Fairmount Properties - Orange Village, Ohio

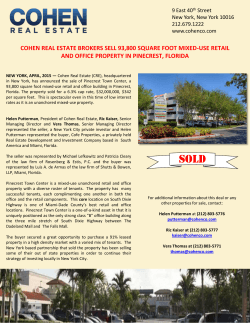

PINECREST PROJECT OVERVIEW PINE ORANGE LLC DEVELOPER Site Location Original Approved PDP Currently Approved PDP Site Plan for Ground Level Concept Plan - Upper Levels Inspiration Images Inspiration Images Landscape Images Main Street Conceptual Rendering Main Street Conceptual Rendering Retail Rendering Retail Rendering Retail Rendering Retail/Residential Rendering Town Center Rendering Judson Kline – Architect Orange Village Council Person PINECREST; An Architectural Perspective Orange Village Public Meeting March 25, 2015 Judson A. Kline, FAIA, NCARB,LEED AP President, CIVITAD Services, LLC PINECREST; An Architectural Perspective The Domain, Austin, TX The Domain, Austin, TX Kierland TC, Scottsdale, AZ Santana Row Angelica Corner Plano, TX The Domain, Austin, TX • Design the first signal of human intent • Creating lasting value • Transforming the Village through design • Characteristics of place PINECREST; An Architectural Perspective • Design the first signal of human intent PINECREST; An Architectural Perspective • Creating lasting value PINECREST; An Architectural Perspective • Transforming the Village through design PINECREST; An Architectural Perspective • Characteristics of place PINECREST; An Architectural Perspective • Orange Goes Green Certification Program – Encouraging a Sustainable Project Orange Goes Green Certification Program a sustainable building strategy for – Promoting Promoting the use of the OG₃C program for Commercial Projects Pinecrest Quality of Life for Families Reduced Carbon Footprint Community Water Quality Bio-Diversity Increased Energy Efficiency Paul J. Singerman, Esq. - Singerman, Mills, Desberg & Kauntz Co., L.P.A. Village Development Counsel Price D. Finley, Esq. – Bricker & Eckler LLP Village Public Finance Counsel Tax Increment Financing Price D. Finley, Esq. Bricker & Eckler LLP March 25, 2015 © 2015 Bricker & Eckler LLP What is TIF? Redirect new tax property tax revenue in connection with a new development (or redevelopment) away from normal recipients and toward payment of costs of improvements that benefit that development – Infrastructure Improvements – Direct Development Costs © 2015 Bricker & Eckler LLP Increment Increase in real estate taxes resulting from development over and above the value prior to the date that the development occurred. Property owner does NOT receive a tax break. Existing taxes continue to go to taxing districts (i.e., schools, county, village continue to receive predevelopment tax revenues). © 2015 Bricker & Eckler LLP TIF Revenue Stream * “Tax Increment Finance Best Practices Reference Guide” (CDFA and ICSC), page 2. © 2015 Bricker & Eckler LLP Why Use TIF? Encourage Development Facilitate Redevelopment of Existing Sites Finance Infrastructure © 2015 Bricker & Eckler LLP Uses of TIF Revenue Public Infrastructure Improvements Land Acquisition Demolition Utilities Debt Service © 2015 Bricker & Eckler LLP Specific Features of Pinecrest TIF Facilitates redevelopment of site Helps developer address unique costs of development – Costs of public infrastructure – parking, roads, streetscape, utilities, sewers, stormwater management facilities, safety station, public restrooms, etc. No economic risk to the Village or the School District © 2015 Bricker & Eckler LLP Matthew Stuczynski Village Public Finance Advisor

© Copyright 2026

![[that gets you there faster.] - GPLLM](http://cdn1.abcdocz.com/store/data/001251404_1-9df53b1f24404c74a09a4e292f2a02d8-250x500.png)