2564 Good Sameritan case study

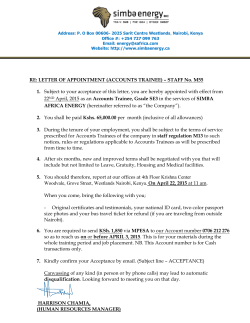

A RelayHealth Case Study Smoothing the Path to Faster Payments Good Samaritan Health System 2 Introduction Introduction Critical Issues Results Rapid change, right decision Quick Facts Tracing errors Most of the obstacles on the way to successful payment are small. The problem is that there can be a lot of them, and no matter how small or large, they cause delays. At Good Samaritan Health System in Lebanon County, Pa., Sue Hauck’s financial services team is always on the lookout for ways to ease the path to timely payment. With a close eye on the department’s acceptance rate, Hauck and her team use a combination of process and technology to find and fix errors before they cause a claim denial. RelayAssurance™ Plus is the most important instrument in their bag, according to Hauck, Critical Issues director of corporate patient financial services. “It’s a great management tool—it allows us to look at our key metrics, and it’s a centralized way for us to really look at what is going on with our claims,” she said. • Low acceptance rates on claims • Frequent payer changes slow down remits • Productivity metrics must be submitted daily Results • Acceptance rates rose from 70 percent to 90 percent or higher • Bridge routines written to alleviate payer issues • Metrics on claims billed per worked hour collected in minutes rather than hours 3 Introduction Critical Issues Results Rapid change, right decision Quick Facts Rapid change, right decision Interestingly, the financial services team did not initially view RelayAssurance Plus (then called ePREMIS®) that way. In spring 2009, the department was experiencing rapid change. Its claims system was being discontinued, and the entire health system was about to upgrade to McKesson Paragon.® Despite the chaos, the Tracing errors department was able to get the new claims system up and running quickly. “The decision was made in a very short period, and at the time, we didn’t realize all the benefits that would come from it,” Hauck said, referring to how RelayAssurance Plus enables the department to successfully raise its acceptance rate through clear, understandable and timely edits. “We had to implement a claims processing system sooner than we wanted to,” said Mary Jo Fies, systems support “Because the edits are in place before the effective date, we analyst. “ClaimTrack was being discontinued, and we weren’t can let our coding department know what’s coming, and ready to go live with EC2000. For about a year, we were live they can make the change,” said Bonel Borrelli, a biller. “That on two systems and had two customer ID numbers, which means we get our bills out in a more timely fashion, and the meant we needed a method for preventing duplicate claims claims are cleaner,” added and saving the additional Cynthia Schwalm, patient Quick Facts time and staffing resources accounting manager. it takes to resolve them.” • Hospital: Good Samaritan Health System, Lebanon County, Pa. • Solutions: RelayAssurance Plus, RelayAssurance Attachments • Beds: 172 • Employees: 1,450 • Medical Staff: 429 4 Introduction Critical Issues Results Rapid change, right decision Similarly, the department’s use of RelayAssurance™ Attachments for workers’ compensation and auto insurance claims led to faster payments, fewer denials and lower postage costs. “There are times when a claim has several pages of medical records that need to be sent,” Schwalm said. “In the past, we sent it by mail and followed up by phone. Sometimes we were told they didn’t receive it, and we had to start over. Electronic claims attachments are faster and traceable.” This facilitates the identification of areas causing delays in payment. Quick Facts Tracing errors Recently, Schwalm saw a drop in the acceptance rate and used a field error report to trace it to a dictionary entry in Paragon® with a zip code of 00000. “We went into our reference master and fixed the information that was there, and we’re in the process of also making the correction in Paragon,” she said. Being able to create custom reports is a tremendous timesaver, Fies said. “We also create our own bridge Tracing errors routines. Payers change things all the time, and this helps The department’s ideal acceptance rate was set at 90 percent. us solve our own problems without going to support.” Fies Currently, it has even surpassed this goal by running at added that she can try out the routines in the test mode 90 percent and higher. Both Hauck and Schwalm are of RelayAssurance Plus to make sure they work and don’t confident they can maintain and even improve upon affect other components before they go live. this success. Moving the acceptance rate up a notch higher is a team Timely reports are a large part of the effort. In addition to effort, Hauck said. “We’re looking at the kind of edits a daily email with the acceptance rate, Schwalm and her we’re seeing, and we’re working with Health Information team regularly use the edit reports and the hold-bill report. Management and other departments to get errors cleaned “The report capability in RelayAssurance Plus is very good,” up so that when we get it, it’s virtually a clean claim, and it Schwalm said. “I love the edit report, and I can quickly break goes out the door.” down the hold-bill report by holds or by payer.” 5 Introduction Critical Issues Results Rapid change, right decision RelayAssurance Plus also helps make gathering productivity metrics faster and easier. Without a centralized data system, it would take Schwalm two to three hours to pull together the data on claims billed per worked hour for all payers, something she does daily as part of a system-wide productivity effort. With RelayAssurance Plus, the process takes five to 10 minutes. Benefits like these lead Hauck to describe RelayAssurance Plus as a critical part of her department’s workflow. “We have had situations where we’ve decided against a third-party system because it was not able to integrate appropriately with RelayAssurance Plus,” she said. “We would rather have a few manual steps than choose something we’re not confident will flow data correctly into RelayAssurance Plus.” Quick Facts Tracing errors Health Connections Brought to Life™ www.relayhealth.com • 888.743.8735 © 2013 RelayHealth and/or its affiliates. All rights reserved. 2564 0813

© Copyright 2026