RACE FOR CE - NAIFA

connections that count APRIL 2015 | VOLUME 87 | NO. 8 A publication of the National Association of Insurance and Financial Advisors – Dallas NAIFA-Dallas & TRIPLE CROWN SPONSORS present 13th Annual CE Event RACE FOR CE Friday, April 24, 2015 LONE STAR PARK Grand Prairie, Texas IN THIS ISSUE: 6| 2015-16 NAIFA-Dallas Official Board Ballot 8| Advisor of the Year and O.C. Jackson Hall of Fame 9| 2014-15 President’s Cabinet 1 0 | Free NAIFA Members-Only Webinar – Success Stories Shared by Your Fearless Female Leaders 12| NAIFA Launches LUTCF Scholarship Program 1 3 | NAIFA Congressional Conference 1 5 | Thanks to Our Sponsors Registration: 9:00 am | CE: Interspersed from 10:00 am - 5:00 pm Cash Bar, Dinner & Races : 5:00 pm until... see page 5 NAIFA-DALLAS was founded in 1913 as the Dallas Association of Life Underwriters (DALU) www.naifadallas.org How can you help your clients make more informed decisions? Tell them something they’ve never heard before. The Living Balance Sheet® is a revolutionary financial model that helps you build a stronger relationship with your clients. As an exclusively authorized user of The Living Balance Sheet®, you’ll provide insight your clients have never heard before. Give them a big-picture view of their finances. And help them make better decisions through every phase of their financial life. Thomas Zanovich CFS Managing Director Opes One Advisors 15303 N. Dallas Parkway Suite 550 Addison, TX 75001 To learn more, call Thomas Zanovich, CFS at 214-346-0985, or email thomas_ [email protected]. The Living Balance Sheet ® and the Living Balance Sheet ® Logo are registered service marks of The Guardian Life Insurance Company of America (Guardian), New York, NY. The graphics and text used herein are the exclusive property of Guardian and protected under U.S. and International copyright laws. © Copyright 2005 – 2013, The Guardian Life Insurance Company of America. Registered Representative and Financial Advisor of Park Avenue Securities LLC (PAS) 14990 Landmark Blvd. Suite 300 Dallas TX, 75254 214-346-0985. Securities products/services and advisory services are offered through PAS, a registered broker/dealer and investment advisor. Financial Representative, The Guardian Life Insurance Company of America, New York, NY (Guardian). PAS is an indirect, wholly owned subsidiary of Guardian. This firm is not an affiliate or subsidiary of PAS or Guardian. |PAS is a member FINRA, SIPC| Pub5597 GEAR 2013-13036 APR IL 2015 | FA N | 2 The DI Center: Making DI Easy SM www.TheDICenter.com Disability Insurance Can Pay You 20% Renewals! PERSONAL SERVICE – “So Much More than just a Quote.” No Exams or Income Documentation – Up to $5,000 of Monthly Benefit 15% Discount Available to Attorneys, Dentists, or Physicians Lump Sum DI – Up to $100K with JUST an Application: “Simple. Affordable. Attainable.” http://service.ameritas.com/JSP/premiumCalculator.jsp Andra Grava, CLU, RHU Jim Coyle, CLU, RHU, REBC Jay Noble, DIA, DHP, LUTCF GA & Branch Manager DFW & Northwest Texas North TX, OK, & AR [email protected] [email protected] [email protected] NEW LOCATION: 40 E. McDermott Dr. | Allen, TX 75002 Toll-Free: 888-2-SELL-DI (273-5534) | Office: 972-774-9663 | Fax: 972-774-1792 For Producer Use Only. Not for Use with Clients. Disability Income insurance (Forms 4501NC, 4502GR and 4503BOE) is issued by Ameritas Life Insurance Corp. in approved states. In New York, Disability Income insurance (Forms 5501-NC, 5502-GR and 5503-BOE) is issued by Ameritas Life Insurance Corp. of New York. APR IL 2015 | FA N | 3 FAN Financial Advisor News CONTENTS 4| Officers, Directors and Staff 4| Important Numbers 5| Race for CE, Lone Star Park, 4/24/15 6| 2015-16 Official Ballot NAIFA-Dallas Board of Directors 7| President’s Message 8| 2014 Advisor of the Year and Hall of Fame Award Recipients 9| 2014-15 President’s Cabinet 10| Free NAIFA Members-Only Webinar: The How: Success Strategies Shared By Your Fearless Female Leaders 11 | NAIFA-Dallas 2015 Membership Directory 12 | NAIFA Launches LUTCF Scholarship Program 12 | Welcome New Members 13 | NAIFA Congressional Conference, May 19-20, 2015 2014-15 BOARD OF DIRECTORS OFFICERS DIRECTORS President Grover Brillhart ARMOR Wealth Management 469.737.4117 phone Professional Development Brian J. Craig, LUTCF New York Life 972.377.5202 phone [email protected] [email protected] President-Elect Cheri C. Stanwix Stanwix Insurance and Benefits 214.455.6623 phone Programs Christi M. Daughenbaugh, CLTC, CSA Borden Hamman Agency 214.420.4120 phone 214.302.8258 fax [email protected] [email protected] Secretary Ruth Shannon State Farm 972.735.9797 phone 877.414.8153 fax [email protected] Professional Designations Karl A. Drescher, Jr., FSS, LUTCF, RICP Mutual of Omaha 972.424.0484 x227 phone 972.874.1234 fax [email protected] Treasurer/Chief Investment Officer Mel Meyers, CLU, ChFC, AEP ARMOR Wealth Management 469.737.4119 phone Community Relations Mark D. Elder New York Life 972.377.5214 phone [email protected] [email protected] Immediate Past President Emeritus John Norman, CLU, ChFC ARMOR Wealth Management 469.737.4076 phone Membership Claudia Foraker, NRCMA Insurmed Services 972.404.8113 phone 972.404.8116 fax 14 | Karen’s Korner 14 | Association Calendar 15 | Thank You Sponsors & Exhibitors ADVERTISER INDEX 11 |Allstate [email protected] [email protected] 8| DI Broker