Asymmetry in price transmission in agricultural markets Alain McLaren

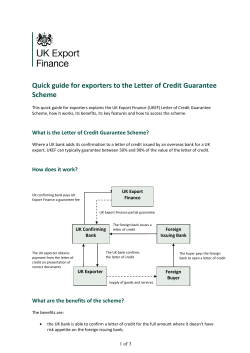

WPS 13-10-2 Working Paper Series Asymmetry in price transmission in agricultural markets Alain McLaren October 2013 Asymmetry in price transmission in agricultural markets. Alain McLaren∗ Forthcoming in the Review of Development Economics September 2013 Abstract This paper explores the asymmetries in price transmission from international to local markets. We expect the presence of large intermediaries in agricultural markets to lead to a stronger price transmission when international prices decline than when they rise. The empirical evidence conrms the presence of asymmetric price transmission consistent with the presence of large intermediaries with monopsony power. JEL codes: Q13, Q17. Keywords: Asymmetric price transmission, agricultural markets. University of Geneva, Département d'Economie Politique, Unimail, Bd. du Pont d'Arve 40, 1211 Genève, Switzerland. Telephone: +41-788431321. Email: [email protected]. I am grateful to Jean-Louis Arcand, Richard Baldwin, Marcelo Olarreaga, Frederic Robert-Nicoud, Takamune Fujii and Henry Kinnucan for their helpful comments and discussions. I would also like to thank all participants at the "ProDoc Trade PhD Workshop", the "University of Geneva Young Reseachers Seminar" as well as the "Bari Third International Workshop on Economics of Global Interactions: New Perspectives on Trade, Factor Mobility and Development" for their useful comments and suggestions. ∗ 1 "While grocery store shelves appear to provide abundant choices, most of these products are marketed by a small and decreasing number of rms. Gigantic multinational corporations are consolidating their control over our food system [...]. The trend raises concerns about how this power is exercised, as most of these corporations are accountable to their shareholders, not to communities in which they operate." Phil Howard (Howard (2006)) 1 Introduction Many poor countries have a large proportion of their active population working in agriculture. In many cases, the amount of revenue they receive will be crucial for their survival. Using data from the World Development Indicators (2010) one sees that in the year 2000, the world's 25 percent poorest countries had at least a quarter of their population working in agriculture, and half of these 25% poorest had over 70% of their population active in agriculture. An illustration of this is given in Figure 1. Thus poorer countries will be more exposed to large falls in agricultural prices. Understanding the determinants of changes in agricultural prices is therefore crucial for the poorest countries. In this paper the focus is on the extent of asymmetry in the price transmission from international to local markets. Whether a farmer is selling locally or exporting, the price he will receive for his production will be directly or indirectly aected by prices determined in world markets. Indeed, Mundlak & Larson (1992) show that variations in local agricultural prices are mainly explained by variations in world prices. But the transmission from international to local markets may not necessarily be symmetric. Depending on market conditions falls in international prices may be better transmitted to local markets than increases in international prices. The consequences of this asymmetric price transmission could be particularly harmful in poor countries where farmers often live close to the poverty line. In fact, Mosley & Suleiman (2007) suggest that a portion of the small farmers are below the poverty line 2 in some of the poorer countries. They also put forward that the one sector that has had a strong ability to stimulate pro-poor growth processes, especially in East and South Asia, is smallholder agriculture. Why would one expect a better price transmission when agricultural prices fall? Agricultural markets are characterized by the presence of large international intermediaries, with strong monopsony power over often small and numerous producers. Murphy (2006) shows that in the United States two companies (Cargill and Archer Daniels Midland) export 40 percent of all U.S. grains. Rogers & Sexton (1994) show that in the United States more than 60 percent of all food and tobacco markets can be considered as noncompetitive when measured by their top four-rm concentration ratio (with a threshold at 50 percent). Figures for other countries are similar. For example in Vink & Kirsten (2002), concentration ratios for the four largest rms for South Africa are also large: 47 percent in slaughtering, dressing and packaging livestock, 65 percent for vegetables and animal oils and fats, 43 percent for our, 37 percent for animal feeds, 99 percent for sugar, golden syrup and castor sugar, 80 percent for coee, coee substitutes and tea. In this paper it is shown that in the presence of strong monopsony power of agricultural intermediaires with suciently convex cost functions one should expect an asymmetric price transmission which is consistent with the use of this monopsony power by intermediaires. Indeed as international price falls, local prices will fall proportionally more than when international prices increase. This prediction is conrmed when confronted to a sample of 161 agricultural products produced in 117 countries over a period of 35 years. Moreover, the asymmetry seems to be driven by the results for markets where large international intermediaries are present or when exports represent a large share of total production which increases the monopsony power of international intermediaries. Questions of asymmetric price transmission have been widely studied for oil markets, known as the literature on "Rockets and Feathers", where prices rise like rockets but fall like feathers. Many researchers have been analyzing the evolution of oil output prices. Tappata 3 (2009) analyzed the theoretical aspect of potential asymmetric responses of oil retail prices. Many empirical studies come to the conclusion that asymmetry does exist. This is the case of studies such as Galeotti et al. (2003) or the main study on the topic done by Borenstein et al. (1997). The latter has several