BB&T Business Services Pricing Guide TENNESSEE Effective April

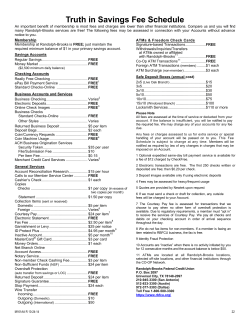

BB&T Business Services Pricing Guide TENNESSEE Effective April 15, 2015 Checking Accounts Business Value 200 Checking / Basic Public Fund Checking Minimum Opening Deposit $100.00 Monthly Maintenance Fee $12.00 (No monthly maintenance fee for the first 95 days) To avoid monthly maintenance fee: $1,500 average monthly balance (Business Value 200 Checking/ Basic Public Fund Checking) OR $6,000 combined average monthly balances in checking accounts (business/public fund/personalA), Money Rate Savings accounts (business/ public fund/personalA), Business Investor’s Deposit Accounts and/or outstanding balances on both business and/or personal loansB, lines of creditC and credit cardsD OR A qualifying transaction from a BB&T Merchant Services account E Debits, Credits and Items Deposited - First 200 Combined ItemsF No Charge - Fee per Combined Item over 200 $0.50 Coin/Currency Deposited - $10,000 or less No Charge Coin/Currency Deposited - greater than $10,000 (per $1,000) $2.10 Earns Interest No Business Analyzed Checking / Public Fund Analyzed Checking Minimum Opening Deposit Monthly Maintenance Fee Credits - Credits posted (This refers to any credits, including paper and electronic) - Deposited items – per item (In addition to credits posted) Debits - Check Paid – per item - Other Debit – per item Coin and Currency, Per $1,000 Deposited Earns Interest $100.00 $20.00 $0.80 $0.13 $0.19 $0.19 $2.00 No Business Value 500 Checking Minimum Opening Deposit $100.00 Monthly Maintenance Fee $25.00 (No monthly maintenance fee for the first 95 days) To avoid monthly maintenance fee: $5,000 minimum daily balance (Business Value 500 Checking) OR $15,000 average monthly balance (Business Value 500 Checking) OR $50,000 combined average monthly balances in checking accounts (business/public fund/ personalA), Money Rate Savings accounts (business/managed/public fund/personalA), business CDs and/or outstanding balances on both business and/or personal loansB, lines of creditC and credit cardsD OR $50,000 average monthly balance in Business Investor’s Deposit Account Debits, Credits and Items Deposited - First 500 Combined ItemsF No Charge - Fee per Combined Item over 500 $0.50 Coin/Currency Deposited - $20,000 or less No Charge Coin/Currency Deposited - greater than $20,000 (per $1,000) $2.10 Earns Interest No Earnings2 Checking / Earnings2 Checking – Public Funds Minimum Opening Deposit Monthly Maintenance Fee Credits - Credits posted (This refers to any credits, including paper and electronic) - Deposited items – per item (In addition to credits posted) Debits - Check Paid – per item - Other Debit – per item Coin and Currency, Per $1,000 Deposited Coin Rolling (Per Roll) Earns Interest $100.00 $26.00 $0.85 $0.13 $0.22 $0.22 $2.00 $0.12 Yes Service charges on the above accounts may be reduced or eliminated through an earnings credit.G The prices listed for Business Analyzed Checking are also applicable to Collateral Reserve Checking, Intercompany Checking and Public Special Money Rate Checking. Service charges on the above accounts may be reduced or eliminated through an earnings credit.G The prices listed for Earnings2 Checking are also applicable to Intercompany Interest Checking. Business Interest Checking / Public Fund Interest Checking Community Checking Minimum Opening Deposit Monthly Maintenance Fee To avoid monthly maintenance fee: $6,000 average monthly balance Debits, Credits and Items Deposited - First 150 Combined ItemsF - Fee per Combined Item over 150 Coin/Currency Deposited - $5,000 or less Coin/Currency Deposited - greater than $5,000 (per $1,000) Earns Interest $100.00 $15.00 No Charge $0.50 No Charge $2.10 Yes Minimum Opening Deposit Monthly Maintenance Fee Balance requirements Debits, Credits and Items Deposited - First 225 Combined ItemsF - Fee per Combined Item over 225 Coin Roll and Currency Sales Coin and Currency Deposited Earns Interest $100.00 No Charge None No Charge $0.25 No Charge No Charge No Personal accounts of business owners only. loans include loans originated in a branch; including personal loans and loans secured by savings/CDs/stocks (excludes 1st and 2nd closed end personal loans secured by a residence and Sales Finance loans). C Personal lines of credit include Preferred Lines and Home Equity Lines. D Accounts, loans, lines of credit and credit cards are subject to credit approval. E Subject to business type and credit approval. A BB&T Merchant Services qualifying transaction is a payment card settlement (e.g., Visa®, MasterCard®, American Express® or Discover®) from a BB&T Merchant account deposited to a linked BB&T checking account at least once during the monthly statement cycle. F Combined items