National Committeewoman Tallie O. Young, RFC, LUTCF Tallie O. Young & Associates 214.420.0158 phone 214.420.0174 fax Government Relations Joseph Kane, CLU, ChFC, RFC, MBA Personal Economics Group 972.503.2734 phone 8| The Fisher Agency [email protected] [email protected] 13 | Insurance Designers NAIFA-Texas Trustee Chris Hatton, CFP Money Matters 817.717.8200 phone [email protected] Planning & Development Danny O’Connell, MBA Benefit Resource Group 214.750.7557 phone 214.750.6101 fax 3| Ameritas/The DI Center 10 | Assurant Health 7| Insurmed Services 9| Mutual of Omaha 7| National Life Group [email protected] 9| New York Life 2| OpesOne Advisors/Guardian 12 | Rice & Rice, PC 13 | State Farm Executive Vice President Karen H. True NAIFA-Dallas 972.991.2364 phone Member Involvement Lacey Zumberge Opes One Advisors/Guardian 214.446.0989 phone [email protected] [email protected] NAIFA–DALLAS Editorial and Advertising Office 16990 Dallas Parkway, Suite 212 Dallas, TX 75248 972.991.2364 www.naifadallas.org | [email protected] The Financial Advisor News is produced 10 times per year by NAIFA-Dallas. Annual subscription is $1.00 per year for members only. Subscription is included in the dues. Unless specifically stated, the publishing of an article or an advertisement does not imply endorsement by NAIFA-Dallas of either the views expressed or the products advertised. NAIFA-DALLAS STAFF 972.991.2364 | www.naifadallas.org Karen True, Executive Vice President | [email protected] Pam Thompson, Executive Administrative Assistant | [email protected] IMPORTANT NUMBERS DAHU | Carolyn Goodwin, CBC, SGS | 972.503.4248 Dallas Estate Planning Council Teresa Moore | 214.340.8020 FPA DFW | Melisa Hall | 972.747.0407 IFAPAC | Joe Kane, RFC, CLU, ChFC, MBA | 972.503.2734 IFAPIC | Steve Harris, CLU, ChFC | 972.680.2777 NAIFA National | 877.866.2432 NAIFA-Texas | 512.716.8800 SFSP | Patricia Pattison | 817.370.8991 Women in Insurance & Financial Services (WIFS) DFW | Patricia Pattison | 817.370.8942 Young Advisors Team | Jessica Gibbons | 972.736.9797 APR IL 2015 | FA N | 4 NAIFA-Dallas & TRIPLE CROWN SPONSORS present 13th Annual CE Event RACE FOR CE Friday, April 24, 2015 LONE STAR PARK Grand Prairie, Texas Registration: 9:00 am | CE: Interspersed from 10:00 am - 5:00 pm Cash Bar, Dinner & Races : 5:00 pm until... REGISTRATION INCLUDES: + Continuing Education (CE) + Back by popular demand... 2-Hour Texas Regulations & Ethics Course +Industry Trade Show with PRIZES + Admission to Lone Star Park and free parking + Refreshment Breaks, Lunch and Dinner for one + Evening at the Races TOTAL PRICE = $100 TICKET PRICING: Ticket Price: $100.00 ($150 at the door) Block Tickets (not available on day of event): 10 tickets @ $95 ea. = $950 Guest Ticket for Dinner & Racing: $50 CHAMPION SPONSORS: Aetna Small Group AIG/American General Assurant Health AXA Equitable Benefit Concepts, Inc. Blue Cross and Blue Shield of Texas The Brokerage, Inc. Enterprise Rent-A-Car Craig Hallenberger Insurmed Services MFS Investment Management Mutual of Omaha Ohio National The Plus Group SBLI State Farm/Brad Campbell RACE FOR CE REGISTRATION Name ___________________________________ Company ___________________________________ TDI License # _______________ Address _____________________________________________________________ Local Association ___________________________ Phone _____________________ Fax _____________________ Email _____________________________________________________ ____ Tickets to CE Event @ $100.00 | I am staying for Dinner Yes No Block Tickets 10 tickets = $950.00 Guest Ticket for Dinner & Races $50.00 Check (payable to NAIFA-Dallas) Charge (circle one) VISA MC AMEX Credit Card # ________________________________________________________ Expires on _____ / _____ Security Code __________ MAIL TO: NAIFA-Dallas, 16990 Dallas Parkway, Suite 212, Dallas, Texas 75248 SCAN/EMAIL: [email protected] | ONLINE: www.naifadallas.org No refunds after April 22, 2015 APR IL 2015 | FA N | 5 2015-16 OFFICIAL BALLOT NAIFA-DALLAS BOARD OF DIRECTORS Vote for four (4) and only four (4) | Any more or less will invalidate ballot Ballot must arrive in NAIFA-Dallas office by Friday, April 17, 2015 DANNY O’CONNELL, MBA KARL A. DRESCHER, JR., FSS, LUTCF, RICP CLAUDIA FORAKER, NRCMA • Entered the business in 2001 • Entered the business in 2003 • Entered the business in 1989 • Benefit Resource Group • Mutual of Omaha • Insurmed Services • NAIFA member since 2007 • NAIFA member since 2007 • NAIFA member since 1994 • Director, NAIFA-Dallas Planning & Development Committee, 2013-2015 • Director, NAIFA-Dallas Professional Designations Committee, 2014-2015 • Director, NAIFA-Dallas Member Involvement Committee, 2012-2015 • Elected as Fall 2014 NAIFA’s “Four Under Forty” • Member, NAIFA-Dallas Political Involvement Committee, 2013-2014 • Director, NAIFA-Dallas Planning & Development Committee, 2009-2011 • Member, NAIFA-Dallas President’s Cabinet, 2013 to present • Member, NAIFA-Dallas Casino Committee, 2008-2009 • Contributor, NAIFAPAC, Envoy Level • Member, NAIFA-Dallas Legislative Committee, 2007-2008 • Qualifier, MDRT, 6 COT, 5 TOT, 2007-2014 • Member, Top of the Table Planning Committee • Member, NAIFA-Dallas President’s Cabinet, 2013 to present MARY LYONS • Past Board Member and State Leader in an International Fraternal organization, 2006-Present • Contributor, NAIFAPAC, Ambassador