explanations for asymmetry. The one than seems to be closest to what is found for agriculture is one of costly search of consumers. The idea is that the consumer will believe that a change in price at the retail station during a period of volatile crude oil prices will really be due to a change in this price, whereas in less volatile periods he will believe that the station's margin is changing. He will put more eort into searching for a lower price elsewhere if he believes that it is that specic station increasing its price. This is because the consumer's expected gain of search is higher in this case. This, in turn, leads to a higher market power of retailers who can dampen the rate of passthrough of upstream price decreases. This paper shows similar eects for agriculture, however aecting the producer side rather than the consumer side. The results are interesting from a policy perspective and give room for active competition policies when facing large international intermediaries. Levinsohn (1994) suggests that many countries are more lax in their competition policy when dealing with export markets, perhaps because anticompetitive practices in an export market will not be harmful for domestic consumers. However, the asymmetric price transmission identied in this paper would lead to increased losses for often poor farmers. More generally, as argued by Murphy (2006), market power in international markets is not factored into the models and assumptions that inform the trade and agriculture debate, which can mislead policy makers in terms of the distribution of the gains from trade liberalization in these markets. This result can also oer some interesting perspectives in terms of aid-eectiveness. Some studies such as Mosley & Suleiman (2007) have made clear some important aspects of aid, such as the importance of food crops due to their high poverty leverage. The result of this paper concerning intermediaries may complement such studies, proposing some strategies that may be adopted within the agricultural sector. An asymmetric price transmission could also alter the usual way of 4 approaching the analysis of welfare linked to price changes. De Hoyos & Medvedev (2011) study the changes in welfare created by the price transmission from international prices to domestic prices. They put forward the importance of the degree of price transmission in explaining short to medium-term poverty eects. The presence of asymmetric transmission can give new insights to such theories and a new way of thinking about the eects of international price changes for welfare. The remainder of the paper is organized as follows: section 2 presents a simple model to illustrate how asymmetric price transmission can arise in the presence of large intermediaries with suciently convex cost functions. Section 3 presents the data used to empirically explore this question and section 4 presents the empirical strategy. Results are presented in section 5 and section 6 concludes. 2 Theoretical background Agricultural markets are characterized by a large dispersion of farmers, as noted by Sexton (1990), which are numerous and therefore act as price takers. He also emphasizes the bulkiness and/or perishability of raw products that will have an inuence on market structure. This could lead to what he calls spatial oligopsony power of processors or wholesalers. As quoted in OECD (2008) it is the diculty for sellers to nd other buyers which determines the extent of a buyer's monopsony power. Murphy (2006) says that most farmers lack the storage and capital needed to get their goods to distant markets, so they are left selling locally, to middle-men who now have more suppliers to choose from. Market power is modeled based on Sexton (1990). Wholesalers are considered homogeneous and act as price takers in their selling markets, notably due to the size of international markets. The xed cost associated with exporting is too high for the individual farmer to face, such that he has to pass by a wholesaler. This is consistent with the literature, notably with Gopinath et al. (2007) who say that agriculture is unique as farmers often do not export 5 directly since it is marketing rms that make the export decision. The international price of a good is denote by P ∗ and is considered as being exogenous. The wholesalers therefore face an innitely elastic demand and it is assumed that they benet from economies of scale, such that there will be much fewer of them than farmers. Dening the price received by the farmer as pf i , such that one can write the supply of one farmer as in equation (1). qis = qi (pf i ) with qi (pf i )0 > 0 and qi (pf i )00 ≥ 0 (1) By summing over all farmers one gets the aggregate supply of farmers to a processor, presented in equation (2). Qs = Qs (pf ) with Qs (pf )0 > 0 and Qs (pf )00 ≥ 0 (2) For later use one can dene the inverse supply function as in equation (3). (Qs )−1 (Q) = pf (3) This inverse supply will be called w(Q) which leads to the expression given by equation (4). w(Q) = pf with w(Q)0 > 0 and w(Q)00 ≥ 0 (4) The wholesaler must either package the products or incur some extra costs to export the product. These costs will be increasing in the quantity of raw product Q and will be given by the function m(Q). For higher quantities, the wholesaler will have to pay even higher costs to get products from farmers that are further away. Besides these costs the wholesaler must incur the cost of buying the product, w(Q)Q as 6 well as a xed cost to export. Total cost is given by equation (5). c(Q) = w(Q)Q + m(Q) + f (5) The xed cost to export mentioned above is denoted by f and is added to the model such that there are economies of scale. This will spread out the dierent wholesalers geographically, instead of having one at each farm site. The next step is to depart from the analysis of Sexton (1990) to see what will happen if there is an exogenous shock to P ∗ , as illustrated in Figure 2. Due to the fact that an increased quantity must at least in part be supplied by farmers that are further away, which comes on top of the usual increasing supply in the presence of monopsony power, the marginal cost will be increasing and convex in Q and