dubai`s difc registry of wills and probate

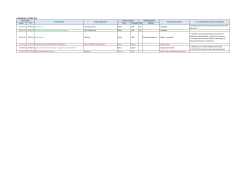

May 2015 DUBAI’S DIFC REGISTRY OF WILLS AND PROBATE The long-awaited DIFC Wills and Probate Registry (“DIFC WPR”) is now live. The DIFC WPR aims at addressing with certainty succession and inheritance matters of non-Muslims with assets in Dubai. As such, it represents a fundamental step forward for the jurisdiction. Legal uncertainties over expatriate wills in Dubai will become a thing of the past with the launch early next year of a new registry. The Dubai International Financial Centre (DIFC) hopes that the DIFC WPR – open to all non-Muslim expatriates – will benefit those wishing to hold financial and real estate assets in Dubai, but who are concerned about the uneven treatment of wills by the Dubai Courts. The new registry will allow non-Muslim expatriates over the age of 21 to register wills written in English in the DIFC Courts, doing away with the current need for translating wills into Arabic and having them attested by a local notary public. Crucially, the registry will issue a court order from the DIFC Courts, enforceable in the Dubai Courts for the direct distribution of Dubai-based assets in accordance with the register will, thus removing any ambiguity as to how held assets locally are distributed. The DIFC’s Dispute Resolution Authority (“DIFC DRA”) hopes that the new registry will begin offering services during the first quarter of next year. Only assets in Dubai can be included in wills registered in the new centre, according to the draft rules. Sources in the DIFC DRA said that the centre’s jurisdiction may be expanded to cover assets outside Dubai, but that such a move was not under active consideration. While the existing UAE law in theory provides that the law of the nationality of a non-Muslim should apply to the devolution of his or her estate, in practice the Dubai Courts have tended to apply Sharia law at first instance. “Assuming the executors and heirs do not wish the Sharia rights of inheritance to apply, they are then forced to appeal such decisions through the Dubai Courts,” he said. “Invariably, this process is uncertain and can take years to resolve. In the meantime, assets located in Dubai may be frozen, forcing some into financial hardship”. Such uncertainties have made individuals reluctant to invest in Dubai, choosing to minimize assets held in the emirate by keeping cash offshore and holding real estate (ultimately) through an offshore company, he noted. The launch of the registry has been welcomed by Dubai’s legal community for clearing up many of the ambiguities. “After years of observing the pressing need for clarity on the current UAE wills and inheritance legislation, and the inconsistent approach of judges in inheritance matters, we are pleased to welcome the new regime,” said Nita Maru, managing partner of TWS Legal Consultants, and an active member of the working group involved in formulating and contributing to the registry’s rules. The registry should provide certainty for non-Muslim expatriates to pass on their Dubai estate in the event of death to their chosen beneficiaries. “It’s a very necessary step that the DIFC has taken. With the number of grey areas around the application of the law and the problems that we’ve seen with judges refusing to recognize wills, something like this had to be done”, said Diana Hamade, managing partner of IALS in Dubai, also part of the working party. The services of the new registry do not come cheap, however. Under the draft rules, those wishing to use the registry will have to pay €2.500 to register their wills, more than double the standard cost typically charged by lawyers for the drafting, translation, and attestation of wills with the Dubai Courts. “At the end of the day it’s about providing people with the choice,” said a Dubai-based lawyer who did not want to be named. “If your situation is less complicated, or the total assets in Dubai are fewer, then the Dubai Courts is still an option, whereas for that extra peace of mind people can opt for the new registry. The draft rules are largely drawn from the UK’s administration of estates law, and also draws on similar legislation in other common law jurisdictions including Australia, Hong Kong and Singapore. IN SUMMARY What is the DIFC WPR An English language registry based inside the DIFC and enabling the formal registration of wills. Who is aimed at Non-Muslim individuals over the age of 21 with assets in Dubai. The DIFC WPR is not open to Muslims. What assets are covered Any assets physically located or registered in the emirate of Dubai. The DIFC WPR does not extend to assets located or registered in other emirates or abroad. Real estate Dubai located real estate can be covered in a DIFC will. Who can register UAE residents as well as non-residents can register a DIFC WPR. DIFC WPR’s legal framework The DIFC is a common law jurisdiction. The WPR’s rules are based primarily on the principles contained in the UK Estates Act and Probate Rules. Shariah principles do not form part of the DIFC WPR’s legal framework. Any restrictions to the devolution of assets The DIFC WPR provides for full testamentary freedom. Some restrictions may apply depending on the testator’s citizenship and/or place of residency. Guardianship issues The guardianship of minor children habitually residents in Dubai with the testator may be specifically addressed in a DIFC will. How the DIFC WPR work in practice An appointment is booked online (www.difcprobate. ae). The execution of the will takes place at the time of registration in the presence of a registry officer and one witness chosen by the testator. The will is stored electronically at the DIFC WPR as the original. Registration cost €2.500 for a standard DIFC WPR and €3.500 for two mirror DIFC wills. They do not include professional fees for assistance in drafting the DIFC WPR, registering it, acting as witness, drafting the letter of wishes, being appointed and/or acting as executor. Cost of enforcement €1.250 for an application for a grant of probate. A “grant of probate” is a legal instrument that gives authority to the executor to handle the disposal of the deceased’s assets and debts. Who can act as executor A family member, a friend or a legal representative (attorney). It is possible to appoint co-executors eg a family member together with an attorney. Being appointed as executor is not neutral and comes with its set of specific duties. Challenge to WPR A challenge may be lodged before the DIFC Courts who will hear any claim launched against a will. (Courtesy “The National”, “M/Advocates of Law”, UAE) ONEWORLD MIDEAST LT D Oneworld MidEast ltd (OME) is rendering a wide range of fiduciary and business services to our international clientele. We provide clients the whole spectrum of corporate structures - offshore, free zone, mainland and specialized entities - depending on each client’s circumstances and targets. Free zone and mainland entities benefit from an extensive UAE tax treaty network and offshore are easy to set-up and flexible to use. Our Services Corporate and Trust Company Formation International Structuring Fund Administration Domiciliary Management Registrar and Shareholders Global Compliance Risk and Regulatory Compliance Bookkeeping and Reporting Fund Valuation Services HR and Payroll Tax and Legal International Tax Planning Legal Services Legal Support Business Advisory Regulatory Compliance Corporate Strategy HR Management Internal Audit and Review Financial Advisory Corporate Finance Financial Due Diligence Mergers and Acquisitions Financial Reporting Family Office Asset Management Asset Protection Investment Advice Bayswater Tower, Level 18, Al Abraj South Street Business Bay, PO Box 333641, Dubai UAE T +971 45515693 F +971 42767612 [email protected] www.oneworldmideast.net

© Copyright 2026