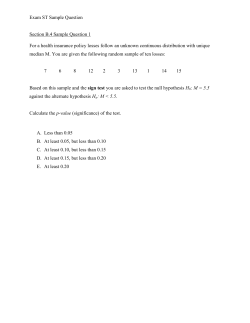

paying for what doesn`t count - CWA