Document 121441

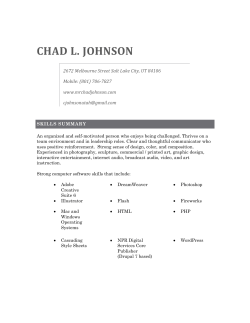

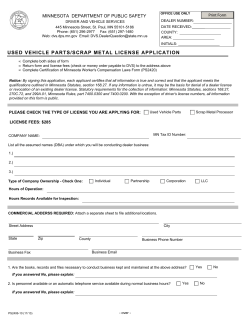

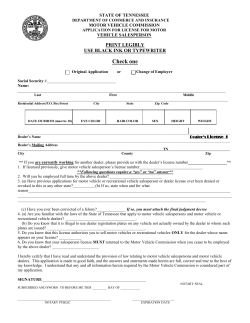

New License Used Car Dealer Packet Courtesy of Providing Quality Dealer Solutions Since 1978. 7414 S State Street Midvale, UT 84047 Phone: 801.566.3802 Toll Free: 800.324.7009 Fax: 801.566.0708 www.IDSinfo.com Also with locations in Ogden & Orem Requirements for Obtaining a Motor Vehicle License in Utah IDS Recommended Checklist (review each step before beginning process) □ Education: Each person involved with the dealership as an owner, partner, corporate officer, or member must attend an eight-hour (8) training seminar. The original training certificate will need to be provided in order to obtain the license. This class is highly recommended as a first step so you know what you will be getting into as a business owner in the automobile industry. If you believe that this business and dealer license is just about being able to buy and sell cars, think again. There are lots of laws to abide by and the penalties are steep. EDUCATION IS RECOMMEDED AS A FIRST STEP BEFORE YOU DO ANYTHING ELSE TOWARD OBTAINING YOUR LICENSE. □ Location: A permanent office structure where the dealership records can be stored and reviewed safely is required. This area cannot be shared with any other business and must meet all local zoning and business requirements. Permanent sign at least 24 square feet. The sign must be painted on or permanently affixed to the building, or cemented in the ground — ABSOLUTELY NO BANNERS. A display area for at least three vehicles is required. This area must be used for display only and denoted by a fence, chain or some other approved method. The sign, office and display area must be contiguous. No other business shall have to impede this area to get to their location, nor must anyone have to pass through another business’ area to arrive at the dealership. Please note that all licenses issued by MVED expire on June 30. Licenses are not prorated. □ Bonds: Obtain a surety bond in the amount of $75,000. Motorcycle or small trailer licenses only require a bond in the amount of $10,000. □ Proper Paperwork: See Paperwork Section below Paperwork Requirements: □ Application for Dealer License: Fill out the Application for Dealer License (TC301). This must be filled out completely. Use the legal name registered with the Department of Commerce and under which you will be conducting business. Be sure to include all names or owners, corporate officers or members and be sure that each has signed the application. Please note that these signatures are required to be notarized. □ FBI Fingerprint Card & Fingerprint Waiver (TC-465): Complete a standard FBI Fingerprint Card and a Fingerprint Waiver (TC-465) for each owner, corporate officer or member. Be certain that each person who submits their fingerprints signs a waiver and has their signature notarized. The fingerprint card must be filled out completely, and signed by the applicant and the peace officer doing the printing or it cannot be accepted. Please note any criminal conviction for a motor vehicle or drug related crime, fraud or registrable sex offense could be grounds for denial. □ Owner(s) Photo: Include a passport-type photo of each owner, partner, corporate officer or member. The photo should only show the head and shoulders and must be large enough to see the face clearly. Photos MAY NOT be smaller than a passport photo, nor larger than a 5 x 7 print. Polaroidtype photos are acceptable if head and shoulders fill the entire frame. Each photo must be of ONE person. Label each photo with the name of the person pictured. □ TC-450: Have your bonding insurance company fill out the Bond of Motor Vehicle Dealer, Crusher or Body Shop (TC-450). The Company name on the bond must read EXACTLY as it does on application form TC-301. The bond must have a revision date of 4/05. After the bonding company completes the bond, it should be returned to the dealership. An owner, partner, corporate officer or member must sign the front as “Principle” (line located just above the insurance agent’s signature on the face of the bond) in front of a notary. Be certain that the notary signs and seals the back of the bond in the appropriate section: If your dealership is an individual proprietorship, the notary seals the fi rst section. If your dealership is a partnership, the notary must seal the second section. If your dealership is a corporation that chose to use a corporate seal when validating documents, you must emboss the bond in the designated position to the left of the notary stamp on the back of the bond. The notary must seal the third section. If your dealership is a Limited Liability Company (LLC), the notary must seal the fourth section. If your dealership is a corporation without a corporate seal, the notary must seal the