represent checks paid, debit and credit memos, deposit tickets, checks deposited, online bill payments, and electronic debits and credits (including debit card transactions). G Earnings Credit (ECR) is calculated by applying the earnings credit rate to the average positive collected balance for services in the account. The earnings credit rate is determined by the Bank and is subject to change at the Bank’s discretion. A B Personal Equal Housing Lender. © 2015, Branch Banking and Trust Company. Member FDIC. Rev. 4/15/2015, Page 1 BB&T Business Services Pricing Guide TENNESSEE Effective April 15, 2015 Commercial Checking Accounts Commercial Interest Checking Minimum Opening Deposit Monthly Maintenance Fee Credits - Credits posted (This refers to any credits, including paper and electronic) - Deposited items – per item (In addition to credits posted) Debits - Check Paid – per item - Other Debit – per item Coin and Currency, Per $1,000 Deposited Earns Interest $100.00 $20.00 $0.80 $0.13 $0.19 $0.19 $2.00 Yes Interest on Lawyers’ Trust Accounts (IOLTA) Checking Minimum Opening Deposit Monthly Maintenance Fee Credits - Credits posted (This refers to any credits, including paper and electronic) - Deposited items – per item (In addition to credits posted) Debits - Check Paid – per item - Other Debit – per item Coin and Currency, Per $1,000 Deposited Earns Interest $100.00 No Charge No Charge No Charge No Charge No Charge No Charge Yes This account is subject to rules governing attorney trust accounts in the state whose laws govern this account. These rules cover payment of interest, reporting of information to third parties (OD, NSF, etc.). Money Market and Investment Accounts Business Money Rate Savings / Public Fund Money Rate Savings Minimum Opening Deposit $100.00 Monthly Maintenance Fee $10.00 To avoid monthly maintenance fee: $250 minimum daily balance OR $500 average monthly balance OR One recurring pre-authorized deposit or transfer of at least $100 per monthly statement cycle Credits - Credits posted No Charge (This refers to any credits, including paper and electronic) - Deposited items – per item (In addition to credits posted) First 20 deposited items No Charge Fee per deposited item over 20 $0.39 Transfers / Withdrawals - Six (6) transfers or withdrawals per monthly statement cycleH No Charge - Excessive Activity Fee (after six) – per item $15.00 - BB&T 24 ATM and in-branch withdrawals No Charge (Business/Public Fund Money Rate Savings accounts are subject to funds transfer charges when transfers are made through a BB&T Phone24 associate) Coin/Currency Deposited - $5,000 or less No Charge Coin/Currency Deposited - greater than $5,000 (per $1,000) $2.10 Earns Interest Yes Business Investor’s Deposit Account (BIDA) Minimum Opening Deposit $100.00 Monthly Maintenance Fee $15.00 To avoid monthly maintenance fee: $10,000 minimum daily balance Credits - Credits posted No Charge (This refers to any credits, including paper and electronic) - Deposited items – per item (In addition to credits posted) First 10 deposited items No Charge Fee per deposited item over 10 $0.39 Transfers / Withdrawals - Six (6) transfers or withdrawals per monthly statement cycleH No Charge - Excessive Activity Fee (after six) – per item $15.00 - BB&T 24 ATM and in-branch withdrawals No Charge (Business/Public Fund Money Rate Savings accounts are subject to funds transfer charges when transfers are made through a BB&T Phone24 associate) Coin/Currency Deposited - $5,000 or less No Charge Coin/Currency Deposited - greater than $5,000 (per $1,000) $2.10 Earns Interest Yes The prices listed for Business Money Rate Savings are also applicable to Business Managed Money Rate Savings. H Per regulation, Money Market and Investment Accounts are ONLY permitted to have six (6) transfers or withdrawals during any monthly statement cycle for the purpose of transferring funds to another BB&T account or making third-party payments by means of a check, draft, debit card, pre-authorized or automatic transfer, telephonic transfer, online banking or similar order. Your account is subject to conversion to a checking account if you repeatedly exceed the permitted number of transactions. Equal Housing Lender. © 2015, Branch Banking and Trust Company. Member FDIC. Rev. 4/15/2015, Page 2 BB&T Business Services Pricing Guide TENNESSEE Effective April 15, 2015 Additional Banking Services BB&T Business Debit Card Debit Card Replacement FeeI ATM & Purchase International Service Assessment Fee $5.00 3% of transaction amount (Fee charged for ATM and purchase transactions performed or processed outside the United States, Puerto Rico and U.S. Virgin Islands. International services include purchase, credit voucher, ATM transaction and cash disbursement original and reversal