners, where he colead’s the firm’s global electronic discovery practice and

advises clients involved in regulatory investigations and litigation. Please email the authors at [email protected] and [email protected]

with questions about this article.

Disclaimer • Privacy

The Metropolitan Corporate Counsel, Post Office Box 1399, Mountainside, NJ 07092.

Contact us at [email protected] © 2015The Metropolitan Corporate Counsel All rights reserved.

http://www.metrocorpcounsel.com/articles/31977/howsecureyourcompany%E2%80%99sediscoveryprogram

5/5

© Copyright 2026