is given by equation (6). mc(Q) = dw(Q) ∂m(Q) ∂c(Q) = Q + w(Q) + ∂Q dQ ∂Q (6) The supply curve of the wholesaler on the international market is his marginal cost. On Figure 2 one can see that a change in international price leads to a lower increase in quantity than the decrease in quantity associated with a decrease in price of the same magnitude. This larger decrease in quantity will induce a larger change in pf for a decrease in international price if the farmers supply has a constant slope or if it doesn't, as long as marginal cost is suciently convex, as will be presented below. This intuitive mechanism will be formally developed below, with a model linking international price to producer price. One can then formulate the wholesaler's prot function as given by equation (7).1 1I owe special thanks to Henry Kinnucan for proposing a simpler and shorter route in nding the relationship between farmer price and international price. The development below, from equations (7) to (15), closely follows the development that he proposed. 7 max π = P ∗ Q − w(Q)Q − m(Q) − f (7) In this model w(Q) = pf is the inverse supply function for the farm-based input and m(Q) is the cost function associated with preparing the farm product for home consumption or export, and f is the xed cost mentioned above. By maximizing prot with respect to Q one gets the First Order Condition (FOC) as presented in equation (8). P ∗ − w0 (Q)Q − w(Q) − m0 (Q) = 0 (8) where the quantity that optimizes prot is denoted Q. What we are interested in here is how optimal quantity will vary for a given change of P ∗ . Since one can't directly isolate Q in equation (8), an implicit function is used. Denoting F (Q) as being the left hand side of the FOC leads to the identity presented in equation (9). F (Q, P ) = P ∗ − w0 (Q)Q − w(Q) − m0 (Q) ≡ 0 (9) The implicit function is the one given in equation (10), which is the wholesaler's supply function. Q = Q(P ∗ ) (10) The use of the Implicit Function Theorem is now useful to dierentiate optimal quantity with respect to price, as in equation (11). 8 dF dQ 1 dP ∗ = − = − dF dP ∗ −w00 (Q)Q − w0 (Q) − w0 (Q) − m00 (Q) dQ = (11) 1 > 0 w00 (Q)Q + 2w0 (Q) + m00 (Q) The relationship between farm and wholesale prices that was given in equation (4) can now be written, at the optimum, as in equation (12). (12) pf = w(Q) = w[Q(P ∗ )] Using the chain rule, the change of farmer price for a change in the international price is given in equation (13). dw(Q(P ∗ )) dQ w0 (Q) dpf = = > 0 dP ∗ dP ∗ dQ w00 (Q)Q + 2w0 (Q) + m00 (Q) (13) Two important remarks can be said concerning the relationship between international price and farmer price. The rst is that the relationship is increasing, and the second is that 0< dpf dP ∗ < 1. 2 It basically means that a one dollar increase in wholesale price causes farm price to rise by less than a dollar. If the farm supply and m(Q), the cost of packaging as well as other extra costs to export, are linear functions, then dpf dP ∗ = 12 , and the one dollar increase in international price mentioned above would lead to a 50 cents increase in farm price. Any asymmetry in the price transmission will take place if the price transmission relation is non-linear in wholesale price. This can be evaluated by taking the second derivative with respect to P ∗ of equation (12). This is given by equation (14). 2 I thank Henry Kinnucan for pointing out that in much of the literature, the term "imperfect price transmission" is used in situations such as this, which is not entirely correct. For a detailed explanation of this, see Kinnucan & Zhang (2013) in which it is shown that a farm-retail price transmission of 1 isn't a prerequisite for competitive market clearing and that one must distinguish between the elasticity of price transmission and the slope of price transmission. 9 d2 pf dQ = w00 ∗ 2 (dP ) dP ∗ !2 + w0 d2 Q (dP ∗ )2 (14) Asymmetric price transmission requires non-linearity of either the farm supply or the wholesale supply functions. If both functions are linear, then d2 pf (dP ∗ )2 = 0, and price transmis- sion is symmetric. Whether the sign of the right hand side of equation (14) is negative or positive is indeterminate. Although w0 (Q) and w00 (Q) are positive as dened higher up, and the squared term dQ dP ∗ 2 > 0 is also positive, the last term d2 Q dP ∗2 is negative (assuming convexity of the marginal cost curve, if it were linear then this term would be zero). The sign of equation (14) can be made determinate by placing restrictions on the shapes of the farm and wholesale supply functions. This becomes clearer when rewriting it with w00 on the left hand side, as in equation (15). 2 2 w00 < d Q −w0 (dP ∗ )2 dQ dP ∗ 2 ∗ d P w0 (dQ) 2 = dQ dP ∗ (15) 2 One such restriction is that the inverse wholesale supply function must be suciently convex compared to the inverse farm supply function. If this is the case, then there will be a negative sign in equation (15). For the wholesalers inverse supply function to be convex, that is supply function must be concave, meaning that d2 Q (dP ∗ )2 d2 P ∗ (dQ)2 > 0, its ordinary > 0. The latter is a necessary condition for equation (14) to have a negative sign, and thus produce the concave function for the price transmission relation shown in Figure 3. To summarize, the relationship between P ∗ and w is increasing and concave as long as the marginal cost curve is suciently convex with respect to the inverse supply curve of farmers. If this is the case, the relationship between the two will be such that transmission will be larger if there is a downward international price movement from the equilibrium than 10 if there is an upward movement. 