transactions) International ATM Transaction Fee $5.00 (Fee charged for ATM transactions outside the United States, Puerto Rico and U.S. Virgin Islands.) BB&T ATM Transaction Fee No Charge Non-BB&T ATM Transaction Fee $2.50 (Fee charged when using any domestic ATM that is not a BB&T 24 ATM, unless otherwise disclosed.) ATM Mini statement (last 10 transactions or pending) $1.00 ATM Full statement (all transactions since last statement) $2.00 BB&T Phone 24 Automated and Person-to-Person Inquires Cash Processing Currency, Per $1,000 Supplied Coin (Per Roll Supplied) Coin Rolling (Per Roll) Charged-Off Account Fee Check, Deposit and Withdrawal Slip Orders (Based on account type and style selection) Check-Paid RejectsJ - per item No charge $1.20 $0.14 $0.05 $30.00 Fee may vary $0.50 CPA Confirmation $20.00 Credit Inquiry by Third Party $20.00 Deposit Account Usage FeeK Variable Deposit Correction - per item $7.50 Early Account Closing Fee (within 180 days of opening) Funds Transfer between BB&T Accounts BB&T Small Business OnLine Transfer - Credit BB&T Small Business OnLine Transfer - Debit BB&T OnLine Transfer - Credit BB&T OnLine Transfer - Debit In-Branch Transfer - Credit In-Branch Transfer - Debit In-Branch Transfer by Phone - Credit In-Branch Transfer by Phone - Debit Phone 24 Transfer - Non-Automated Credit Phone 24 Transfer - Non-Automated Debit Phone 24 Transfer - Automated Credit Phone 24 Transfer - Automated Debit $25.00 No Charge No Charge No Charge No Charge $3.00 $3.00 $2.00 $2.00 $2.00 $2.00 $1.00 $1.00 InactivityL Fee $7.50 per month International Services Branch-Initiated Wire Transfer CashManager OnLine Wire Transfer Check Collection Tracer (Per Message) Corporate Call Wire Transfer Incoming Wire Transfer Foreign Currency Bank Note Buys/Sales Foreign Currency Drafts Foreign Currency Overnight Delivery Foreign Check Returned Item (Plus any foreign bank fee) Foreign Check Collection (Plus any foreign bank fee) US Dollars Checks Drawn on Canadian Banks US Dollars Checks Drawn on European Banks Wire/Draft Tracer/Amendment (Per Message) Wire/Draft Recall/Stop Payment (Per Message) $75.00 $36.00 $20.00 $50.00 $18.00 $10.00 $30.00 $20.00 $30.00 $75.00 $7.50 $35.00 $20.00 $30.00 Legal Process (Levy/Garnishment/Attachment/etc.) up to $125.00 Money Order $5.00 Negative Account Balance FeeM $36.00 (Fee assessed to your checking or savings account on the seventh calendar Day that your account is overdrawn) Night Depository Service (Per bag processing fee) $2.00 Non-Depositor Check Cashing Fee for non-BB&T Checks $8.00 Non-Depositor Check Cashing Fee for On Us (BB&T) Checks (Applies only to checks cashed greater than $50.00) $8.00 Official Check $10.00 Outgoing Collection Item $25.00 Overdraft Protection Automatic Overdraft Protection Transfer Fee (Limit of one fee per linked account, per day) - Business Value 500 Checking Clients - All Other Clients Overdraft/Returned Item Payroll by ADP® (up to 5 employees) Pre-Encoded Deposited Items BB&T Other In-State Institution Out-of-State Institution Pre-Encoded Rejects No Charge $12.50 $36.00 $39.99/monthly $0.13 $0.13 $0.13 $0.50 I Fee applies to cards replaced due to being lost, stolen, damaged, personalized card request and other circumstances. If card replacement is related to a valid dispute, the fee will be refunded. J Fee applies only to Business Analyzed Checking and Public Fund Analyzed Checking accounts. A Check-Paid Reject is defined as an illegible item rejected by BB&T’s items processing equipment. K The Deposit Account Usage Fee includes various expenses incurred by the Bank for servicing accounts. This fee applies only to Business Analyzed Checking, Public Fund Analyzed Checking, Earnings2 Checking, Earnings2 Checking – Public Funds, Collateral Reserve Checking, and other checking accounts with ECR. The fee is assessed monthly and disclosed on your periodic statement or client analysis statement. It is calculated per $1,000 of the average monthly balances in the account. The charge is variable and subject to change at any time without notice. L Inactivity is defined as having no deposits or withdrawals for 12 consecutive months in your checking account and 24 consecutive months for money market savings accounts. Interest posted or fees charged on your account are not considered to be activity. Applies only to accounts with balances less than $1,000 and greater than $0. M Applies only to Business Value 500 Checking, Business Value 200 Checking, Business Interest Checking, Basic Public Fund Checking and Community Checking accounts. Equal Housing Lender. © 2015, Branch Banking and Trust Company. Member FDIC. Rev. 4/15/2015, Page 3 BB&T Business Services Pricing Guide TENNESSEE Effective April 15, 2015 Additional Banking Services - continued Research Check photocopy, viewed