fourth section. The bond company must either have the designated attorney-in-fact sign the back of the bond in the last section, Affidavit of Qualification or attach a power of attorney to the bond. □ Dealership Photo: A photo of the dealership location that shows the sign must be included with the application. The company name on the sign must read EXACTLY as it appears on the application and bond. Please be certain that the sign is legible and permanently attached in the photo, and that the facility is shown. □ Franchise Dealers: Franchise dealers must include a copy of the franchise agreement. □ Application for Special Plates & Decals: In order to obtain dealer plates, an Application for Special Plates and Decals (TC-142) must be completed and notarized. Be sure to include insurance information including a policy number. Initially there is a limit of two plates. If you do not order plates when applying to become a dealer, it can take 4-6 weeks for future plate orders. □ Sales Tax Number: You must secure a sales tax number issued to the dealership by the Utah State Tax Commission. Submit the application (TC-69) either by mail or in person to the Utah State Tax Commission at 210 North 1950 West, Salt Lake City, Utah 84134. (Before a Utah State Sales Tax number can be issued you must also have a federal I.D. number for the dealership.) Considerations in Obtaining a Dealer License • After submitting the application packet please allow five to ten working days for a site inspection. • After the site passes inspection, you will receive your dealer license within three to five working days. • Application packets received that are either incomplete or sent with an incorrect fee will be returned. • Licensees who finance their own sales in-house must file notification under Utah Consumer Credit Code with the Department of Financial Institutions, located at 324 S. State, Suite 201, SLC Utah 84111 (801) 538-8830. • Your business information must be filed with the Department of Commerce at (801) 530-4849. Before registering a name with the Department of Commerce, please contact MVED at (801) 297-2600. MVED will not license dealers with similar names, to avoid public confusion. Names will be considered on a case-by-case basis. • If you are registering as a new motor vehicle or new powersport vehicle dealer, manufacturer, distributor or other representative of a franchisor, you may also be required to register with the Department of Commerce • • • under the New Automobile Franchise Act, Utah Code §13-14-105, or the New Powersport Vehicle Franchise Act, Utah Code § 13-35-105. See the following websites: commerce.utah.gov/mvfranchise.html commerce.utah.gov/psfranchise.html or call (801) 530-6431 for more information. Salespeople must also be licensed. Please contact Motor Vehicle Enforcement Division for a salesperson packet. Each owner, partner, corporate officer or member of the dealership is issued an owner license which allows them to sell. Utah State Tax Commission Bonded Motor Vehicle Business Application TC-301 Rev. 5/05 Dealer number: Application date: Complete entire form and return it to the Motor Vehicle Enforcement Division at: 210 North 1950 West, Salt Lake City, Utah 84134, Telephone (801) 297-2600 Sales tax number: I am familiar with the statutes and rules governing the conduct and operations of motor vehicle dealers and will cooperate with the Utah State Tax Commission to eliminate abuses and unfair trade practices. License type New motor vehicle and/or new large trailer dealer ($127) Used motor vehicle and/or used large trailer dealer ($127) Business organization Sole Proprietorship LLC Partnership LLP Corporation S-Corp Entity Change Bodyshop ($112) Dealership name New motorcycle and/or new small trailer dealer ($51) Used motorcycle and/or used small trailer dealer ($51) Additional location ($26 each) Telephone number Principal place of business street address City State Bond company ZIP code Bond number Effective date Addresses of additional locations of this business operated in Utah (attach additional sheet(s) if necessary) ($26 fee for each location) Lot # Street address Lot # Street address City ZIP code Street address City Street address Lot # City ZIP code ZIP code Lot # ZIP code City Owner(s), partner(s), or corporate officers information (attach additional sheet(s) if necessary) Name Title Home phone Home address Driver's license number Social security number City Hair color Eye color State ZIP code Date of birth Height Weight Gender Name Title Home phone Home address Social security number Driver's license number City Hair color Eye color State ZIP code Date of birth Height Weight Gender Name Title Home phone Home address Social security number Driver's license number City Hair color Eye color State ZIP code Date of birth Height Weight Gender PAGE 1 OF 3 Previous employment during the last ten