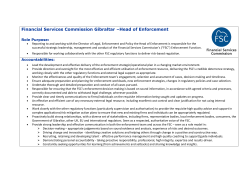

Compliance and enforcement policy and standards