or printed $5.00/copy (Check Safekeeping and Check Image clients receive their first three copies at no charge) Account Research $25.00/hour Returned Deposited Items Returned Deposit / Cashed Item $12.00 - Re-deposited (Reclear) additional $5.00 - Return Item - Branch additional $5.00 (Branch of Deposit, Branch of Ownership, Branch Other) Returned Deposited Item Special Handling Maintenance $10.00 per month Safe Deposit Boxes (See a BB&T representative for current pricing and availability) Lost Key Drilling Cost Varies $25.00 $150.00 Self-Service Coin Machine (available in a limited number of Financial Centers) BB&T Clients - Less than or equal to $25.00 No charge - Greater than $25.00 5% of total amount Non Clients - All amounts 10% of total amount Small Business OnLine Services Basic Service - BB&T Small Business OnLine - Unlimited OnLine Bill Payment Add Business Services - Multiple Users Access (allow multiple users) - ACH & Wire - Multiple Users Access with ACH & Wire - QuickBooks - Quicken Transaction Fee - Stop Pay - ACH Payment – Federal Tax - Other ACH Payments - Direct Deposit per Recipient - Business-to-Business - Business-to-Consumer ACH Payment - Return ACH Payment - Notification of Change Domestic Wire Transfer International Wire Transfer Returned Domestic Wire Transfer Returned International Wire Transfer Book Transfer Fee No Charge No Charge $5.00/monthly $15.00/monthly $17.00/monthly $14.95/monthly $9.95/monthly $34.00 $3.00 $1.00 $1.00 $1.00 $3.00 $2.00 $15.00 $30.00 $8.00 $18.00 $12.00 Statement Services Deposit Statements - Duplicate Statement Fee $5.00 per monthly statement cycle (An additional current statement that is mailed to an alternate address) - Statement Copy $7.00 + account research fees may apply (An additional copy of a statement after receiving the original) - Hold Statement at Bank $5.00 per monthly statement cycle - Interim Statement $25.00 (A statement that is produced on a day other than the normal statement cycle cut date (next regular statement will only include the activity since the interim statement cut)) - Snapshot Statement $5.00 (A statement that is produced on a day other than the normal statement cycle cut date (next regular statement will include all activity beginning with the last regular statement cycle cut date up to the current statement cut date)) Account Analysis Statement - Upon Request No Charge - Duplicate Copy $5.00 per monthly statement cycle (A statement that is mailed to an alternate address) - Account Analysis Invoice $10.00 per monthly statement cycle (Billed Clients) Statement Delivery and Check Options Online Statements No Charge Check Safekeeping No Charge (Only paid check transaction summary is included in the statement) Check Images with Statement $4.00 per monthly statement cycle (Front and back images of paid checks are included in the statement) Check Returns with Statement (Check return is a substitute check - a digital reproduction of an original check. It constitutes a legal check in lieu of the original check. Front and back of a check are presented). - Fee Per Monthly Statement Cycle $5.00 - Additional fee per enclosed check $0.06 (Fee is waived for Business Value 200, Basic Public Fund, Business Value 500, Business Interest, Public Fund Interest, Community Checking, Business MRS, Public Fund MRS, Business Managed MRS, BIDA and IOLTA accounts) Overnight Statement Delivery (Per package) $10.00 Stop Payment Order Uncollected Funds ChargeN Wire Transfer Services CashManager OnLine Wire Maintenance Fee CashManager OnLine Repetitive Wire Transfer CashManager OnLine Non-Repetitive Wire Transfer Corporate Call Repetitive Wire Transfer Corporate Call Non Repetitive Wire Transfer Branch-Initiated Wire Transfer Incoming Wire Transfer Standing Order Outgoing Wire Wire Repair Wire Advice Phone Wire Advice Fax Wire Advice U.S. Mail Wire Advice Email $34.00 Prime Rate + 4.0% $10.00/monthly $11.00 $12.00 $17.00 $25.00 $65.00 $14.00 $10.00 $10.00 $10.00 $5.00 $4.00 $3.00 For other fees, please contact your BB&T Relationship Manager or local BB&T Financial Center N Fee applies only to Business Analyzed Checking, Public Fund Analyzed Checking, Public Fund Interest Checking, Collateral Reserve Checking, Intercompany Checking, Intercompany Interest Checking, Public Special Money Rate Checking, Commercial Interest Checking, Earnings2 Checking, Earnings2 Checking – Public Funds, Business Money Rate Savings, Public Fund Money Rate Savings and Business Investor’s Deposit Account. Equal Housing Lender. © 2015, Branch Banking and Trust Company. Member FDIC. Rev. 4/15/2015, Page 4 BB&T Business Services Pricing Guide TENNESSEE Effective August 3, 2015 Checking Accounts Business Value 200 Checking / Basic Public Fund Checking Minimum Opening Deposit $100.00 Monthly