Level RYAN SOULIER, CFP, CLU KARLA STRYNADKA, ChFC • Entered the business in 2006 • Entered the business in 2007 • Entered the business in 1985 • OneAmerica • Northwestern Mutual • NAIFA member since 2013 • NAIFA member since 2007 • Platinum Crest Insurance & Financial Services • Chairman’s Council, OneAmerica, 2014, 2013, 2011 • Qualifier, MDRT, 2014 • Graduate, Leadership Development Program, OneAmerica, 2013 • NAIFA Sales Achievement Award, 2009-2012 • Past Secretary, Homeowners Association, 2002-2007 • Top 100 in company for new clients, 2009 • Received ChFC, December 2010 • Will receive CLU, 2015 • USMC, Operation Enduring Freedom, 2001-2002 • Supporter, Operation Kindness • NAIFA member since 2014 • Past President, Homeowners Association, 2008 • NAIFA Quality Award, 20122014, 2010 • Founder and President, Flight Young Professionals Organization, Vogel Alcove • President, Pearls and Pinstripes Women’s Networking Group, 2010-2013 • Contributor, NAIFAPAC, Envoy Level JERRY SILVERMAN, LUTCF, FIC, CSA JESSICA GIBBONS • Entered the business in 1962 • Entered the business in 2012 • Independent Broker • State Farm Insurance • NAIFA member since 1975 • NAIFA member since 2013 • Director, DALU Public Relations Committee, 1988-1989 • Chair, NAIFA-Dallas Young Advisors Team (YAT), 2014-2015 • Teacher, LUTC classes, 2 years • Member, NAIFA-Dallas President’s Cabinet, 2014-2015 • Commander Post #256, Dallas Jewish War Veterans, 2011-2012 • President, Homeowners Association, 1982-1986 • Member, Metrocrest Chamber of Commerce, 2012 to present • Member, Metrocrest Young Professionals Connect, 2013 • Bachelor of Science, UNT, 2009 INSTRUCTIONS: Print this page. Mark four and only four (any more or less will invalidate ballot). Then submit by: (1) Scan and email to: [email protected] or (2) Mail to: NAIFA-Dallas, 16990 Dallas Parkway #212, Dallas, TX 75248 BALLOT MUST ARRIVE IN NAIFA-DALLAS OFFICE BY FRIDAY, APRIL 17, 2015. APR IL 2015 | FA N | 6 PRESIDENT’S MESSAGE Grover Brillhart | 2014-15 NAIFA-Dallas President You hopefully had the opportunity to hear Juli McNeely, the National NAIFA President, speak at the March 26th luncheon at Prestonwood Country Club recently. She spoke on the current state of NAIFA and the challenges we face in the future and how NAIFA is proposing that they be handled. In addition she also shared some sales ideas that she has personally implemented in her own practice that have allowed her and her team to achieve MDRT Court of the Table production levels. NAIFA is such a great organization, where successful professionals are so willing to share their personal secrets so that others can become successful. What other industry has people of such character? Professionals, willing to share, so that others can become successful and share into the future for generations to come. Why should one have to reinvent the wheel when there are so many ideas that just need to be tweaked a little for the current times and situation so that families and businesses can be protected, so that people are not thrown out of their homes or jobs because of poor planning on the part of a loving, caring spouse or employer. In my meager 20 years in the financial services industry, I have seen a lot of new software, illustration concepts, and fancy presentations put in front of prospects, but nothing beats a plain simple yellow note pad (or a napkin in the absence of a note pad). The professional can get the concept across in a few simple words and drawings, thus allowing the prospect, with the simple stroke of a pen, to create a plan that will make future dreams come true for those they love and care about the most. What other industry can do something so dramatic as make the future delivery of dollars paid for with pennies today a reality? I have been privileged to pay a few death claims in my short career, one really large one and many much smaller ones. No one has ever been upset that there was a check delivered; in fact my very first claim that I paid, the beneficiary insisted that there was no insurance in force at all, but the money was much needed and it was there as promised. Some of them have asked me “is that all there is?” but no one has ever said that is too much. The personal satisfaction that I received in each of these instances has reinforced within me the power of what we do for our clients in the life insurance business. The satisfaction of knowing that a properly designed health insurance plan has made itself most evident to me personally after my recent heart attack and my wife’s health issues. The promise of a disability company to pay my wife’s income to us for many years to come has also been a blessing. Also, my personal car was involved in a freak accident two years ago, and the auto policy replaced my car and got me going in a new one in very few days. And then lastly, my homeowners policy replaced my roof following a bad hail storm. Yes, I did have to come up with out-of-pocket in some of these instances, but the insurance company was there to do as promised and kept me in my own world. My family was not forced into a bad situation because of nature, other peoples’ bad driving, or my health situation, because I had the strength of the insurers behind me who were able to handle my claims, and keep my family in our little world. NAIFA touches on all of the insurance