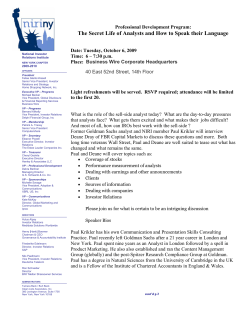

Fortnightly Thoughts