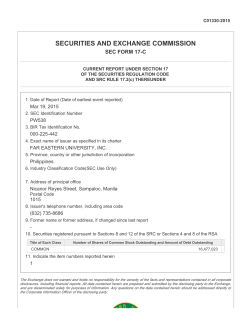

CBOE Holdings 2015 Proxy