3 Data In order to estimate the impact of international agricultural price variations on producer prices, yearly data on export and producer prices from the Food and Agriculture Organization of the United Nations (FAO) is used. The producer price is the price received by farmers as collected at the point of sale for primary crops, live animals and livestock primary products. FAO's export data is produced according to the International Merchandise Trade Statistics Methodology and mainly comes from national authorities and other international organizations. The export values are reported as Free-on-Board (FOB) such that insurance and transport costs are not included. It is an unbalanced panel of 161 items, 117 countries and 35 years, ranging from 1966 to 2000. The list of items and countries are presented in the Appendix. Higher frequency data are usually used in the Feathers and Rockets literature as well as some studies on agricultural commodities' price transmission. However, the latter are usually case studies, covering a few items or a specic country. This paper is aimed at a more general approach. Tomek & Myers (1993) say that farmers often make annual decisions. Crops are an example, where the farmer decides at the beginning of the period the area where he is going to plant, then can't change it. Other similar decisions are taken by the farmers which can't then be changed, whether international prices change or not. The data used for the meteorological IV's comes from Mitchell et al. (2003). For the natural catastrophies what is used is The OFDA/CRED International Disaster Database (n.d.). The neighbouring countries' data was taken from the World CIA Factbook (2011). As the interest here is on price transmission, exporters who are considered large are excluded from the sample. A benchmark of 1% of total exports in each item-country pair is set as a small exporter. This is to stay in line with the idea of a "small country" being a 11 price taker. This is also a rst step towards dealing with endogeneity. Data is also cleaned in a way such that extreme values are excluded. Even though intuition leads to expect a price of exports above the domestic price, due to processing and handling costs, we however allow an export price as low as 80% of the producer price in order to include dierent possible scenarios, such as exceptional price variations. A ratio of export price over domestic price that is above 20 is also excluded, as producer prices reported as being less than 5% of the export price suggests that what is captured is probably that the product may be slightly dierent from what is sold locally.3 Beyond product quality dierences and potential mistakes in the data, the exclusion of export prices that are considerably lower than producer prices can also be justied by the fact that it may reect some "dumping" mechanisms.4 To study the link between oligopsony and asymmetry, data on one of the main companies that trades agricultural products worldwide is included. This data was collected by looking at Cargill's worldwide website. The company reports each country in which it is present and have either a page or a specic website for each. The information given includes the year from when it has been active in that country and the products that it covered in that country. Matches were done so that the product names were comparable to the FAO database. The list of items covered by Cargill are presented in the Appendix. 3 There is a relatively large amount of observations for which the ratio is below 0.8. These cases don't seem to be coming from any countries or items in particular, but the frequency does drop somewhat after 1990. This seems to be coming from the fact that FAO producer prices come from two databases, one being considered as historical price data and intitled "Price archive". The latter is probably of lower quality than the more recent data. Regressions without any cleaning were run but low R2 and Hansen test values conrm that some cleaning is necessary. 4 According to the World Trade Organisation, if a company exports a product at a price lower than the price it normally charges on its own home market, it is said to be "dumping" the product. We can therefore beleive that if companies are engaged in dumping, the causality and mechanism of price transmission isn't as clear. 12 4 Empirical strategy 4.1 Asymmetry of price transmission International prices are proxied by export prices and the explained variable is producer prices. The log of export price will be regressed on the log of producer price such that one can interpret the price transmission coecient as an elasticity. A dummy taking a value of 1 if the export price for a certain good in a specic country increased from the previous year and 0 if it decreased is added to the regression. This will enable us to distinguish increasing prices from decreasing prices. The specication used is given by equation (16). λic , λct and λit are respectively itemcountry, country-year and item-year xed eects. prod exp ln(Pi,c,t ) = α + γ(price upi,c,t ) + β ln(Pi,c,t ) (16) exp +δ(price upi,c,t ) ln(Pi,c,t ) + λic + λct + λit + i,c,t Items are noted by i, with i = 1, ..., N , countries by c, with c = 1, ..., C and years by t, with t = 1, ...T . To get rid of the item-country, country-year and item-year xed eects the transformation given by equation (17) is used. prod prod prod prod prod ln(Pi,c,t ) = ln(Pi,c,t ) − ln(Pi,c,· ) − ln(Pi,·,t ) − ln(P·,c,t ) g prod prod prod prod + ln(Pi,·,· ) + ln(P·,i,· ) + ln(P·,·,t ) − ln(P·,·,· ) with prod ln(Pi,c,· )≡ 1X Pcit T t 13 (17) prod ln(Pi,·,· )≡ prod ln(P·,·,· )≡ 1 XX Pcit CT c t 1 XXX Pcit CN T c i t The other means being dened in the same way. This transformation is applied to all variables individually, which will eliminate the xed eects and the constant such that what is left is presented in equation (18). prod gexp ) g up) + β ln(P ln(Pi,c,t ) = γ (price t i,c,t g (18) g ln(P exp ) + g +δ (price up) t i,c,t i,c,t The β coecient is the elasticity of price transmission. The asymmetry is given by the δ coecient. A value dierent from zero will reveal asymmetry. Results for the Ordinary Least Squares (OLS) estimation are given in column 1 of table 1. Standard errors are clustered by item-country in this regression as well as for the Two-Stage Least Squares (2SLS) regression presented below. 