15 Q1 - Inside Lane - Santander Consumer USA

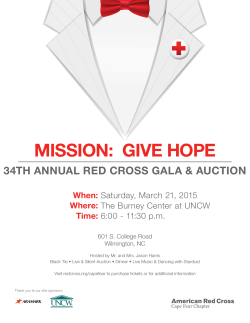

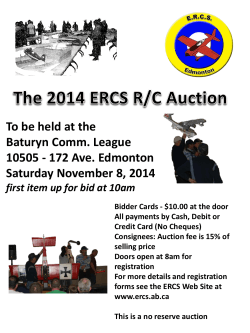

GREENLIGHT DRIVING GROWTH FOR THE REMARKETING PROFESSIONAL DIGITAL LIFE How new technology has shifted buyer expectations and seller strategies P4 INNOVATIONS SPEED UP THE AUCTION PROCESS P9 DO MOBILE APPS IMPROVE CONDITION REPORTING - OR COMPLICATE IT? P10 ISSUE 25 WHAT DO YOU THINK? YES. We really want to know your opinion of GREENLIGHT REMARKETING magazine. We welcome your ideas, suggestions or other comments at: http://bit.do/Greenlight-survey As a thank you, the first 50 readers to respond will receive a limited-edition Santander Consumer USA baseball cap just in time for spring training. Quality • Price • Value Selection • Performance Service • Satisfaction IN FRONT LEADERSHIP Showing the Way We’re gearing up for a big year at Santander Consumer USA remarketing. 3 CONTENTS 9 But before we look ahead, we will take a look back for the fourth straight year at those auction partners who were among the strongest in 2014, through our Santander Auction Partner Awards. The awards, which go out at the annual Conference of Automotive Remarketing, scheduled March 17-20 in Las Vegas, NV, recognize auto remarketing professionals who are showing the way in the industry. This includes our Auction Representative of the Year award to a top Santander employee. Otherwise, we’ll be naming an Auction Partner of the Year, Overall Auction of the Year, E-Commerce Auction of the Year, Operational Auction of the Year, and best performing auctions in four regions. We also will recognize those winners in this column in next quarter’s edition of GreenLight Remarketing. THROUGH THE LOOKING GLASS: Consumers get a window into wholesale auctions *** Meanwhile, we’re anticipating big things from our new Chrysler Capital off-lease program as vehicles begin to hit the auction lanes. We expect to start with around 1,000 vehicles in March, increasing to 3,000 by May and settling in around 2,000-3,000 monthly the rest of 2015. Active Auctions Buy Santander Consumer USA vehicles at auctions nationwide We’re excited about the opportunity to get this program, more than a year in the making, up and running with Chrysler Certified products that meet the same standards to which auction participants have become accustomed through Santander Consumer USA’s Santander 7 certification program. Into the Fast Lane Wholesale auctions poised for innovations in speed and convenience *** We also are eager to get your feedback on GreenLight Remarketing magazine. Take a look at the facing ad for more details, and then take a few minutes to reply – and possibly receive one of 50 limited edition Santander Consumer USA baseball caps just in time for spring training. *** 4 6 8 10 11 Digital Life What does growing digital adoption mean for the auction industry? Condition Reports on the Fly Mobile apps and smartphone cameras allow for fast and detailed condition reporting Lease Returns Don’t Dent Residuals Three-year leases keep rolling in, but wholesale values hang tough Finally, we hope you find this edition of the magazine informative, and, again, thank you for your business. Brent Huisman SVP, Asset Remarketing Santander Consumer USA Inc. GreenLight Remarketing is published by Royal Media on behalf of Santander Consumer USA Inc. For more information about Santander Consumer USA or RoadLoans™ call 888.540.5626 or visit www.santanderconsumerusa.com. Royal Media can be found at www.royalmedia.com. ©2015 Santander Consumer USA Inc. 4 AUCTION STRATEGY DIGITAL LIFE How new technology has shifted buyer expectations and seller strategies BY KAREN JONES T HE PERVASIVE GROWTH OF DIGITAL technologies has been a game changer for auto auctions, both in-lane and online. In less than 20 years, buyer and seller adoption of technology has gone from curiosity or caution to “I need this,” according to Mike Williams, vice president of mobile and direct sales at Black Book. From data compilation and distribution to live streaming, online bidding and mobile apps, digital technology today “is an integral, intertwined part of the business,” says Williams. “It is no different than having a parking lot.” Marketshare is trending up for online/simulcast-only auction sales, but has yet to dominate, according to 2013 NAAA data, the most recent available at press time. Figures for 2013 are at 17.4% of total volume, up from 14% in 2009. This signals a slow but steady adoption of online auctions by dealers from the days of the first industry simulcast in 2002 to now, says Larry Dixon, senior manager of market intelligence at NADA Used Car Guide. The tipping point was establishing trust in technology, adds Dixon. “Trust is critical for a deal- er, especially online.” He emphasizes that instead of kicking the tires at live auctions, dealers had to develop confidence in digital delivery systems