years (attach additional sheet(s) if necessary) Business name Beginning date Ending date Street address City State Business name Beginning date Ending date Street address City State Business name Beginning date Ending date Street address City State ZIP code ZIP code ZIP code If you are a franchise dealer of new vehicles, RVs, motorcycles, and/or trailers, furnish required information below Name of manufacturer or distributor Make Address of manufacturer or distributor Name of manufacturer or distributor Make Address of manufacturer or distributor Name of manufacturer or distributor Make Address of manufacturer or distributor Name of manufacturer or distributor Make Address of manufacturer or distributor Banks and other financial institutions or persons that will be financing vehicles for the dealership Bank, financial institution or person's name Bank, financial institution or person's name Street address City Street address State ZIP code City State ZIP code 1. Has anyone connected with the ownership or management of the dealership ever been the holder of a motor vehicle salesperson, dealer, dismantler, or auction license? No Yes, give business name: 2. Has the license mentioned above ever been denied, suspended or revoked? No Yes, give details: 3. Has anyone connected with the ownership of management of the dealership ever been employed by a dealer whose license was suspended or revoked? No Yes, give details: 4. During the past 10 years, have you been convicted of any misdemeanors or felonies in Utah or any other state, or do you have any pending charges awaiting judicial action or review? Failure to disclose any of the requested information No Yes, list each conviction: may result in suspension of this license. A criminal conviction for a motor vehicle or drug related crime, fraud or registrable sex offense can be grounds for denial. PAGE 2 OF 3 I am familiar with the statutes and rules governing the conduct and operations of motor vehicle dealers and will cooperate with the State Tax Commission to eliminate abuses and unfair trade practices. I do solemnly swear (or affirm) that the statements set forth in the foregoing application are true and correct and that I, as owner, as a member of the partnership, or as an officer of the corporation, have authority to sign this application and to make the statements set forth herein. (Firm name) Signature of owner, partner, or corporate officer STATE OF UTAH County or City of Title Subscribed and sworn to before me this day of , 20 (Notary Public) My Commission Expires PAGE 3 OF 3 . TC-465 ORIGINAL - BCI YELLOW - MVED Subscribed and sworn to before me this Signed day of , 20 Commission expires TC-465.CDR Rev. 1/00 Notary public for the state of Signature of notary public Date . Rev. 1/00 I hereby ask that the criminal information requested be released to the Utah State Tax Commission, Motor Vehicle Enforcement Division and release the Utah State Bureau of Criminal Identification from any liability resulting from such request. Waiver Utah State Tax Commission BOND NO. BOND OF MOTOR VEHICLE DEALER, CRUSHER OR BODY SHOP KNOW ALL PERSONS BY THESE PRESENTS: That we, of (Street Address), (City), County of , Utah, as Principal, and a Surety Company qualified and authorized to do business in the State of Utah, and with a rating of at least B+ with the A.M. Best Company, as Surety, are jointly and severally held and firmly bound to the people of the State of Utah to idemnify persons, firms, and corporations for loss suffered by reason of violation of the conditions hereinafter contained, in the total aggregate sum of Dollars ($ ), regardless of the number of claimants or the number of years a bond remains in force, as required by Chapter 3, Title 41, Utah Code Ann. (1953, as amended), lawful money of the United States for the payment of which, well and truely to be made, we bind ourselves, our heirs, executors, administrators, successors and assigns, jointly, severally and firmly by these presents. The total aggregate liability on this bond to all persons making claims, regardless of the number of the claimants or the number of years a bond remains in force, may not exceed $ , as set forth in Chapter 3, Title 41, Utah Code Ann. (1953, as amended). THE CONDITION OF THIS OBLIGATION IS SUCH, That, WHEREAS, the above bounden Principal has applied for a license to do business as a Motor Vehicle within the State of Utah, and that pursuant to the application, a license has been or is about to be issued. NOW, THEREFORE, if the above bounden Principal shall obtain said license to do business as such Motor Vehicle , and shall well and truely observe and comply with all requirements and provisions of THE ACT PROVIDING FOR THE REGULATION AND CONTROL OF THE BUSINESS OF DEALING IN MOTOR VEHICLES, as provided by Chapter 3, Title 41, Utah Code Ann (1953, as amended), and idemnify