4.2 Dealing with endogeneity As mentioned above, the export price may be endogenous. This implies that the price up dummy and the interaction may also be endogenous. For this reason the method of estimation that will be used is that of 2SLS. For this one must nd a variable that will aect export price without however being directly correlated to producer price. This can be done by using climatological phenomena in other countries exporting the same good. Three meteorological Instrumental Variables (IV's) will be used, which includes the amount of rainfall, temperature and cloud cover. A variable of catastrophic events is also used as 14 an instrument. To avoid any correlation between the weather conditions in the country considered and the weather in other countries, all neighbours are excluded when creating the instrument. The three meteorological IV's will be created in the same manner. As it is hard to know what the eect of a certain change of each variable on prices will be and since the study contains many dierent types of goods, it will be considered that being far away from the mean is bad for the farmer. This is close to Shaw (1964) where it is said that a reasonable way of seeing the relationship between meteorological factors and yield is by representing it as a bell-shaped curve. In our case the eect of the three IV's will be seen in this way such that what will be used will be the standard deviation of the monthly temperature, monthly rainfall and cloud cover each year. What is considered is the eect of these variables on all other countries that are exporting the good, multiplied by their share of exports with respect to the rest of the world in that good, and excluding neighboring countries. This exclusion is to avoid any direct correlation between the neighbouring countries' weather conditions and the producer price considered. This will give us exogenous shocks to all other countries' prices, therefore inuencing international price but not the own country's price directly. An illustration of the construction of these variables is given in Figure 4 for bananas in Zimbabwe in the year 2000. This illustrates that all neighbours and non exporters of the good aren't included in the instrument. All others are counted, the weight in the instrument depending on their export share. This is explicited in equation (19). rain IVb = X rainf allict ∗ export shareict , c 6= n and c 6= b (19) c with: b: own country c: country n: neighbours Finally, a count variable of the number of climatological (including extreme temperature, 15 drought, wildre) or meteorological (storm) events in other countries is added as another instrument. It is constructed in the same way as before but this time the number of disasters is used directly rather than the standard deviation. As the price up dummy may also be endogenous, it is instrumented by a dummy taking the value 1 if the IV variable in question went up and taking the value 0 otherwise. This dummy is also interacted with the IV variable itself in order to instrument the interaction of price up with the export price. 5 Results Results of the regression using the IV's are given in column 2 of table 1. The results of the rst stage regressions are given in table 2. The interaction term clearly points to some asymmetry. The sign of the asymmetry term is the same as in the OLS regression given in column 1 and the p-value of the test of underidentication as well as the one for overidentifying restrictions suggest that the instruments are valid. Empirical results suggest that when FOB export prices rise by 1% farm prices rise by 0.60%,5 and when FOB export prices fall by 1% farm prices fall by 0.98%. In other words, there is near perfect transmission of declines in wholesale price, but imperfect transmission of rises in wholesale price. This is consistent with a situation in which the wholesalers supply function is suciently convex. 5.1 Robustness checks The results above show that there is an asymmetry in the long run price transmission of international prices to local prices. However, it is important to check the immediate response as well. The inclusion of the lagged value of producer price as an explanatory variable will enable one to do the aforementioned interpretation. The specication used is given by equation (20). λi and λc are respectively item and 5 From table 1 we can work out the upward tranmission as being 97.83% − 37.47% = 60.36%. 16 country xed eects. prod prod exp ln(Pi,c,t ) = α + ρ ln(Pi,c,t−1 ) + γ (price up)t + β ln(Pi,c,t ) (20) exp +δ (price up)t ln(Pi,c,t ) + λi + λc + i,c,t First-dierencing will eliminate the xed eects as well as the constant. However, one prod then has ln(Pi,c,t−1 ) on the left hand side which will be correlated with the error term i,c,t−1 . To deal with this problem the estimation method used is that of Arellano & Bond (1991) and Arellano and Bover / Blundell and Bond (Arellano & Bover (1995); Blundell & Bond (1998)) who developed a Generalized Method-of-Moments (GMM) estimator that instruments the dierenced variables that are not strictly exogenous with all their available lags in levels or in rst dierences. It is implemented using the approach of Roodman (2006) based on the Arellano and Bond (Arellano & Bond (1991)) and Arellano and Bover / Blundell and Bond (Arellano & Bover (1995); Blundell & Bond (1998)) dynamic panel estimators. As mentioned above, the explanatory variables used here cannot be considered strictly exogenous and the change in the export price cannot be considered uncorrelated with item and country unobservable xed eects, therefore the original equation in levels is not added to the system. The export price, the price change as well as the interaction term are considered as being predetermined such that the rst lag that is used as an instrument for these variables in t is t − 2. The rst lag for producer prices that is used in t − 1 (the lag of the explained variable) is t − 3. When running the regression on the whole data the N dimension is composed of countries and items and is therefore much larger than T . Even though this is good in the case of these types of estimators requiring small T and large N , only half of the periods in the sample are used as instruments to limit the number of instruments used. Time dummies are also included in the regression. As the suciency of the variables' past values being used as instruments may be questionable we also use a specication with the above mentioned economic instruments, used in 17 the 2SLS specication. The results are shown in table 3. These results support the ones found in the OLS and 2SLS specications, that is a negative and signicant asymmetry term. Due to the lag of producer price on the right hand side of equation (20) the interpretation of the coecients is slightly dierent. The short run price transmission is given by β in equation (20) whereas the long run transmission, comparable to the β in equation (18), is computed as follows: is obtained by computing ρ − β−δ . 