Medwizeâ Frequently Asked Questions PERSONAL ACCIDENT

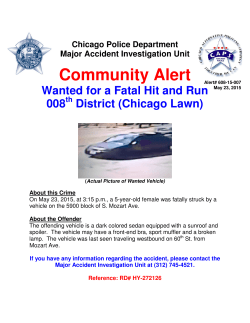

Medwize– Frequently Asked Questions PERSONAL ACCIDENT SECTION – Permanent Disability WHO CAN CLAIM UNDER THE PERSONAL ACCIDENT SECTION? The Personal Accident benefit is available to all insured members. WHAT IS DEFINED AS AN "ACCIDENT"? An Accident is ANY event that results in your body being unintentionally injured. Examples of Accidents can be as follows: Motor Vehicle Accidents (MVA's), Recreational Sports Injuries, Injuries on Duty, Injuries at Home, Snake, Dog and/or Spider Bites, Hi-Jacking and/or Assault WHAT DOES IT MEAN TO BE PER Permanent Disability, broadly speaking, means that your body has been altered / damaged following an Accident, to a severe enough degree that it will never recover 100%. Some examples of Permanent Disability can be as follows: o Paraplegia following a Motor Vehicle Accident – here you would qualify for 100% of the Permanent Disability lump sum benefit. o Loss of a whole finger following an attack by a dog – here you would qualify for 15% of the Permanent Disability lump sum benefit But, not all cases can determine the level of Permanent Disability directly after an Accident. If we use the example of a serious multiple bone break in your leg, following a sporting Accident, the Insurers will require that on-going medical reports be supplied to them in order to plot your recovery progress during your months of therapy following a number of operations. If it is determined that you have a permanent degree of loss of movement following therapy, which will never return fully, the Insurer will still consider paying a portion of the Permanent Disability lump sum to you, as a result of the permanent (though not total) damage incurred to your leg. IS THERE A TIME PERIOD THAT CLAIMS NEED TO BE NOTIFIED IN? Yes, all claims need to be notified within 180 days following the date of the Accident. HOW LONG DOES IT TAKE BEFORE THE PERMANENT DISABILITY BENEFIT IS PAID? Insurers have up to 24 months to determine the level of Permanent Disability prior to releasing the lump sum benefit to the Principal Member. But, as mentioned above, this will be in severe cases where the level of disability cannot be determined directly after an Accident. Each case will be handled individually, but it is important to remember that the claim can only be assessed once ALL relevant documentation is received – this will include a Medical Certificate (included in the Claim Form) which requests details of your injuries as well as recovery prognosis from a Medical Practitioner, ongoing medical reports (where required) as well as any other Medical motivation required, a copy of the Traffic Collision Report (in the event of a Motor Vehicle Accident), a copy of the Police Report (in the event of a criminal act – e.g. a hijacking, assault etc.) etc. WHAT WILL THE PERSONAL ACCIDENT SECTION NOT COVER? The Insurers shall not be liable to pay any claim under this Section in respect of any Insured Person 1. While engaging in flying as pilot or member of the crew. This exception does not apply to Insured Persons engaging in ballooning, hang-gliding, paragliding and parachuting, provided that such activities are solely for social and/or pleasure purposes and not of a competitive nature or for reward. 2. caused by the Insured Person's intentional self-injury. 3. caused solely by an existing physical defect or other infirmity of the Insured Person. 4. as a result of the influence of alcohol, drugs or narcotics upon the Insured Person unless administered by a member of the medical profession (other than himself) or unless prescribed by and taken in accordance with the instructions of a member of the medical profession (other than himself) 5. caused by the Insured Person's participation in any riot or civil commotion. 6. arising from war, invasion, act of foreign enemy, hostilities (whether war be declared or not), civil war, rebellion, revolution, insurrection, military or usurped power 7. as a result of the Insured Person’s deliberate exposure to exceptional danger (except in an attempt to save human life) or the Insured Person’s own criminal act. 8. while participating in sport as a professional player. 