of vehicle data to influence their bids and participation online. “Condition dictates, to a degree, what dealers will pay for a vehicle, and if they guess wrong then profits may be squeezed, or there may be no profits at all,” says Dixon. He adds that in an industry where net profit for dealerships in 2014 before taxes averaged approximately 2.5% of total sales, today’s dealer must be techno-savvy. AUCTION STRATEGY THE WORLD SPEEDS UP Jeff Hart, senior director of digital administration at Manheim, agrees with Williams. “What used to take days now can be done in hours or minutes.” Instead of doing research by physically attending an auction several days ahead to “walk the inventory,” dealers can use online condition reports and digital imaging of presale inventory “to refine what they are looking for, review the vehicle details, wholesale values through Manheim Market Report, (look at) vehicle history reports and create a list to buy, all without leaving the office” he says. Also gone are the days when buying and selling was confined to specific auction dates or times. If buyers need a vehicle immediately, “with a few simple clicks they can search, compare and buy the vehicle they need,” says Hart. He adds that last year, dealers purchased 400,000 vehicles through Manheim online channels, noting that this figure does not include in-lane/online simulcast sales. A byproduct of inventory moving through alternative channels is that “it allows auctions to provide better placement for sellers who want to sell in-lane,” observes Peter Kelly, president and CTO of KAR Auction Services. “There is a whole spectrum of activities and choices available today,” says Kelly, who is also a co-founder of Openlane, acquired by KAR unit ADESA in 2011. The company has invested heavily in technology infrastructures, online and mobile tools for auctions and upstream programs. TradeRev, for example, is an online tool with mobile capabilities, allowing a franchise dealer who has a trade-in to do a quick appraisal and launch that vehicle into an immediate one-hour auction where other dealers can bid. “He can sell that vehicle in real time before it leaves the dealership,” says Kelly. With an eye on continuing to refresh dealer confidence, newly launched ADESA Assurance offers a 30-day $30 return guarantee for selected off-lease vehicles sold on ADESA DealerBlock, the company’s 24/7 online marketplace. “$30 is a very low price for peace of mind,” says Kelly, and peace of mind is translating into sales. Kelly confirms that today “close to 40% of cars sold through ADESA are sold through an online bidder.” That figure includes cars at a physical auction or upstream. Upstream is the name of the game at SmartAuction, Ally Financial Inc.’s wholesale internet auction platform for remarketing vehicles for consignors that include OEMs, financial institutions, rental agencies and fleet companies. Founded in 2000, it has sold 4.7 million cars to date, says Steve Kapusta, vice president of dealership online services at Ally. He adds, “We expect to hit 5 million in 2015.” Kapusta says the impetus for success in this platform “is to describe accurately and stand behind the purchase.” Photo: Art Kanovalov The good news, says Dixon, is the industry as a whole has recovered and is nearing the volume of 2000 to 2006 with 16.4 million new cars sold in 2014. He adds that both new and used markets are doing “incredibly well.” Used car-sales hit 42 million units in 2014, with prices up 18% since 2007 “due to strong demand and declining supply.” Even more telling, used-car gross profit margins were at 12.7% as opposed to 3.7% for new. “That is why some of the larger dealer groups are placing more emphasis on used cars, which makes digital technology even more critical,” says Dixon. Today’s techno-savvy dealer is a multi-screen multitasker, who can utilize digital technologies to keep used-car inventory flowing in and out of lots very quickly, says Williams. “It’s all about maximizing efficiency of information right now. Fifteen years ago, a dealer might have one audio/video screen open.” That has evolved to numerous digital screens — desktops, laptops, smartphones, iPads — delivering information simultaneously. “He could be looking at a wholesale site, retail site, bidding online or checking pricing information” he says. “Dealers are juggling more information than before and doing more with it. They are the centralized person directing their businesses and making sure everything is moving fluidly.” FOCUSED CONSUMERS Technology has also created a much more savvy consumer who “flows back up the channel,” says Dixon. “Dealers recognize that consumers today have so much access to pricing data, and that influences what they are willing to spend.” Data that can be mined from consumer emails and other online sources will influence the types 5 TradeRev’s full suite of information is easily