1−ρ β . 1−ρ The long run asymmetry This yields the results presented in table 4. Standard errors are computed using a calculation technique based on the "delta method".6 One sees that the initial transmission, although relatively small, is asymmetric. This then leads to a long run transmission that is, albeit slightly smaller than what is found with the 2SLS approach, not dierent in terms of statistical signicance. 5.2 Oligopsony and asymmetry The next step is to see whether measures of market power are linked to asymmetry. For this two variables are used. The rst is the importance of exports in the market. By looking at the quantity exported with respect to the quantity produced, we will be able to see whether asymmetry is inuenced by a larger share of exports.7 One might expect the fact of exporting more of local production to lead to more price transmission. However, this would not explain more asymmetry. What is of interest here is whether the mechanism specic to exporting plays a role in explaining asymmetry. A larger local presence of intermediaries will be a prerequisite for exporting a larger share of local production. A dierence in asymmetry for high versus low shares of exports will point to the impact of intermediaries in the asymmetric pattern of price transmission. We will therefore use two groups of countries, those exporting a large share of their production and those exporting a small share. Results are given in table 5. One sees that in markets where exports consist of a large share with respect to local production there is a signicant amount of asymmetry whereas in the other markets there 6 This 7A is implemented in the statistical package STATA using the nlcom command. benchmark value of 30 percent is used to distinguish a large share from a small share. 18 is no signicant asymmetry. This is complemented by another measure of market power. This measure is a regression run specically on items where the presence of one of the main wholesalers is present, namely Cargill. As mentioned in section 3, this data has been collected from Cargill's country websites. This is an item specic information that will enable us to separate the regressions into two groups, one where Cargill is present and the other where it isn't. A larger asymmetry for the group where Cargill is present will point to an inuence of the wholesaler on asymmetry. The results of these regressions are given in table 5. We see that market power plays a role in explaining asymmetry. The presence of Cargill signicantly increases the asymmetry of price transmission whereas when it is absent from a market, the asymmetry term isn't signicantly dierent from zero. The presence of one of the main intermediaries as well as the share of local production exported abroad are both explaining asymmetry, supporting the theory presented above. 6 Conclusion A model of price transmission from international agricultural prices to producer prices is presented in order to understand the mechanisms behind price transmission. Due to the geographical dispersion of farmers and economies of scale in wholesaling, agricultural markets will we characterized by market power on the demand side. The model predicts that this power of intermediaries buying the products from farmers leads to an asymmetric price transmission when intermediaries have suciently convex marginal cost curves. The asymmetry is such that there is more price transmission when prices fall. The results are shown using a Two Stage Least Squares estimator to control for endogeneity problems. This approach has the advantage, as noted by Acharya et al. (2011), of avoiding some of the disadvantages of many studies in the recent literature that focus on the time-series properties of the data such that it is sometimes unclear whether rejection 19 of symmetry isn't simply due to specication error. The instruments used are variations in rainfall, temperature, climate disasters and cloud cover in other geographic regions. The exclusion of neighbouring countries within the region ensures that these instruments aren't correlated to the local weather conditions, thus local prices. The results are clear in pointing out the presence of asymmetry, with the transmission being stronger for price decreases. Robustness checks using two dierent specications of a Generalized Method of Moments estimator conrm the presence of an asymmetric price transmission. The link between market power and asymmetry is then tested. A variable indicating the presence of intermediaries on specic markets is used to test this link. More specically it is the presence of Cargill, one of the largest intermediaries in commodity markets, that is used as a variable and the results show that asymmetry is stronger when Cargill is present. This result is supported by another regression where the larger the share of local production exported abroad, the higher the degree of asymmetric price transmission. This points towards some policy issues, notably the fact that governments should be aware of the eect of market power of intermediaries and the role they play in inuencing the price received by farmers, and therefore the gains from trade liberalization in agricultural markets. Abuse of monopsony power by large intermediaries in agricultural markets can be particularly harmful in poor countries where farmers often live close to the poverty line. Future research could be done in the collection of market power data at the item and country level on a yearly basis. Other private companies than the one looked at here could also be integrated into such studies. Measures of search costs should also be considered. 