Maintenance Fee $12.00 (No monthly maintenance fee for the first 95 days) To avoid monthly maintenance fee: $1,500 average monthly balance (Business Value 200 Checking/ Basic Public Fund Checking) OR $6,000 combined average monthly balances in checking accounts (business/public fund/personalA), Money Rate Savings accounts (business/ public fund/personalA), Business Investor’s Deposit Accounts and/or outstanding balances on both business and/or personal loansB, lines of creditC and credit cardsD OR A qualifying transaction from a BB&T Merchant Services account E Debits, Credits and Items Deposited - First 200 Combined ItemsF No Charge - Fee per Combined Item over 200 $0.50 Coin/Currency Deposited - $10,000 or less No Charge Coin/Currency Deposited - greater than $10,000 (per $1,000) $2.50 Earns Interest No Business Analyzed Checking / Public Fund Analyzed Checking Minimum Opening Deposit Monthly Maintenance Fee Credits - Credits posted (This refers to any credits, including paper and electronic) - Deposited items – per item (In addition to credits posted) Debits - Check Paid – per item - Other Debit – per item Coin and Currency, Per $1,000 Deposited Earns Interest $100.00 $20.00 $0.80 $0.13 $0.19 $0.19 $2.00 No Business Value 500 Checking Minimum Opening Deposit $100.00 Monthly Maintenance Fee $25.00 (No monthly maintenance fee for the first 95 days) To avoid monthly maintenance fee: $5,000 minimum daily balance (Business Value 500 Checking) OR $15,000 average monthly balance (Business Value 500 Checking) OR $50,000 combined average monthly balances in checking accounts (business/public fund/ personalA), Money Rate Savings accounts (business/managed/public fund/personalA), business CDs and/or outstanding balances on both business and/or personal loansB, lines of creditC and credit cardsD OR $50,000 average monthly balance in Business Investor’s Deposit Account Debits, Credits and Items Deposited - First 500 Combined ItemsF No Charge - Fee per Combined Item over 500 $0.50 Coin/Currency Deposited - $20,000 or less No Charge Coin/Currency Deposited - greater than $20,000 (per $1,000) $2.50 Earns Interest No Earnings2 Checking / Earnings2 Checking – Public Funds Minimum Opening Deposit Monthly Maintenance Fee Credits - Credits posted (This refers to any credits, including paper and electronic) - Deposited items – per item (In addition to credits posted) Debits - Check Paid – per item - Other Debit – per item Coin and Currency, Per $1,000 Deposited Coin Rolling (Per Roll) Earns Interest $100.00 $26.00 $0.85 $0.13 $0.22 $0.22 $2.00 $0.12 Yes Service charges on the above accounts may be reduced or eliminated through an earnings credit.G The prices listed for Business Analyzed Checking are also applicable to Collateral Reserve Checking, Intercompany Checking and Public Special Money Rate Checking. Service charges on the above accounts may be reduced or eliminated through an earnings credit.G The prices listed for Earnings2 Checking are also applicable to Intercompany Interest Checking. Business Interest Checking / Public Fund Interest Checking Community Checking Minimum Opening Deposit Monthly Maintenance Fee To avoid monthly maintenance fee: $6,000 average monthly balance Debits, Credits and Items Deposited - First 150 Combined ItemsF - Fee per Combined Item over 150 Coin/Currency Deposited - $5,000 or less Coin/Currency Deposited - greater than $5,000 (per $1,000) Earns Interest $100.00 $15.00 No Charge $0.50 No Charge $2.50 Yes Minimum Opening Deposit Monthly Maintenance Fee Balance requirements Debits, Credits and Items Deposited - First 225 Combined ItemsF - Fee per Combined Item over 225 Coin Roll and Currency Sales Coin and Currency Deposited Earns Interest $100.00 No Charge None No Charge $0.25 No Charge No Charge No Personal accounts of business owners only. loans include loans originated in a branch; including personal loans and loans secured by savings/CDs/stocks (excludes 1st and 2nd closed end personal loans secured by a residence and Sales Finance loans). C Personal lines of credit include Preferred Lines and Home Equity Lines. D Accounts, loans, lines of credit and credit cards are subject to credit approval. E Subject to business type and credit approval. A BB&T Merchant Services qualifying transaction is a payment card settlement (e.g., Visa®, MasterCard®, American Express® or Discover®) from a BB&T Merchant account deposited to a linked BB&T checking account at least once during the monthly statement cycle. F Combined items represent checks paid, debit and credit memos, deposit tickets, checks deposited, online bill payments, and electronic debits and credits (including debit card transactions). G Earnings Credit (ECR) is calculated by applying the earnings credit rate to the average positive collected balance