your health smart choices

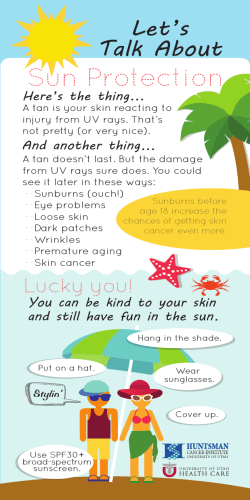

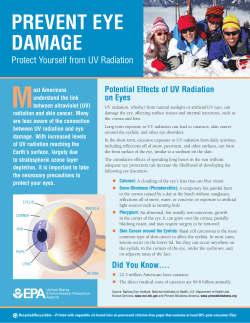

It’s... your health smart choices Make... Financial Directions July is UV Safety Month® UV Safety Month is celebrated every July, and is a great time to spread the message of sun, fun and UV safety to your community. Read on to learn more about UV Safety Month and the importance of keeping yourself protected from those harmful rays this summer. Lori Spivey Christy Kim Becky Mayle-Tyndall Jeff Gambrel Millie Buchanan Sandra Archer Amanda Hayden Our Health & Welfare Team [email protected] [email protected] [email protected] [email protected] [email protected] [email protected] [email protected] l Skin cancer is almost 100% curable when it’s found early and treated right away. That’s why it’s a good idea to check your skin every month for new growths and other signs of cancer. Tell your doctor or nurse right away if you find a change. What is the goal of UV Safety Month? Ultraviolet (UV) radiation is the main cause of skin cancer. Anyone can get skin cancer, but the risk is greatest for people with: White or light-colored skin with freckles Blond or red hair UV rays can also damage your eyes. Blue or green eyes We stress the importance of protecting your eyes from the sun’s harmful rays by wearing sunglasses and wide-brimmed hats. A large number of moles Studies show that exposure to bright sunlight may increase the risk of developing cataracts, age-related macular degeneration and growths on the eye, including cancer. You can take these steps to help prevent skin cancer: Stay out of the sun between 10 a.m. and 4 p.m. Use sunscreen with SPF 15 or higher. Cover up with long sleeves and a hat. Check your skin regularly for any changes. Wear sunscreen even on cloudy days. UV rays can still harm your skin through the clouds. Plan ahead – put sunscreen on 30 minutes before you go outside. Be sure to use enough sunscreen (a handful). If you wear very light clothing, put sunscreen on under your clothes. Put on more sunscreen every few hours and after you swim or sweat. Why do I need to protect my skin from the sun? Protect your skin from the sun today to help prevent skin cancer later in life. Most skin cancer appears after age 50, but damage from the sun can start during childhood. Staying out of the sun and using sunscreen can also help prevent: Wrinkles (919) 678-0007 (919) 678-8422 (919) 534-0567 (919) 534-0580 (919) 678-8426 (919) 678-8421 (919) 678-8425 Blotchy or spotty skin Other damage caused by the sun Don't focus on color or darkness of sunglass lenses: Select sunglasses that block UV rays. Don't be deceived by color or cost. The ability to block UV light is not dependent on the price tag. Check for 97-100% UV protection: Make sure your sunglasses block 97 to 100 percent of UV rays and UV-B rays. Choose wrap-around styles: Ideally, your sunglasses should wrap all the way around to your temples, so the sun's rays can't enter from the side. Wear a hat: In addition to your sunglasses, wear a broad-brimmed hat to protect your eyes. Don't rely on contact lenses: Even if you wear contact lenses with UV protection, remember your sunglasses. Don't be fooled by clouds: The sun's rays can pass through haze and thin clouds. Sun damage to eyes can occur anytime during the year, not just in the summertime. Protect your eyes during peak sun times: Sunglasses should be worn whenever outside and it's especially important to wear sunglasses in the early afternoon and at higher altitudes, where UV light is more intense. Don't forget the kids: Everyone is at risk, including children. Protect their eyes with hats and sunglasses. In addition, try to keep children out of the sun between 10 a.m. and 2 p.m., when the sun's UV rays are the strongest. What is skin cancer? Skin cancer is the most common kind of cancer in the United States. There are 3 different kinds of skin cancer. The 2 most common kinds of skin cancer are basal cell carcinoma and squamous cell carcinoma. They are both also called non-melanoma skin cancer. The most dangerous kind of skin cancer is called melanoma. 