accessed on mobile devices, facilitating far more rapid trading and selling cycles. of vehicles dealers will purchase. With a greater understanding of what today’s used-car buyers want, dealers are better able “to tap into technology to find where those vehicles are anywhere in the country, and have them shipped directly to them,” says Dixon. Though the availability of digital information means that many consumers now enter a dealership knowing what vehicle they want to buy and what they will spend, making traditional negotiating more challenging, it confirms regional preferences, which is key for inventory. Kelly senses that dealers today “are much more focused on the exact type of inventory they are seeking to buy. They are coming into the auction, online or in person, with a defined purchase list. They are focused on getting the right inventory mix into the dealership to meet the retail needs of the community.” He also sees no downside to technology from the dealer point of view. “Nothing has been taken away from the buyer,” he says. “If they have a preference to come and participate in-lane, that is still available, and we welcome that.” Kelly adds that with digital technologies there are more choices than ever. “Technology is driving efficiency and, from our perspective, we just need to be in tune with the trends and the opportunities they create. We need to make sure we make the investments to stay current and ahead of the game.” “Trust is critical for a dealer, especially online ... Condition dictates, to a degree, what dealers will pay for a vehicle, and if they guess wrong then profits may be squeezed, or there may be no profits at all.” — L arry Dixon, senior manager of market intelligence, NADA Used Car Guide 6 AUCTIONS ACTIVE AUCTIONS Manheim Seattle Wednesdays Brasher’s Northwest Brasher’s Idaho Thursdays Dealers get a close-up look at vehicles rolling through the Santander Consumer USA (Santander) auction lane at ABC’s recently renovated Bowling Green location. Brasher’s Sacramento Brasher’s Salt Lake City Tuesdays Brasher’s Reno Wednesdays ADESA Golden Gate Tuesdays ADESA Las Vegas Manheim Southern California Thursdays ADESA Los Angeles Fridays ADESA Phoenix Wednesday Manheim Tucson Manheim Hawaii Wednesdays* Ringman Tommy Knight, left, manages a Santander Consumer USA (Santander) auction lane at Manheim’s Southwest Atlanta location along with Nick Coney, top left, auctioneer Tommy Echols and Marcia Bennett. Auto Auction RV Auction (please contact auction for dates) Boat Auction (please contact auction for dates) Dealers AA of Alaska Wednesdays AUCTIONS Manheim NorthStar Minnesota Thursdays Manheim Minneapolis Manheim Detroit Thursdays ADESA Colorado Springs Manheim Kansas City Wednesdays DAA Oklahoma City Thursdays ADESA Dallas Thursdays ABC Bowling Green Fridays Manheim Louisville Thursdays Manheim New York Wednesdays ADESA New Jersey Thursdays Manheim New Jersey Wednesdays Bel Air Auto Auction Tuesday specialty; Thursday Auto ADESA Cincinnati Tuesdays ABC St. Louis Thursdays Manheim Denver ABC Lancaster Wednesdays Americas Auto Auction - Chicago Manheim Ohio Wednesdays Tuesdays Manheim Arena Tuesdays ADESA Concord Wednesdays Capital City AA Fridays Manheim Balt-Wash Tuesday Manheim North Carolina Mondays ADESA Charlotte Thursdays Carolina Auto Auction Wednesdays Manheim Nashville Tuesdays ABC Birmingham Wednesday specialty Manheim Dallas Wednesdays Manheim Mississippi Manheim DFW Thursdays ADESA Birmingham Wednesdays ADESA Atlanta Wednesdays Manheim Georgia Tuesdays Americas AA - Greenville Americas Auto Auction Tuesdays Manheim San Antonio Wednesdays ADESA Houston Wednesdays Manheim Lakeland ABC Baton Rouge Thursdays Manheim Central Florida Wednesdays Manheim Tampa Thursdays ADESA Tampa Mondays Weekly weekend online events are available through OVE and ADESA Dealer Block. Contact your favorite auction or go online to ADESA.com, Manheim. com or OVE.com for listings. Copart and IAAI auction sites are available across the country. Please visit www.copart.com and www.iaai.com for details. *Contact auction for exact sale date 7 8 TECHNOLOGY LIFE IN THE FAST LANE Digital advances bring online auctions up to speed BY PHIL RYAN It’s about time. Cars have been sold at wholesale auctions online for more than 10 years, and familiarity with the idea is now firmly established in the industry. The next speed bump is, well, speed. Major initiatives are now underway by industry players to make digital buying and selling faster and more efficient, more like the flashy apps that young people are beginning to consider the norm. “There’s definitely an increasing level of comfort with digital in the industry,” says Joseph Miller, head of marketing for AutoIMS. Miller points to several initiatives to increase efficiency around the edges of transactions. “Efficiency continues to improve with each of the online processes,” he says. For one