persons, firms and corporations in accordance with Chapter 3, Title 41, Utah Code Ann. (1953, as amended), for loss suffered by reason of fraud or fraudulent representations made or by violating subsection 41-3-301(1) which requires a dealer to submit or deliver a certificate of title or manufacturers certificate of orgin, so that the total aggregate liability on the bond to all persons making claims, regardless of the number of claimants of the number of years a bond remains in force, may not exceed $ , as set forth in Chapter 3, Title 41, Utah Code Ann. (1953, as amended), on account of fraud or fraudulent representation or for any violation or violations of said law during the time of said license and all lawful renewals thereof, then the above obligation shall be null and void, otherwise to remain in full force and effect. Said bounden Principal shall also pay reasonable attorneys’ fees in cases successfully prosecuted or settled against the Surety or Principal if the bond has not been depleted. The surety or principal shall notify the Motor Vehicle Enforcement Division Administrator if a claim on the bond is successfully prosecuted or settled against the surety or principals. The surety herein reserves the right to withdraw as such surety except as to any liability already incurred or accrued hereunder and may do so upon the giving of written notice of such withdrawal to the Principal and to the Motor Vehicle Enforcement Division, provided, however, that no withdrawal shall be effective for any purpose until sixty days shall have elapsed from and after the receipt of such notice by the said Administrator, and further provided that no withdrawal shall in anywise affect the liability of said Surety arising out of fraud or fraudulent representations or for any violation or violations of said laws by the Principal hereunder prior to the expiration of such period of sixty days, regardless of whether or not the loss suffered has been reduced to judgement before the lapse of sixty days. Signed and Sealed this Approved as to Form Office of the Utah Attorney General MVED-1 (Rev. 4/05) day of , 20 __________________________ __________________________ Principal ______________________ , Surety __________________________ By Attorney-in-Fact TC-450.indd Rev. 4/05 . INDIVIDUAL ACKNOWLEDGMENT OF PRINCIPAL STATE OF UTAH SS COUNTY OF On this day of , in the year 20 , before me personally appeared , to me known and known to me to be the person, and described in, and who executed the foregoing instrument, and acknowledged to me that he executed the same. (NOTARY SEAL) ___________________________ Notary Public LLP/PARTNERSHIP OR FIRM ACKNOWLEDGMENT OF PRINCIPAL STATE OF UTAH SS COUNTY OF On this day of , in the year 20 , before me personally appeared to me known and known to me to be of the firm of described in, and who executed the same as and for the act and deed of said firm. (NOTARY SEAL) , , ___________________________ Notary Public CORPORATE ACKNOWLEDGMENT OF PRINCIPAL (TO BE COMPLETED BY CORPORATION WITH CORPORATE SEAL) STATE OF UTAH SS COUNTY OF On this day of , in the year 20 , before me personally appeared , to me known, who, being by me duly sworn, did depose and say: That he resides in , that he is of the , the cor poration described in and which executed the above instrument; that he knew the seal of said corporation, and that he signed his name thereto by like order. (CORPORATE SEAL) (NOTARY SEAL) ___________________________ Notary Public CORPORATE ACKNOWLEDGMENT OF PRINCIPAL / LLC (TO BE COMPLETED BY LLC OR CORPORATION WITHOUT CORPORATE SEAL) STATE OF UTAH SS COUNTY OF On this day of , in the year 20 , before me personally appeared , to me known, who, being by me duly sworn, did depose and say: That he resides in , that he is the of the , the cor poration which executed the above instrument and which is described therein; that he signed the above mentioned instrument on behalf of said corporation; that he was authorized to do so (NOTARY SEAL) ___________________________ Notary Public AFFIDAVIT OF QUALIFICATION STATE OF UTAH COUNTY OF SS being first duly sworn, on oath deposes and says that he is the of said company, and that he is duly authorized to execute and deliver the foregoing obligations; that said company is authorized to execute the same and has complied in all respects with the laws of Utah in reference to becoming sole surety upon bonds, undertakings and obligations. Subscribed and sworn to before me this day of My Commission expires: (NOTARY SEAL) 20 ___________________________ ___________________________ ___________________________ Notary Public Utah State Tax Commission TC-142 Rev. 12/04 Application for Special Plates and Decals Return application and fees to Utah State Tax Commission, Motor Vehicle Enforcement Division, 210 North 1950 West, Salt Lake City, Utah 84134. License #: Company name: Manufacturer Transporter Dealer Dismantler As owner, partner, or corporate officer of the above noted company, I hereby make application to the Utah State Tax Commission for the following items: Dealer plates ($12.00 each - including decal) $ Motorcycle plates ($12.00 each - including decal) $ Dismantler, Manufacturer, or Transporter plates ($10.00 each - including decal) $ Renewal decals for Dealer plates ($10.50 each) $ Renewal decals for Dismantler, Manufacturer, or Transporter plates ($8.50 each) $ Additional instructions: Total $ Decal number: I, the undersigned, being first duly sworn, depose, and say that I have applied for a license to engage in the business shown above; and I hereby make application for special license plates. The license plates will not be used on any vehicle other than the vehicles authorized under the provisions of the law. I further certify, under penalty of law, that all vehicles operated, displaying such special plates, will be insured as prescribed by law. Insurance company Policy number Address Telephone number STATE OF UTAH City or County of (Firm name) Signature (must be signed by owner, partner, or corporate officer) Title Subscribed and sworn to before me this day of , 20 My Commission Expires (Notary Public) . UTAH STATE BUSINESS AND TAX REGISTRATION TC-69 Rev. 10/06 Use form TC-69 to register with the Utah State Tax Commission for all taxes listed below. For registration of a DBA, use Department of Commerce form, Business Name Registration / DBA Application, available at all registration locations, online at commerce.utah.gov, or by telephone at (801) 530-4849. NOTE: You do not need to file this form if you register your business online. Online registration allows registration with the Tax Commission, Department of Commerce, Department of Workforce Services and select municipalities all at once. If you are interested in registering online, see OneStop Business Registration at business.utah.gov/registration. General Instructions • Read the instructions carefully. Utah State Tax Commission 210 North 1950 West Salt Lake City, UT 84134-3310 (801) 297-2200 1-800-662-4335 Fax: (801) 297-3573 www.tax.utah.gov • Type or print clearly. • Applications with missing or illegible information will be returned. • Mail or fax the completed application to the Tax Commission (address at right). • Allow 15 business days for processing if submitting a paper application. • Contact the appropriate city or county for business licensing requirements. Office Use Only (USTC) Type of Registration 7Check each box that applies Fee Complete Sections Employer Withholding License* No Fee 1, 3, 4 Sales and Use Tax License* No Fee 1, 2, 4 Use Tax License Only* No Fee 1, 2, 4 Beer Tax (distributor/manufacturer only) No Fee 1, 4 Lubricating Oil Fee No Fee 1, 4 Telecommunications Service Provider No Fee 1, 2, 4 Cable or Home Satellite Service No Fee 1, 4 Sexually Explicit Business / Escort Service No Fee 1, 4 Cigarette and Tobacco License $30 per location 1, 4 Cigarette Stamper License and Bond† 1, 4 Tobacco Products License and Bond† 1, 4 (make check payable to Utah State Tax Commission) † A bond is required for cigarette stamping and tobacco wholesale distribution. The minimum bond amount is $500 for cigarettes or tobacco, or $1,000 for both. Contact an insurance company of your choice to obtain a surety or performance bond. Attach the bond to the application, or forward the bond after submitting the application. * Previous or Existing Accounts: Granting of license for sales tax and withholding is conditional. Applicants or fiduciaries of applicants with a history of filing and paying late are required to resolve past delinquencies and/or post a bond of at least $25,000 but not more than $500,000. Enter all previous or existing licenses and account numbers you have had with the Utah State Tax Commission: ______________________________________________________________ Streamlined Sales Tax (SST) Registration Number If you purchase a business, obtain from the seller a letter from the Tax Commission stating no sales and use tax is due; or withhold enough of the purchase money to cover all unpaid taxes. If you fail to withhold sufficient funds from the purchase money, you will be held personally liable for the seller's unpaid sales and use tax, including all sales-related taxes (Utah Code §59-12-112). If you need an accommodation under the Americans With Disabilities Act, contact the Tax Commission at (801) 297-3811 or TDD (801) 297-2020. Please allow three working days for a response. Section 1 – General Information Required by all applicants. 1a. Organizational Structure Must check one Individual/Sole Proprietor Limited Partnership General Partnership Limited Liability Partnership Corporation S Corporation Business Trust (attach approval of election by IRS) Limited Liability Company (LLC): Type of return the LLC will be filing with the IRS. 1b. Incorporation Date If a corporation, enter the date: _______________ and state: ______ of incorporation or qualification in Utah. 1c. Department of Commerce Entity Number Enter number issued by the Dept. of Commerce. 