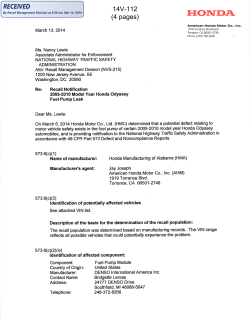

Contents