Presentation - How to Prepare for an MCAS Exam

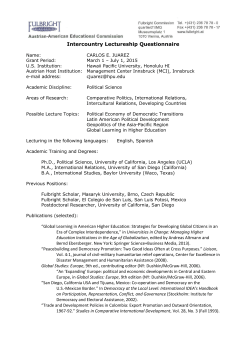

MCAS How to Prepare for an Exam IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Panelists Moderator: Robin Clover – AGCS Presenters: Roshi Fekrat – GIE Amy Groszos – Florida Jim Pafford – Florida Randy Helder – NAIC IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA MCAS Those are humongous waves, dude! April 30, 2015 - Adding LTC Filings from Health Companies One new state - Tennessee 2 more weeks until the due date IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Filing Your MCAS Riptides and Jellyfish - Definitions Data Gathering Limitations Validation Difficulties Ambiguities IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Definitions Ankle Busters Cancellations – who initiated Dwellings – premium and renters Complaints – types to include Claims – final payment and closed date IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Definitions Wipeouts - Replacements - Median Days - Annuities IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Data Gathering Long Boards - Coverage Parts Claimants and Transactions Median Days Claims – with and without payment Cancellations – date issued IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Validations Riptides and Jellyfish - Focus on high ratios and results - Small data sets - Cross-checking opportunities - Balancing checks IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Ambiguities Mushy Waves - Residence or Issuance - Replacements - Comments IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Attestations Righteous, Bro - Accuracy, Completeness - Audit Trail, Re-create the filing - Comments IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Allocation of Resources 1. 2. 3. 4. MCAS filings are required for each company at the state level Limitation of resources within the Company Degree of in-depth understanding of the filing and definitions Management turn over IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Allocation of Resources Continues 5. 6. 7. Detail review of the filings including an evidence of prepare and review process. Relinquishing the responsibility of the data to IT staff without providing details on the definitions and/or annual changes to the filing. Lost institutional knowledge and lack of written P&P. IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Objective of Exam • Set by the regulators and can include but is not limited to the following: • Determine Timely Filing of Market Conduct Annual Statement Reports • Verify Accurate Filing of Market Conduct Annual Statement Reports • Perform Anti-Fraud Review • Perform Consumer Complaint System Review IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Accurate Filing of MCAS 1. The Company may not understand the MCAS data set instructions • • • • Evolving Process Understanding the definitions Taking a snap shot Provide for a prepare review process IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Accurate Filing of MCAS 2. The Company does not have a process in place to verify the data that is presented for MCAS reporting; and update data requirements as reporting changes. • Changes in legal entities, company management or • Blocks of business administered by Third Parties • Legacy blocks of business on other systems IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Accurate Filing of MCAS 3. The Company is unable to produce or capture detailed information necessary to produce the MCAS Report or relies on Third parties to provide information. 4. The Company may prepare the MCAS based on a live system query and is not able to capture detailed data sets or reproduce accurate data sets for subsequent examinations IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Accurate Filing of MCAS 5. Reported MCAS information may indicate outliers. Life Outliers Replacements issued compared to the number of policies issued. Replacements for insureds > 65 compared to the total number of replacements issued. Surrenders compared to the total number of policies issued. Policies surrendered < 10 years from issue date compared to total surrenders. Claims paid beyond 60 days from the date of due proof of loss compared to total claims paid. Claims denied, resisted or compromised compared to the number of claims closed. Complaints per 1,000 policies in force. IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Accurate Filing of MCAS 5. Reported MCAS information may indicate outliers (cont.) • Annuity Outliers Replacements issued compared to the number of policies issued. Replacements for insureds > 80 compared to the total number of replacements issued. Deferred annuities issued to insureds > 80 compared to total deferred annuities. Policies surrendered < 10 years from issue date compared to total surrenders. Complaints per 1,000 policies in force . IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Accurate Filing of MCAS 5. Reported MCAS information may indicate outliers (cont.) • Homeowners & PPA Outliers Claims closed without payment to total claims closed Percent of claims open at end of period Percent of claims paid beyond 60 days Percent of claims paid beyond 90 days Cancellations over 60 days to total policies inforce Cancellations under 60 days to policies issued Number of Suits opened during the period to Number of claims closed without payment . . IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Anti-Fraud Plan Review High level review is done with the MCAS exam. • Is the Anti-Fraud Plan accurate? • Are there material changes made in personnel or functions previously reported that have not been updated? • Can the Company document training of its SIU staff? IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Consumer Complaint Review High level review should be done with the MCAS exam. • Reconcile DOI list of consumer complaints to Company list of complaints received from DOI? • Does the Company maintain a log of complaints received from all sources by calendar year and does this log include origination and resolution? IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Exam Process Initial Record Request 1. 