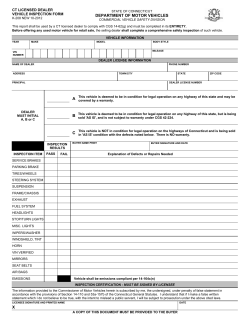

Dealer Licensing and Salesperson’s