How to balance between getting the best price and

The difficult challenge: How to balance between getting the best salmon price and security? Observations, methods and tools used in the agriculture markets ODA IN FRANCE AND EUROPE AMR HOLDING AMR RESEARCH DEPARTMENT Fundamental research Weather models Price models Weekly recommendations + Alerts 100 employees - 3000 clients – 10,000,000 mt of grains ODA (Analysis, informations, recommendations) 20/04/2015 ODA FUTURES (Futures brokerage) ODA Group – Managing commodity price volatility AGRICOTE (Physical brokerage) 2 Get the balance between price en security Security You’ve solid margins Stop dreaming! Performance Ready to die? 20/04/2015 Here we are! ODA Group – Managing commodity price volatility 3 How to improve your security/performance ratio? Security 1 2 Performance Plan I. Price risk in your business II. Price risk management – Margins hedging III. Decision process to secure and improve your business margin 20/04/2015 ODA Group – Managing commodity price volatility 5 Managing commodity price volatility A major stake for agro-businesses since ever … but rather recent on European ag-markets Our mission: protect margins & revenus against market volatility through innovative risk management 20/04/2015 ODA Group – Managing commodity price volatility 6 Salmon price volatility ($/kg)… 20/04/2015 ODA Group – Managing commodity price volatility 7 … VERSUS WHEAT PRICE VOLATILITY 300 280 Prix blé price mondial US wheat 260 Prix blé price UE UE wheat Prix en €/T 240 220 200 180 160 140 120 100 80 copyright@ODA 20/04/2015 ODA Group – Managing commodity price volatility 8 Market analysis matters, but… Market analysis: understanding offer, demand, balance between the two, weather follow-up… Analysing short-term tendencies through charts Using modelization to anticipate At the end, can we predict tomorrow’s proteine & vegetal production conditions? Market analysis based decision making can lead to risk taking 20/04/2015 ODA Group – Managing commodity price volatility 9 … framework is the most important ODA’s framework integrate market analysis, but first of all it’s a process in depth 1. Buying & selling conditions check up, timing 2. Margin check up 3. Objectives & means (cash, tools, rules) 4. Ratio & level fixing 5. Personal strategy design 6. Backtesting & stress testing 7. Reporting system 20/04/2015 ODA Group – Managing commodity price volatility 10 ODA risk matrix No sales price change A Value chain B B Value chain Medium risk(3) High risk(5) High margin Low margin Low risk(1) Medium risk (3) A Price change Low(1) Quite low (2) Medium (3) Quite high (3) High (4) 13/06/2014 13/05/2014 13/04/2014 13/03/2014 13/02/2014 13/01/2014 13/12/2013 13/11/2013 13/10/2013 13/09/2013 13/08/2013 13/07/2013 13/06/2013 13/05/2013 13/04/2013 13/03/2013 13/02/2013 13/01/2013 13/12/2012 13/11/2012 13/10/2012 13/09/2012 13/08/2012 13/07/2012 13/06/2012 13/05/2012 13/04/2012 220 13/03/2012 Applying decision with supplier or futures market? If supplier price is too high If no buying agreement with supplier Euronext wheat price and hedging for food industry 230 Buying price 210 200 Prix Blé Nov14 190 180 170 Example of result Agro-food A : WHEAT FLOUR 2013 Achats décembre12-mars 13 2012 à 262 €/T + 100% PUT Moyenne marché blé C1 Achats aout-décembre 2012 à 205€/T Exercice PUT Achats janvier-aout 2012 à 180€/T Average wheat price (Euronext): 240€/T Client buying price (Euronext ref.): 205€/T If 10 000T: 350 000€ earning in procurement budget, 15% of yearly result 13 Example of result Agro-food A: WHEAT FLOUR 2014 Achats mars-mai 2013 à 230 €/T + 50 % PUT Exercice PUT + Achats juinAout 13 2013 à 215 €/T Achats Aout-février 14 2013 à 180 €/T + 35 % PUT Achats février 14- février 15 à 190 €/T Average wheat price (Euronext): 218€/T Client buying price (Euronext ref.): 215€/T => Less performance but all way protected against a new price rise 14 Your contacts Stefan Nether Directeur grands comptes / International Business Development GSM : +33 (0)607 518 916 [email protected] Bruno Ben said Expert IAA / Industry Expert GSM : +33 (0)778 820 732 [email protected] Emeline Bergeron Expert IAA / Industry Expert GSM : +33 (0) 610 547 710 [email protected] 20/04/2015 ODA Group – Managing commodity price volatility 15

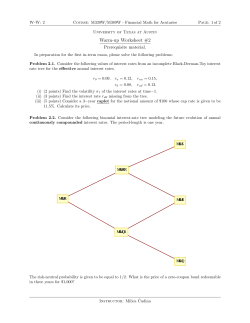

© Copyright 2026