2. 3. 4. 5. Policy level detail data sets supporting the MCAS filing. Company’s MCAS process narratives. Annual filings for Annual Statements, Management Discussion and Analysis and Independent Audit reports. Other examination reports. Company’s Financial Examination Planning Exhibit C - ITPQ Systems Summary Grid. IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Sample Selection & Request • Determine MCAS line items to be tested • Determine Sample size • Determine attributes of MCAS line items that are selected for testing • Request supporting data needed to verify the attributes being tested for the sample items selected IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Sample Review • Determine Attributes to be tested Will vary based upon MCAS line item being tested Refer to NAIC MCAS instructions for the year being tested IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Sample Review • Example- Life Replacement Attributes State of Residence at Issuance Cash Value or Non Cash Value Policy Individual Policy Internal or External Replacement Age of Insured at Issuance Age of Replaced Policy IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Sample Data Request • Will vary based upon MCAS line item tested • Discuss with Company prior to request • Example- Life Replacement Attributes Underwriting file – Application, Info on replaced policy Replacement Policy Issued including Dec Page IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Sample Data Testing • Excel worksheet • Attribute Columns for items being retested • Outcome Column to summarize examiner observations IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Common Areas of MCAS Reporting Errors All Companies Data set presented does not provide sufficient information to determine that the Company’s reporting is correct IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Common Areas of MCAS Reporting Errors Life and Annuity MCAS • Internal vs. external replacements – information is not captured. • Issue state vs. resident state. When did the policy owner move? • Location of Risk: The policy owner is a Trust sitused elsewhere or the insured lives elsewhere. Is the Company consistent in how they report this type of policy/contract? • Did the insured list his address as an express mail service and is actually a foreign national? • Was the policy applied for in the state being examined? If not, is the application and policy form approved for use in the state being examined? IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Common Areas of MCAS Reporting Errors Life and Annuity MCAS • Are legacy blocks of business, managed by a TPA or reinsurer accounted for in the MCAS reporting? • Are surrenders and pending death claims properly accounted for in the related schedules for issued policies, written premium, and inforce business? • Does the Company understand the MCAS aging buckets and is their aging consistent with the method used in their policy/contract? • Are policies cancelled during the free look period included in the policies issued count? • Are there a substantial number of death claims that the Company has not properly investigated and settled? IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Common Areas of MCAS Reporting Errors Property Casualty MCAS • Are cancellation reasons captured and properly reported? • Does the Company include duplicate policies issued in error and cancelled effective to the inception? • Does the Company include applications uploaded in error by agents as policies issued in error? • Does the Company calculate the aging on company initiated cancellations back to the original effective date without regard to policy renewals? • Does MCAS reporting roll forward between periods? • Are there claims reported opened on 1/1 of the subsequent period that are not included as opened as 12/31 of the current period? IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Common Areas of MCAS Reporting Errors Property Casualty MCAS • Can the current year MCAS report been reconciled: Open at beginning + open during the period less claims closed equals open at the end of the period? • For claims reopened and closed in the current MCAS reporting period, did the Company calculate a separate aging based on the re-opened to close date? • For suits, are suit lines of business captured and consistently reported? • For claims with multiple features identified in separate MCAS reporting? IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Next Steps for Regulators At the conclusion of the MCAS Exam • Evaluate Company based upon results of MCAS Exam • Consider target or comprehensive exam • Regulatory actions/fines IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA Questions IRES Foundation 2015 National School on Market Regulation Surfin’ the waves of Regulation | April 12-14, 2015 | Hilton La Jolla | San Diego, CA

© Copyright 2026