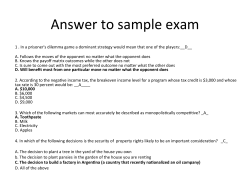

sample answers - Washington State University

EconS 301, Spring 2015, Dr. Rosenman Homework 9 1. One measure of market power is called Lerner’s Index which is given by the formula LI=(P-MC)/P. Explain how elastic demand minimizes the market power of a firm. (Hint: use the profit maximizing rule for setting output). (2 points) MR = P(1 + 1/ep) and ep < -1 for a monopoly. Profit maximization required MR = MC MC = MR = P(1 + 1/ep) which allows us to solve for P --> P = MC*(ep/1+ep) with (ep/1+ep) > 1. MC = P*(1+ 1/ep) which arranges to (P-MC)/P = -1/ep --> as ep increases Lerner's Index decreases. as ep-, PMC which means LI0, and market power is low. 2. A local town wants to raise more tax revenues. It is considering two taxes. One tax would be imposed on local cable television, which has a monopoly. The other tax is on gasoline, which is sold in a competitive market environment. An economist testifies that consumers would pay all the tax on gasoline, but the cable television company would share part of that tax. But gasoline station owners say their competitive market would force them to absorb the tax, while the monopoly cable television company plans to just pass the tax on to its customers. Who is correct, and why? In each case, discuss what would happen to profits for the firm or firms in the industry. (4 points) The economist is correct in his statement. The competitive market set P = MC. And in long run equilibrium P=min LAC. With the tax levied on the competitive gasoline industry, it will just raise its price and put all the burden of the tax on the consumers in the long run. But because of the tax the profits will go down and costs will go up causing some of the firms in the competitive industry to shut down. So with a tax on the competitive industry, yes the burden is on all the consumers in the long run, some of the gasoline firms go out of business in the LR. Note, however that they were making only the normal rate of return, so can make that elsewhere with any new investments. The competitive firms only absorb the burden of the tax in the short run. When the tax is levied on the monopoly, it will increase the costs and decrease its profits. In a monopoly setting the burden is shared by the monopolist and the consumer both. Let us assume that the tax changes the long run costs of the monopoly. The figure below illustrates why the monopoly absorbs some of the higher cost. We assume constant returns to scale to keep the analysis simple. Initially, the firm faces marginal cost (which equals average cost because of the constant economies of scale) of C1. It produces Q1, and charges P1. Profit is the rectangle P1abC1. If marginal cost (average cost) increases to C2 and the firm tries to pass the entire amount on to the consumers, it would have to raise price to P2 (notice that [P2-P1]=[C2- C1]). At that price, the monopolist could sell only Q2 units. But since marginal revenue exceeds marginal cost at that output, we know profit is not being maximized; it is given by the rectangle P2deC2. For marginal revenue to equal C2 output must be Q3, which means the firm can charge a price of only P3. Profit is the rectangle P3fgC2. The increase in price is smaller than the increase in cost, but the amount sold does not fall as far as it would if the entire cost increase was forced onto customers. The monopolist gains (by rectangle hfge minus rectangle P2dhP3) by absorbing some of the cost increase. 3. In 1984 in what may its most famous anti-trust action, the Department of Justice forced AT&T to give up its monopoly on local and long-distance phone service and the market moved from being a monopoly to one of competition – in some sense, with new phone service available through the internet and with cell phones, phone service is now close to a perfect competition. Using graphs, contrast the following aspects of phone service under the AT&T monopoly and the current competitive system: a. The price consumers pay and the quantity of service they use (2 point) b. Consumer surplus and producer surplus (1 point) c. The cost of producing phone services (1 point) a) Now under the current competitive system the price consumers pay is less. From the figure we can see that now the price is P* instead of P and consumption is Q* instead of Q. b) Now the consumer surplus is feP* and Producer surplus is afP*. Under monopoly Consumer surplus was edP and producer surplus was ecdP. c) The cost has gone up since Marginal cost is upward sloping. 4. In the 1990s Gritman Memorial Hospital (GMH) in Moscow and Pullman Regional Hospital (PRH) discussed a merger. Part of the motivation was that it is generally thought that the MoscowPullman area is a single market for hospital care. Some local residents in Pullman worried that it would create a monopoly for hospital services, and because wages, and thus costs, are lower in Moscow, a merger would mean PRH would close and GMH would be the only hospital in the area. a. Using the idea of a multiplant monopolist, explain why we might expect after a merger the monopoly firm would keep both hospitals operating if demand is large relative to the efficient size of a hospital (2 points) b. Suppose instead the demand in each town is small relative to the efficient size of a hospital. Would we then expect the monopoly to keep both hospitals open? (2 points) a) The purpose of the merger is to lower the average cost. It is not necessary that merger would mean closing down of one facility. The monopoly can still operate with multi-plants. If the demand is large enough, then all a monopoly is doing is lowering average cost by reducing the management costs while operating both the hospitals, but now under one management. This would bring cost efficiency and keep both the plants running. b) If the demand in both towns is small then we expect one of the facilities to shut down. The monopoly wants to lower its average cost and in this case it can only do that by shutting down one hospital and operating other at economies of scale. If we had one high demand and one low demand, we could still say that both hospitals would keep running but in this case it is more likely that one hospital would shut down. 5. Most movie theatres offer a “senior price” to customers over the age of 60 or 62. Using the rule for mark-up of price over marginal cost, explain how this tells us that the demand for movies by seniors is more elastic than the demand for movies by non-seniors. (2 points) This is an example of market segmentation. MR = MC in each market. Let p1 = senior price and p2 = normal price we know that p1 < p2 MC = MR1 = P1*(1 + 1/ep1) = MR2 = P2*(1 + 1/ep2) ---> P1 = MC*(ep1/1+ep1) and P2 = MC*(ep2/1+ep2) and P1 < P2 ---> This will only mean that ep1 > ep2 because MC is constant in both equations. 