thing, the wall between digital and physical is coming down, and processes can move between the two with minimal friction. “Data is improving the handoff process between the digital and the physical.” Data is now available, from transport companies that can “trigger when a car goes up for sale on a certain platform”, Miller says. In other words, periods when vehicles are in transit are shrinking, leading to more time for selling. Inspections are also becoming more efficient, thanks to the proliferation of mobile devices. “We’re seeing more and more third-party inspec- Consumers go online almost exclusively to track down vehicles they want, and compare prices. ADESA and Manheim provide dealers with the same type of access to wholesale selling. tions, and handheld inspections” Miller says. Data is tying these various reports together and rapidly providing buyers with more accurate pictures of vehicles. Manheim is also using data to improve the user experience within digital auctions. In October 2014, the company began requiring sellers on its sites to set starting bids just three bids below their floor price. The idea is to make sure “the prices are real. In the past, the gap could be so wide — thousands of dollars away — that buyers would put in bid increments, and it could take so long to get there, or never get there, to a realistic floor price.” MOBILE ADVANCES ADESA says that buyers want vehicles to be easy to find online and to be properly priced. To this end, the company released a new app in the fall of 2014 called ADESA Marketplace that allows users to quickly find, research, and accurately price vehicles. The app is a companion to ADESA’s older app, Liveblock, which allows buyers to participate in physical auctions via mobile devices. “The Marketplace app basically offers all of the other functionality available on our website,” says Peter Kelly, president and CTO of KAR Auction Services, ADESA’s parent company. “It also lets customers find vehicles on the auction lot faster with the app’s GPS function. And customers can instantly access the vehicle information by using the app to scan the VIN. These apps definitely speed up the process for customers.” Eggert sees the situation as not just the advancement of technology, or even growth in the comfort of industry players, as much as it is retail innovations carrying over to the wholesale side. Getting opening bids closer to floor prices is just the start of the greater efficiencies that are possible, she says. “If we consider all the Cox Automotive assets,” she says, “sites like AutoTrader, Manheim, and Kelley Blue Book, there are better decisioning tools we are able to provide to our buyers. Specifically, there are retail innova- tions we can bring to wholesale data.” Manheim is increasingly able, she says, “to better leverage the data to help wholesale initiatives.” Not every retail initiative translates precisely to wholesale, however. (Eggert’s previous work at AutoTrader, from which she transferred in August 2014, gives her some perspective on both sides of the equation.) “If a car has more demand on the retail side, we have a better idea of what it is going to sell for” she says. “On the retail side, you negotiate one-on-one, versus wholesale, which is based on bidding, and there is a long tradition of bidding the price up.” Data modeling in wholesale is advancing to allow for better predictions of a vehicle’s ultimate sale price, Eggert says. “We’re in a space on the wholesale side, where retail on the digital side was five or 10 years ago.” – Jenifer Eggert, vice president of digital services, Manheim Auctions Data and the computing power lent by mobile devices have empowered dealers to find the cars they want faster and more accurately. Simply put, wholesale buyers now know more without being anywhere near the vehicle. “There was a time on the retail side where consumers moved past listings to online and now it seems like, culturally, dealers and customers are asking for this on the wholesale side too,” Eggert says. “We’re in a space on the wholesale side, where retail on the digital side was five or 10 years ago.” CHANNELS THROUGH THE LOOKING GLASS How introducing consumers to wholesale auctions could revolutionize remarketing BY LARISSA PADDEN No matter how profitable and prosperous the wholesale auction market is for used-car dealers, there are always risks - floorplan limits that cut down capacity for vehicles, leveraging credit to fund used inventory, and, of course, taking on the risk that a car may not be sold even after incurring reconditioning costs. These risks are just some of the reasons that Cheryl Munce, chief executive consultant at Alteso, a company that develops digital solutions for auto remarketing programs, began working on a concept that blends together aspects of the retail auction model and traditional wholesale auctions, or what she calls “whole-tail.” “Whole-tail” allows consumers access to wholesale auctions, while keeping the dealer at the center of the process. “The used-car remarketing industry has been moving toward the blurring of the lines between wholesale and retail for a few years,” Munce says. “In fact, in the U.K., there are no longer just wholesale auctions but rather all auctions are open to dealers and the public.” In the U.K., many auctions are open to the public. MyDealerOnline’s data stream aims to mirror this online in the United States. Munce’s product is MyDealerOnline, an online platform that connects wholesale inventory directly with dealer websites for consumers to purchase. “How many customers are dealers not seeing in their showrooms because the online shopper simply didn’t find what they wanted from their stock of 30 cars?” Munce asks. The difference in the whole-tail concept is that consumers will be able to see what cars will be available at auction before they go up on the block. Consumers would not be able to see the wholesale prices through MyDealerOnline, Munce says, nor would they be able to place bids or attend auctions themselves, but they can alert the dealer to their interest. Munce’s business is designed to alleviate some of the guesswork for dealers when creating that inventory, because they will already know exactly what the consumer wants to buy, and how much they are willing to pay, according to Munce. Alec Gutierrez, senior analyst at Kelley Blue Book, said that this does happen in some capacity today — where dealers will allow consumers to view what will be up for auction, but it is only in a small part of the market. “There are smaller dealers out there that will offer their services to a consumer where the consumer can come to them and say, ‘I’m looking for a three-year-old BMW 3 series with so many miles,’” Gutierrez says. “And that dealer might make available to them the presale inventory for that auction. The dealer will basically act on their behalf.” There are also a few key reasons why consumers are kept out of the wholesale auction experience today, Gutierrez says, including auction fees, transportation costs to move the vehicles 9 back to the lot, and, of course, reconditioning needs — not retail-ready, in other words. “Most of these vehicles that are running through auction have yet to be reconditioned,” Gutierrez says. “There might be some work that needs to be done. There might be some dings and dents. Maybe it needs some new tires, new brakes. And, ultimately, if you’re Enterprise Rent-A-Car and you just want to liquidate a couple hundred cars over the next few months, you don’t necessarily want to invest the $500, $1,000 per vehicle to get it up to a point that would make sense to retail to a consumer.” Through the blended model, Munce explains, the consumer would have access to general condition and disclosures, as well as year, make, model and photos. They can have the option to purchase a vehicle history report before contacting the dealer. “Often the retail price is listed, but sometimes the vehicles won’t have a price,” Munce says. “The product is designed to have the dealer in the middle so the consumer will have to get more info from the dealer before making a final decision anyway.” Munce hopes the platform will not just improve inventory for the dealer, but also transparency to consumers, by putting the decision “squarely in the hands of the end user, the consumer.” Gutierrez said that there was a time when dealers preferred to keep information — such as how they conduct business and price inventory — closer to their vests, but that is changing. “Today, a lot of progressive dealers have embraced transparency,” Gutierrez says. “Let’s say I’m a dealer and I have a website where consumers could go to me and say, ‘I’ve looked at your inventory, but I’m looking for X, Y, Z,’ and provide a forum for them to browse upcoming auction inventory or guide them. Personally, I could see that as a program that some dealers and wholesalers could potentially embrace.” Munce and the MyDealerOnline team began to develop the concept in 2012, and are currently prospecting both small and large dealers, as well as potential distribution and sales channel partners, she says. “While we do have upwards of 50,000 vehicles in inventory on any given day, the vast majority are salvage — insurance write-offs — and not the right product for the used-car dealerships,” Munce says. “Our hope is to have some critical mass of clean used cars within the next six months and begin to distribute it to paying dealers.” 