20 References Acharya, R., Kinnucan, H. & Caudill, S. (2011), `Asymmetric farm-retail price transmission and market power: a new test', Applied Economics 43(30), 47594768. Arellano, M. & Bond, S. (1991), `Some tests of specication for panel data: Monte carlo evidence and an application to employment equations', The Review of Economic Studies 58(2), pp. 277297. Arellano, M. & Bover, O. (1995), `Another look at the instrumental variable estimation of error-components models', Journal of Econometrics 68(1), 2951. Blundell, R. & Bond, S. (1998), `Initial conditions and moment restrictions in dynamic panel data models', Journal of Econometrics 87(1), 115143. Borenstein, S., Cameron, A. C. & Gilbert, R. J. (1997), `Do gasoline prices respond asymmetrically to crude oil price changes?', The Quarterly Journal of Economics 112(1), 30539. De Hoyos, R. & Medvedev, D. (2011), `Poverty eects of higher food prices: A global perspective', Review of Development Economics 15(3), 387402. Galeotti, M., Lanza, A. & Manera, M. (2003), `Rockets and feathers revisited: an international comparison on european gasoline markets', Energy Economics 25(2), 175190. Gopinath, M., Sheldon, I. M. & Echeverria, R. (2007), `Firm heterogeneity and international trade: Implications for agricultural and food industries', International Agricultural Trade Research Consortium, Trade Policy Issues Papers #5 . Howard, P. (2006), `Consolidation in food and agriculture: Implications for farmers & consumers', The Natural Farmer, publication of Nofa Spring 2006, 1720. Kinnucan, H. & Zhang, D. (2013), `Perfect farm-retail price transmission', manuscript . Levinsohn, J. (1994), `Competition policy and international trade', Working National Bureau of Economic Research Working Paper Series . unpublished paper No. 4972, MacLaren, D. & Josling, T. (1999), `Competition policy and international agricultural trade', Working paper #99-7, International Agricultural Trade Research Consortium Working Paper Series . Mitchell, T., Carter, T., Jones, P., Hulme, M. & New, M. (2003), `A comprehensive set of high-resolution grids of monthly climate for europe and the globe: the observed record (1901-2000) and 16 scenarios (2001-2100)', Journal of Climate: submitted . Mosley, P. & Suleiman, A. (2007), `Aid, agriculture and poverty in developing countries', Review of Development Economics 11(1), 139158. Mundlak, Y. & Larson, D. F. (1992), `On the Transmission of World Agricultural Prices', World Bank Econ Rev 6(3), 399422. 21 Murphy, S. (2006), `Concentrated market power and agricultural trade', logue Discussion Papers (1). Ecofair Trade Dia- Organisation for Economic Co-operation and Development, Directorate for Financial and Enterprise Aairs Competition CE, Policy Roundtables . OECD (2008), `Monopsony and buyer power', Rogers, R. T. & Sexton, R. J. (1994), `Assessing the importance of oligopsony power in agricultural markets', American Journal of Agricultural Economics 76(5), pp. 11431150. Roodman, D. (2006), How to do xtabond2: An introduction to `dierence' and `system' gmm in stata, Working papers, Center for Global Development. Sexton, R. J. (1990), `Imperfect competition in agricultural markets and the role of cooperatives: A spatial analysis', American Journal of Agricultural Economics 72(3), pp. 709720. Shaw, L. H. (1964), `The eect of weather on agricultural output: A look at methodology', Journal of Farm Economics 46(1), pp. 218230. Tappata, M. (2009), `Rockets and feathers: Understanding asymmetric pricing', Journal of Economics 40(4), 673687. RAND The OFDA/CRED International Disaster Database (n.d.). EM-DAT: The OFDA/CRED International Disaster Database, www.emdat.be, Université Catholique de Louvain, Brussels (Belgium). Tomek, W. G. & Myers, R. J. (1993), `Empirical analysis of agricultural commodity prices: A viewpoint', Review of Agricultural Economics 15(1), 181202. Vink, N. & Kirsten, J. (2002), `Pricing behaviour in the south african food and agricultural sector'. Report commissioned by the National Treasury, Pretoria. World CIA Factbook (2011). factbook/elds/2096.html. https://www.cia.gov/library/publications/the-world- World Development Indicators (2010). World dataBank, The World Bank Group. 22 Appendix Appendix 1: Sample of items. Item 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Almonds, with shell Anise, badian, fennel, corian. Apples Apricots Arecanuts Artichokes Asparagus Avocados Bananas Barley Beans, dry Beans, green Beeswax Berries Nes Blueberries Broad beans, horse beans, dry Buckwheat Cabbages and other brassicas Canary seed Carobs Carrots and turnips Cashew nuts, with shell Castor oil seed Cattle meat Cauliowers and broccoli Cereals, nes Cargill No No Yes No No No No No No Yes Yes Yes No No No No No No No No No No No Yes No No Item 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 23 Cherries Chestnuts Chick peas Chicken meat Chicory roots Chillies and peppers, dry Chillies and peppers, green Citrus fruit, nes Cloves Cocoa beans Coconuts Coee, green Cotton lint Cottonseed Cow milk, whole, fresh Cow peas, dry Cranberries Cucumbers and gherkins Currants Dates Duck meat Eggplants (aubergines) Fibre Crops Nes Figs Flax bre and tow Fruit Fresh Nes Cargill No Yes No Yes No No No No No Yes No Yes Yes Yes No No No No No No Yes No No No No No Appendix 1: Sample of items (continued). Item 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 Fruit, tropical fresh nes Game meat Garlic Ginger Goat meat Goose and guinea fowl meat Gooseberries Grapefruit (inc. pomelos) Grapes Groundnuts, with shell Hazelnuts, with shell Hemp Tow Waste Hempseed Hen eggs, in shell Hops Horse meat Jute Karite Nuts (Sheanuts) Kiwi fruit Leeks, other alliaceous veg Leguminous vegetables, nes Lemons and limes Lentils Lettuce and chicory Linseed Lupins Maize Maize, green Mangoes, mangosteens, guavas Manila Fibre (Abaca) Maté Meat nes Millet Mixed grain Mushrooms and trues Mustard seed Natural honey Cargill No No No No Yes Yes No Yes No Yes No No No Yes Yes Yes No No No No No No No Yes No No Yes Yes No No No Yes Yes No No No No Item 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 24 Natural rubber Nutmeg, mace and cardamoms Nuts, nes Oats Oilseeds, Nes Okra Olives Onions (inc. shallots), green Onions, dry Oranges Other Bastbres Other bird