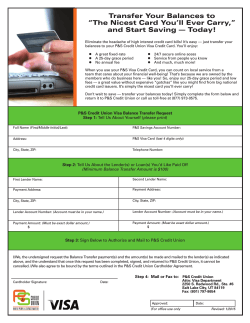

STEP 1: Please email the following items listed under Broker