for services in the account. The earnings credit rate is determined by the Bank and is subject to change at the Bank’s discretion. A B Personal Equal Housing Lender. © 2015, Branch Banking and Trust Company. Member FDIC. Rev. 8/03/2015, Page 1 BB&T Business Services Pricing Guide TENNESSEE Effective August 3, 2015 Commercial Checking Accounts Commercial Interest Checking Minimum Opening Deposit Monthly Maintenance Fee Credits - Credits posted (This refers to any credits, including paper and electronic) - Deposited items – per item (In addition to credits posted) Debits - Check Paid – per item - Other Debit – per item Coin and Currency, Per $1,000 Deposited Earns Interest $100.00 $20.00 $0.80 $0.13 $0.19 $0.19 $2.00 Yes Interest on Lawyers’ Trust Accounts (IOLTA) Checking Minimum Opening Deposit Monthly Maintenance Fee Credits - Credits posted (This refers to any credits, including paper and electronic) - Deposited items – per item (In addition to credits posted) Debits - Check Paid – per item - Other Debit – per item Coin and Currency, Per $1,000 Deposited Earns Interest $100.00 No Charge No Charge No Charge No Charge No Charge No Charge Yes This account is subject to rules governing attorney trust accounts in the state whose laws govern this account. These rules cover payment of interest and reporting of certain account activity (e.g., overdrafts, returned items, etc.) to third parties. Money Market and Investment Accounts Business Money Rate Savings / Public Fund Money Rate Savings Minimum Opening Deposit $100.00 Monthly Maintenance Fee $10.00 To avoid monthly maintenance fee: $250 minimum daily balance OR $500 average monthly balance OR One recurring pre-authorized deposit or transfer of at least $100 per monthly statement cycle Credits - Credits posted No Charge (This refers to any credits, including paper and electronic) - Deposited items – per item (In addition to credits posted) First 20 deposited items No Charge Fee per deposited item over 20 $0.39 Transfers / Withdrawals - Six (6) transfers or withdrawals per monthly statement cycleH No Charge - Excessive Activity Fee (after six) – per item $15.00 - BB&T 24 ATM and in-branch withdrawals No Charge (Business/Public Fund Money Rate Savings accounts are subject to funds transfer charges when transfers are made through a BB&T Phone24 associate) Coin/Currency Deposited - $5,000 or less No Charge Coin/Currency Deposited - greater than $5,000 (per $1,000) $2.50 Earns Interest Yes Business Investor’s Deposit Account (BIDA) Minimum Opening Deposit $100.00 Monthly Maintenance Fee $15.00 To avoid monthly maintenance fee: $10,000 minimum daily balance Credits - Credits posted No Charge (This refers to any credits, including paper and electronic) - Deposited items – per item (In addition to credits posted) First 10 deposited items No Charge Fee per deposited item over 10 $0.39 Transfers / Withdrawals - Six (6) transfers or withdrawals per monthly statement cycleH No Charge - Excessive Activity Fee (after six) – per item $15.00 - BB&T 24 ATM and in-branch withdrawals No Charge (Business/Public Fund Money Rate Savings accounts are subject to funds transfer charges when transfers are made through a BB&T Phone24 associate) Coin/Currency Deposited - $5,000 or less No Charge Coin/Currency Deposited - greater than $5,000 (per $1,000) $2.50 Earns Interest Yes The prices listed for Business Money Rate Savings are also applicable to Business Managed Money Rate Savings. H Per regulation, Money Market and Investment Accounts are ONLY permitted to have six (6) transfers or withdrawals during any monthly statement cycle for the purpose of transferring funds to another BB&T account or making third-party payments by means of a check, draft, debit card, pre-authorized or automatic transfer, telephonic transfer, online banking or similar order. Your account is subject to conversion to a checking account if you repeatedly exceed the permitted number of transactions. Equal Housing Lender. © 2015, Branch Banking and Trust Company. Member FDIC. Rev. 8/03/2015, Page 2 BB&T Business Services Pricing Guide TENNESSEE Effective August 3, 2015 Additional Banking Services BB&T Business Debit Card Debit Card Replacement FeeI ATM & Purchase International Service Assessment Fee $5.00 3% of transaction amount (Fee charged for ATM and purchase transactions performed or processed outside the United States, Puerto Rico and U.S. Virgin Islands. International services include purchase, credit voucher, ATM transaction and cash disbursement original and reversal transactions) International ATM Transaction Fee $5.00 (Fee charged for ATM transactions outside the United States, Puerto Rico and U.S. Virgin Islands.) BB&T ATM Transaction Fee No Charge Non-BB&T ATM Transaction Fee $2.50 (Fee charged when using any domestic