companies, regardless of the type of insurance provided. NAIFA is the voice of the agent; they are the ones who are getting the ear of our political leaders and expressing our wishes and concerns for the good of our clients. Where would we be without this wonderful organization and its help for our industry? What have you personally done for NAIFA other than paying your dues (a necessary evil) and attending a luncheon? Have you asked your professional associates if they have heard about this organization? Have you invited them to a luncheon to see for themselves? Have you been keeping NAIFA a secret from the general public? Please share the word about this organization so that more people can share the wealth of knowledge that is available with this group. Call me and let’s talk about the good (there is a lot of this) and the bad (hopefully not too much of this), and how can we make this organization better, how can we better serve the public and our country? Let’s talk about it, call me at 214789-9600. Life Insurance You Don’t Have To Die To Use Die Too Soon Become Ill Live Too Long National Life Group is concerned with every piece of the puzzle, whether your concern is dying too Die soon, becoming ill, or living too long. Too Soon Become For more information contact: Ill Live Too Lon Christina Johnson Regional Vice President 214-412-3471 National Life Group® is a trade name of National Life Insurance Company, Montpelier, VT, Life Insurance Company of the Southwest (LSW), Addison, TX and their affiliates. Each company of the National Life Group is solely responsible for its own financial condition and contractual obligations. For Agent Use Only. Form No. 11405(0613); TC74584(0613)1 Claudia Foraker President Insurmed Services Concourse Office Park 6330 LBJ Freeway Suite 130 Dallas, TX 75240 T 972-404-8113 F 972-404-8116 [email protected] www.Insurmed.com APR IL 2015 | FA N | 7 2014 Advisor of the Year 2014 O.C. Jackson Hall of Fame Steve Anderson, LUTCF John M. Connally, LUTCF Mr. Anderson joined Mutual of Omaha in 1988. He is a 22-year Honor Club recipient, including 16 President’s Club honors, three Sales Leaders Round Tables and two Chairman’s Council Awards. He has earned an Honor Club every year he has been in sales. He has qualified nine times for the Million Dollar Round Table (MDRT), which includes each of the past five years. His best production year was 2014. After attending Texas Tech University on a football scholarship and graduating with a BBA and a minor in Finance and Economics, John Connally entered the life insurance industry in 1963. He is President & CEO of Financial Protection Life and Annuity Corporation and is associated with ARMOR Wealth Management. He is a Life Underwriter Training Council Fellow (LUTCF), as well as a Life Member of the Million Dollar Round Table (MDRT). He was a speaker at the 1983 MDRT meeting. Steve graduated with a BBA in Management and Marketing from Colorado Mesa University, while working full-time to pay for it. He earned Series 6 and 63 licenses in 1992 and became a Life Underwriting Training Council Fellow (LUTCF) in 1993. After receiving his LUTCF designation, he moderated LUTC classes for several years. Mr. Anderson became an Investment Advisor Representative in 2013. Steve joined NAIFA in 1995. He became a NAIFADallas Board member in 2008 and was appointed as the Professional Designations Director. He started through the chairs in 2009-2010 and became NAIFA-Dallas President in 2011-2012. Steve has not only served on the Golf Committee since 2011, but served several years as co-chair. He currently serves as Chair of the NAIFA-Dallas Political Involvement Committee (PIC), and Chair of the 2015-2016 Nominating Committee. He attended the NAIFA National Legislative Fly-In May 2014 and the PIC Committee Summit, both in Washington, DC. Steve was a NAIFA-Dallas delegate for both 2014 and 2015 NAIFA-Texas Career Conferences. In his community, Mr. Anderson served for numerous years on the Country Forest/Jackson Meadows Homeowners Association, serving as Membership Director and then President. He contributed to building of the SLPS in Irving, Texas, a community center for the Dallas/Fort Worth Asian American Community. Steve, and his wife, Maria, have two sons, Danny and Curtis. Mr. Connally was selected as the NAIFA-Dallas 2007 Advisor of the Year. John served on the NAIFA-Dallas board two times; the first time was from 1968 to 1972. He came back to the board in 2005 and served as President in 2010-2011. He went on to serve on the NAIFA-Texas Board of Trustees from 2012-2014. John has also served on NAIFA boards in Houston and El Paso. He served as President of the El Paso General Agents and Managers Association (GAMA) and was GAMA Agent of the Year in 1981. John served his community as well. He was a City Council member in Richardson and was one of the founders of Richardson Sports Inc, serving as its president for two years. He served on the Board of Directors for both Richardson and Plano Chambers of Commerce. He was a member of the Plano East Rotary Club and served on the Board of Directors of Richardson General Hospital. He is an active member in his church, Custer Road United Methodist Church. Active politically, John was campaign manager for Preston Smith and Wayne Connally, as well as Regional Director for John B. Connally for President campaign. He