1d. Federal Identification Number A sole proprietor is required to provide a Social Security Number (SSN). In addition, a sole proprietor with employees is required to also provide an Employer Identification Number (EIN). All other organizational structures must provide an EIN. Social Security Number (SSN) 1e. Name of Business Entity - PRINT Federal Employer Identification Number (EIN) If you are a sole proprietor, write your name here Daytime phone number Owner's street address Office Use Only Cell phone number City County State 1f. DBA/Business Name Business or trade name at this physical location County Code ZIP Code Business phone number City Code Physical street address of business (P.O. Box not acceptable) City Fax number County State ZIP Code SIC Code Local government entity issuing business license for this location: 1g. Business Mailing Address USTC SIC Write "same" if same as business location (1f) City State E-mail address ZIP Code Contact phone number NAICS 1h. Business Description Describe in detail the specific nature of your business (include the types of products sold) If business is a restaurant, check the box that best describes your business: Fast food Family restaurant with liquor Theme with liquor White table cloth with liquor Specialty food 1i. Officer/Owner Information Provide the following information for each officer, general partner, managing member, trustee, or enterprise owner of the applying entity. Tax Commission Rule R861-1A-15 requires the SSN of each individual and the EIN of each entity listed. To avoid unlawful disclosure, access to account information is limited to those listed. If more space is needed, attach additional sheets. If changes occur, notify the Tax Commission. Name and Title - PRINT SSN and EIN SSN EIN SSN EIN SSN EIN Home address and City/State/ZIP Telephone Number Section 2 – Sales and Use Tax Sales and use tax is reported on form TC-61 and Schedules PS and PSD. For additional sales and use tax information, see Tax Commission Pub 25 available on our website at tax.utah.gov/forms. To find sales tax rates, go online at tax.utah.gov/sales/rates.html. NOTE: Goods or services purchased tax free, but used or consumed by you or your business, must be reported on line 4 of the sales and use tax return. You must pay sales or use tax on goods you consume. 2a. When will you start selling or making purchases? Month Day Year 2b. Estimate your annual net sales and purchases subject to tax. $16,000 or less (annual filing*) $16,001 - $800,000 (quarterly filing*) $800,001 - $1,500,000 (monthly filing) $1,500,001 or more (monthly filing plus mandatory EFT payments) *Check this box to voluntarily file monthly: 2c. Sales and Use Tax 7Read and review all questions. Check all boxes for which your answer is "yes." 1. Will you sell goods or services from only one fixed place of business in Utah? 2. Will you sell goods or services from more than one fixed place of business in Utah? • If yes, complete and attach form TC-69B, listing each place of business. 3. Will you sell goods or services from a non-fixed place of business, such as door-to-door or through vending machines or multi-level marketing? Also check this box if your business is located in Utah and you ship goods from a location outside Utah to a Utah customer. 4. Are you a seller who has no physical or representational presence in Utah who is selling goods or services shipped direct by U.S. mail or common carrier to Utah customers? See Pub 37, Business Activity and Nexus in Utah. 5. Will you have sales of prepared food or beverages? 6. Are you a utility providing telephone service, electricity or gas? • If yes, complete and attach form TC-61Q. 7. Will you have retail sales of new tires? This includes new tires sold as part of a vehicle sale, new tires purchased on or for vehicles that are rented, or new tires purchased from all those not collecting the Waste Tire Recycling Fee. 8. Do you purchase natural gas or electricity from someone other than your local public utility? 9. Are you selling or operating motel, hotel, trailer court, campground or other lodging accommodations? 10. Will you rent motor vehicles (registered for 12,000 pounds or less) to customers for 30 days or less? 11. Will you sell motor vehicles, aircraft, watercraft, manufactured homes, modular homes or mobile homes in municipalities imposing the resort communities tax?