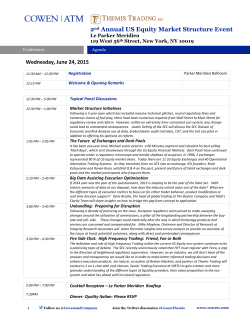

Are Corporate Spin-offs Prone to Insider Trading?