is a personal friend of longtime Congressman, Ralph Hall, and served as Ralph’s legislative Key Contact for many years. John has three daughters, Kellie, Katie and Jaelyn. Studies show that producers who regularly offer Disability Insurance to their clients also sell more life insurance than those who don’t. Almost 50% more according to a survey conducted by a large mutual company; surprisingly, less than 10% of producers claim to regularly offer DI. Just saying… Disability and Long Term Care Products & Services Howard S. Hanger, RHU, LTCP 5001 Spring Valley Rd. #400E Dallas, Tx 75244 (877) 636-2112 Toll Free (469) 233-9674 Cell [email protected] www.dibroker.com APR IL 2015 | FA N | 8 2014-15 PRESIDENT’S CABINET Grover Brillhart (at press time) Q Are you earning what you are worth in your current position? Are you happy doing what you do? Do you have a clear path for the future? People come to us looking for something important: ■ ■ ■ Steve Anderson, LUTCF Jessica Gibbons Reed Ashwill, CLU, CFP Andra Grava, CLU, RHU David Ayres, CLU Stephen Harris, CLU, ChFC ■ David Blanchard, CLU, ChFC Todd Healy, CLU, ChFC, AEP, CAP ■ Lane Boozer, LUTCF Beth Henderson, CLU, ChFC John Connally, LUTCF Christina Johnson Jim Coyle, CLU, RHU, REBC Joseph Kane, CLU, ChFC, RFC, MBA Howard Crissey, CLU, ChFC Lee McCasland, CLU, ChFC Christi Daughenbaugh, CLTC, CSA Jay McCluskey, CLU, ChFC, MSFS, MBA Scott Dial Mel Meyers, CLU, ChFC, AEP Karl Drescher, Jr., FSS, LUTCF, RICP Yuka Nakahara-Goven, CLU, MBA Tom DuRoss Beverly Norman Donna Thomas Edwards, LUTCF, CASL John Norman, CLU, ChFC Mark Elder Danny O’Connell, MBA Mike Evans, CLU, ChFC, LUTCF Joe Radovic, CLU, ChFC, CFP, MSFS Danny Fisher, CLU, ChFC Randy Robertson, LUTCF Randy Ford, CLU, ChFC Ruth Shannon Frank Frey, CLU, LUTCF Cheri Stanwix James Garner, CLU, ChFC, AEP, CAP Tallie O. Young, RFC, LUTCF ■ More meaningful work More control over their schedule A culture that values them and their dreams A company that gives them built-in name recognition A business to call their own Great income potential They stay because we deliver all of that and more. Kim Murphy Administrative Manager North Texas Division Office 800 E. Campbell Road, Suite 241 Richardson, TX 75081 972-424-0484 [email protected] mutualofomaha.com/agency/ northtexasdo M27899_0113 Newly Opened North Dallas Sales Office Management Team Same Industry – Different Image Dream BIG, work HARD, have a BLAST! 2600 Network Blvd., Suite 130, Frisco, TX 75034 972-377-5201 | Fax 972-377-5259 [email protected] APR IL 2015 | FA N | 9 NAIFA Members Only FREE Webinar Wednesday, April 22, 2015 | 1:00 - 2:00 pm CDT The How: Success Strategies Shared By Your Fearless Female Leaders No one typically says, “When I grow up I want to be a financial services professional.” But here you’ve landed and you want to grow your practice and leadership skills! Now’s your chance to gather some helpful success strategies from Juli McNeely, National President of NAIFA, and Susan Combs, National President of WIFS, that have helped take their personal practices to the next level and enhance their opportunities for leadership. Juli McNeely, CFP, CLU, LUTCF Juli joined McNeely Financial Services in 1996, and is now the owner and president of the 46-year-old independent agency in Spencer, Wisconsin, founded by her father. She specializes in the areas of retirement planning, education funding, business continuity planning and estate planning. Her clientele consists of business owners, individuals, married couples and successful professionals. No matter the need, you’ll have the solution You never want to say no to a client. With Assurant Health, you won’t have to. We offer you one of the broadest portfolios in the industry — from major medical and fixed-benefit plans, to supplemental and even temporary health plans. When you have options like these, you can meet the McNeely became NAIFA’s first female president in September 2014 after serving in numerous leadership positions for local, state and national NAIFA organizations. She is a frequent speaker at industry events, is a contributing author to Advisor Today magazine’s “Back Page” column, and has been interviewed by many media outlets, including Reuters, InvestmentNews, the Atlanta Business Journal, Employee Benefit Advisor, InsuranceNewsNet, and National Underwriter. McNeely has a Bachelor of Science degree in marketing from Northwestern College. She graduated from NAIFA’s Leadership in Life Institute. She has earned the Certified Financial Planner™ (CFP) certification, as well as the Charter Life Underwriter (CLU) and Life Underwriters Training Council Fellow (LUTCF) designations. needs of nearly every individual and small-business client. Learn more today! Assurant Health Small Group Sales Office 214.891.2300 Susan Combs, PPACA The daughter of a 2-star general father (and county judge) and an entrepreneurial mother, Susan Combs has risen to the top of her field in insurance having been named as one of the “Top 20 Women You Need To Know” in insurance by LifeHealthPro in 2013. She is the resident insurance expert for eHow.com, the 2011 recipient of the prestigious Graduate of the Last Decade (G.O.L.D.) award from the University of Missouri, National Association of Health Underwriters Soaring Eagle for 2014 as well as the recipient of SmartCEO Magazine’s Brava Award for 2014 and