ATM that is not a BB&T 24 ATM, unless otherwise disclosed.) ATM Mini statement (last 10 transactions or pending) $1.00 ATM Full statement (all transactions since last statement) $2.00 BB&T Phone 24 Automated and Person-to-Person Inquires No Charge Cash Processing Branch Coin and Currency Change OrderJ Currency, Per $1,000 Supplied Coin (Per Roll Supplied) Coin Rolling (Per Roll) $5.00 per order $1.30 $0.14 $0.05 Charged-Off Account Fee Check, Deposit and Withdrawal Slip Orders (Based on account type and style selection) Check-Paid RejectsK - per item $30.00 Fee may vary $0.50 CPA Confirmation $20.00 Credit Inquiry by Third Party $20.00 Deposit Account Usage FeeL Variable Deposit Correction - per item $7.50 Early Account Closing Fee (within 180 days of opening) $25.00 Funds Transfer between BB&T Accounts BB&T Small Business OnLine Transfer - Credit BB&T Small Business OnLine Transfer - Debit BB&T OnLine Transfer - Credit BB&T OnLine Transfer - Debit In-Branch Transfer - Credit In-Branch Transfer - Debit In-Branch Transfer by Phone - Credit In-Branch Transfer by Phone - Debit Phone 24 Transfer - Non-Automated Credit Phone 24 Transfer - Non-Automated Debit Phone 24 Transfer - Automated Credit Phone 24 Transfer - Automated Debit InactivityM Fee No Charge No Charge No Charge No Charge $3.00 $3.00 $2.00 $2.00 $2.00 $2.00 $1.00 $1.00 $7.50 per month International Services Branch-Initiated Wire Transfer CashManager OnLine Wire Transfer Check Collection Tracer (Per Message) Corporate Call Wire Transfer Incoming Wire Transfer Foreign Currency Bank Note Buys/Sales Foreign Currency Drafts Foreign Currency Overnight Delivery Foreign Check Returned Item (Plus any foreign bank fee) Foreign Check Collection (Plus any foreign bank fee) US Dollars Checks Drawn on Canadian Banks US Dollars Checks Drawn on European Banks Wire/Draft Tracer/Amendment (Per Message) Wire/Draft Recall/Stop Payment (Per Message) Legal Process (Levy/Garnishment/Attachment/etc.) Money Order $75.00 $36.00 $20.00 $50.00 $18.00 $10.00 $30.00 $20.00 $30.00 $75.00 $7.50 $35.00 $20.00 $30.00 up to $125.00 $5.00 Negative Account Balance FeeN $36.00 (Fee assessed to your checking or savings account on the seventh calendar Day that your account is overdrawn) Night Depository Service (Per bag processing fee) $2.00 Non-Depositor Check Cashing Fee for non-BB&T Checks $8.00 Non-Depositor Check Cashing Fee for On Us (BB&T) Checks (Applies only to checks cashed greater than $50.00) $8.00 Official Check $10.00 Outgoing Collection Item $25.00 I Fee applies to cards replaced due to being lost, stolen, damaged, personalized card request and other circumstances. If card replacement is related to a valid dispute, the fee will be refunded. J Fee does not apply to Business Interest Checking, Business Value 200, Business Money Rate Savings, Business Managed MRS, Business Value 500 Checking, Business IDA, Public Fund Interest Checking, Public Fund Money Rate Saving, Basic Public Fund Checking, Intercompany MRS, Community Checking, Community Interest Checking and Civic Checking. K Fee applies only to Business Analyzed Checking and Public Fund Analyzed Checking accounts. A Check-Paid Reject is defined as an illegible item rejected by BB&T’s items processing equipment. L The Deposit Account Usage Fee includes various expenses incurred by the Bank for servicing accounts. This fee applies only to Business Analyzed Checking, Public Fund Analyzed Checking, Earnings2 Checking, Earnings2 Checking – Public Funds, Collateral Reserve Checking, and other checking accounts with ECR. The fee is assessed monthly and disclosed on your periodic statement or client analysis statement. It is calculated per $1,000 of the average monthly balances in the account. The charge is variable and subject to change at any time without notice. M Inactivity is defined as having no deposits or withdrawals for 12 consecutive months in your checking account and 24 consecutive months for money market savings accounts. Interest posted or fees charged on your account are not considered to be activity. Applies only to accounts with balances less than $1,000 and greater than $0. N Applies only to Business Value 500 Checking, Business Value 200 Checking, Business Interest Checking, Basic Public Fund Checking and Community Checking accounts. Equal Housing Lender. © 2015, Branch Banking and Trust Company. Member FDIC. Rev. 8/03/2015, Page 3 BB&T Business Services Pricing Guide TENNESSEE Effective August 3, 2015 Additional Banking Services - continued Overdraft Protection Overdraft Transfer Fee (Limit of one fee per linked account, per day) - Business Value 500 Checking Clients - All Other Clients Overdraft/Returned Item No Charge $12.50 $36.00 Payroll by ADP® (up to 5 employees) $39.99/monthly Pre-Encoded Deposited Items BB&T