10 AUCTIONS INSPECTIONS ON THE GO Mobile apps can provide clean condition reports – but are they just adding confusion? BY MONICA LINK Condition reporting is a thorny subject in remarketing. A lack of industrywide standards can leave buyers and sellers with a lot of guesswork, which means that two different reports on a single vehicle may conflict. Several industry players including NADA and NAAA have spoken out about this issue, and even proposed standards for electronic condition reporting (ECR), but nothing has taken hold across the industry. In the absence of such standards, mobile apps such as OnceOVR and Inspect2go have arisen, and use their own approaches to electronically reporting the condition of vehicles. Inspect2go offers a number of apps for inspecting vehicles of all types. The company says it is able to create custom reporting apps upon request, and got its start reporting environmental issues in workplaces and restaurants. Currently available only for the Apple iPad and first released in April 2012, Inspect2go for vehicles walks users through several sections: Body, Engine, Electrical, Under Vehicle, and Tires and Brakes. In each section, it allows users to mark items as OK, Replacement Recommended, or High Priority (replacement required.) There is “The app is designed for layman users with little or no automotive knowledge.” – Gary Mott, vice president, FLD also a question mark function to request help or more information on a topic. Notes and photos can be attached for problem areas, and the whole report, once the inspection is complete, is dropped into an email as a PDF attachment, ready to send. Launched in June 2013 but significantly updated in February 2015, OnceOVR is available for iOS and Android devices of all types, including smartphones with their tiny screens. The app allows users to conduct multiple inspections, save inspections in process, and sync up different inspections that may belong to the same vehicle. Symptomatic of the lack of CR standards, it delivers a report that differs from Inspect2go’s. First, the vehicle’s VIN and odometer are photographed. It takes users through the exterior of a vehicle, noting the condition of the following: left side, right side, front, back, top, paint, glass, hail and collision damage. Photos are taken throughout. The user moves similarly through the vehicle’s interior and mechanical sections. OnceOVR is a product of FLD, a remarketing firm specializing in fleets since 1979. FLD notes on its website that it created the industry’s first ECR in 1995. Gary Mott, vice president of FLD, says the app initially saw usage from commercial fleets, but is increasingly gaining traction with dealers and consumers. “The app is designed for layman users with little or no automotive knowledge,” Mott says, but adds that in a dealer’s hands, it can be a valuable tool. “The OnceOVR app gives dealers the power to gauge the initial trade-in value for a vehicle before the customer steps on the lot.” To further dealer adoption, the company plans to launch a new version of the app in late 2015 with special features tailored for buying and selling at auction, as well as inspecting trade-ins. OnceOVR is a product of remarketing firm FLD, and features a clean interface designed for consumers, which is shown here. For Jonathan Banks, executive automotive analyst for NADA, codition reporting apps are welcome additions to the marketplace, especially as online auto sales have increased. This increase underlines the need for condition reporting standards and guidelines. In the case of CPOs, Banks says, where strict standards, prevail, this is not an issue, but it remains one in the general market. “Using a condition reporting app is better than using nothing,” Banks says. “At least the apps ask a list of standardized questions. If the consumer reporting the condition follows the process in the app, it is better than just guessing.” This observation makes sense, but it is not clear that the apps will move the industry closer to a solution of this problem, since each uses its own idiosyncratic approach. In the search for standards and guidelines, it appears the auction industry has a ways to go to find the solution in mobile devices. TRENDS 11 LEASE RETURNS ROLL IN Wholesale prices rise, but the details show off-rental units face weakness BY TOM KONTOS Average wholesale usedvehicle prices rose significantly in January on both a month-over-month and yearover-year basis. One would be quick to conclude that the market seems to be admirably absorbing the highly Tom Kontos anticipated growth in supply, and that would be true. Still, it is important to disaggregate averages and indexes in order to look at the underlying impact the supply of off-rental and off-lease vehicles is having on current-to-one-yearold models and three-year-old models, respectively. A somewhat different picture emerges here in that prices for these age segments did indeed take a hit in January, as: 1. Auction “factory” sales were resumed for large inventories of off-rental program units that had been curtailed at yearend 2014, and 2.Growing numbers of vehicles leased approximately 36 months ago continue to reach ma- turity and enter online and in-lane remarketing