† † Jurisdictions imposing the resort communities tax: Alta, Boulder, Brian Head, Garden City, Green River, Kanab, Midway, Moab, Monticello, Orderville, Panguitch, Park City, Park City East, Springdale, Tropic 2d. Use Tax 7Read and review both questions. Check all boxes for which your answer is "yes." 1. Are you a real property contractor bringing material directly to a Utah job site and/or having material shipped directly to a Utah job site from a location outside Utah? 2. Will you purchase goods or services tax free from sellers located outside Utah for storage, use or consumption by you or your business in Utah and need to report use tax of more than $400 annually? NOTE: If only the "Use Tax" boxes are checked, you will be issued an "H" number for reporting tax-free purchases from outside of Utah. An "H" number may not be used to make tax-free purchases. If an answer to any question above changes, notify the Tax Commission. Temporary License for Special Events Regardless of whether you have a permanent sales tax license, all persons or sellers who participate in a one-time event or an event that runs six months or less where sales occur are required to obtain a temporary sales tax license. These special events are generally removed from a seller's usual location and fall under a variety of situations, including state and county fairs, festivals, antique shows, gun shows, food shows, art shows, auctions, mall kiosks, swap meets, conventions, hobby shows, seasonal stands found in malls, and other similar events. Registering for a temporary license is easy. Register online at tax.utah.gov/sales/specialevents.html, or call (801) 297-6303, or toll free (outside the SLC area), 1-800-662-4335, ext. 6303. Section 3 – Employer Withholding 3a. When will you start paying wages? Month Day Year 3b. Household Employment Annual Filing Option Will you file annual household employment taxes on Schedule H of your federal income tax return, Form 1040? Yes No (If you answer "yes," do not complete 3c. You will file annually) 3c. Estimate the amount of Utah wages you expect to pay in a calendar year. $16,000 or less (annual filing) $16,001 - $200,000 (quarterly filing) $200,001 or more (monthly filing) Section 4 – Authorized Signature Required by all applicants. The Tax Commission will review all officers/owners listed in Section 1i (page 2) for previous unresolved tax debt. Granting a license may require resolution or bonding prior to license approval. I understand any person (including employees, corporate directors, corporate officers, etc.) who has or will have the authority to direct accounting processes or who is required to collect, account for, and pay any taxes and fails to do so shall be liable for a penalty equal to the total amount of tax not collected, not accounted for, or not paid under the provisions of Utah Code §59-1-302. I understand I am required to notify the Tax Commission if I add or close a business location; or change the name, organizational structure, officer status, or address of the business. I also understand my signature indicates I have reviewed this section with all named on this form. Sign Here: ______________________________________________ Title: __________________ Print Name: ______________________________________________ Date: __________________ Signature Requirements: Organizational Structure (as checked on line 1a) Signature • Individual/Sole Proprietor .............................................................. Signature must match SSN provided in Section 1 (1d) (e.g., a husband or wife may not sign on behalf of each other). • All Partnerships ............................................................................ One general partner must sign. • Corporation / S Corporation ......................................................... An officer of the corporation authorized to sign on behalf of the corporation must sign. • Business Trust .............................................................................. The grantor or a trustee must sign. • Limited Liability Company ............................................................. A member must sign. Reporting and Remittance Guidelines Always file tax returns by the due date and remit full payment. You must file a return, even if no taxes are due. Just declare zero tax, sign and date your return, and file by the due date. You must file and pay timely, even if you do not receive a preprinted form. Forms are available online at tax.utah.gov/forms, at all Tax Commission locations, or by calling the automated forms line at (801) 297-6700. If you do not file a return or pay taxes due, you will be sent a tax delinquency notice and/or contacted. If you disagree with an action taken by the Tax Commission, you have the right to file an appeal within 30 days of receiving the notice. See Pub 2, Utah Taxpayer Bill of Rights, for more information. For questions about EFT payments, refer to form TC-85 for sales and use tax, or call (801) 297-3817 for assistance. For employer withholding, refer to Pub 43, or call (801) 297-7626 for assistance.

© Copyright 2026