eggs,in shell Other melons (inc.cantaloupes) Palm kernels Palm oil Papayas Peaches and nectarines Pears Peas, dry Peas, green Pepper (Piper spp.) Persimmons Pig meat Pigeon peas Pineapples Pistachios Plantains Plums and sloes Poppy seed Potatoes Pulses, nes Pumpkins, squash and gourds Pyrethrum,Dried Quinces Rabbit meat Ramie Rapeseed Cargill No No Yes Yes Yes No No No No No No No No Yes Yes No No No Yes Yes No No Yes No No No No No No No No No No No Yes No Yes Appendix 1: Sample of items (continued). Item 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 156 157 158 159 160 161 Cargill Raspberries Rice, paddy Roots and Tubers, nes Rye Saower seed Sesame seed Sheep meat Silk-worm cocoons, reelable Sisal Sorghum Sour cherries Soybeans Spices, nes Spinach Stone fruit, nes Strawberries Sugar beet Sugar cane Sunower seed Sweet potatoes Tangerines, mandarins, clem. Taro (cocoyam) Walnuts, with shell Watermelons Wheat Wool, greasy Yams Yautia (cocoyam) 25 No Yes No Yes No No Yes No No Yes No Yes Yes No No No Yes Yes Yes No No No No No Yes No No No Appendix 2: Sample of countries. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 Albania Algeria Argentina Armenia Australia Austria Azerbaijan Bangladesh Barbados Belarus Belgium Belize Bhutan Bolivia Bosnia and Herzegovina Brazil Brunei Darussalam Bulgaria Burkina Faso Burundi Cambodia Cameroon Canada Chile China Congo Costa Rica Croatia Cuba Cyprus Czech Republic Denmark Dominican Republic Ecuador Egypt El Salvador Eritrea 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 Estonia Ethiopia Finland France Georgia Germany Ghana Greece Guinea Honduras Hungary India Indonesia Iran, Islamic Republic of Ireland Israel Italy Jamaica Japan Jordan Kazakhstan Kenya Korea, Republic of Kyrgyzstan Lao People's Democratic Republic Latvia Lebanon Lithuania Luxembourg Madagascar Malawi Malaysia Mali Mauritius Mexico Moldova Mongolia 26 Appendix 2: Sample of countries (continued). 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 Morocco Mozambique Myanmar Namibia Nepal Netherlands New Zealand Nicaragua Niger Nigeria Norway Pakistan Panama Paraguay Peru Philippines Poland Portugal Romania Russian Federation Rwanda Saudi Arabia Slovakia Slovenia South Africa Spain Sri Lanka Sudan Sweden Switzerland Syrian Arab Republic Tajikistan Thailand Togo Trinidad and Tobago Tunisia Turkey 112 113 114 115 116 117 27 Ukraine United Kingdom United States of America Uruguay Yemen Zimbabwe Table 1: Asymmetry of agricultural price transmission. OLS IV VARIABLES ln(prod price) ln(prod price) ln(exp price) 0.4393*** 0.9783*** -0.0014 2.2348** -0.0122*** -0.3747** 40174 0.3285 4978 40174 (0.0083) price up (0.0229) price up * ln(exp price) (0.0035) N R2 Number of clusters Number of instruments Kleibergen-Paap rk LM statistic Hansen J statistic (0.1205) (1.0889) (0.1712) 4978 12 P-val = 0.0000 P-val = 0.4260 Standard errors in parentheses: *** p<0.01, ** p<0.05, * p<0.1 Clustering by item-country. 28 Table 2: First stage regressions ln(exp price) ln(temperature IV) -0.5035*** (0.0399) ln(cloud cover IV) 0.2892*** (0.0726) ln(climate disaster IV) 0.2025*** (0.0107) ln(rainfall IV) -0.0499 (0.0501) ln(temp * price up) 0.0389 (0.0326) ln(cloud cover * price up) -0.0981 (0.0683) ln(climate disaster * price up) -0.0137 (0.0117) ln(rainfall * price up) 0.0710 (0.0711) ln(temp * temp up) 0.0072 (0.0191) ln(cloud cover * cloud cover up) 0.0375 (0.0320) ln(climate disaster * clim. disast. up) 0.0077 (0.0098) ln(rainfall * rainfall up) -0.0098 (0.0209) N 40174 2 Partial R 0.0551 F(12, 4977) 46.49 Standard errors in parentheses * p < 0.10, ** p < 0.05, *** p < 0.01 29 of the 2SLS. price up ln(exp price * price up) -0.0292* -0.5175*** (0.0171) (0.1165) 0.0281 0.3575 (0.0363) (0.2489) -0.0369*** -0.0995*** (0.0040) (0.0263) -0.0732*** -0.5280*** (0.0221) (0.1511) 0.0459* 0.3825** (0.0241) (0.1656) 0.0323 -0.0461 (0.0571) (0.4047) 0.1387*** 0.8697*** (0.0076) (0.0520) 0.0481 0.2388 (0.0499) (0.3395) 0.0415*** 0.2282** (.0138) (0.0946) 0.0130 0.1905 (.0267) (0.1892) 0.0159*** 0.1159*** (.0048) (0.0331) 0.0116 0.1050 (0.0146) (0.0996) 40174 40174 0.0324 0.0284 156.95 132.05 Table 3: GMM regressions. Lags as IV's Adding economic instruments lag ln(producer price) 0.8028*** 0.8129*** (0.0131) (0.0129) price up 0.1976*** 0.1890*** (0.0578) (0.0576) ln(exp price) 0.1744*** 0.1615*** (0.0129) (0.0127) price up * ln(exp price) -0.0193** -0.0181** (0.0085) (0.0085) year dummies Yes Yes N 28483 28483 AR(1) 0.0000 0.0000 AR(2) 0.1137 0.1205 Hansen J statistic 0.8050 0.7252 Standard errors in parentheses * p < 0.10, ** p < 0.05, *** p < 0.01 Table 4: Long and short run transmission. lags as IV's Adding economic instruments short run long run short run long run ln(exp price) 0.1744*** 0.8840*** 0.1615*** 0.8631*** (0.0129) (0.0373) (0.0127) (0.0381) price up * ln(exp price) -0.0193** -0.1791** -0.0181** -0.1470* (0.0085) (0.0740) (0.0085) (0.0771) Variable Table 5: Asymmetry explained by the export importance. large exp share small exp share OLS 2SLS OLS 2SLS ln(exp price) 0.6403*** 1.1080*** 0.4666*** 0.6715*** (0.0108) (0.1908) (0.0108) (0.1621) price up -0.1747*** 2.3992 -0.0416 -0.6772 (0.0558) (1.5583) (0.0324) (1.5970) price up * ln(exp price) 0.0020 -0.4344* -0.0069 0.0497 (0.0079) (0.2376) (0.0051) (0.2402) N 16343 16343 23831 23831 Standard errors in parentheses * p < 0.10, ** p < 0.05, *** p < 0.01 30 Table 6: Cargill presence. Cargill No Cargill OLS 2SLS OLS 2SLS ln(exp price) 0.5168*** 0.9979*** 0.4709*** 0.9258*** (0.0130) (0.1196) (0.0105) (0.1582) price up -0.0180 1.3850 -0.0178 1.7369 (0.0358) (0.9782) (0.0332) (1.5599) price up * ln(exp price) -0.0143*** -0.2533* -0.0099* -0.2886 (0.0055) (0.1539) (0.0051) (0.2437) N 14692 14692 25482 25482 Standard errors in parentheses * p < 0.10, ** p < 0.05, *** p < 0.01 Figure 1: Proportion of population in agriculture and wealth. 31 P ∗ ,pf mc(Q) P ∗2 w(Q) P ∗0 P ∗21 pf p0f p1f Q1 Q0 Q2 Q Figure 2: Price transmission for various international prices. pf P∗ Figure 3: Relationship between international price and producer price. 32 Figure 4: Rainfall IV. In parenthesis the export share and the annual standard deviation of rainfall in millimeters. 33

© Copyright 2026