9. directly or indirectly caused by or contributed to buy or arising from ionizing radiations or contamination by radio-activity from any nuclear fuel or from any nuclear waste from the combustion of nuclear fuel or from any nuclear weapons material. For the purpose of this exception only, combustion shall include any self-sustaining process of nuclear fission. BESIDES THE PERMANENT DISABILITY LUMP SUM BENEFIT, ARE THERE ADDITIONAL BENEFITS THAT FORM PART OF THE PERSONAL ACCIDENT SECTION? There absolutely are! The following Automatic Extensions will also be included in your Policy, again, at no additional cost to you. It is important to remember that these also apply in the event of an Accident: Emergency Transportation/Search and Rescue up to R25,000 Life Support Equipment up to R25,000 Trauma Counselling up to R750 per visit, with an annual limit of R25,000 Claims Preparation Costs up to R20,000 Mobility up to R25,000 Rehabilitation up to R25,000 RAF Medico Legal Costs up to R10,000 For additional information on Admed, an explanation of the Personal Accident Automatic Extensions as well as to access the Personal Accident Claims Guide, please visit our website, the details of which are : www.medwize.co.za - Under "Choose Your Interest", please select Admed. IF I AM INVOLVED IN AN ACCIDENT BUT AM NOT DISABLED, CAN I STILL CLAIM FROM THE AUTOMATIC EXTENSIONS? Yes you can. In the event of your Medical Scheme not covering the full cost of the Ambulance, you can submit a claim under the Emergency Transportation Automatic Extension, which will pay the balance of the account NOT covered by your Scheme, up to a maximum of R25,000. It is important to remember that you will need to attach your Medical Scheme statement which confirms the amount that has not been paid by your scheme. It is equally important to remember that only Ambulance costs as a result of an Accident will be covered under. Medwize – Frequently Asked Questions ROADCOVER WHO ARE ROADCOVER? RoadCover is a Company that assists members by managing Road Accident Fund (RAF) claims on behalf of the member, from start to finish! They employ a team of Legal Practitioners to formulate member’s claims with the RAF, and as a result of their expertise, can assist members in halving the claim turnaround time. IS THERE AN ADDITIONAL FEE THAT NEEDS TO BE PAID FOR THIS SERVICE? Absolutely not! Any compensation received from the Road Accident Fund on behalf of a member will be paid over in FULL. WHO IS COVERED UNDER THE ROADCOVER SECTION OF Medwize? The Principal Member on Medwize as well as any registered dependents on the Principal Member's Medical Scheme membership, who therefore also qualify for Medwize cover. WHAT CAN MEMBERS EXPECT FROM ROADCOVER, WITH REGARDS TO THEIR SERVICES? For the duration of the claim, members will receive the following: o o o o Legal representation Administration and claims management Accident reconstruction Required Medico-Legal reports, Actuarial reports, past and future loss of earnings reports as well as past and future loss of support reports WHO IS ENTITLED TO CLAIM FROM THE ROAD ACCIDENT FUND VIA ROADCOVER? o A person who was personally injured (except a driver who was the sole cause of an accident). o A dependent of the deceased victim o A close relative of the deceased in respect of funeral expenses o A claimant under the age of 18 who must be assisted by a parent or legal guardian WHAT CAN YOU EXPECT TO CLAIM FOR FOLLOWING A ROAD ACCIDENT? o Medical expenses (past and future) o Funeral expenses o Loss of earnings or income if a person is disabled (past and future) o Loss of support for a dependent of a deceased victim (breadwinner, past and future) o General damages for pain, suffering and disfigurement in the case of Bodily Injury (as determined after examining the extent and severity of the injury) WHO DO ADMED MEMBERS CONTACT TO LODGE A CLAIM? Members will be required to contact RoadCover direct, as follows: o Telephone - 0860 726837 / 0860 RCOVER o Website - www.roadcover.co.za

© Copyright 2026