channels. Strong retail demand, especially for CPO units, as well as moderate incentives, have partially offset these impacts for these age segments and the used-vehicle market as a whole. According to ADESA Analytical Services’ monthly analysis of Wholesale Used-Vehicle Prices by Vehicle Model Class1, wholesale used vehicle prices in January averaged $10,220 — up 3.6% compared with December and up 2.4% relative to January 2014. Much of the month-over-month and yearover-year price variance by model class segment is driven by higher off-rental program vehicle sales this January compared with December and January 2014. (Program vehicles are typically currentmodel-year or one-year-old models that sell for higher average prices than other types.) Thus, not a lot should be read into the double-digit increases in average prices seen in some model class segments. However, even after stripping off the impact of higher program vehicle sales, prices for midsize SUVs and full-size pickups still showed strength. Prices for used vehicles remarketed by manufacturers were down 10.8% month-over-month and down 11.5% year-over-year. As anticipated in this report last month, the tailwind to prices that might have been provided by the absence of program units due to sale curtailments in December, turned into a headwind as these units are being released in early 2015. Prices for fleet/lease consignors were up 5.2% sequentially and up 1.3% annually. This indicates healthy demand for older repo and commercial fleet vehicles, even as off-rental risk and off-lease prices face downward pressure from higher supply. Dealer consignors registered a 2.2% increase versus December and a 3.7% increase relative to January 2014, indicating that independent dealers are readily absorbing the excess franchised dealer trades generated from strong new-vehicle sales. Retail used-vehicle sales in January were up 1.4% year-over-year, based on data from CNW Marketing/Research. CPO sales were particularly strong in January, rising 17.2% year-over-year, according to figures from Autodata. WHOLESALE USED-VEHICLE PRICE TRENDS AVERAGE PRICES ($/UNIT) Jan. 15 Dec. 14 Jan. 14 AVERAGE PRICES ($/UNIT) LAST MONTH Vs. Prior Mo. Prior Yr. Jan. 15 Dec. 14 Jan. 14 LAST MONTH Vs. Prior Mo. Prior Yr. Total All Vehicles $10,220 $9,864 $9,983 3.6% 2.4% Total Trucks $11,015 $10,851 $10,438 1.5% 5.5% Total Cars $9,134 $8,620 $8,869 6.0% 3.0% Mini Van $7,663 0.1% 2.9% Compact Car $7,377 $6,654 $7,010 10.9% 5.2% Fullsize Van $11,331 $10,198 $10,341 11.1% 9.6% Midsize Car $8,004 $7,712 $8,258 3.8% -3.1% Mini SUV $13,002 $12,748 $11,987 2.0% 8.5% Fullsize Car $8,546 $6,075 $6,771 40.7% 26.2% Midsize SUV $8,246 6.2% 9.9% Luxury Car $12,593 $12,466 $12,209 1.0% 3.1% Fullsize SUV $10,893 $11,569 $10,981 -5.8% -0.8% Sporty Car $13,050 $12,950 $12,343 0.8% 5.7% Luxury SUV $18,243 $19,109 $18,941 -4.5% -3.7% $12,768 2.5% -4.2% Compact Pickup $7,559 $10,965 $10,565 $11,553 3.8% -5.1% Fullsize Pickup Mid/Fullsize CUV$13,157 $12,875 $13,999 2.2% -6.0% Total Crossovers $12,233 $11,931 Compact CUV $7,658 $7,763 $7,441 $7,448 $7,503 $7,362 $13,550 $13,027 $12,632 1.6% 2.7% 4.0% 7.3% Source: ADESA Analytical Services The analysis is based on over six million annual sales transactions from over 150 of the largest U.S. wholesale auto auctions, including those of ADESA as well as other auction companies. ADESA Analytical Services segregates these transactions to study trends by vehicle model class. 1 The views and analysis provided herein relate to the vehicle remarketing industry as a whole and may not relate directly to KAR Auction Services, Inc. The views and analysis are not the views of KAR Auction Services, its management or its subsidiaries; and their accuracy is not warranted. The statements contained in this report and statements that the company may make orally in connection with this report that are not historical facts are forward-looking statements. Words such as “should,” “may,” “will,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “bode”, “promises”, “likely to” and similar expressions identify forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the results projected, expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include those matters disclosed in the company’s Securities and Exchange Commission filings. The company does not undertake any obligation to update any forward-looking statements. A STANDARD OF EXCELLENCE QUALITY • PRICE VALUE • SELECTION PERFORMANCE SERVICE SATISFACTION THE TIME NOW IS The start of a brand new day at the auction means the time is now to look for Chrysler Group off-lease vehicles certified to meet the exacting standards you expect. As one of the largest automotive remarketers in the country, we consistently offer the right vehicles in the right places with the promise of the Santander 7 certification. SC-AD_41113-5_121014 SC-AD_41113-5_121014

© Copyright 2026