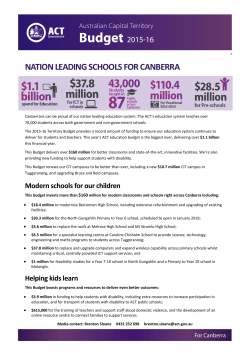

Annual Report - Investor Relations CIT