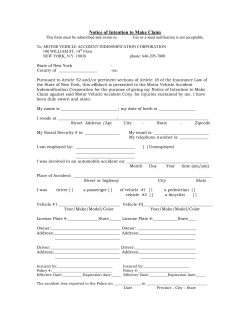

Document 121072