Other In-State Institution Out-of-State Institution Pre-Encoded Rejects $0.13 $0.13 $0.13 $0.50 Research Check photocopy, viewed or printed $5.00/copy (Check Safekeeping and Check Image clients receive their first three copies at no charge) Account Research $25.00/hour Returned Deposited Items Returned Deposit / Cashed Item $12.00 - Re-deposited (Reclear) additional $8.00 - Return Item - Branch additional $8.00 (Branch of Deposit, Branch of Ownership, Branch Other) Returned Deposited Item Special Handling Maintenance $10.00 per month Safe Deposit Boxes (See a BB&T representative for current pricing and availability) Lost Key Drilling Cost Varies $25.00 $150.00 Self-Service Coin Machine (available in a limited number of Financial Centers) BB&T Clients - Less than or equal to $25.00 No Charge - Greater than $25.00 5% of total amount Non Clients - All amounts 10% of total amount Small Business OnLine Services Basic Service - BB&T Small Business OnLine - Unlimited OnLine Bill Payment Add Business Services - Multiple Users Access (allow multiple users) - ACH & Wire - Multiple Users Access with ACH & Wire - QuickBooks - Quicken Transaction Fee - Stop Pay - ACH Payment – Federal Tax - Other ACH Payments - Direct Deposit per Recipient - Business-to-Business - Business-to-Consumer ACH Payment - Return ACH Payment - Notification of Change Domestic Wire Transfer International Wire Transfer Returned Domestic Wire Transfer Returned International Wire Transfer Book Transfer Fee No Charge No Charge $5.00/monthly $15.00/monthly $17.00/monthly $14.95/monthly $9.95/monthly $34.00 $3.00 $1.00 $1.00 $1.00 $3.00 $2.00 $15.00 $30.00 $8.00 $18.00 $12.00 Statement Services Deposit Statements - Duplicate Statement Fee $5.00 per monthly statement cycle (An additional current statement that is mailed to an alternate address) - Statement Copy $7.00 + account research fees may apply (An additional copy of a statement after receiving the original) - Hold Statement at Bank $5.00 per monthly statement cycle - Interim Statement $25.00 (A statement that is produced on a day other than the normal statement cycle cut date (next regular statement will only include the activity since the interim statement cut)) - Snapshot Statement $5.00 (A statement that is produced on a day other than the normal statement cycle cut date (next regular statement will include all activity beginning with the last regular statement cycle cut date up to the current statement cut date)) - Custom Calendar Statement Fee $2.50 per month Account Analysis Statement - Upon Request No Charge - Duplicate Copy $5.00 per monthly statement cycle (A statement that is mailed to an alternate address) - Account Analysis Invoice $10.00 per monthly statement cycle (Billed Clients) Statement Delivery and Check Options Online Statements No Charge Check Safekeeping No Charge (Only paid check transaction summary is included in the statement) Check Images with Statement $4.00 per monthly statement cycle (Front and back images of paid checks are included in the statement) Check Returns with Statement (Check return is a substitute check - a digital reproduction of an original check. It constitutes a legal check in lieu of the original check. Front and back of a check are presented). - Fee Per Monthly Statement Cycle $5.00 - Additional fee per enclosed check $0.06 (Fee is waived for Business Value 200, Basic Public Fund, Business Value 500, Business Interest, Public Fund Interest, Community Checking, Business MRS, Public Fund MRS, Business Managed MRS, BIDA and IOLTA accounts) Overnight Statement Delivery (Per package) $10.00 Stop Payment Order Uncollected Funds ChargeO Wire Transfer Services CashManager OnLine Wire Maintenance Fee CashManager OnLine Repetitive Wire Transfer CashManager OnLine Non-Repetitive Wire Transfer Corporate Call Repetitive Wire Transfer Corporate Call Non Repetitive Wire Transfer Branch-Initiated Wire Transfer Incoming Wire Transfer Standing Order Outgoing Wire Wire Repair Wire Advice Phone Wire Advice Fax Wire Advice U.S. Mail Wire Advice Email $35.00 Prime Rate + 4.0% $10.00/monthly $11.00 $12.00 $17.00 $25.00 $65.00 $14.00 $10.00 $10.00 $10.00 $5.00 $4.00 $3.00 For other fees, please contact your BB&T Relationship Manager or local BB&T Financial Center O Fee applies only to Business Analyzed Checking, Public Fund Analyzed Checking, Public Fund Interest Checking, Collateral Reserve Checking, Intercompany Checking, Intercompany Interest Checking, Public Special Money Rate Checking, Commercial Interest Checking, Earnings2 Checking, Earnings2 Checking – Public Funds, Business Money Rate Savings, Public Fund Money Rate Savings and Business Investor’s Deposit Account. Equal Housing Lender. © 2015, Branch Banking and Trust Company. Member FDIC. Rev. 8/03/2015, Page 4

© Copyright 2026