LifeHealthPro’s Elite Awards recipient for Best Rising Star 2014. Assurant Health is the brand name for products underwritten and issued by Time Insurance Company. J-113524-V-KJ (10/2014) © 2014 Assurant, Inc. All rights reserved. Wednesday | April 22, 2015 Passionate to help others, Susan is part of several organizations including the Corporate Wellness Advisory Board for the NYC Department of Health, member of the National Committee of Mizzou Women Give, member of the National Association of Health Underwriters (NAHU), member of New York Women in Film & Television, Griffiths Society Mentor, and Women in Insurance & Financial Services (WIFS), where she serves as the current National President. Space is limited. CLICK HERE to register. APRIL 2015 | FA N | 10 2015 NAIFA-Dallas Membership Directory We want to serve you better! Please update your communication preferences and demographic information through the NAIFA Member profile system. This information will be used by NAIFA, and only NAIFA, to serve you better and provide all the benefits, tools and resources you want and need through your preferred communication method. It is fast and easy! Follow these simple steps! OPTION #1 – UPDATE ONLINE • On the home page of the NAIFA website, you will notice the “My Profile” button at the top. • To login to the NAIFA website, you will need your user name which is your NAIFA member 7-digit ID number and your password which is your last name, first letter capitalized. If your last name is five characters or less, please add naifa (all lowercase) to your last name. MEMBERSHIP DIRECTORY 16990 Dallas Parkway #212 | Dallas, Texas 75248 | 972.991.2364 | www.naifadallas.org • Once you are logged in to the NAIFA website and click on “My Profile,” you’ll have access to your personal profile page. • Take a moment to update your profile with your communication preferences and demographic information. • When you have entered the new correct information, click on the “Update” box at the bottom of profile page. The site will send you an email automatically confirming any changes. OPTION #2 – LET NAIFA UPDATE YOUR INFORMATION (both state & national) Name __________________________________________________ Company ____________________________________________________ Address _____________________________________________ City ______________________________ State ______ Zip _______________ Phone ______________________ Fax ______________________ Email _______________________________________________________ MAIL TO: NAIFA-Dallas, 16990 Dallas Parkway, Suite 212, Dallas, Texas 75248 | SCAN/EMAIL: [email protected] love wins. Do you have enough life insurance? It’s one of the best ways to provide for your family if something happens to you. With the right coverage, love wins. Call a local Dallas/Fort Worth Allstate agent for a free life insurance quote today. Allstate is a proud sponsor of the National Association of Insurance and Financial Advisors. Availability from a particular company varies by product. Subject to availability and qualifications. Life insurance issued by Allstate Life Insurance Company, Northbrook, IL, and Lincoln Benefit Life Company, Lincoln, NE. In New York life insurance issued by Allstate Life Insurance Company of New York, Hauppauge, NY. Guarantees are subject to the claims-paying ability of the issuing company. Allstate Property and Casualty Insurance Co., Allstate Fire and Casualty Insurance Co., Allstate Insurance Co., Allstate Texas Lloyd's, Allstate Indemnity Co., Allstate Vehicle and Property Insurance Co. © 2011 Allstate Insurance Co. APRIL 2015 | FA N 104075 With Allstate life insurance, We can help you protect your growing family at an affordable price. | 11 NAIFA Launches Life Underwriter Training Council Fellow (LUTCF®) Scholarship NAIFA is proud to announce the launch of the new LUTCF® Scholarship Program in collaboration with the College for Financial Planning (CFFP). The deadline to submit your application is May 1, 2015, and you will be notified if you are awarded the scholarship by June 1, 2015. Each scholarship recipient receives tuition credits for each of the three courses that compose the LUTCF® designation program. Scholarship awards are non-transferable and have no cash value. Scholarship recipients will have three years to use the tuition credits. For this application, tuition may only be applied to LUTCF® courses completed by June 30, 2018. Any tuition unused by that date will be forfeited. Tuition credit may only be applied once to each of the three LUTCF® courses. Applicants must: • Be a member in good standing of the National Association of Insurance and Financial Advisors. WELCOME NEW MEMBERS Dedrick Adell New York Life Sponsored by: Bill Montague Stephen Alexander Alexander Financial Marla Wilkerson New York Life Sponsored by: Cameron Reeves • Be under 40 years of age or have been licensed for less than five years as of May 1, 2015. • Have the endorsement of a member of the National Association of Insurance and Financial Advisors. • Note: You are not eligible to apply for this scholarship if you receive reimbursement for course fees from any other source. For more information and to apply, CLICK HERE LUTCF Course 1 Introduction to Life Insurance and Practice Fundamentals Sponsored by: NAIFA-Dallas Register securely online for all NAIFA events www.naifadallas.org Start Date: 7/13/15 | Mondays – 8 weeks Time: 2:00 - 5:00 pm Location: NAIFA-Dallas office | 16990 Dallas Parkway, Suite 212 | Dallas, TX 75248 For more information and an application for this class, call Karl Drescher at 214.707.4168 or the NAIFA-Dallas office at 972.991.2364. (972) 997-8220 APRIL 2015 | FA N | 12 Congressional Conference 2015 May 19-20, 2015 | Washington, DC YOU CAN MAKE A DIFFERENCE by joining hundreds and hundreds of NAIFA members at the NAIFA Congressional Conference on May 19-20, 2015 in Washington, DC. The first 600 Congressional Conference registrants may be eligible for a travel expense reimbursement up to $350. Spots will go fast, so register today! Total average savings of 825 $ Did you know? 1,336 bills that could have impacted our business were introduced in the 112th Congress: • • • • 632 financial services bills 376 retirement bills 196 health insurance bills 61 annuity bills Come in for a test save. • 45 long term care bills • 19 estate tax bills • 7 property and casualty bills * Let me show you how combining home and auto policies can add up to big savings. Like a good neighbor, State Farm is there. CALL ME TODAY. ® CLICK HERE to register NAIFA Advisors Political Involvement Committee You may have never run for public office. You might not know much about politics. But with NAIFA’s Advisors Political Involvement Committee (APIC), you can still make a difference. Influence how Congress votes on legislation important to insurance and financial services professionals. You can get involved in a number of ways. The level of involvement is up to you. For more information, please contact Maggie Fogg at 703.770.8154 or [email protected]. Ruth Shannon, Agent 18217 Midway Road Dallas, TX 75287 Bus: 972-735-9797 www.babyruth.biz CLICK HERE to fill out the APIC Legislative Contact Form. If you don’t participate, if you decide to drop out, someone else will take your place. They will occupy your seat; they will cast your vote; they will choose your representative for you, ‘your representative‘ will then speak for and represent the interests and views of the other fellow. – U.S. Senator Thad Cochran *In Texas, State Farm Mutual Automobile Insurance Company sells auto insurance; State Farm Lloyds, homeowners insurance. Each insurance company has sole financial responsibility for its own products. Average annual household savings based on national 2012 survey of new policyholders who reported savings by switching to State Farm. State Farm Mutual Automobile Insurance Company, Bloomington, IL, State Farm Lloyds, Dallas, TX P097197TX.1 With 20 years of underwriting experience we could be the difference in placing the case or not. We are here for you! APRIL 2015 | FA N | 13 Save the Dates KAREN’S KORNER Karen H. True | Executive Vice President UH-OH! When a child first learns to communicate, one of his or her first utterances is “Uh-oh”. Children, even very young ones, know exactly what it means and exactly when to use it. As a mother of one toddler put it, “If you hear the toilet flush and the words “Uh-oh”, it’s too late. “Uh-oh” happens, and it happens to all of us, no matter our age. In spite of our best efforts, we make mistakes. We mess up. We do or say things that we later regret. And our mistakes can be costly – in terms of time, money, personal relationships, business success. So what do you do when you blow it and you know it? It’s upsetting and unsettling to make a mistake. While it’s not always clear what you should do to correct a blunder, here are a few things NOT to do... 1. Don’t play the blame game. In the long run, finger-pointing or trying to shift the blame to someone else usually backfires and results in even more trouble. 2. Don’t discuss the issue with people who aren’t involved. Don’t talk about it around the office with people who have nothing at stake or with friends or acquaintances who may not give you the best advice. 3. Don’t beat up on yourself. Learn from the mistake, come up with a plan to avoid repeating it, and keep going. Those are three things NOT to do – but what should you do when you blow it and you know it? 1. Reveal. Take immediate action. Don’t wait for the mistake to be discovered; be proactive. If you mess up, fess up. Go directly to the person who needs to know about the error. In most cases, it’s your boss or the person who stands to be most affected by the mistake. Act immediately. Don’t wait. Waiting only makes the situation worse, not better. 2015 2. Repent. Admit your mistake, apologize, and vow to do better. Just say, “I’m sorry. I‘ll do better in the future.” Don’t try to explain or rationalize. You stand a chance of making things worse if you keep talking. Admit your mistake, mean it, and be quiet. 