6. Most grocers offer “value packs” in their meat departments. This is a form of price discrimination. Explain what type it is, and using graphs explain how it can increase both the profit the grocer makes and consumer surplus. To make your graph easier, assume MC is constant. (3 points) This is an example of second degree price discrimination, also known as step pricing. In this example it is quantity pricing which means that as the consumer buys more of the good the price gets lower after a given quantity. The increase in profit can be seen in the graph by the areas colored light blue. The increase in consumer surplus can be seen by the areas shaded red. The yellow areas is the profit the firm would make without using price discrimination. 7. Avista, the company that supplies electrical power to most of eastern Washington, is a natural monopoly. According to the Washington State Utilities and Transportation Commission (WSUTC) , which must approve the prices Avista charges, the goal is “to ensure regulated companies provide safe and reliable service to customers at reasonable rates, while allowing them the opportunity to earn a fair profit.” Recently Avista announced large salary increases for many of its top executives. Assume “a fair profit” means a normal rate of return. Using graphs, explain: a. That monopolies regulated according to the goals of the WSUTC have little incentive to control costs, and thus we should expect to see high salaries and possibly overinvestment in capital. (2 points) b. The result of the regulatory goal could be less electrical usage. (1 point) a) Since the question explicitly says that the firm will make normal rate of return, it means that the price is P2. Because Avista is a natural monopoly, its marginal cost curve is below average cost curve and hence the firm can afford large salaries for its executives and potentially over investment in capital even when there is regulation in place because the regulation assures a fair rate of return on investment. So if there is over-investment, Avista still gets a fair rate of return on it. In addition, if high salaries raise costs, the extra cost is absorbed by rate-payers because P+AC. b) The result of this regulation will be that the firm would make less mark up on the quantity sold, but Q2>Q1, which means that there is more electrical usage. 8. Suppose United Airlines has a monopoly on the route between Chicago and Omaha. During the winter the monthly demand is given by P=a1-bQ. During the summer the monthly demand is given by P=a2-bQ where a2>a1. Assume the MC is the same in the summer and winter. Will United charge a higher price in the summer or winter? Explain. (3 points) The figure above shows that the price during the summer will be higher than the price during the winter. The slopes of the demand curve do not change. Recall for a linear demand curve, elasticity = -1 at the midpoint and increases at prices above it. You can use this to show that at any specific quantity, D’ is less elastic than D. Since MR=MC for both, so MR’=MR, it means P’>P. A simple graphical analysis shows that the increase in demand has caused and increase in quantity sold and increase in prices. (The graphical analysis without the explanation about elasticity earns 2 points). XC1: A perfect competition can produce a good at a constant marginal cost of $10 per unit. Monopolized, the industry can still produce at a cost of $10 per unit, but also must pay lobbying costs of $2 per unit to keep the monopoly. The market demand is given by Qd=1000-5P a. Calculate the output, price and profit under perfect competition and monopoly. (2 points) a. Calculate the loss in consumer surplus and producer surplus from monopolization. Where did it go? (2 points) b. Suppose the monopoly firm is able to be a perfect price discriminator. What will its profit be? What will be the price of the last unit sold? What will happen to consumer surplus? (1 point) a) Q = 1000 - 5P and MC = 10 = P for competitive equilibrium. So P = 10 and Q = 950. Profit=0 For monopoly, the inverse demand is P = 200 - q/5. We have to equate MR = MC R = (200 - q/5)q MR = dR/dq = 200 - 2q/5 MR = MC ---> q = 475 and P = 105. Since MC is constant, MC=AC=10. Profit=(105-10)475=45125 b) CS in competition = 0.5(200-10)*q=90250. CS in monopoly=0.5(200-105)*475=22562.5. Lost in CS= 67687.5 PS in Monopoly=(P-MC)q=95*475=45125. Since P=MC in competition, PS=0 in that system Some of the loss in CS went to producer surplus and some of it was dead weight loss. c) Now, under perfect price discrimination, the demand curve is equal to the MR curve. The price of last unit sold will be 12 dollars. Total units sold will be q = 1000 - 5*12 = 940. Total profits =0.5* (200-12)*940 = 88360. XC2: In a monopoly market the inverse market demand curve given by P=968-20Q. The firm has two plants. At one modern plant the cost of production MC1=8 for any number of units produced at plant 1 (MC is constant). The other, older plant faces a MC given by the formula MC2=1+0.5Q2 where Q2 is the amount produced at plant 2. a. Find the profit-maximizing price and quantity for this market. (2 point) b. How will the firm allocate production across the 2 plants? (2 points) c. If the MC in the modern plant goes up to 10, what would be the new answers to parts a and b? (1 point) I set the MC2 equation equal to MC1=8 to see the quantity from plant 2 would result in MC2 being 8. After this I set the MR equation equal to 8 and then solved to get the total quantity. I then subtracted the quantity from plant 2 from the total quantity to find out the quantity from plant 1. P=968-20Q MR=968-40Q MC1=8 MC2=1+0.5Q2 968-40Q=8 Q=24 Q1=10 Q2=MC1=14 P=488 For part C. MC1=10 968-40Q=10 MC2=1+0.5Q2=10 Q2=18 Q1=5.95 Q=23.95 P=489

© Copyright 2026