5001 Weston Parkway Suite 200 Cary, NC 27513 * employee benefits * Source: http://www.healthfinder.gov, http://development.aao.org tel 919.678.0007 business owner and executive benefits * fax 919.678.0065 individual financial planning * www.financialdirections.com investments * life insurance * It’s... your health smart choices Make... Financial Directions Five Items for Your Mid-Year Financial Check-Up On New Year’s Day, you had plans and promises to get your finances in order in 2011. But the calendar has jumped from January to July in barely more than a blink of an eye. With the July 4th weekend come and gone, your thoughts are hopefully turning to a mid-year review of your finances. So today, check your financial pulse and ask yourself the following five questions. Our Financial Advisors Lori Spivey Robbie Spivey Linda Housand John Mitchell Steed Rollins Shawn Startti Kent Thompson John Young 1. How are you progressing versus your financial planning goals? Assuming you have a financial plan in place, this is a good point in the year to review your progress toward goals such as retirement and saving for college. If you don't have a financial plan or if your plan is many years out of date, this is a great time to get one in place. 2. Are your investments properly allocated? A key element of your financial plan should be an asset allocation strategy for your investments. As in most years, some investment categories have done well, others not as well. Mid-year is a good time to review your portfolio's overall allocation and rebalance as needed. 3. If you are self-employed, have you started a retirement plan for yourself? You work hard to grow your business and serve your clients. There are many options available to you ranging from a Solo 401(k) to many other options. What is best for you will depend in part on factors such as whether or not you have employees, the predictability of your company's cash flow, and the amount you are willing to contribute. Whichever plan you choose, start a retirement plan for yourself. You deserve it. 4. Parents of minors, have you made provisions for your children in the event of your death? Do you have a will? Have you selected a guardian for your children in the event of your premature death? Have you selected someone to administer your estate and your assets for the benefit of the children? If not you should consider consulting an estate planning attorney today. 5. Is it time to finally get the financial planning help you need? Maybe you don't want to spend the money. Maybe you are convinced you can do this yourself. In reality, ask yourself a few questions: 5001 Weston Parkway Suite 200 Cary, NC 27513 * employee benefits * (919) 678-0007 (919) 678-0007 (919) 678-8423 (919) 678-0007 (919) 534-0579 (919) 534-0581 (919) 678-4835 (919) 678-8428 [email protected] [email protected] [email protected] [email protected] [email protected] [email protected] [email protected] [email protected] Do I devote time to my finances and investments on a regular basis? Does my portfolio consist of a random collection of stocks, mutual funds, and other investments (financial clutter)? Do you know how much you will need to accumulate for financial goals such as retirement or college? Do you have a clue how your investments are performing? Do you benchmark your portfolio's performance? Do you review your investments as a portfolio, or just as individual holdings? Managing your financial future is critical to meeting your goals, and it isn't always as easy as it looks. If you don't like your answers to these questions, consider hiring a fee-only financial adviser to help you. July 4th has come and gone. Take the time to sit down and take stock of where you are financially at mid-year. It's easy to put this off, but the rewards of staying on top of your finances can pay off for a lifetime. Source: http://money.usnews.com Securities offered through First Allied Securities, Inc. A Registered Broker Dealer, Member FINRA / SIPC tel 919.678.0007 business owner and executive benefits * fax 919.678.0065 individual financial planning * www.financialdirections.com investments * life insurance *

© Copyright 2026