3. Reconcile. Reconcile means “to restore, to settle, resolve.” Ask: “What can I do to make this situation better?”, and then do it. 4. Recover. Move on. Don’t dwell on it. It’s over. Done. Do what you can to fix it, but don’t continue to dwell on it. And keep this in mind... being in a position of authority doesn’t isolate you from error. If you’re the boss, a parent, a government official, and you make a mistake, follow the same four steps. Ignoring issues creates silent, but very strong, barriers that block future communication, impair relationships, and cause the loss of credibility. Is there someone to whom you owe an apology? It takes a big person to step up and say, “I was wrong. I’m sorry.” If you’ve messed up but not fessed up, perhaps an apology is in order. We all have lots of “uh-oh” experiences in our past, and we’re sure to have more in our future, but today’s a great day to make amends and make a fresh start. – Julie Alexander | [email protected] THOUGHT FOR THE MONTH: 4/9 | WIFS Luncheon Personal Safety: Is there an “App” for that? Jeff McKissack, Defense by Design Neiman Marcus Cafe, NorthPark 11:00 am - 1:00 pm 4/10 | FPA DFW Ballpark Event Globe Life Park, Arlington 12:30 pm - end of game 4/15 | Estate Planning Council N TX How to Identify and What to Do When Professionals see Signs of Dementia in Professional Colleagues Lori Leu, Attorney Gleneagles Country Club 7:30 - 9:00 am 4/15 | DAHU Meeting The Missing Piece of Total Health Gary Deiz, DDS Prestonwood Country Club 11:30 am - 1:00 pm 4/23 | DAHU/FWAHU Event Moving Forward All-Day Sales Symposium 6 Hours of CE including Ethics DoubleTree Hotel at DFW Airport 8:00 am - 4:00 pm 4/24 | Race for CE Lone Star Park, Grand Prairie (see page 5) 5/7 - | TAHU State Convention La Cantera Resort, San Antonio 5/8 Click here to register 5/8 | NAIFA Great Southwest Golf Tournament 817.559.5393 for information 5/12 | NAIFA-Dallas Lunch ’n Learn Bent Tree Tower II, Suite 850, Addison 11:30 am - 1:00 pm (FREE) 5/28 | NAIFA-Dallas Luncheon & CE Judy Hoberman CE Sponsor: The DI Center 6/1 | DAHU Golf Tournament Prestonwood Country Club 6/11 | YAT Sporting Event Sponsor: Guardian 6/25 | NAIFA-Dallas Luncheon & CE Celebration of Achievement Installation of 2015-2016 Board THANK YOU to our March CE Sponsor “Isn’t it nice to think that tomorrow is a new day with no mistakes in it yet?” – E.M. Montgomery Gregg Caldwell | 972.649.6027 [email protected] APRIL 2015 | FA N | 14 THANK YOU 2014-15 SPONSORS & EXHIBITORS Beverly Norman | 469.222.6055 [email protected] Mike Smith, LTCP, SGS | 800.442.4915 [email protected] John Davis, Sr., CLU | John Davis, Jr., CLU 214.696.9756 | www.insdesign.com Tom Brown | 800.608.9868 option 1 [email protected] Marshall Muse, CLU, ChFC | 972.542.5676 [email protected] Claudia Foraker | 972.404.8113 [email protected] Joe Kane, CLU, ChFC, RFC, MBA 972.503.2734 | [email protected] Insurmed Services Andra Grava, CLU, RHU | 972.774.9663 [email protected] Studies show that producers who regularly offer Disability Insurance to their clients also sell more life insurance than those who don’t. Almost 50% more according to a survey conducted by a large Meyer | 214.615.5268 mutualBodoff company; surprisingly, less [email protected] than 10% of producers claim to regularly offer DI. Just saying… Reed Schnittker | 972.943.9999 [email protected] JACKSON NATIONAL LIFE INSURANCE Erin Cover, CLU, CFS | 817.403.0415 [email protected] Kathy & Mark Rice | 972.997.8220 [email protected] RANDY T. ROBERTSON, LUTCF Disability and Long| 469.233.9674 Term Care Howard Hanger Products & Services [email protected] Chris Ratterree, CFP | 214.280.9506 [email protected] 469.408.3019 [email protected] Lane Boozer | 940.566.0800 www.dibroker.com [email protected] Kim Murphy | 972.424.0484 x225 [email protected] Bill Izor, CLU, ChFC, CFP | 619.559.5833 [email protected] KARL A. DRESCHER, JR., FSS, LUTCF, RICP YUKA NAKAHARA-GOVEN, CLU, MBA Joe Radovic, CLU, ChFC, CFP, MSFS 469.737.4000 | [email protected] 972.424.0484 x227 [email protected] 972.774.2325 [email protected] Taylor Wencis | 214.557.1106 [email protected] Bill Brooks, RHU | 214.891.2322 [email protected] Russell Hamilton | 817.829.3787 [email protected] Christina Johnson | 214.412.3471 [email protected] David Reas | 817.559.5393 [email protected] Scott Hoke, CLU, ChFC | 214.675.5012 [email protected] Andie Tackett | 972.596.9767 [email protected] Michael Scovel, MSM, CLU, ChFC | 972.701.3306 [email protected] Brad Campbell, CLU, ChFC, CASL | 972.795.7841 [email protected] Lee Ripley | 713.728.7320 [email protected] Danny Fisher, CLU, ChFC | 972.238.1450 [email protected] Trey Smith | 972.766.9358 [email protected] Scott Dial | 214.346.0985 [email protected] Al Chernay | 972.415.7554 [email protected] Howard S. Hanger, RHU, LTCP Kellie Demaree | 972.866.8000 [email protected] 5001 Spring Valley Rd. #400E Dallas, Tx 75244 (877) 636-2112 Toll Free (469) 233-9674 Cell [email protected] Will Pearce | 972.377.5201 [email protected] Brian Craig, LUTCF | 972.377.5202 [email protected] David Johnson | 225.333.9330 [email protected] Steve Luby | 972.774.2360 [email protected] Harold Phillips | 214.500.0647 [email protected] Ruth Shannon | 214.325.0393 [email protected] Gregg Caldwell | 972.649.6027 [email protected] TALLIE O. YOUNG, RFC, LUTCF Bob Nelson | 972.238.7411 [email protected] Rodney Mogen | 512.428.4145 [email protected] Danny O’Connell, MBA | 214.750.7557 [email protected] Craig Hallenberger | 512.560.3778 [email protected] GROVER BRILLHART (representing ARMOR Wealth Mgmt.) BETH HENDERSON, CLU, ChFC 469.737.4117 [email protected] 214.236.9200 [email protected] Thomas Mahony, CLU, LUTCF | 817.600.4713 [email protected] 214.420.0158 [email protected] Lacey Zumberge | 214.446.0989 [email protected] Is your company listed here and getting free promotion? Kevin Olson | 214.592.3571 [email protected] If not, why not? Call the NAIFA-Dallas office at 972.991.2364. APRIL 2015 | FA N | 15

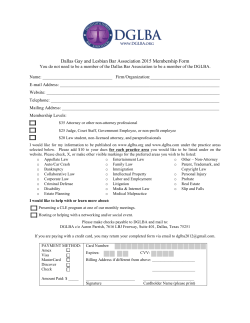

© Copyright 2026